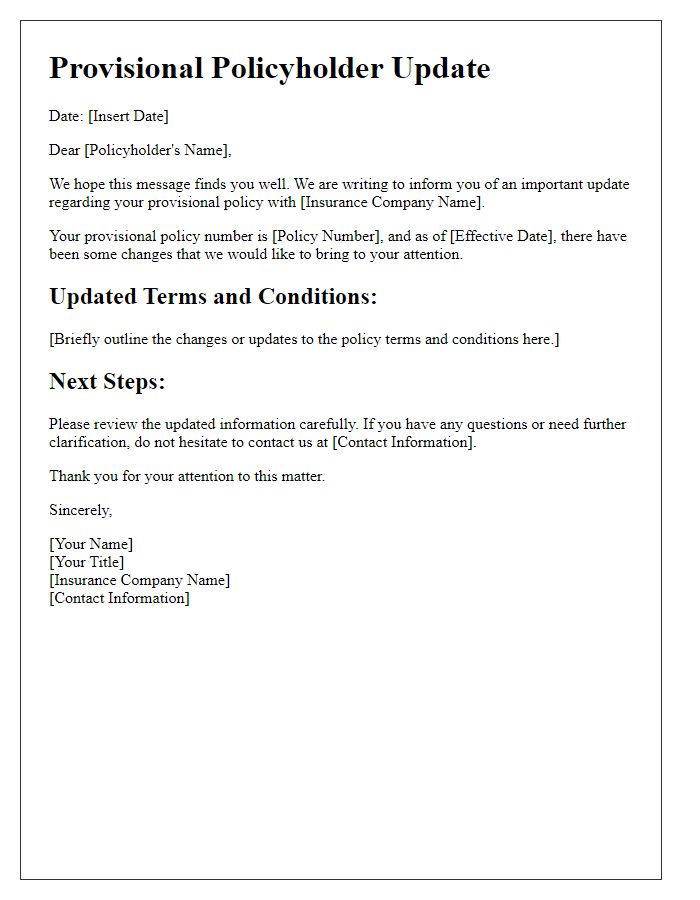

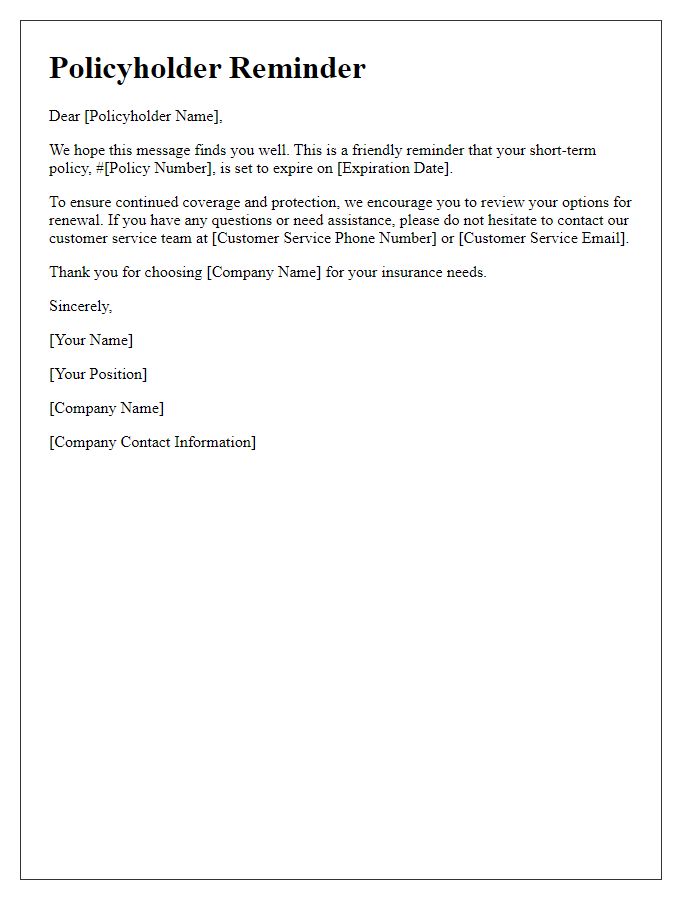

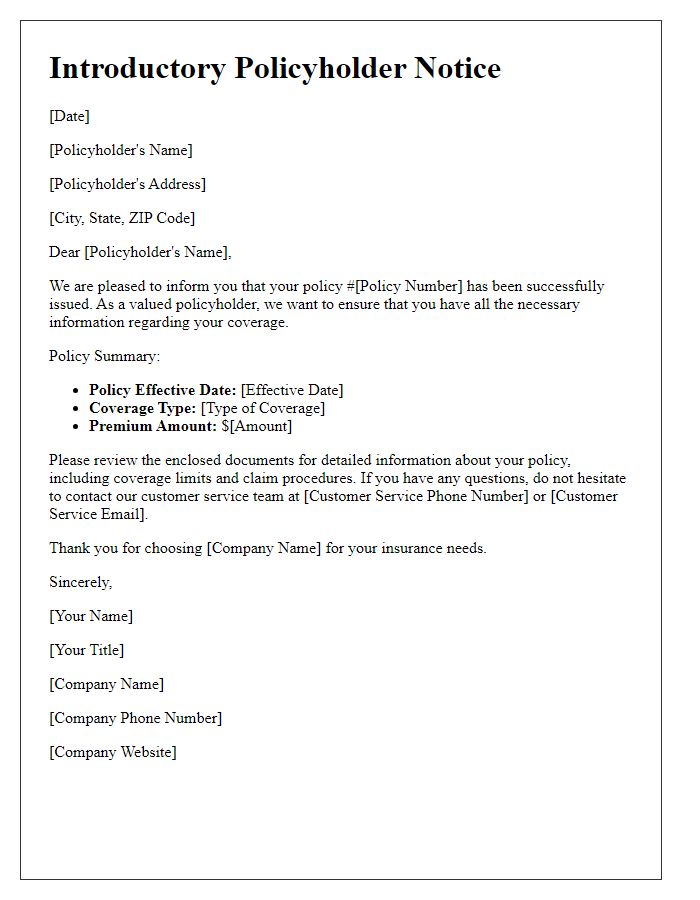

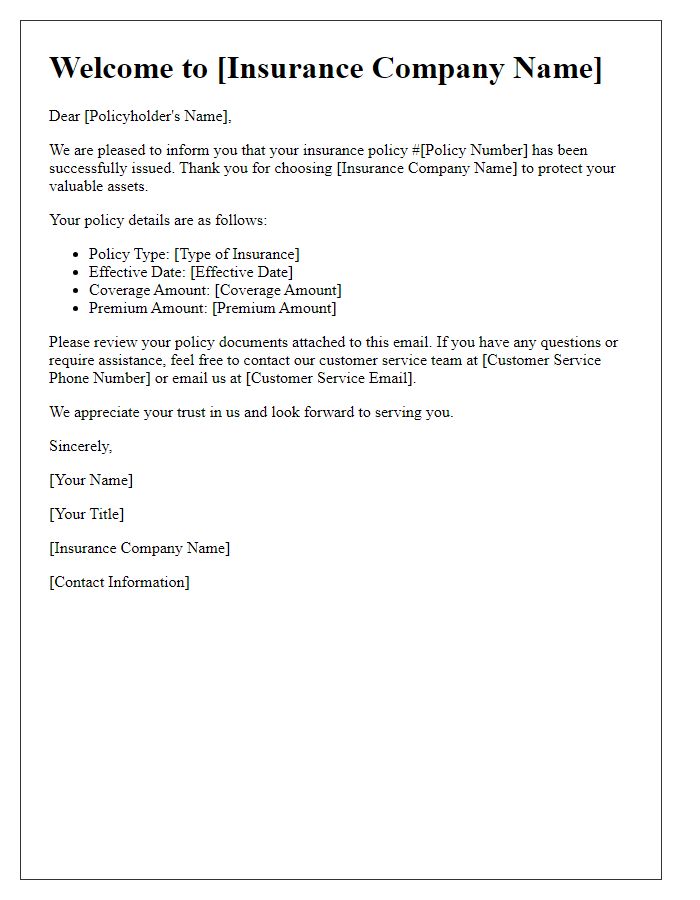

Are you navigating the world of probationary policyholders and wondering how to effectively communicate important updates? Crafting an informative letter that clearly outlines the probationary period and its implications can make all the difference in ensuring your policyholders feel valued and informed. It's essential to strike the right toneâfriendly yet professionalâto foster a positive relationship. If you're curious about the key elements to include in such a letter, keep reading for detailed insights and templates to guide you!

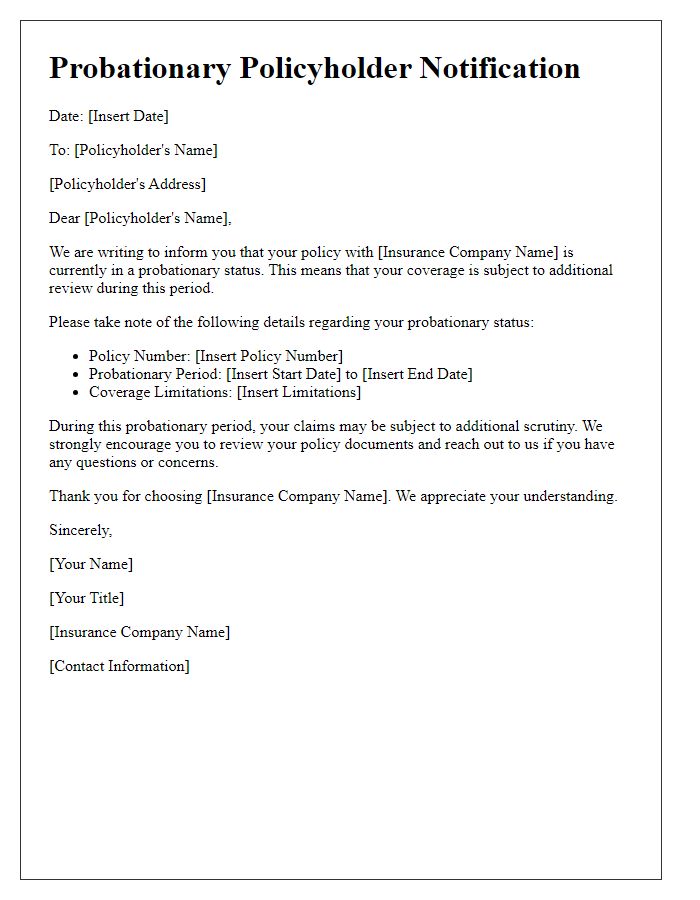

Policyholder Identification Details

Probationary policyholders must verify their identification details to ensure compliance with regulatory standards. Essential information includes full name, date of birth, policy number, and address. Missing or incorrect details can result in policy delays or denial. Regular updates are encouraged to maintain accurate records. This verification process protects both the policyholder and the insurance provider, ensuring seamless service. Always refer to the policy agreement for specific requirements and timelines related to identification verification.

Probationary Period Duration

The probationary period for policyholders, lasting six months after the contract commencement date, serves as a crucial phase for evaluating risk management effectiveness. During this timeframe, insurers, such as XYZ Insurance Company, review claims for validity, ensuring compliance with policy terms and conditions. Any claims made within this period may be subjected to additional scrutiny, potentially impacting coverage eligibility. Furthermore, this duration allows for assessment of the policyholder's adherence to safety protocols, risk assessment reports, and other relevant documentation leading to informed decision-making regarding long-term coverage.

Coverage Limitations and Exclusions

Probationary policyholders face specific coverage limitations and exclusions in their insurance plans. Typically, a probationary period lasts 30 to 90 days, depending on the provider. During this time, certain conditions or treatments may not be covered, including pre-existing medical conditions, specific high-risk activities, or services that require prior authorization from the insurer. Additionally, exclusions can apply to particular illnesses or injuries sustained during this period, leaving policyholders vulnerable to financial responsibility. Understanding these nuances is crucial for effective financial planning and ensuring comprehensive coverage upon the completion of the probationary status in plans like individual health insurance or employer-sponsored group plans.

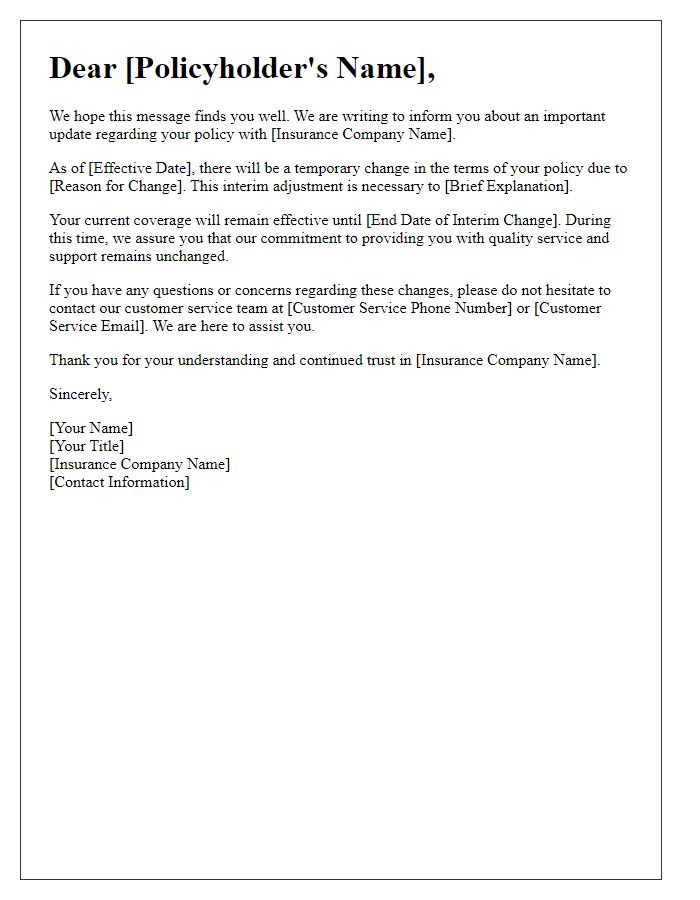

Explanation of Premiums and Payments

Probationary policyholders receive detailed information regarding their insurance premiums and payment schedules. Premium amounts are determined based on various factors including age, health status, and chosen coverage level. Payments are typically due on a monthly or annual basis, with specific due dates outlined in policy documents. It is crucial for policyholders to understand the consequences of late payments, which may include lapses in coverage or additional fees. Insurance providers often accept various payment methods such as direct bank transfers, credit cards, or online payment platforms, ensuring convenience for policyholders. Clear communication regarding premium adjustments due to changes in conditions or regulatory amendments is essential for maintaining transparency and trust between the insurer and policyholder.

Contact Information for Queries

The probationary policyholder notice serves as an essential document detailing the terms and conditions applied to new policyholders during their initial evaluation period. This communication outlines critical information such as coverage limits, waiting periods, and eligibility requirements central to the insurance policy. Queries regarding policy specifics can be directed to the dedicated customer service team at the insurance provider's headquarters, located at 123 Insurance Lane, Suite 456, Citysville, State. The team operates from 9 AM to 5 PM on weekdays and can be reached at the toll-free number 1-800-555-INSURE (4678) or through email at support@insuranceprovider.com. Clear, accessible communication ensures policyholders have the necessary resources to understand their coverage during this probationary period.

Comments