Are you looking for clarity on dependents insurance coverage? Understanding the ins and outs of dependents insurance can be a bit tricky, but it's essential for ensuring your loved ones are protected. In this article, we'll break down the key details about what dependents insurance covers, eligibility requirements, and how to apply. Let's dive deeper into how you can provide peace of mind for your family!

Policyholder Information

Policyholder information includes essential details regarding the individual holding the insurance policy, such as their full name, which identifies the insured party in legal documents. Date of birth, typically formatted as MM/DD/YYYY, is vital for age-related coverage considerations. Social Security Number acts as a unique identifier for managing records and claims. Policy number serves as a reference for coverage specifics and accessing policy benefits, while contact information, including phone numbers and email addresses, is crucial for communication purposes. Address details, like street, city, state, and zip code, establish the policyholder's location for official correspondence and regional regulations. These elements collectively ensure proper management and support of dependents under the insurance plan.

Coverage Details

Dependents' insurance coverage offers critical financial protection for families, ensuring that loved ones have access to necessary medical care. Typically, this coverage includes essential services such as hospitalization, outpatient care, preventive care, and prescription medications. For example, common plans may cover up to $1,500 per person annually for preventive visits, including vaccinations and screenings. Additionally, dependents aged under 26 can remain on their parents' insurance plans, a provision stemming from the Affordable Care Act implemented in 2010. Each insurance provider may have specific networks of hospitals and healthcare providers, influencing access to services. Understanding the nuances of deductibles, copayments, and premium costs is essential for maximizing benefits and ensuring a safety net for dependent family members.

Dependent Identification

Dependent identification is a crucial aspect of insurance coverage for families. Dependent coverage typically includes spouses and children under 26 years of age, as mandated by regulations like the Affordable Care Act in the United States. Proper identification ensures that those eligible for coverage are enrolled correctly. Documentation may include birth certificates for children or marriage certificates for spouses. Insurance companies, such as Blue Cross Blue Shield or Aetna, often require a social security number to facilitate claims processing. Additionally, regular updates on dependent status, particularly in events such as marriage, divorce, or a child reaching adulthood, are important to maintain accurate records and avoid coverage gaps.

Claim Process

Dependent insurance coverage claims require specific documentation and adherence to a systematic process. Policyholders must first gather necessary forms, including proof of relationship (such as birth certificates or marriage licenses) and specific incident documentation (like medical bills or accident reports). Next, submitting a completed claim form to the insurance provider within stipulated timelines, typically 30 days, is crucial. Each policy may have different requirements, so reviewing the coverage details and exclusions listed in the policy document is imperative. During processing, the claims department evaluates the submitted information against policy terms and may request additional documentation for clarity. Once approved, the insurer disburses benefits to cover eligible expenses such as medical treatments or associated costs up to specified limits.

Contact Information

Dependent insurance coverage encompasses various vital aspects that ensure health and financial security for dependents. The policy often includes coverage details such as premiums, deductibles, and out-of-pocket maximums specific to family members. For instance, family plans might cover a spouse and children up to a certain age or marital status, typically 26 years for most states in the U.S. Contact information is essential, featuring the insurance company's helpline numbers, website links for policy management, and email addresses for support inquiries. Additionally, documentation requirements, such as proof of dependency status (birth certificates or marriage licenses), should be clearly outlined to avoid coverage delays. Understanding these details can significantly affect budget planning and access to medical resources.

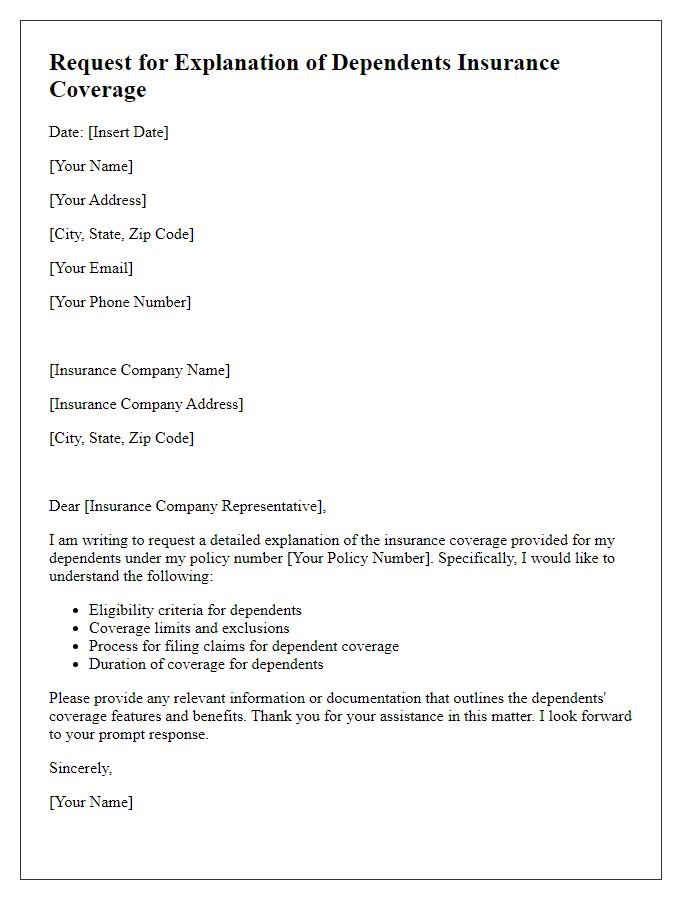

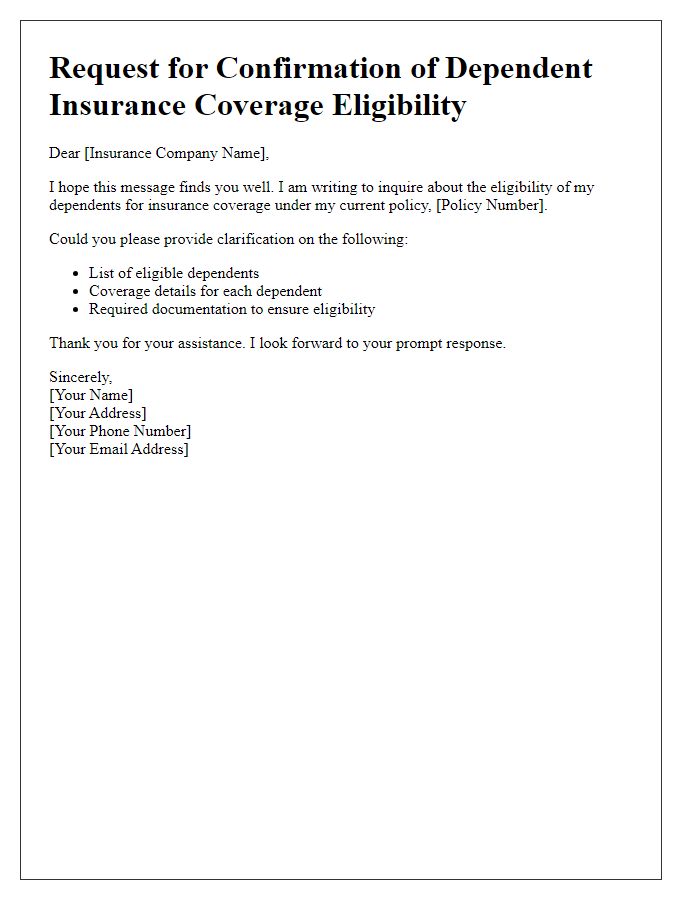

Letter Template For Dependents Insurance Coverage Details Samples

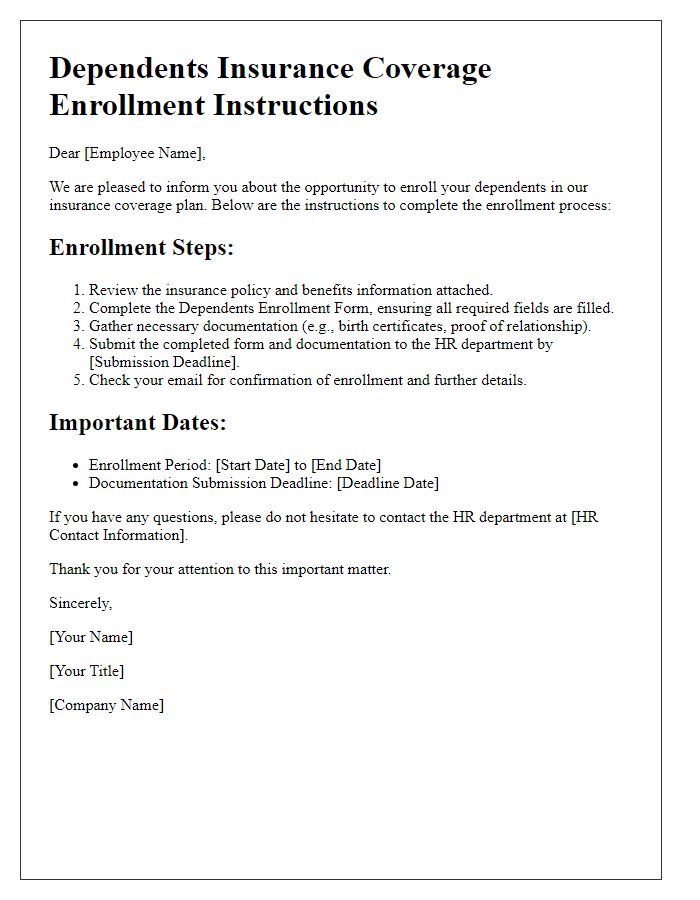

Letter template of dependents insurance coverage enrollment instructions

Comments