Navigating the complexities of health insurance can often feel overwhelming, especially when it comes to understanding coverage gaps. These gaps can leave individuals vulnerable and confused about their options for care and costs. In this article, we'll break down what coverage gaps are, why they occur, and what steps you can take to protect yourself and ensure you have the necessary support. So, if you're ready to reclaim your peace of mind and learn how to navigate these tricky waters, keep reading!

Personal Identification Information

Personal Identification Information (PII) consists of data that can be used to identify an individual specifically. Examples of PII include names, Social Security numbers (SSNs), birth dates, addresses, and biometric data. Protection of this sensitive information is critical, especially in the digital age, where breaches can lead to identity theft and financial fraud. Various regulations, such as the General Data Protection Regulation (GDPR) in Europe, set stringent guidelines for the handling of PII to safeguard individuals. Organizations must implement robust security measures, including encryption, access controls, and employee training, to prevent unauthorized access and ensure compliance with legal standards surrounding PII. Additionally, regular audits and assessments can help identify potential vulnerabilities and mitigate risks associated with the management of personal data.

Detailed Timeline of Coverage Gap

A coverage gap occurs in health insurance when there is a temporary period without insurance, often affecting access to necessary medical services and medications. For instance, an individual may experience a coverage gap during transitions between jobs or enrollment periods. The timeline of this gap can often reveal critical dates; for example, beginning of loss from previous employer insurance benefits on June 1, 2023, followed by a waiting period until new coverage begins on July 15, 2023. This gap of 44 days, during which the individual has no insurance, can lead to deferred medical care and financial burdens due to unexpected healthcare expenses. Furthermore, this absence of coverage may influence the ability to receive preventive care services, leading to potential long-term health issues that require more extensive treatment later. Understanding this timeline is crucial for addressing the implications of coverage gaps on health outcomes and financial stability.

Specific Reasons or Justifications

Coverage gaps in healthcare insurance often arise due to various factors that significantly impact individuals' access to necessary medical services. A common reason for these gaps includes premium increases (averaging 5-10% annually), forcing families to reconsider their financial options. Additionally, changes in employment status can lead to loss of employer-sponsored insurance (affecting 150 million Americans), resulting in periods without coverage. Geographic disparities also contribute; for example, rural areas may lack satisfactory plans, affecting over 20% of the population. Lack of awareness regarding enrollment periods can necessitate urgent explanations, as eligible individuals miss deadlines (which can occur annually and last for only a few weeks). Each of these factors culminates in unmet healthcare needs and increased financial vulnerability for affected individuals.

Supporting Documentation

Coverage gaps in insurance policies can lead to significant financial risks for policyholders. In 2022, approximately 30% of individuals reported experiencing a lapse in coverage due to unpaid premiums, particularly in states like Texas, which had one of the highest rates of uninsured residents at 18%. Gaps often occur during transitions such as job changes or moving between states, where policies may not align. This issue is critical as the Affordable Care Act mandates continuous coverage, aiming to reduce the uninsured rate to under 10% by 2025. Providing documentation that outlines previous coverage, any notifications of premium due dates, and an explanation of the circumstances surrounding the gap can support claims for reinstatement or financial assistance.

Positive Resolution or Mitigation Efforts

Healthcare coverage gaps can lead to significant concerns for patients relying on insurance for necessary medical treatments. Individuals without coverage, which can vary by geographic region such as rural areas or urban centers, often face skyrocketing out-of-pocket costs for essential services. Efforts to address these gaps include legislative initiatives like the Affordable Care Act, which aims to expand Medicaid eligibility in states like California and Texas. Local community health programs also play a role in providing support, offering services on a sliding fee scale based on income to ensure access for low-income individuals. In addition, non-profit organizations focus on educational outreach regarding available resources, helping individuals navigate insurance options during open enrollment periods. Ultimately, a multi-faceted approach involving government, community, and healthcare providers is essential to effectively mitigate coverage gaps and improve health outcomes for vulnerable populations.

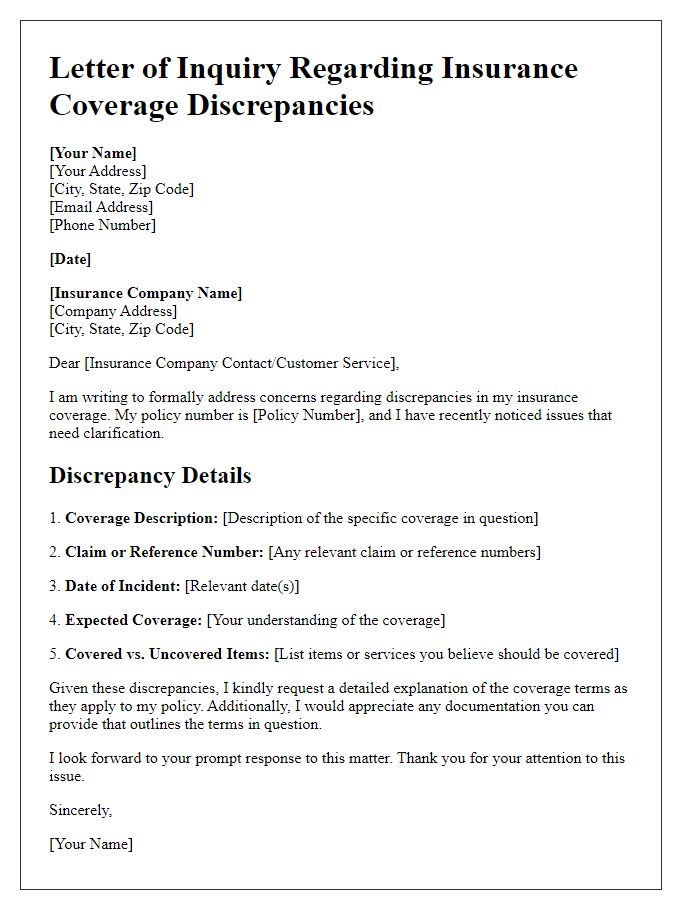

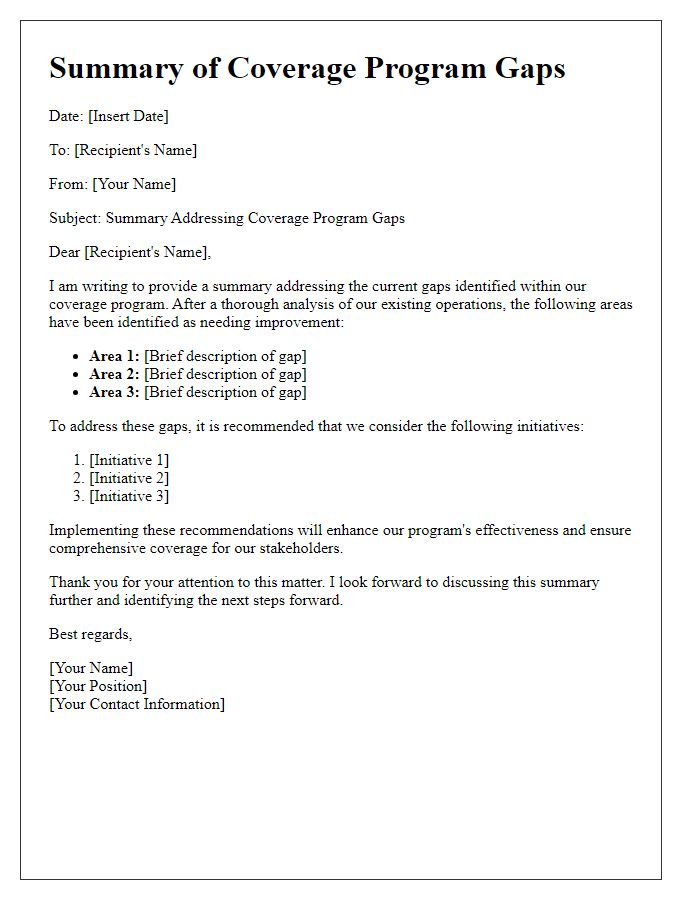

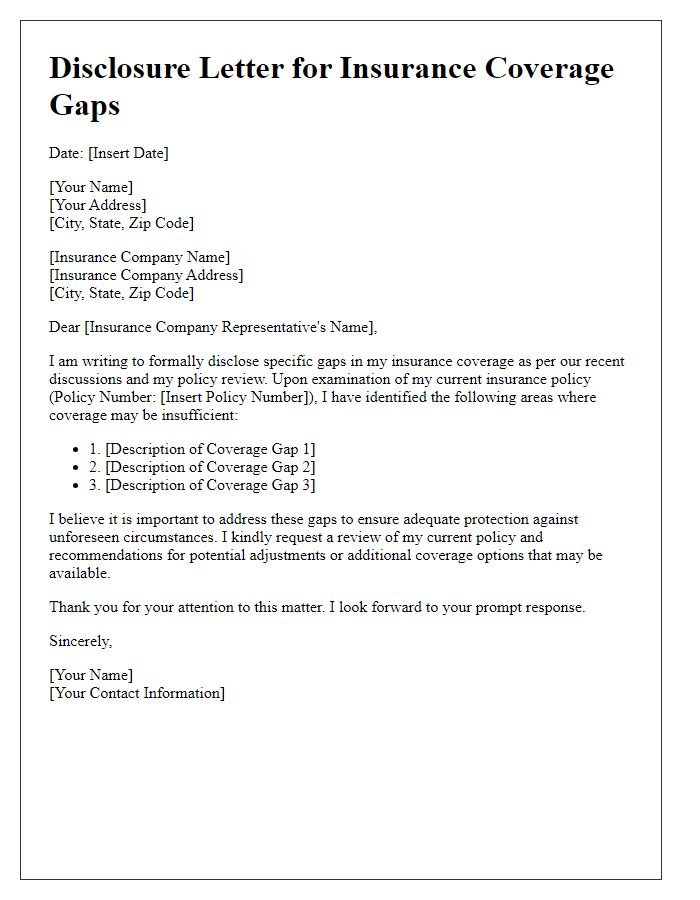

Letter Template For Coverage Gap Explanation Samples

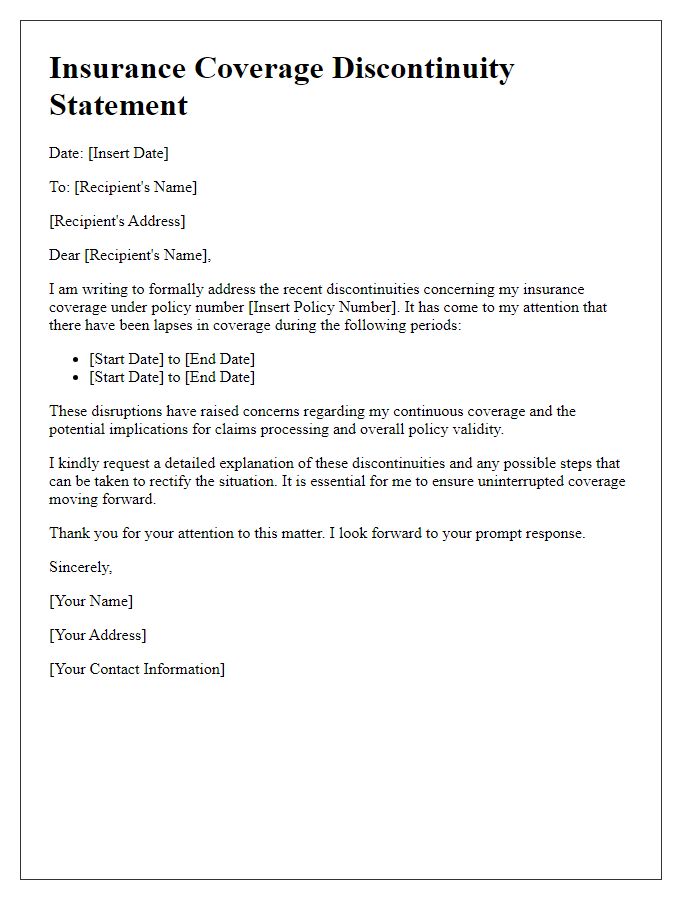

Letter template of statement regarding insurance coverage discontinuities

Comments