Are you curious about how much your insurance coverage will cost? Understanding the factors that influence insurance premiums can feel overwhelming, but it doesn't have to be! In this article, we'll break down the essential components that affect your insurance cost estimates, making it easier for you to navigate your options. Join us as we explore the ins and outs of getting a clear estimate tailored to your needs!

Subject Line: Clear and Specific Inquiry

Subject line clarity is crucial for effective communication in insurance cost estimate inquiries. A detailed subject line, such as "Request for Insurance Cost Estimate for Homeowner's Policy Against Natural Disasters," directly communicates the purpose of the inquiry. Including pertinent details, like the type of insurance (homeowner's policy), specific risks (natural disasters), and the desired coverage areas (like flood or earthquake coverage), streamlines the process. This approach enhances responsiveness and ensures the insurance provider aligns their quote with the relevant factors, such as property location (for instance, residing in California, a state prone to wildfires) and property value (home valued at $500,000). Clear subject lines increase efficiency, getting you the information you need quickly.

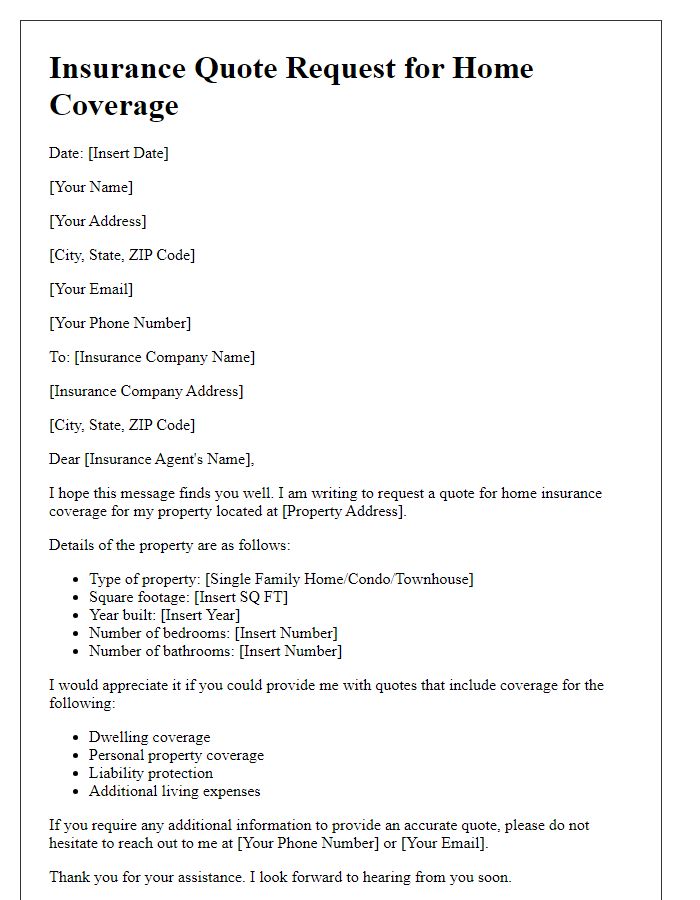

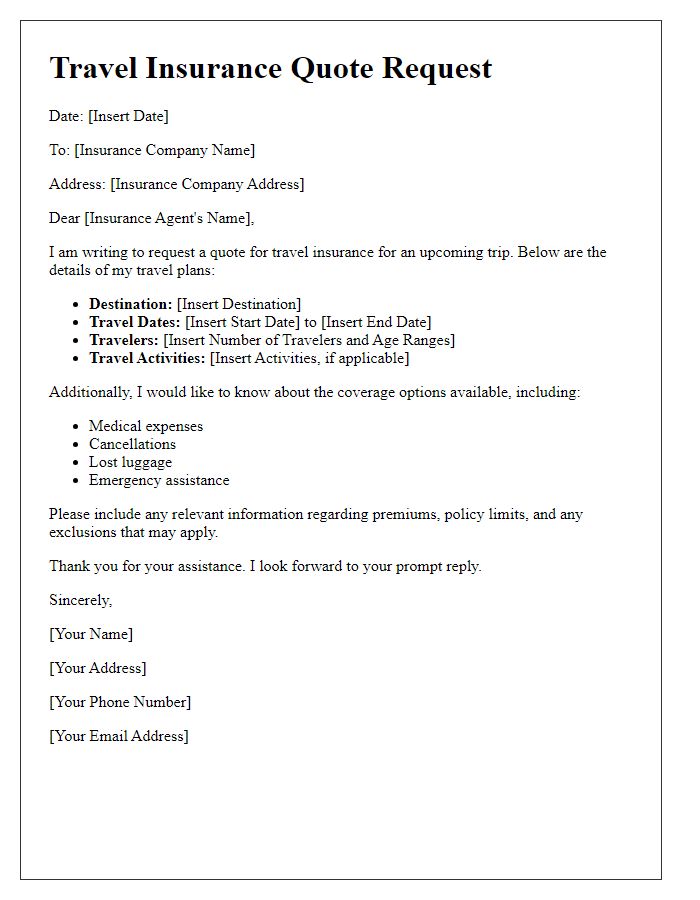

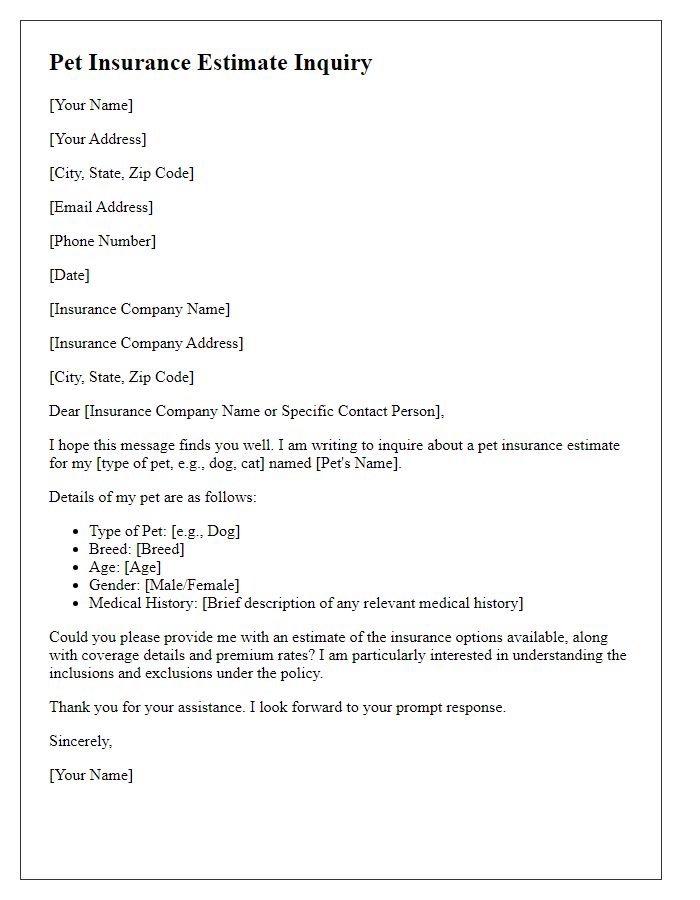

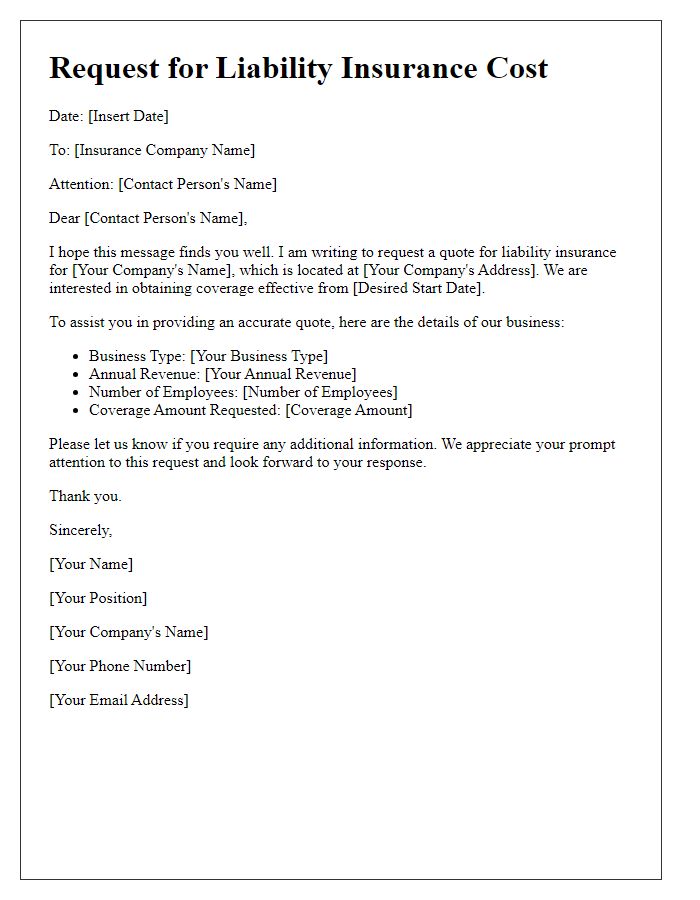

Personal and Policy Details

Insurance cost estimates require specific personal details and policy information to provide accurate assessments. Essential personal details include full name, date of birth (for age-based risk evaluation), address (to determine location-specific risks), phone number, and email (for communication purposes). Policy details encompass the type of insurance (such as health, auto, or homeowners) and existing coverage levels, policy limits, and deductibles. Additionally, factors like prior claims history, credit score (which can impact premiums), and the number of insured valuables add further context. Finally, mentioning the desired coverage start date clarifies urgency and assists in generating prompt estimates.

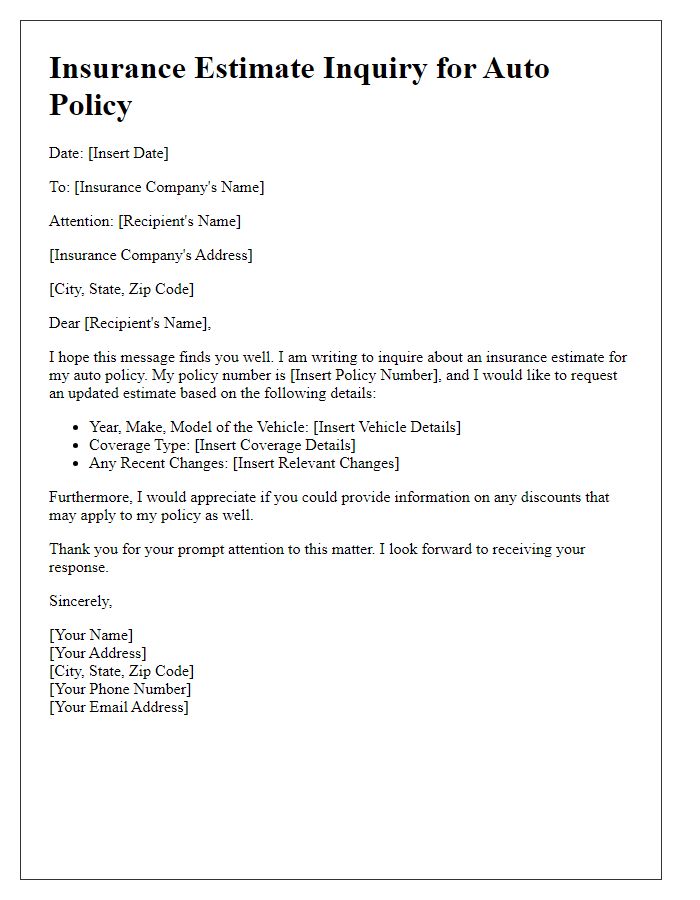

Specific Coverage Interests

Inquiries regarding insurance cost estimates often involve specific coverage interests tailored to individual needs. Homeowners insurance (averaging $1,192 annually in the United States), for example, provides protection for property against risks like fire, theft, and natural disasters. Auto insurance (with national averages around $1,428 per year) covers liabilities and damages related to vehicular accidents. Health insurance (spending approximately $7,911 per person annually) focuses on medical expenses while offering coverage for preventive care, hospitalization, and prescription drugs. Additionally, specialized insurance, such as flood insurance (which varies by flood zone risk), can help protect homes in high-risk areas. Understanding the nuances of each coverage type is crucial in obtaining accurate estimates and making informed purchasing decisions.

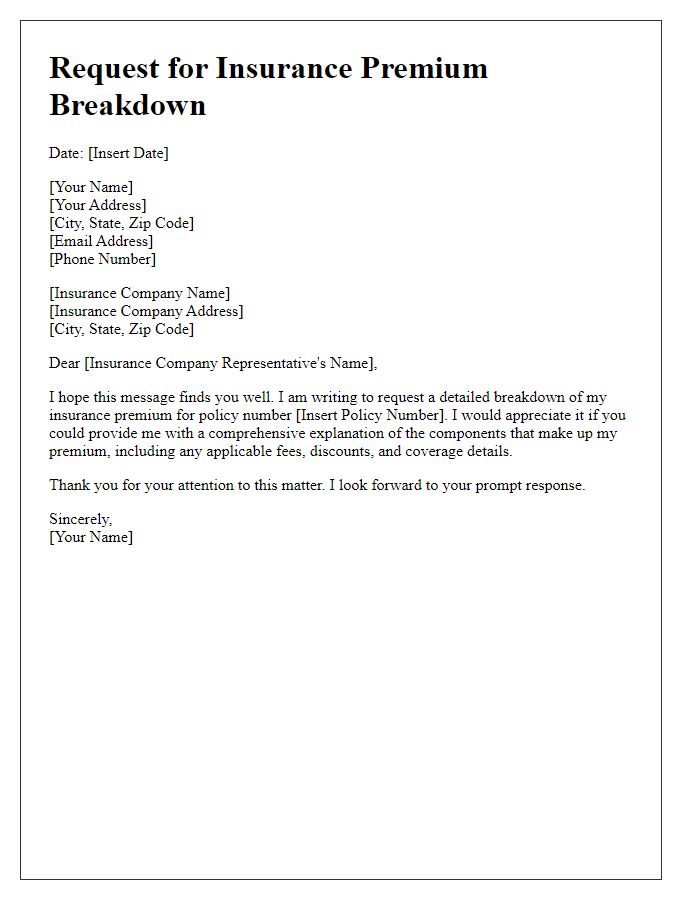

Request for Detailed Breakdown

An insurance cost estimate inquiry can provide insights into premium rates across different plans offered by providers. Factors such as the type of coverage (e.g., health, auto, home) and the specific policy features (deductibles, co-pays, limits) heavily influence costs. Location plays a significant role, with regional differences affecting rates, particularly in metropolitan areas like New York City or San Francisco. The demographic details of the individual seeking coverage, such as age and medical history for health insurance, can also impact the estimate. Additionally, understanding discounts available, like multi-policy bundles or safe driving discounts for auto insurance, offers further clarification on potential savings. Requesting a detailed breakdown aids in comprehensive evaluation, ensuring informed decision-making.

Contact Information and Follow-up Instructions

Insurance cost estimates are crucial for understanding potential expenses related to various policies, including health, auto, or home insurance. Contact information typically includes the individual's name, email address, and phone number for effective communication with the insurance provider, which can be a company like State Farm or Allstate. Follow-up instructions may involve a specific timeframe, such as waiting for a response within five business days, and ensuring the inquiry mentions any policy types, coverage levels, and deductible amounts that are of particular interest, which can aid in receiving a more accurate estimation.

Comments