Are you feeling overwhelmed by the complexities of life insurance payouts? You're not alone in navigating this often confusing process, and understanding your options can make all the difference. In this article, we'll break down the essential steps to inquire about your life insurance payout, ensuring you feel informed and supported. Curious to learn more about securing your financial peace of mind? Let's dive in!

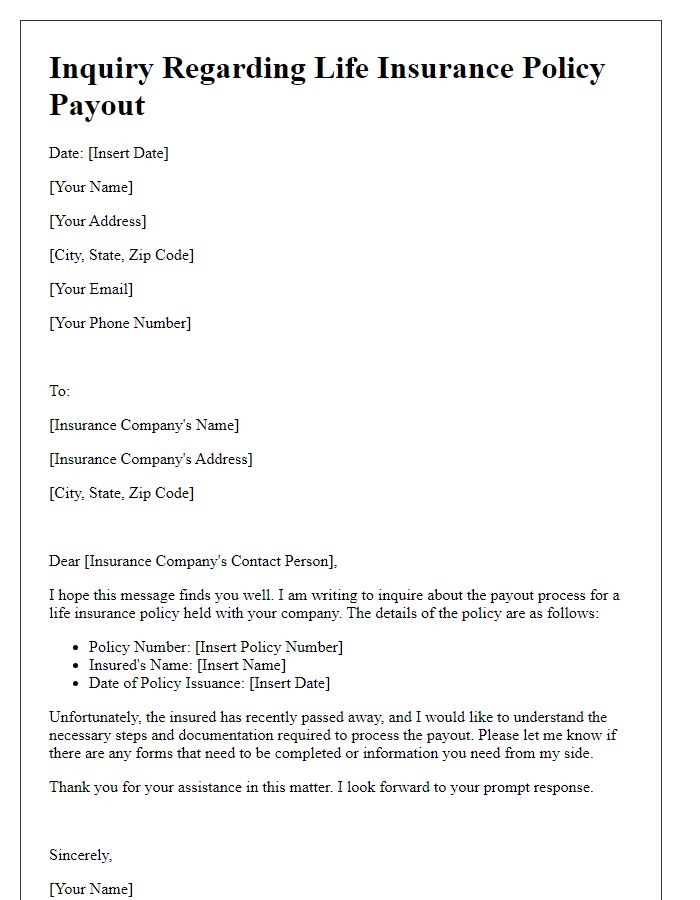

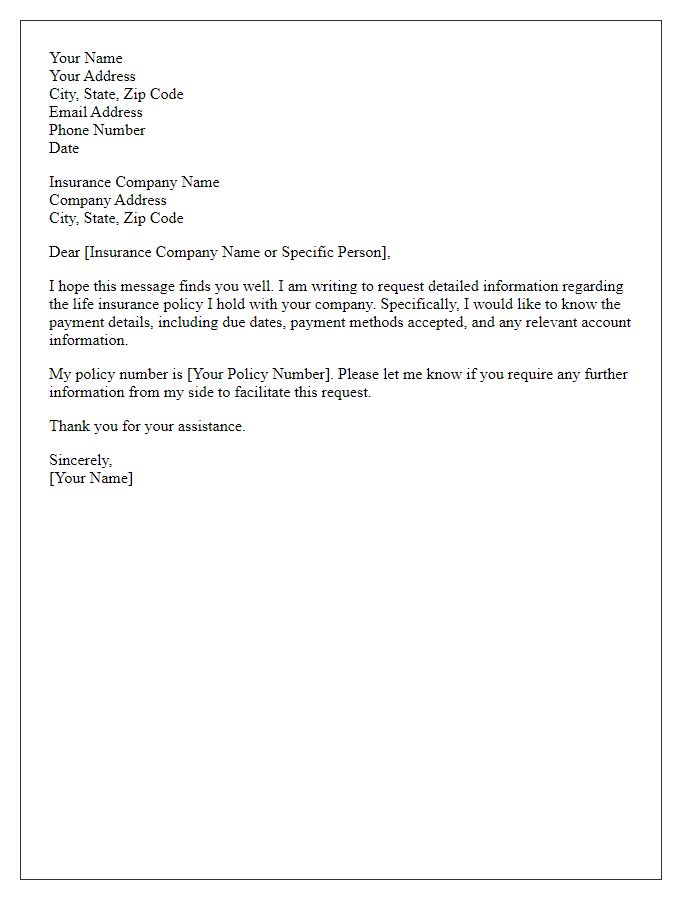

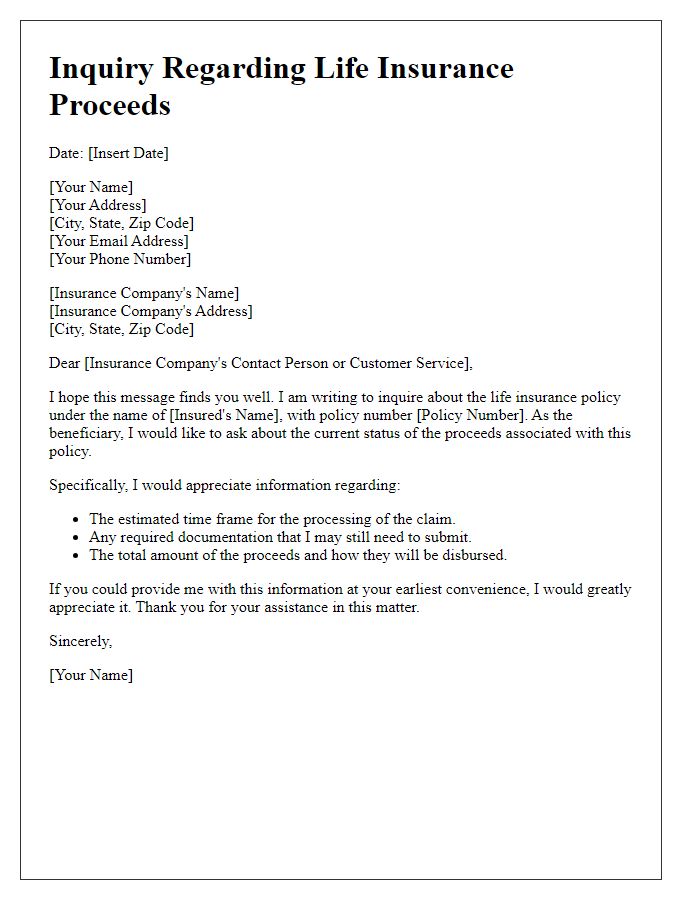

Clear Policy Identification

A clear policy identification number is crucial for initiating a life insurance payout inquiry. This number, usually located on the insurance policy document, serves as a unique identifier for the policyholder, facilitating efficient processing of claims and inquiries. Insurance companies such as Prudential, MetLife, or State Farm prioritize accurate identification to streamline claims, ensuring that policy details remain secure and accessible. Including the policy number alongside personal details, such as the insured's full name, date of birth, and contact information, helps agents verify information swiftly. Accurate identification not only expedites the claims process but also reinforces the security of sensitive information involved in the payout procedure.

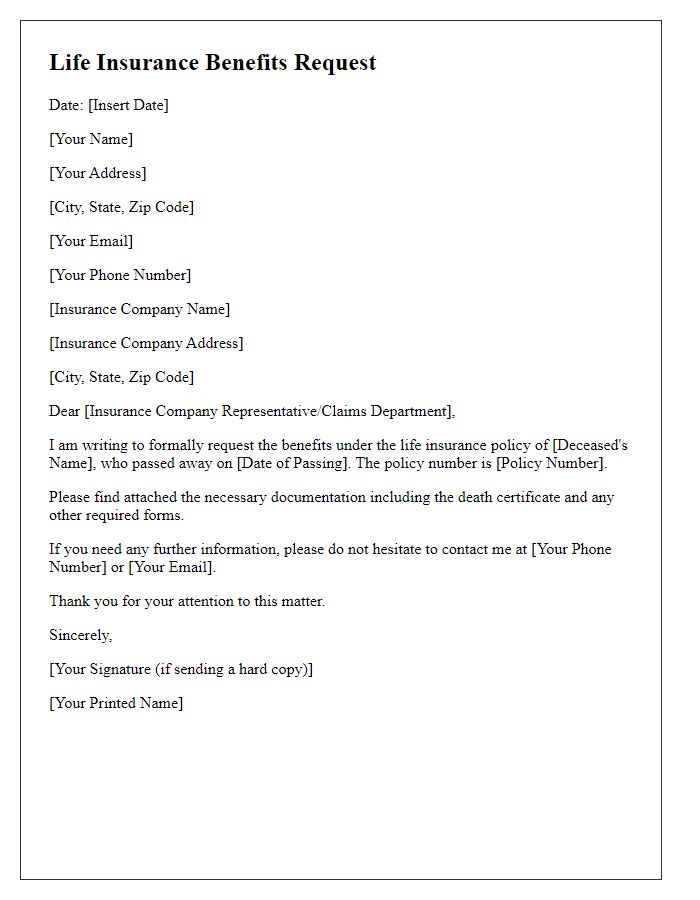

Accurate Claimant Information

When submitting a life insurance payout inquiry, accurate claimant information is crucial for a seamless process. Full name (matching the policy documents) ensures identification correctness. Include contact details, such as phone number and email address, to facilitate communication. Policy number (unique identifier for the insurance contract) must be provided to reference the specific account. In some instances, the date of birth and Social Security number may be required to verify identity. Additionally, submitting a certified copy of the death certificate (official document confirming the individual's passing) is essential for claim processing. Clear documentation reduces delays and increases the likelihood of a prompt payout.

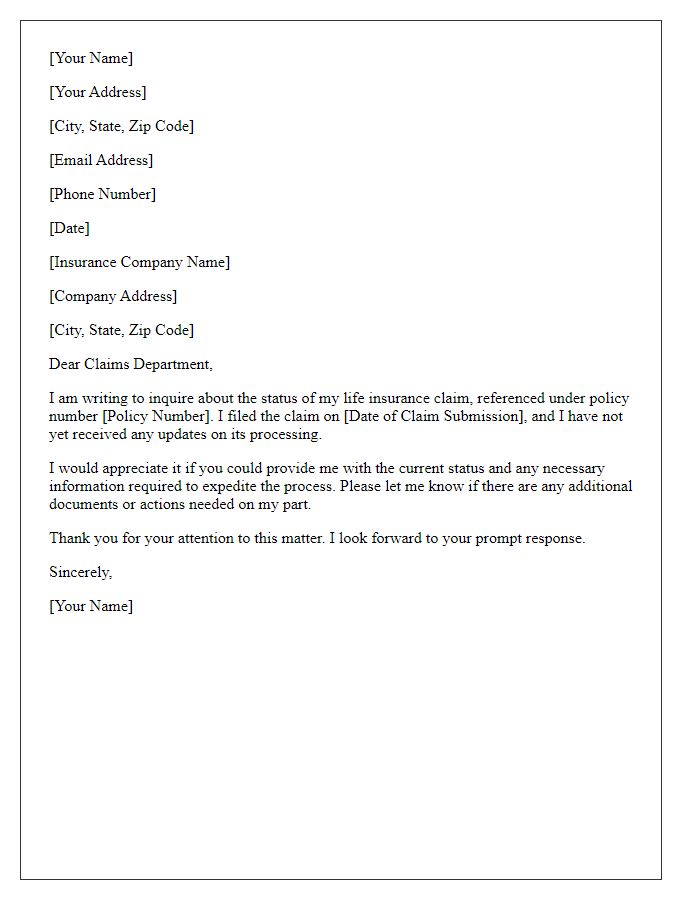

Detailed Policyholder Information

A life insurance payout inquiry requires detailed policyholder information for efficient processing. The policyholder's full name is crucial for accurate identification, alongside the unique policy number issued by the insurance provider. Important dates include the policy's initiation date and the date of the insured individual's passing, which directly affect the claims processing timeline and eventual payout eligibility. Contact details, such as the phone number and email address, facilitate communication between the policyholder's beneficiaries and the insurance company. Additionally, beneficiaries must provide their legal identification information, like Social Security numbers (in the United States) or similar identification documents relevant to their jurisdiction. This data ensures that the claims process adheres to legal standards and protects against fraud.

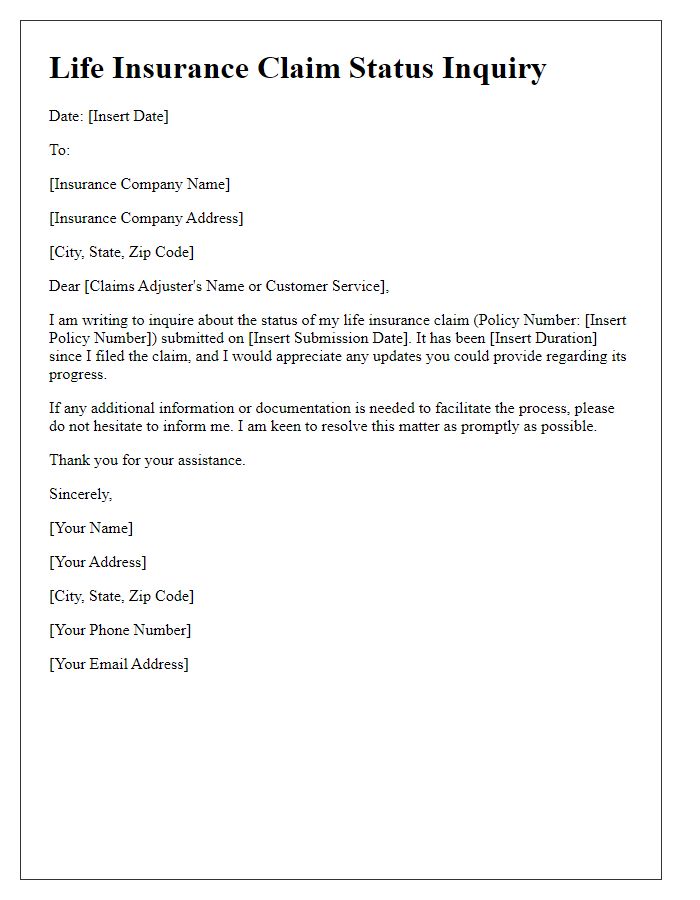

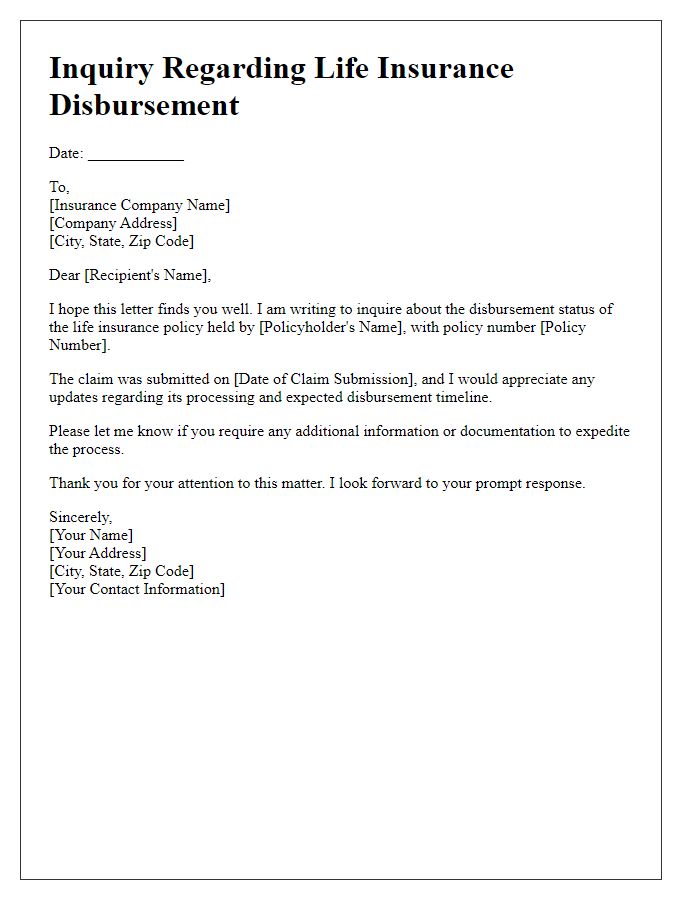

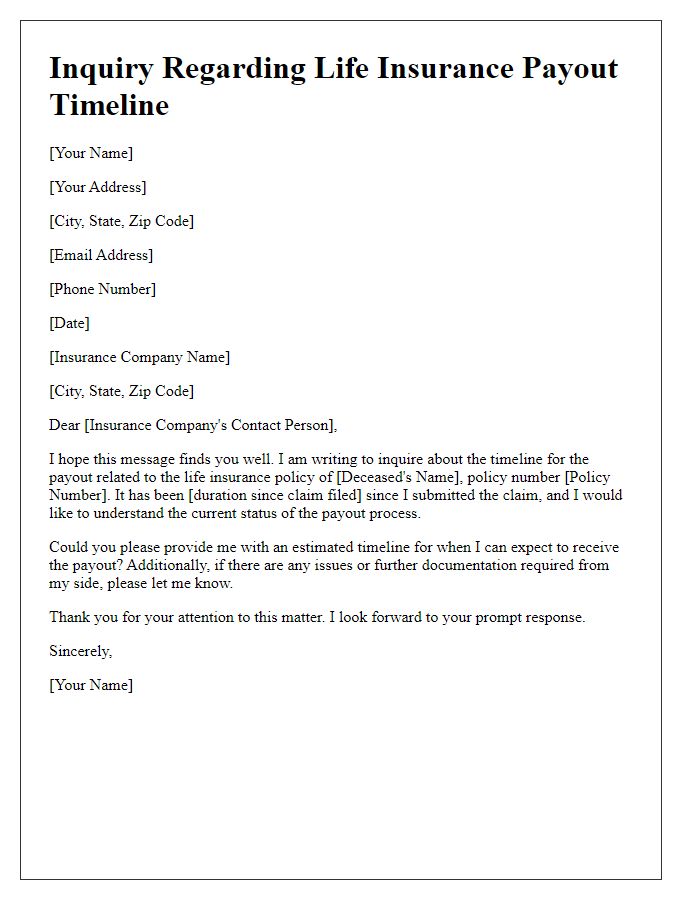

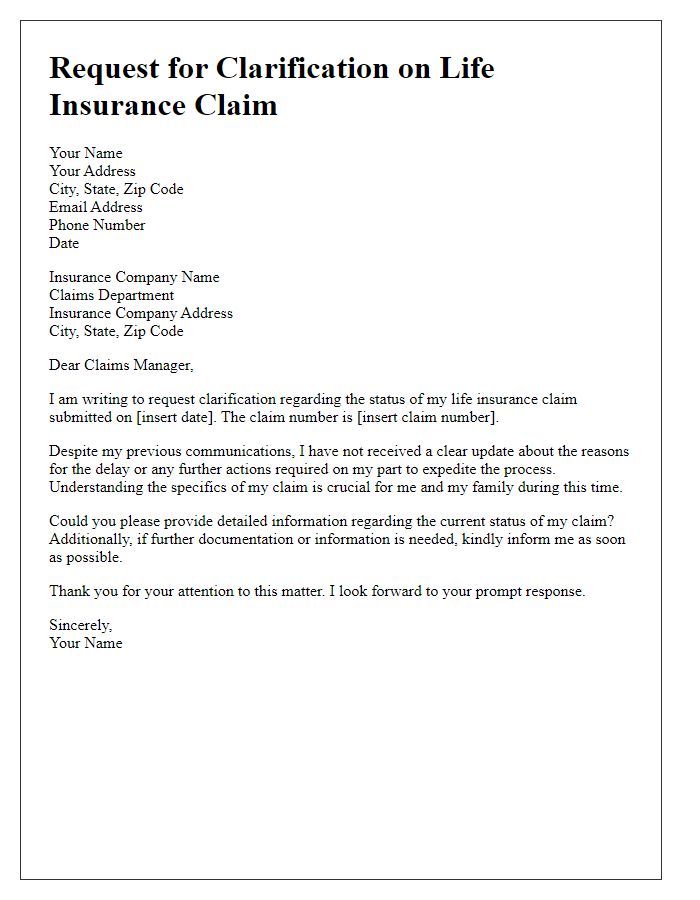

Specific Inquiry Details

A life insurance payout inquiry involves requesting information regarding the processing and status of a claim associated with a deceased policyholder. Claimants typically require details such as the claim number, policy number, and the deceased's name for accurate tracking. Insurance companies like MetLife or Prudential often have dedicated claims departments that handle inquiries. Standard processing times for life insurance claims can extend from a few days to several weeks, depending on required documentation and the complexity of claims. Claimants may also need to provide a death certificate and proof of identity to expedite the inquiry and ensure the legitimacy of the request. Prompt communication and clarity from the insurance provider enhance the overall experience during such difficult times.

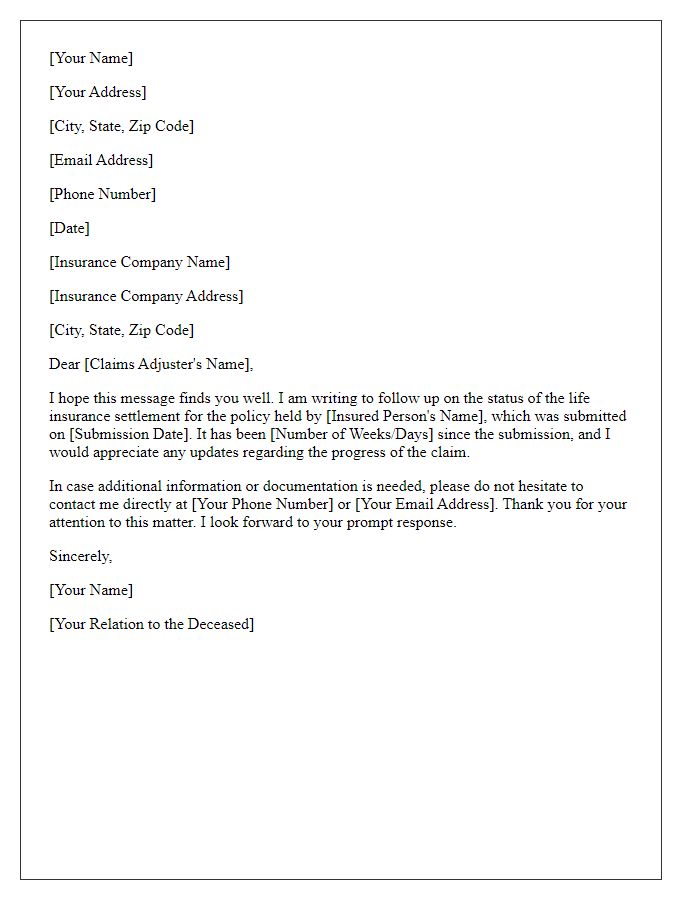

Contact Information for Follow-up

Life insurance payouts often require meticulous attention to detail, specifically in documentation and beneficiary information. Upon initiating the inquiry process, individuals should prepare essential details such as policy numbers, names of the insured parties, and dates of death, typically maintained by companies like Prudential or MetLife. Contacting the insurance company involves identifying the correct department, often found on official websites or policy statements, typically a claims department reachable via phone or email. Additionally, maintaining records of all correspondence, including dates and representatives' names, can enhance the efficiency of follow-up interactions. It's advisable to allow a processing period of 30 to 60 days post-claim submission for a thorough review and final payout assessment.

Comments