Hey there! If you're looking for a simple and effective way to communicate your deductible payment details, you've landed in the right place. Crafting a clear letter not only ensures that all necessary information is conveyed but also adds a personal touch to your communication. So, whether you're reaching out to an insurance company or a healthcare provider, let's explore the ins and outs of creating the perfect letter template. Keep reading to discover tips and examples that will make your letter stand out!

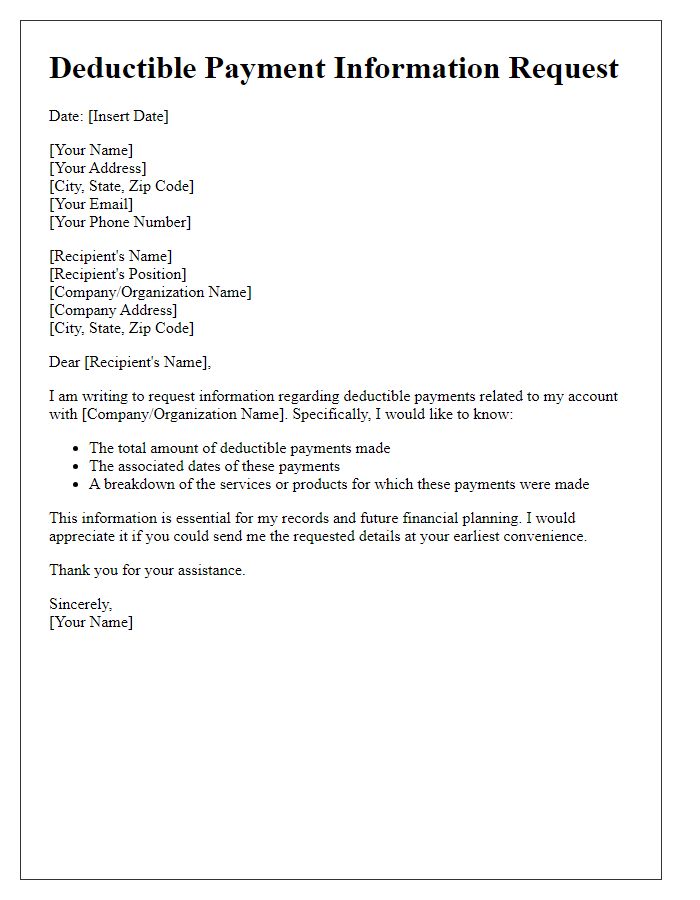

Address and Contact Information

When preparing deductible payment details, it is essential to include clear contact information. The address should specify the recipient's details, including the street number and name, city, state, and ZIP code, ensuring accuracy for timely processing. Additionally, incorporating contact information such as a phone number, preferably a direct line, enhances communication regarding the payment. An email address associated with the account provides an alternative for digital correspondence. Each detail plays a critical role in facilitating easy transactions and addressing inquiries or issues that may arise during the payment process.

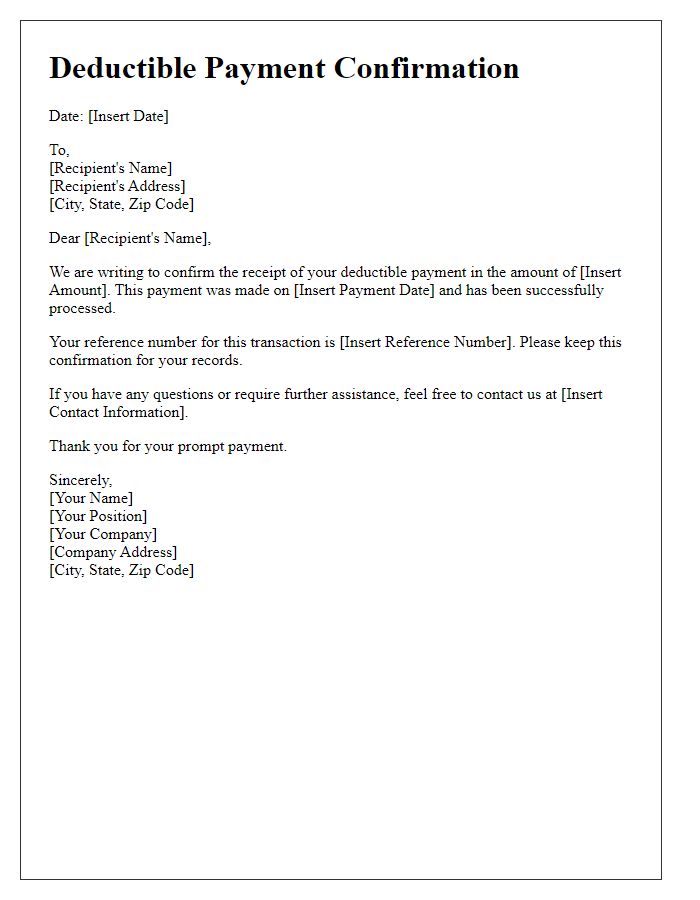

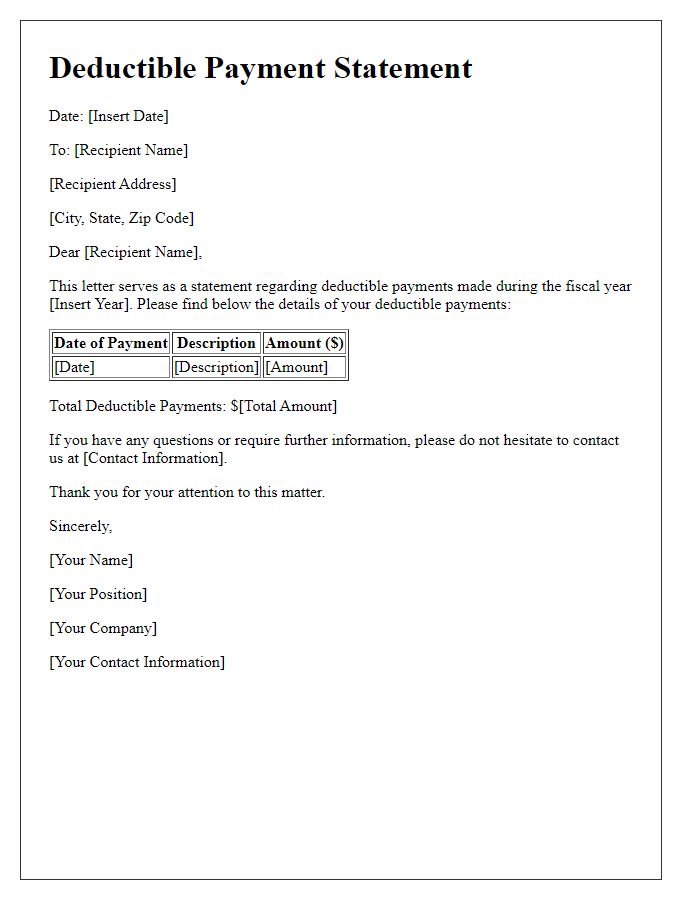

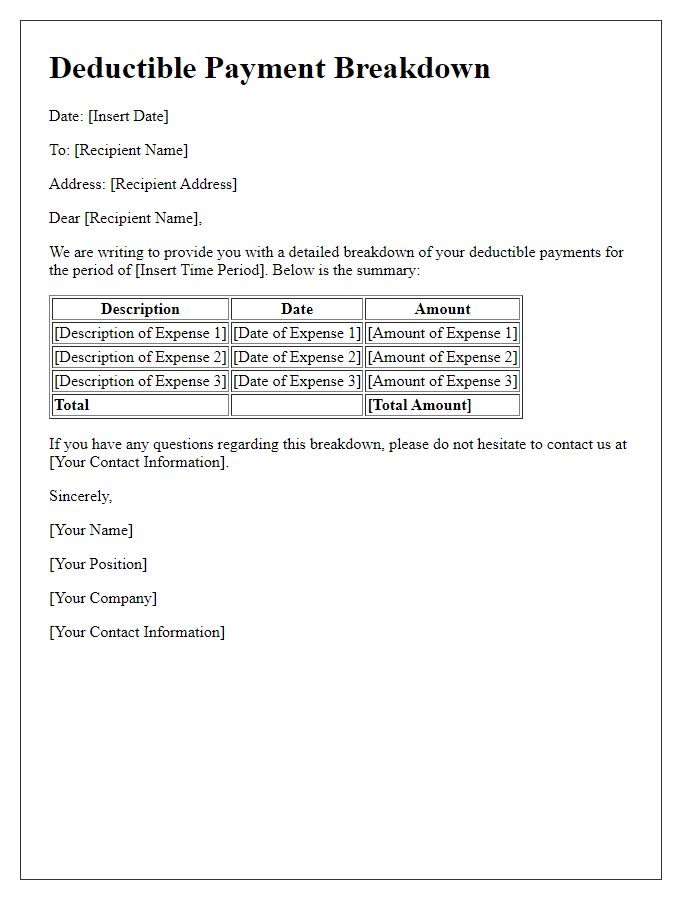

Payment Amount and Currency

The deductible payment details provide essential information regarding the financial obligations that must be met by the insured party in order to process claims effectively. A deductible represents the fixed amount ($500 for instance) the policyholder must pay out-of-pocket before insurance coverage kicks in. This payment usually pertains to various insurance types, including health, auto, and homeowners insurance. Currency is also a crucial detail, typically denoted in United States Dollars (USD) or Euros (EUR), reflecting the monetary standard applicable to the transaction. Reviewing the deductible payment details ensures clarity and eases the claims process, which is vital for policyholders during potentially stressful circumstances.

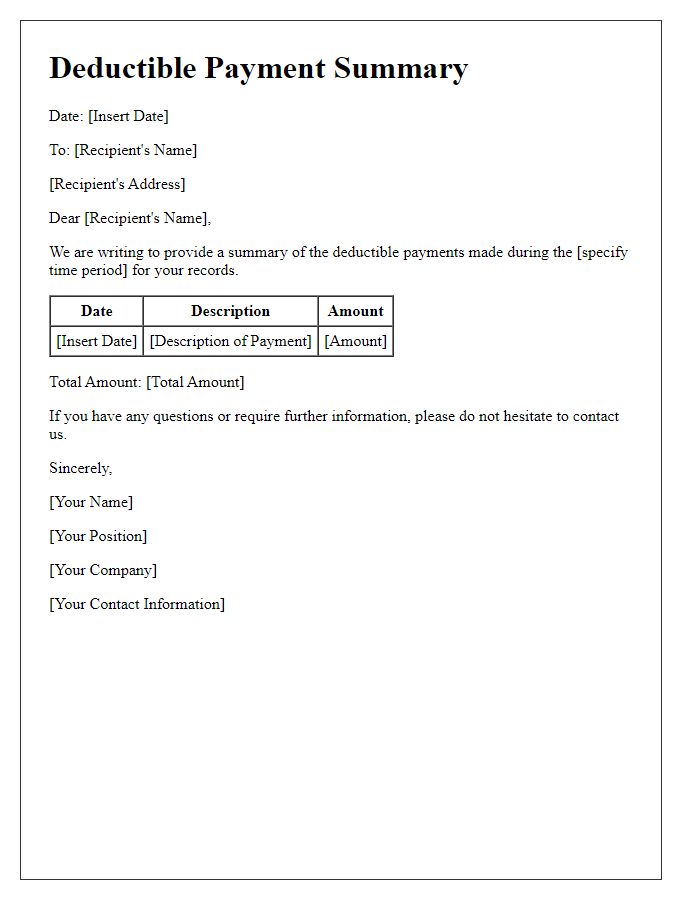

Deductible Description and Policy Number

A deductible is an amount that policyholders must pay out-of-pocket before their insurance coverage kicks in. In health insurance policies, a deductible may vary widely, ranging from as low as $250 to over $10,000 annually, depending on the plan's structure. The policy number, a unique identifier assigned to a specific insurance agreement, allows for efficient processing of claims and tracking of coverage details. Insurance providers may require details such as the deductible amount, the beneficiary's name, and the incident date to facilitate accurate reimbursements under the specified policy. Locations of healthcare services or facilities (e.g., hospitals, clinics) often influence deductible applicability based on in-network versus out-of-network status.

Payment Methods and Instructions

The payment methods and instructions for deductible payments involve several options, including credit card transactions, bank transfers, and mobile payment applications. For credit card transactions, users can utilize major brands like Visa and MasterCard, ensuring secure payments through encrypted processing systems. Bank transfers may require the input of routing numbers and account details, with a typical processing time of 1 to 3 business days. Mobile payment applications, such as PayPal or Venmo, facilitate instantaneous transfers but may involve service fees of around 2.9% plus a fixed fee per transaction. Ensure all payment details, including amounts and due dates, are accurately entered to prevent delays or discrepancies in processing.

Deadline for Payment and Consequences

Failure to meet the deadline for deductible payment can result in significant consequences for individuals and businesses alike. The due date for this payment, often specified in financial agreements or insurance policies, typically falls within a specified timeframe, such as 30 days from the date of notice. Late payments may incur additional fees, potentially ranging from 1% to 5% of the outstanding amount for each month overdue. In severe cases, policyholders may face suspension of coverage or denial of claims because many financial institutions, including insurance providers, enforce strict policies to ensure timely payment. Maintaining adherence to the payment schedule is crucial for uninterrupted access to services required.

Comments