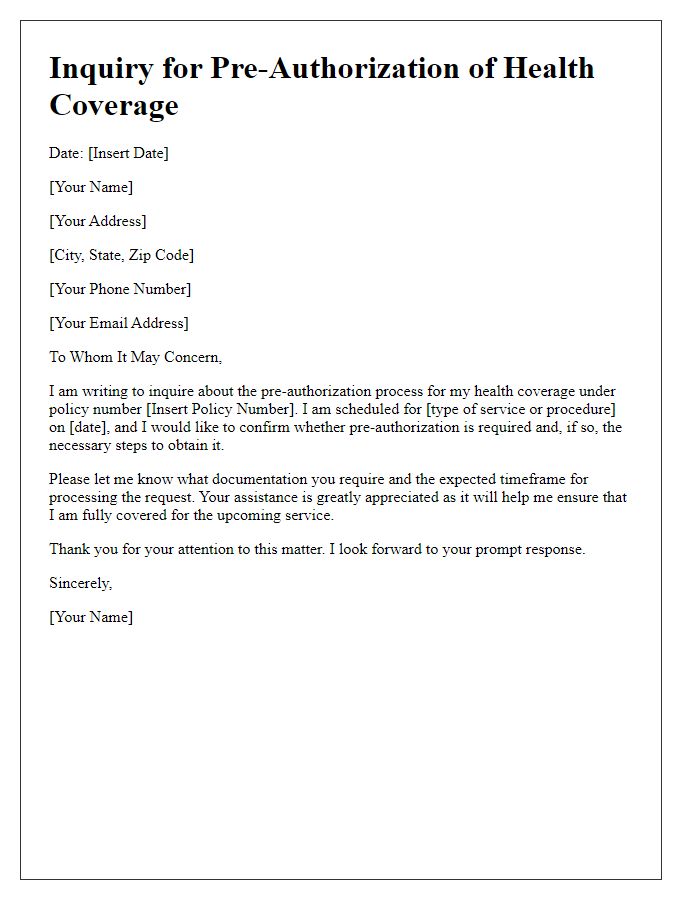

Are you navigating the often complex world of insurance coverage? Writing a letter for pre-authorization of benefits can seem daunting, but it doesn't have to be! With the right approach, you can articulate your needs clearly and effectively. Dive into our comprehensive guide to discover the essential steps and tips for crafting your own pre-authorization letter â you'll be ready to submit your request in no time!

Patient Information

Pre-authorization for coverage benefits requires detailed patient information to ensure smooth processing. The patient's full name, date of birth, and ID number must be accurately documented. Important medical history, including diagnosis codes (ICD-10), treatment plans, and prescribing physician details, should be included to validate the necessity of the requested services. Additionally, the specific procedure or service needing pre-authorization, such as MRI or surgery, along with the dates and relevant codes (CPT) enhances clarity. Insurance details, including policy number, provider name, and contact information, are vital for efficient communication with the insurance company. Proper documentation ensures timely approvals for necessary medical care.

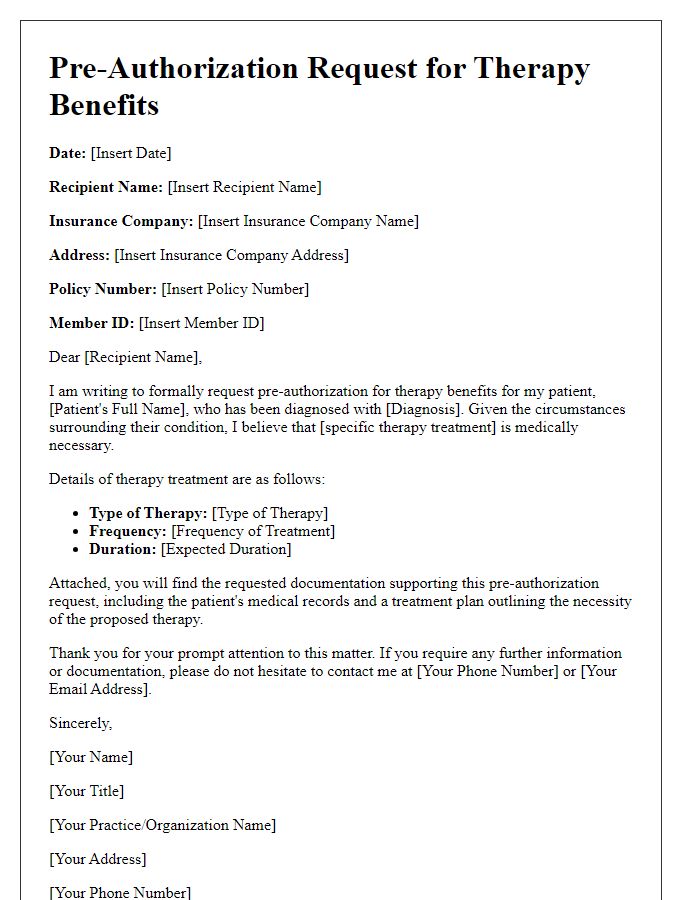

Provider Details

Pre-authorization for coverage benefits is often required by health insurance companies before specific medical services are provided. These requests are typically submitted by healthcare providers (such as doctors, specialists, or clinics) to ensure that the patient's insurance policy will cover the costs associated with planned procedures, treatments, or services. The details included in the pre-authorization request usually consist of the provider's name, including their medical credentials, NPI (National Provider Identifier) number, and practice location. This information assists the insurance company in verifying the legitimacy of the healthcare provider and establishes a clear link between the patient and the authorized care needed. Accurate provider details help facilitate a smoother pre-authorization process and enhance the chances of approval for necessary medical interventions.

Treatment Description

Pre-authorization of coverage benefits is a crucial step for medical procedures such as surgeries or specialized treatments. This process typically involves gathering detailed information about the patient's condition which includes diagnosis codes (ICD-10) and treatment codes (CPT) for billing purposes. The healthcare provider must submit a thorough description of the proposed treatment, often including physician notes, medical history, and previous treatment responses. Each insurance provider may have specific requirements, including timeframes for submission and necessary documentation. Approval processes can vary, with some insurers responding within 24-72 hours, while others may take longer, affecting patient access to timely healthcare services. Well-documented pre-authorization requests can lead to better chances of coverage for necessary medical interventions, ultimately impacting patient care outcomes.

CPT and ICD Codes

The process of obtaining pre-authorization for coverage benefits requires a detailed understanding of medical codes relevant to specific treatments and diagnoses. CPT codes, particularly the 2023 updates, detail specific procedures performed by healthcare providers, while ICD codes outline the diagnosis behind these procedures. For instance, the CPT code 99213 can indicate an established patient office visit, while the ICD code J44.9 may represent chronic obstructive pulmonary disease without acute exacerbation. Accurate association of these codes is vital for insurance claims, ensuring that the proper medical necessity is justified for treatment approval. Payer-specific guidelines necessitate this pre-authorization process, often involving intricate administrative procedures that can impact patient care timelines significantly. Therefore, meticulous attention to detail in coding is essential for compliance and successful reimbursement.

Financial Responsibility Statement

The Financial Responsibility Statement is a critical document utilized in the health insurance process, particularly for pre-authorization of coverage benefits. It typically outlines the patient's obligation to understand their financial responsibilities regarding medical services. This statement often includes specific details about the healthcare provider, such as the name of the hospital or clinic (for instance, Mercy Hospital or Green Valley Clinic), the specific medical services in question (e.g., surgery, diagnostic tests), and the insurance policy details, including the policy number and coverage limits. Patients must acknowledge their understanding that insurance benefits may be subject to deductibles, co-payments, and potential out-of-pocket expenses. Furthermore, the statement may stipulate the need for upfront payment if pre-authorization is not secured, ensuring transparency in financial expectations between the patient and the healthcare provider.

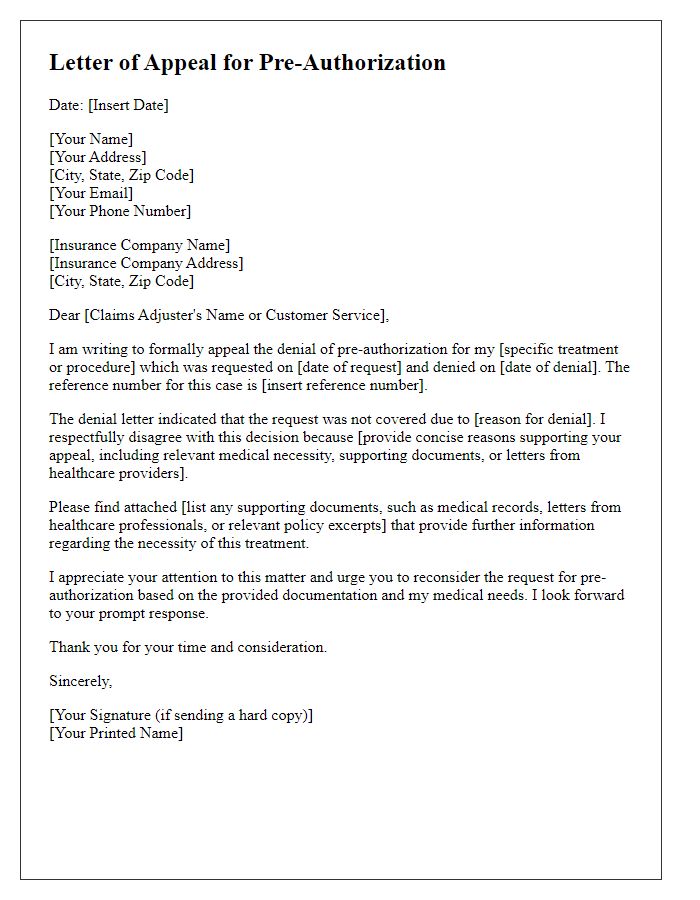

Letter Template For Pre-Authorization Of Coverage Benefits Samples

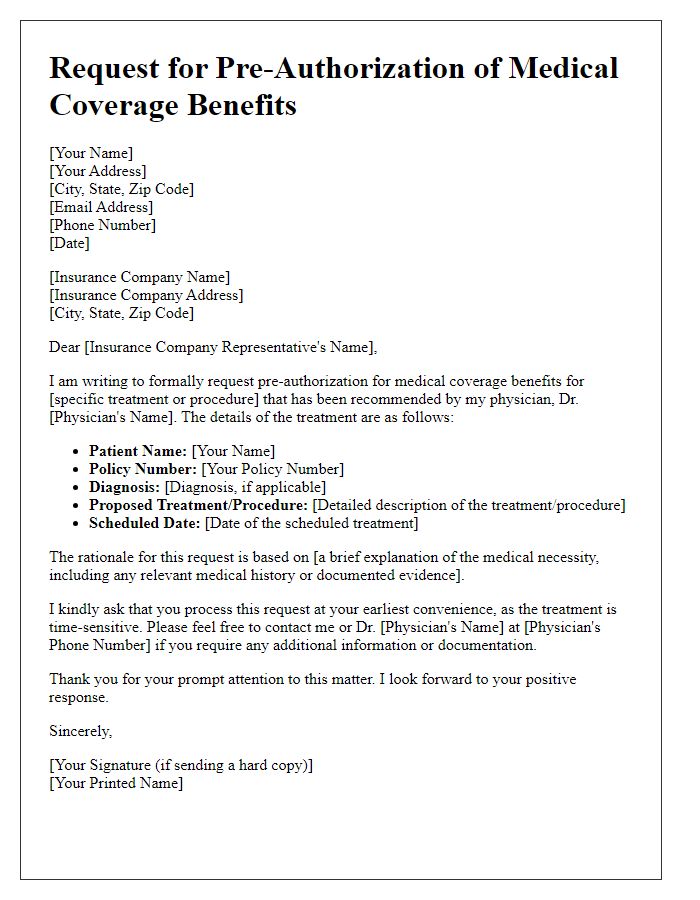

Letter template of request for pre-authorization of medical coverage benefits

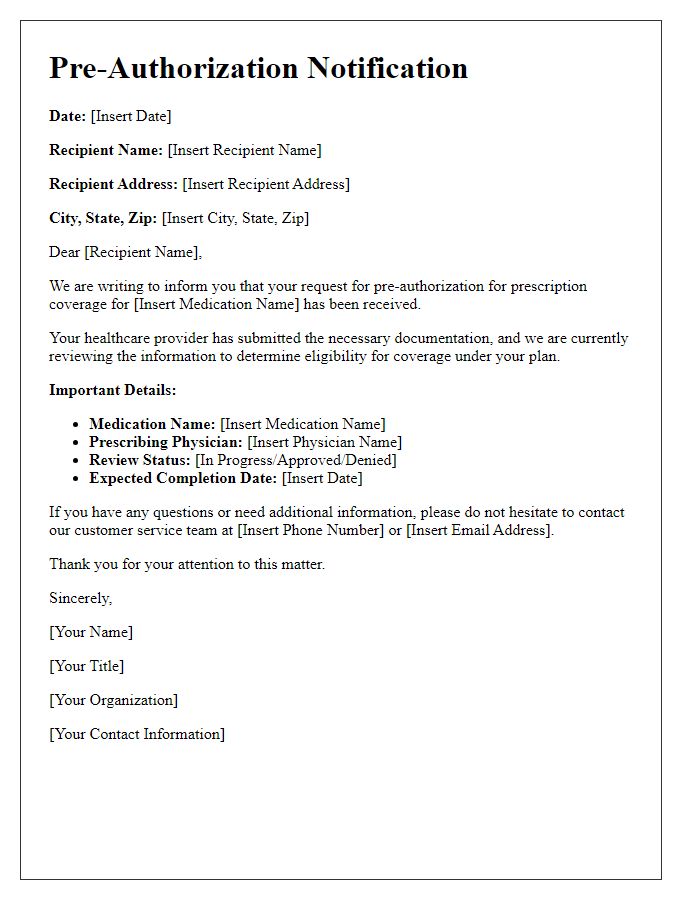

Letter template of notification for pre-authorization of prescription coverage

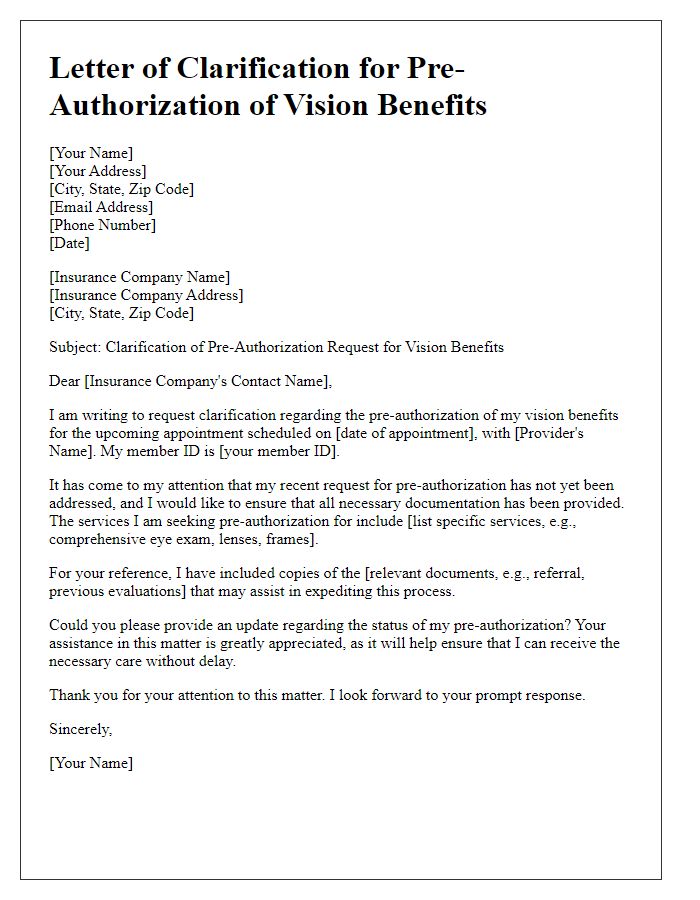

Letter template of clarification for pre-authorization of vision benefits

Letter template of confirmation for pre-authorization of surgical expenses

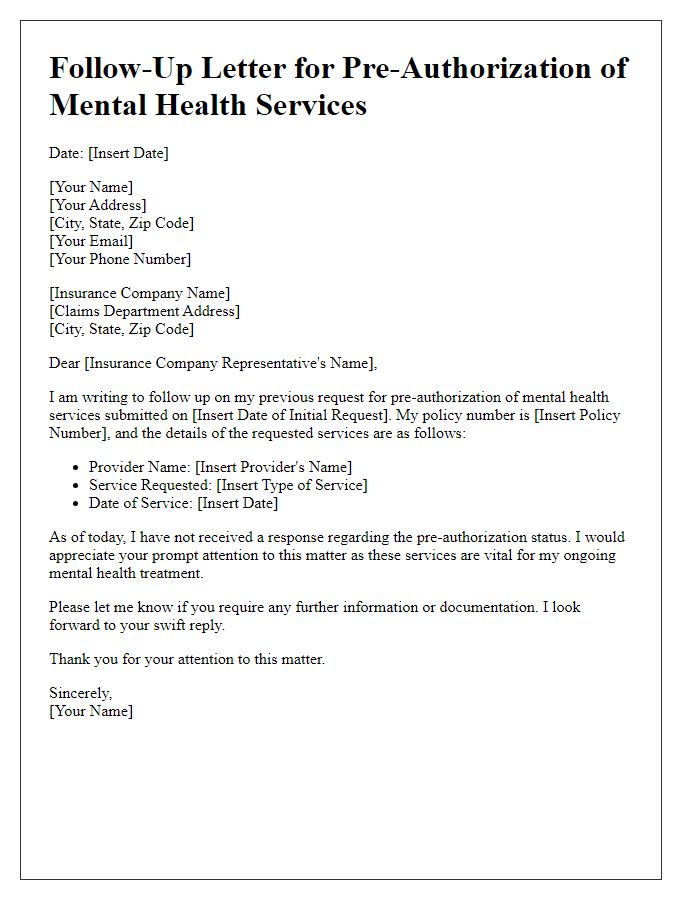

Letter template of follow-up for pre-authorization of mental health services

Comments