Are you in need of a duplicate insurance card but unsure how to request one? We've all been there, whether it's misplaced, damaged, or simply lost in the shuffle of life. In this article, we'll walk you through a simple letter template that will make the process seamless and stress-free. Stick around to discover all the essential details you should include to ensure your request is processed quickly!

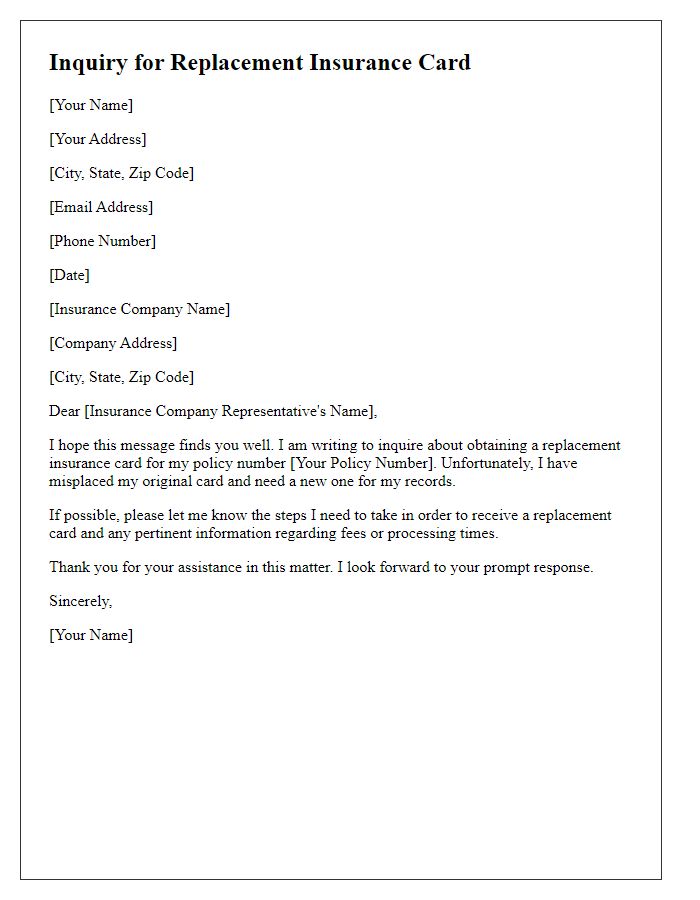

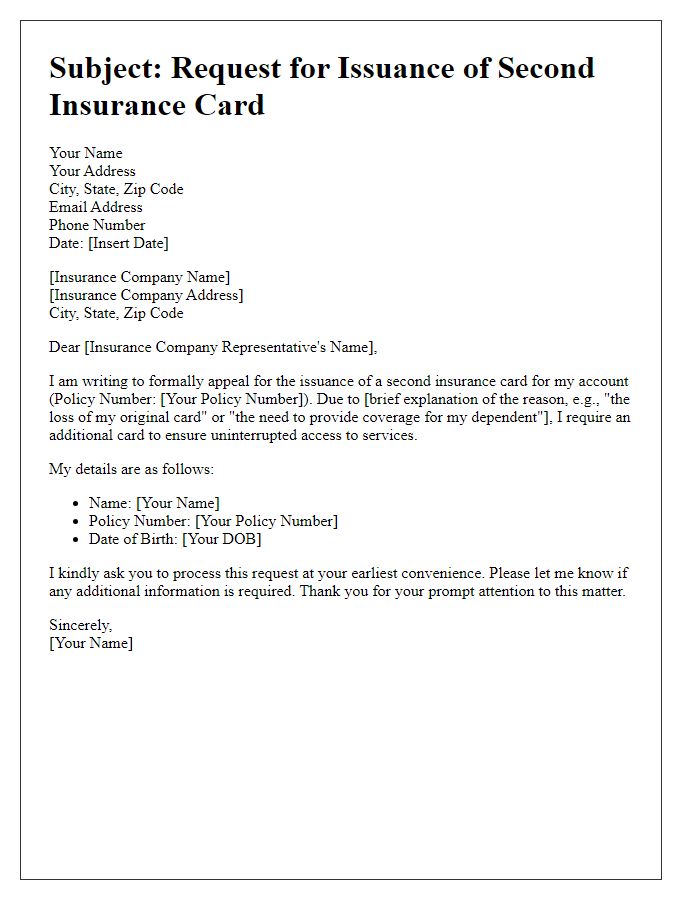

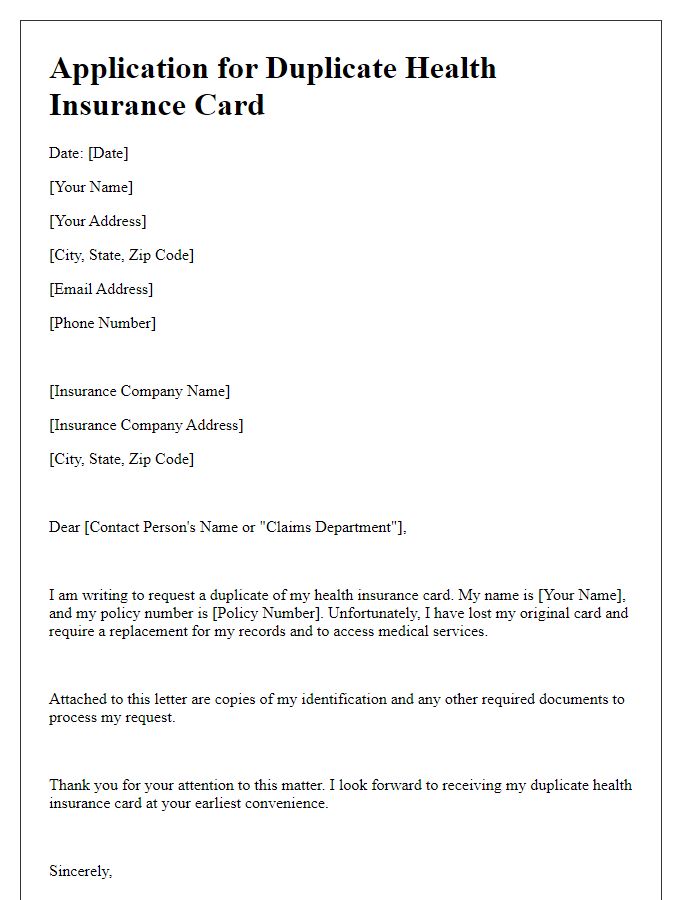

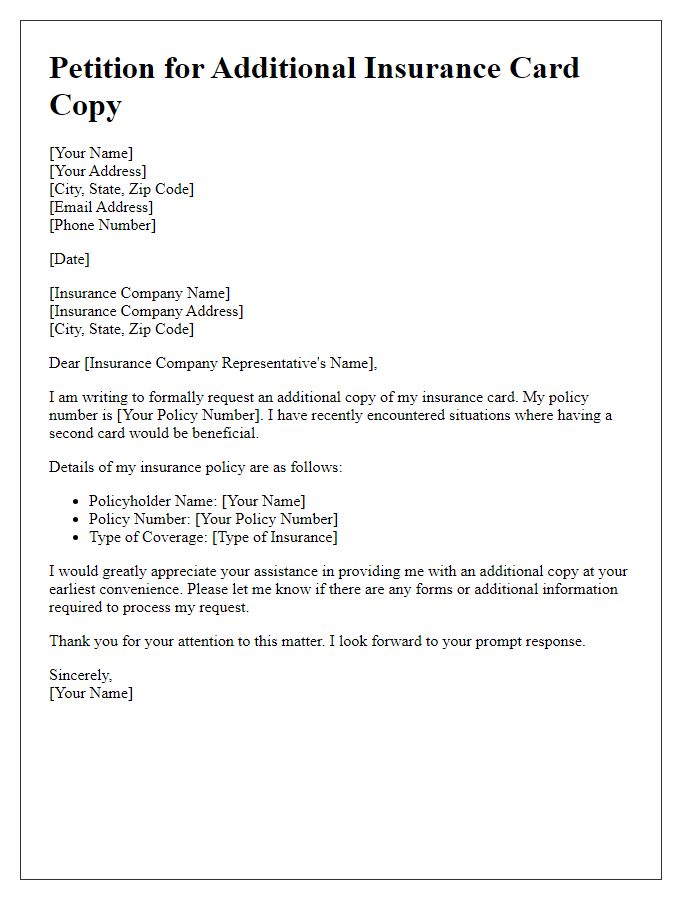

Personal Information and Contact Details

Requesting a duplicate insurance card is essential for ensuring continued access to healthcare services. The policyholder should include personal information such as full name, date of birth, and insurance policy number to identify their account within the insurance provider's system. Specific contact details like a phone number or email address facilitate prompt communication regarding the request. It is also beneficial to mention any relevant circumstances, such as a lost or damaged card, to provide context for the request. Adding a note about preferred delivery methods, whether through postal services or digital channels, can enhance the efficiency of the process and ensure timely receipt of the duplicate insurance card.

Policy Number and Insurance Provider Details

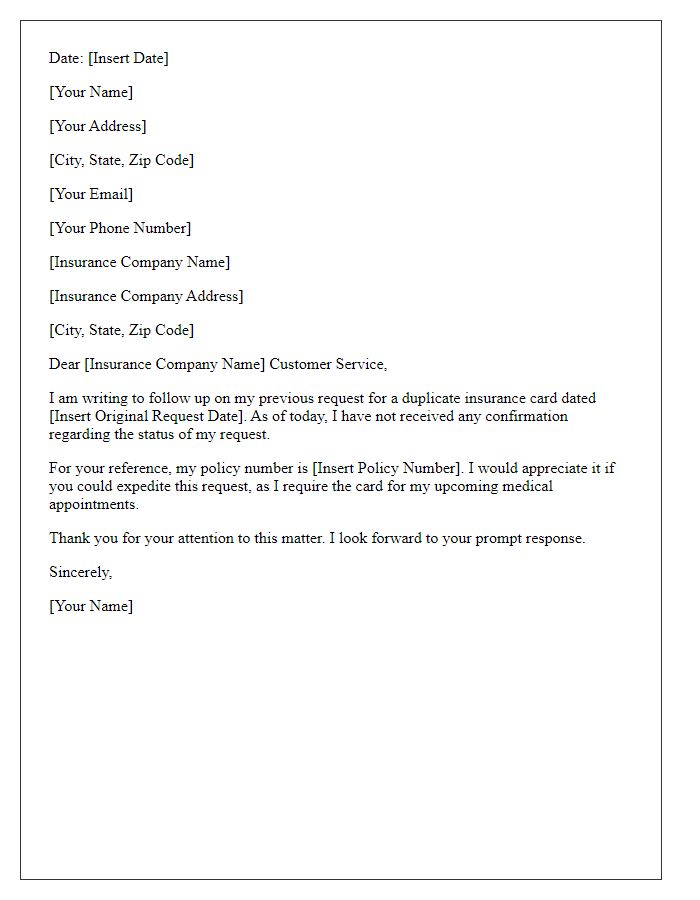

Obtaining a duplicate insurance card is essential for immediate access to benefits when needed, particularly for healthcare or vehicle coverage. The process typically involves submitting a request to the insurance provider, such as Blue Cross Blue Shield or State Farm, including details like the policy number (e.g., 123456789) and personal information. Some insurers allow online requests through their websites, while others may require a phone call or written communication. A quick turnaround is common, often offering an electronic copy via email within 24 hours, while physical cards may arrive by mail within one week. Always confirm the insurance company's specific instructions to prevent delays.

Explanation for Requesting Duplicate Card

Requesting a duplicate insurance card is essential for several reasons related to health and safety. Many individuals experience loss or damage to their original insurance cards, which can occur due to misplacement or accidental wear and tear. In 2023, a significant number of Americans, estimated at over 30 million, required immediate access to their insurance information for medical services. Without a valid insurance card, necessary medical procedures or appointments can be delayed, impacting timely care. Additionally, many healthcare providers, including hospitals and clinics, require up-to-date proof of insurance to ensure proper billing and coverage verification. A duplicate card helps maintain a seamless experience in critical situations, ensuring patients receive appropriate treatments without unnecessary complications related to insurance verification.

Preferred Delivery Method and Address

Requesting a duplicate insurance card can be essential for maintaining proper health coverage. Insured individuals often require a physical card for identification purposes during medical visits. The address for delivery should be precise to ensure timely receipt. Common methods for delivering insurance cards include standard mail, express delivery services, or electronic options like email or secure online portals. Providing clearly stated preferences for delivery method and exact address can expedite the process, ensuring that one has access to necessary health services without delays. Accuracy in the request also minimizes the risk of errors in card reissuance.

Signature and Date

Contacting your insurance provider for a duplicate insurance card can ensure you have your essential information at hand. Insurance cards, typically issued by companies like Aetna or Blue Cross Blue Shield, provide crucial details such as policy numbers, group numbers, and coverage dates. Accurate identification through insurance cards is vital during medical visits. When requesting duplicates, specify the need for immediate processing to avoid disruptions in healthcare services. Providing personal information such as name, address, and policy number streamlines the request, ensuring a prompt response. Additionally, verifying contact methods, whether via phone or online portal, may expedite the process.

Comments