Are you in need of a quick and effective way to communicate your urgent premium payment request? Crafting a well-structured letter can make all the difference in ensuring your message is received and acted upon promptly. In this article, we'll explore essential tips and a practical template to help you articulate your needs clearly and professionally. Ready to get started? Let's dive in and make your request stand out!

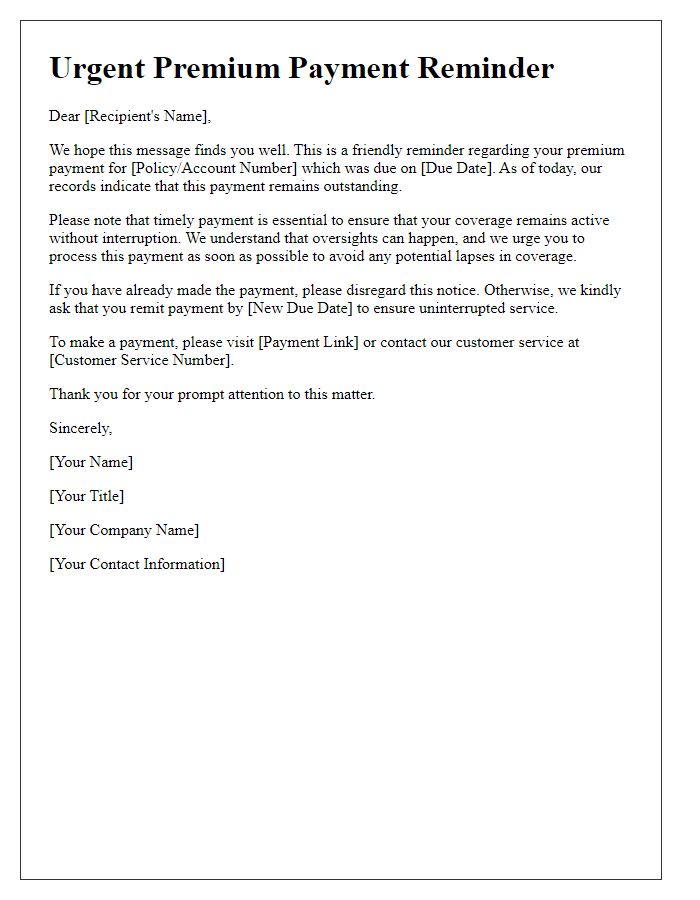

Clear subject line

Urgent Request for Premium Payment: Immediate Attention Required Urgent premium payment requests often concern policyholders in insurance sectors such as life insurance, auto insurance, or health insurance. Timely payment is crucial to maintain coverage benefits and avoid policy lapses. Outstanding balances can result in penalties or loss of benefits, which may impact policyholders during unforeseen circumstances. Specific due dates are commonly specified within policy documents, typically aligning with the start of each premium cycle, and late payments can lead to coverage suspension. Prompt action ensures continual protection under agreements established by respective insurance providers. Regular notifications often help remind clients of imminent deadlines and secure necessary payments.

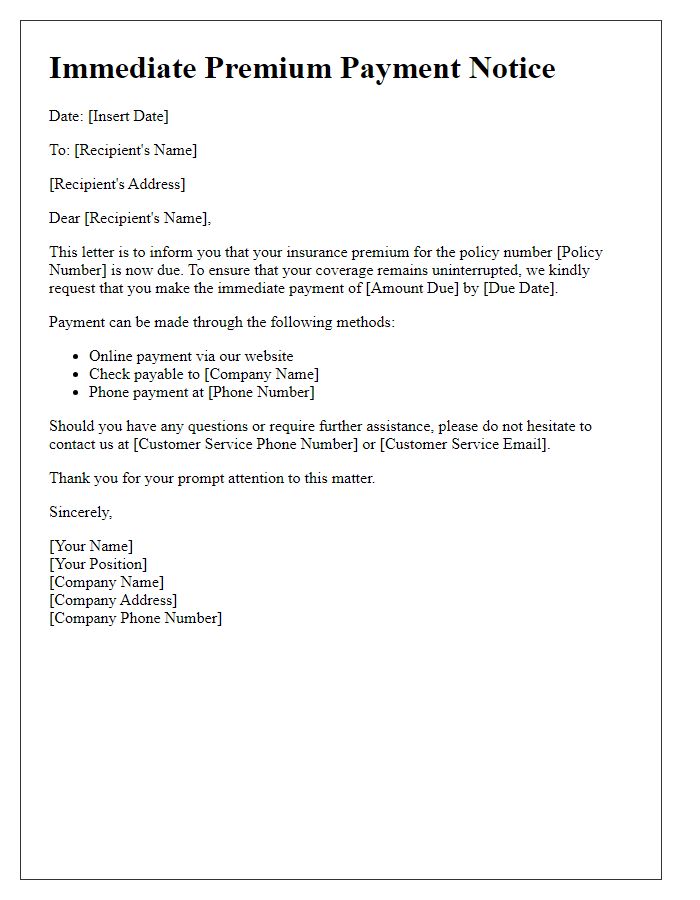

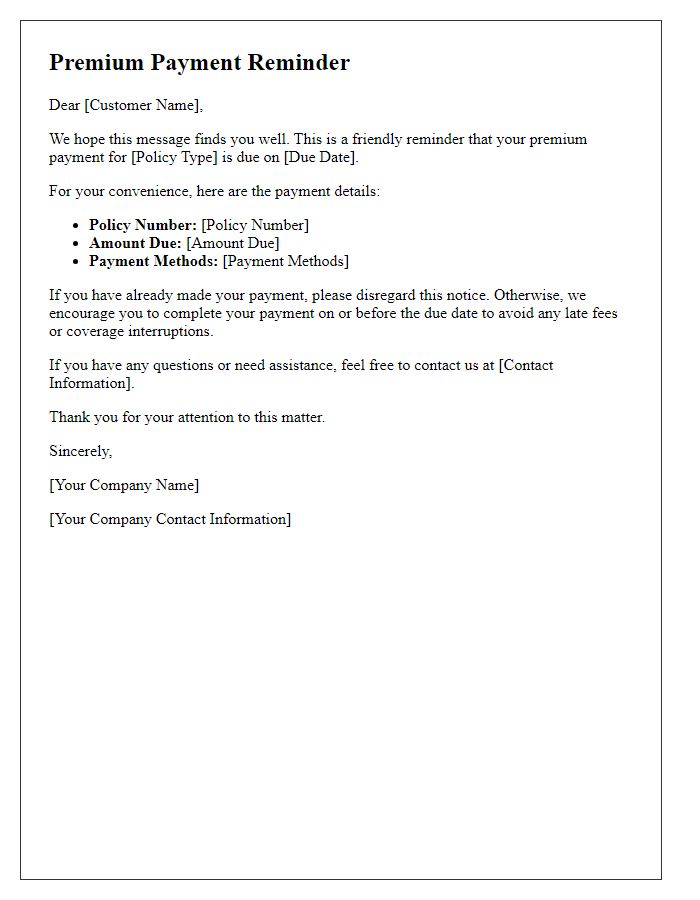

Accurate recipient details

Accurate recipient details are crucial in urgent premium payment requests to ensure timely processing. Including specific information such as the policyholder's full name, policy number, and the insurance company's name creates clarity. For instance, mentioning the due date, which might be the 15th of the month, emphasizes urgency. Additionally, specifying the payment amount, such as $1,200, alongside acceptable payment methods like credit card or direct bank transfer streamlines the process. Clearly stating the recipient's department, such as Billing and Collections, further reduces the chances of miscommunication. When all these elements are precise, it enhances the likelihood of prompt payment processing and minimizes potential delays.

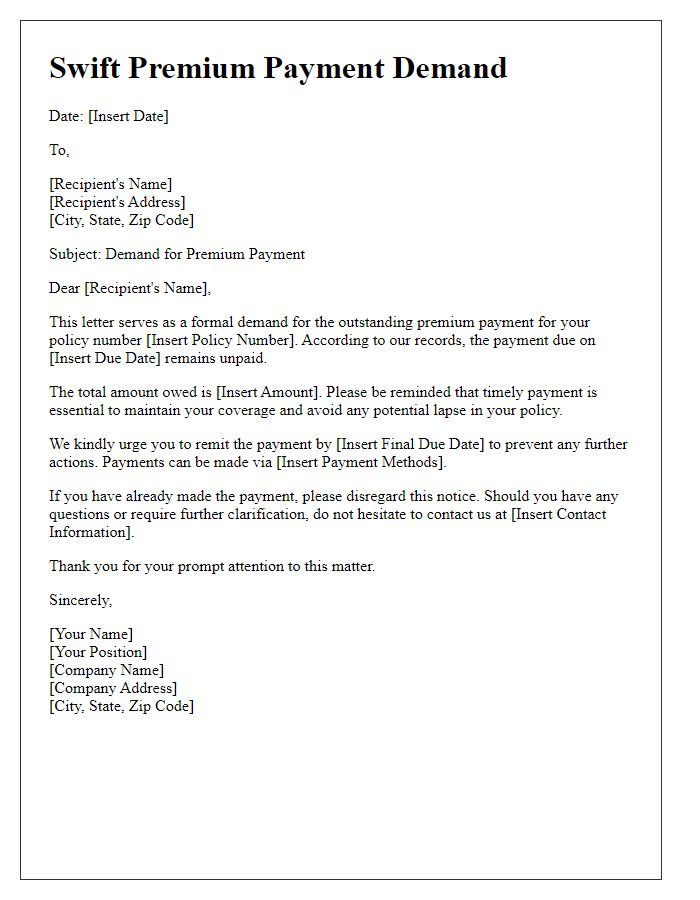

Specific payment amount and due date

Urgent premium payment requests require precise information to ensure timely processing. Premium amount, for example, $500, must be clearly stated along with the due date, which is November 15, 2023. Missing this deadline can result in policy cancellation or coverage lapses, significantly impacting financial protection. Include specific account details for the payment method, such as bank transfer information or credit card instructions, to facilitate seamless transactions. Emphasizing the urgency and importance of the payment ensures the recipient understands the need for immediate action.

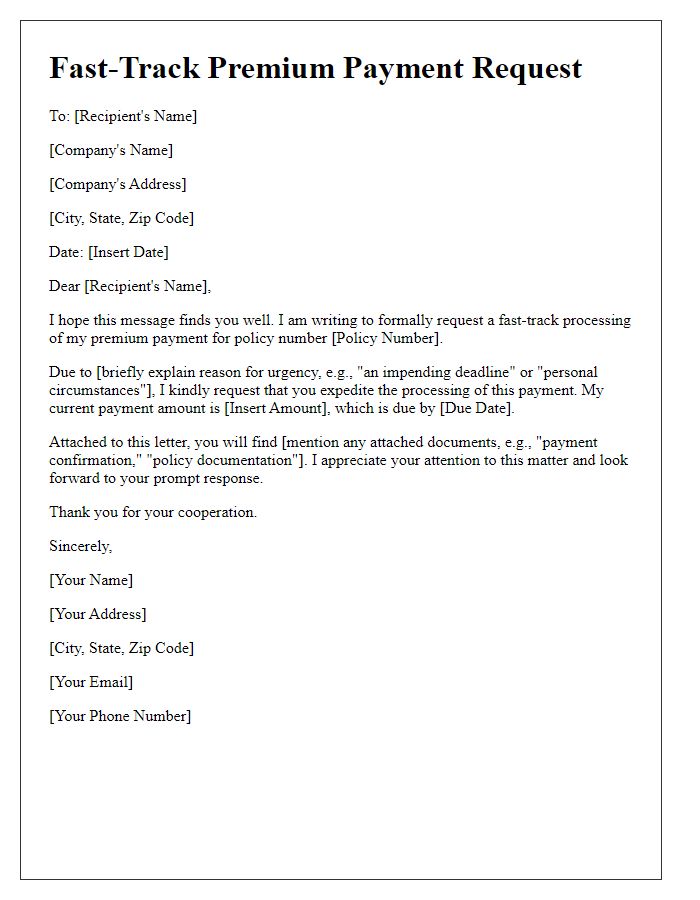

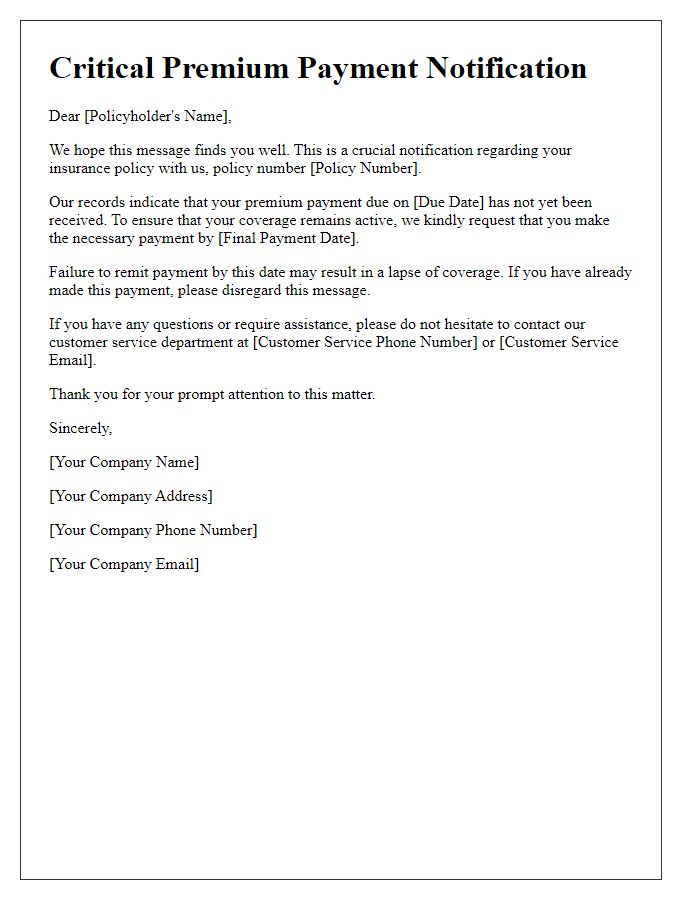

Consequences of non-payment

Failure to remit premium payments can result in significant consequences for policyholders, particularly in the realm of insurance coverage, which includes health, auto, and home insurance. Upon missing a payment deadline, policyholders may experience a grace period of 30 days, depending on the policy terms or jurisdiction regulations. Beyond this period, policies can lapse, leading to loss of coverage and exposing individuals to financial risk during unexpected events, such as accidents or natural disasters. Additionally, reinstatement of coverage may include higher premiums and penalties, significantly increasing total costs. Moreover, prolonged non-payment could adversely affect credit scores, as insurers may report defaults to credit bureaus, impacting future borrowing capabilities. Overall, timely premium payments ensure continued protection and financial stability against unforeseen circumstances.

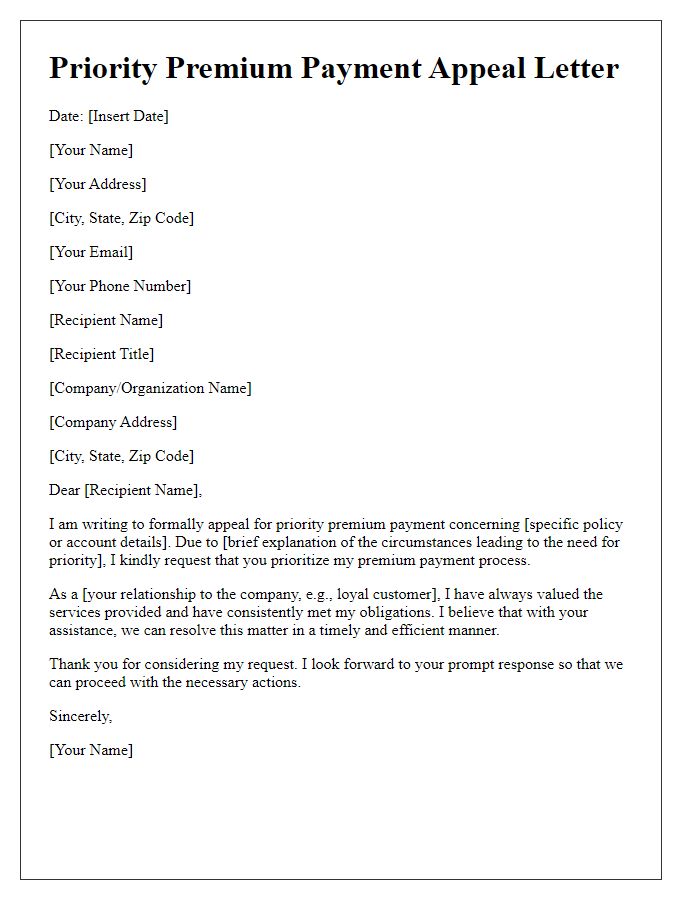

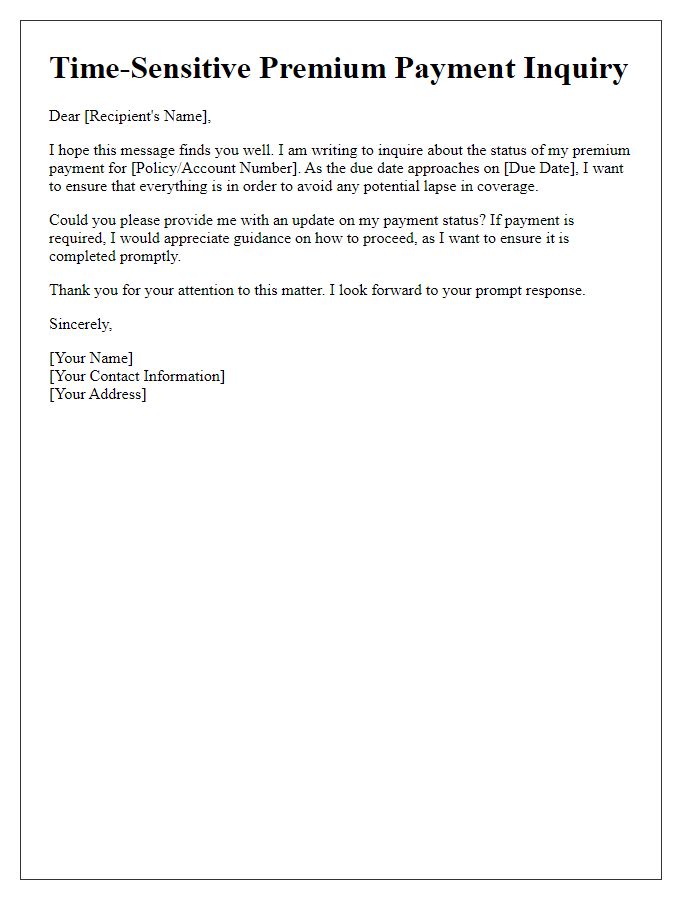

Contact information for queries

Urgent premium payment requests may be essential for maintaining active insurance coverage. Policyholders must adhere to specified due dates, typically outlined in policy documents. Non-payment can lead to coverage lapses, potentially exposing individuals to financial risks associated with unexpected events. The contact information for inquiries is crucial, allowing policyholders to seek clarification or assistance regarding payment methods and deadlines. Common channels include dedicated customer service hotlines, email addresses, and online account management portals. Policyholders are encouraged to retain this information, ensuring prompt resolution of payment issues.

Comments