Losing a loved one is never easy, and navigating the complexities of a death benefit claim can add to the emotional burden during such a difficult time. This article aims to provide you with a clear, step-by-step guide on how to create a heartfelt and effective letter for your death benefit claim application. We'll cover essential elements that should be included and offer tips to ensure your application is processed smoothly. So, if you're ready to learn more about simplifying this process, keep reading!

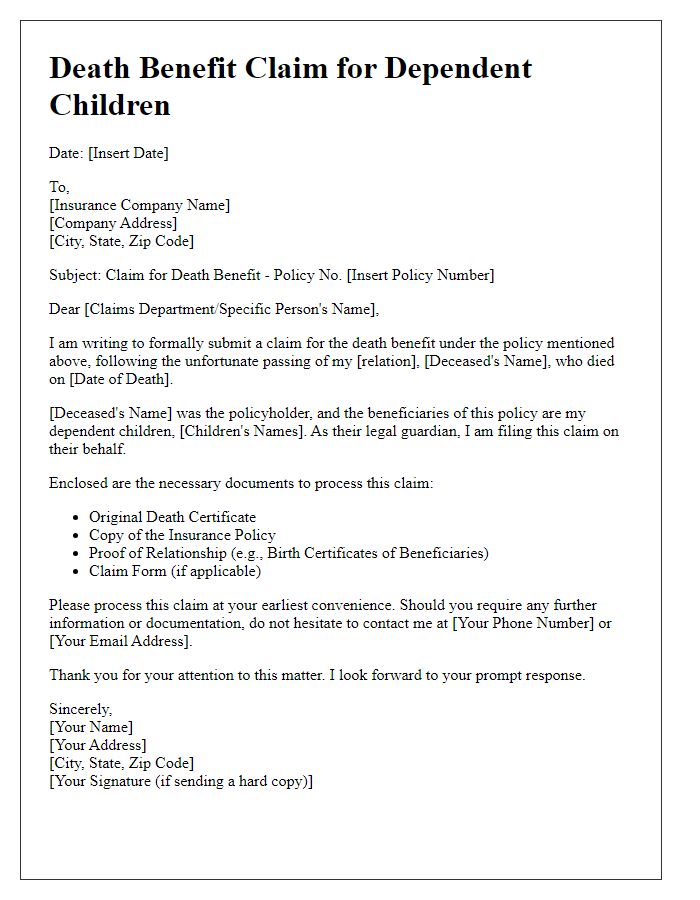

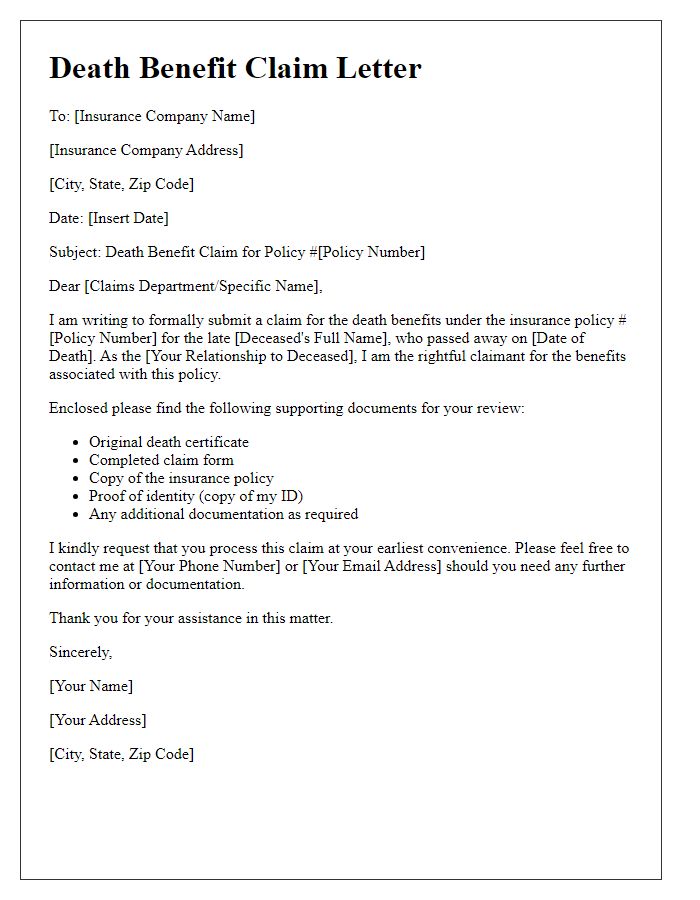

Beneficiary Information

Beneficiary information is crucial for processing death benefit claims efficiently. Accurate details include the full name of the beneficiary, their relationship to the deceased individual, and contact information such as phone number and email address. Additionally, essential supporting documents like the beneficiary's Social Security number may be required. Specific identification proof, such as a driver's license or passport, can facilitate verification. Providing the correct information ensures a smoother claims process and quicker access to funds that may provide financial support during a difficult time.

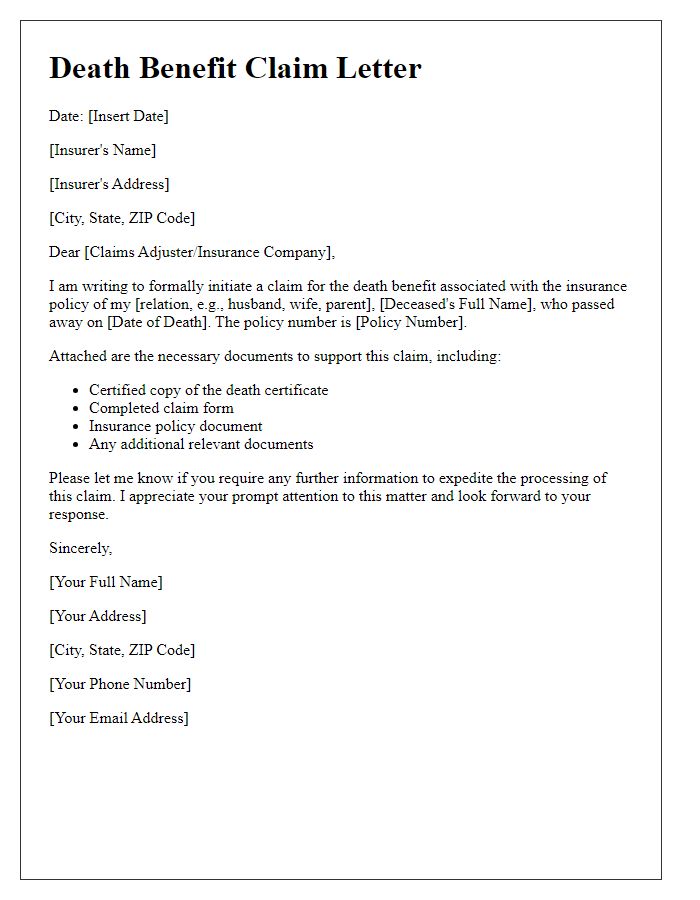

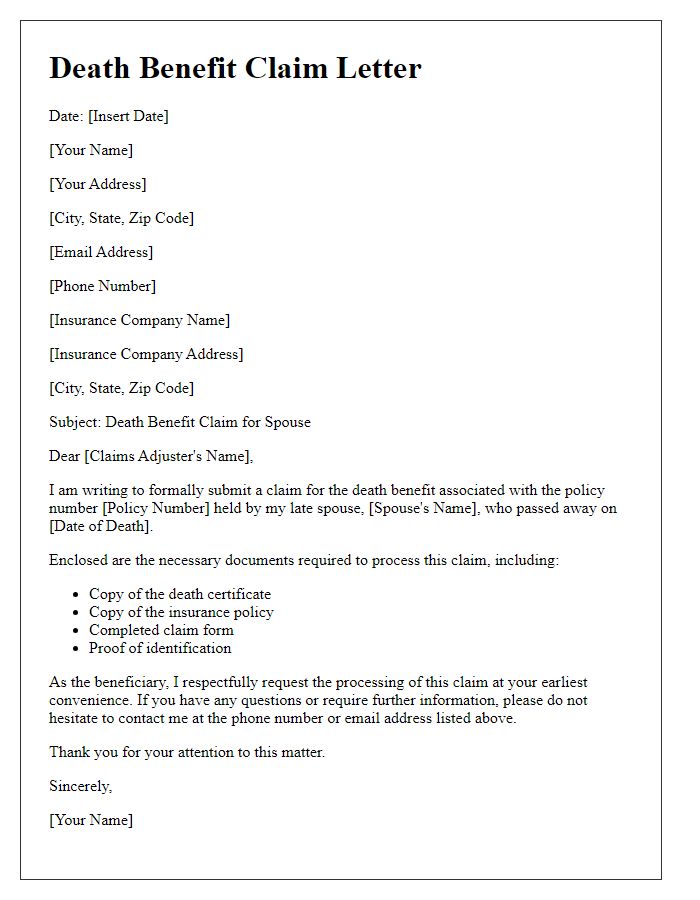

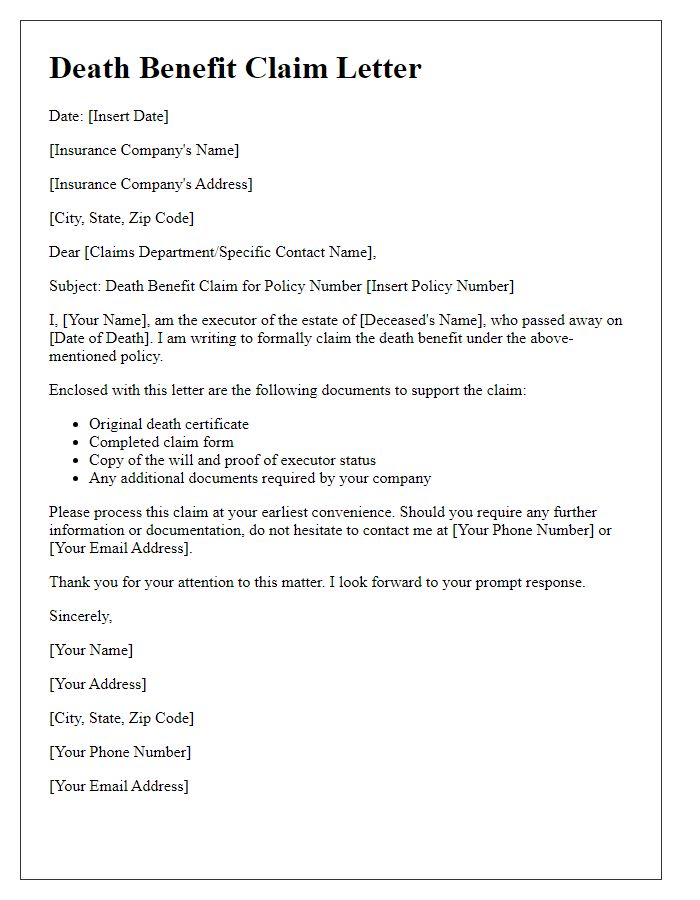

Policyholder Details

The death benefit claim application requires a detailed understanding of the policyholder's information, such as name, date of birth, and policy number, which are critical for processing claims efficiently. The name must match exactly as it appears in policy documents, ensuring no discrepancies that could delay proceedings. The date of birth is essential for verifying eligibility and establishing the policyholder's identity. The policy number (typically a unique identifier like a 12-digit alphanumeric code) is crucial for linking the claim to the specific insurance policy held, facilitating quicker access to account information. Additionally, the relationship to the deceased proves essential, especially if beneficiaries differ among claims. Ensure personal information is accurate and current to avoid complications during the claim process.

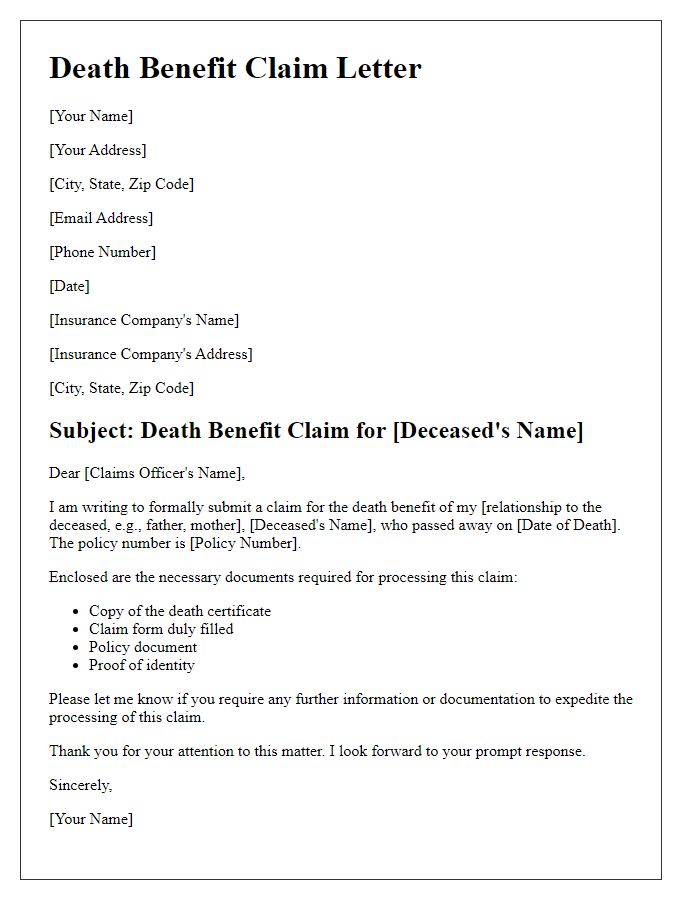

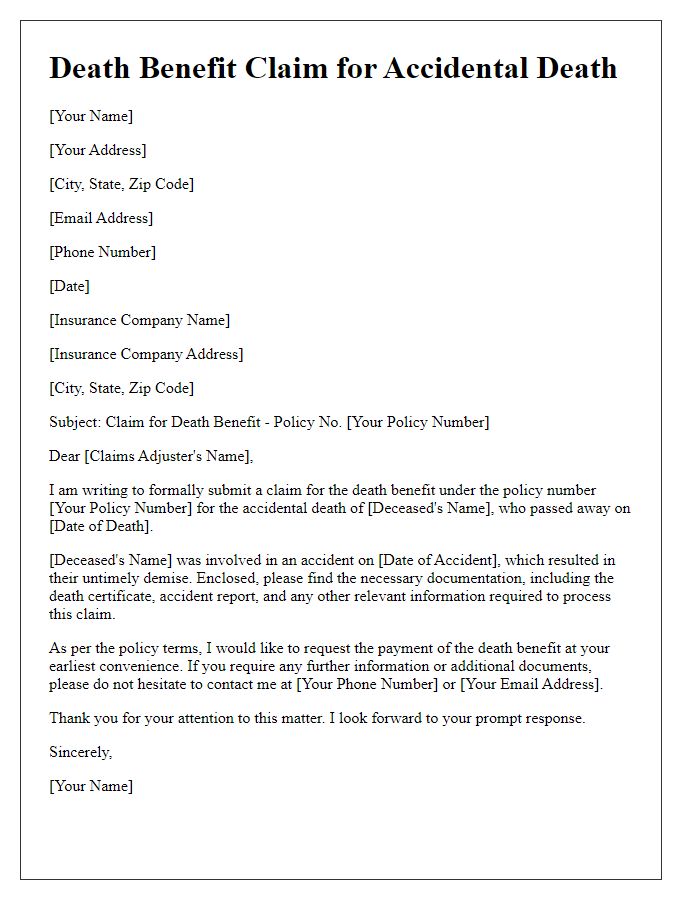

Policy Number

A death benefit claim application refers to a request made to an insurance company for the disbursement of funds following the death of a policyholder, specifically under a life insurance policy or similar financial product. The process typically includes filling out a claim form, submission of necessary documents such as the death certificate, and providing relevant policy details, including the specific policy number. Timely submission is crucial to expedite the claims process, ensuring beneficiaries receive the funds they're entitled to under the policy. Insurance companies often require proof of identity and legal documentation verifying the claimant's relationship to the deceased to process claims efficiently.

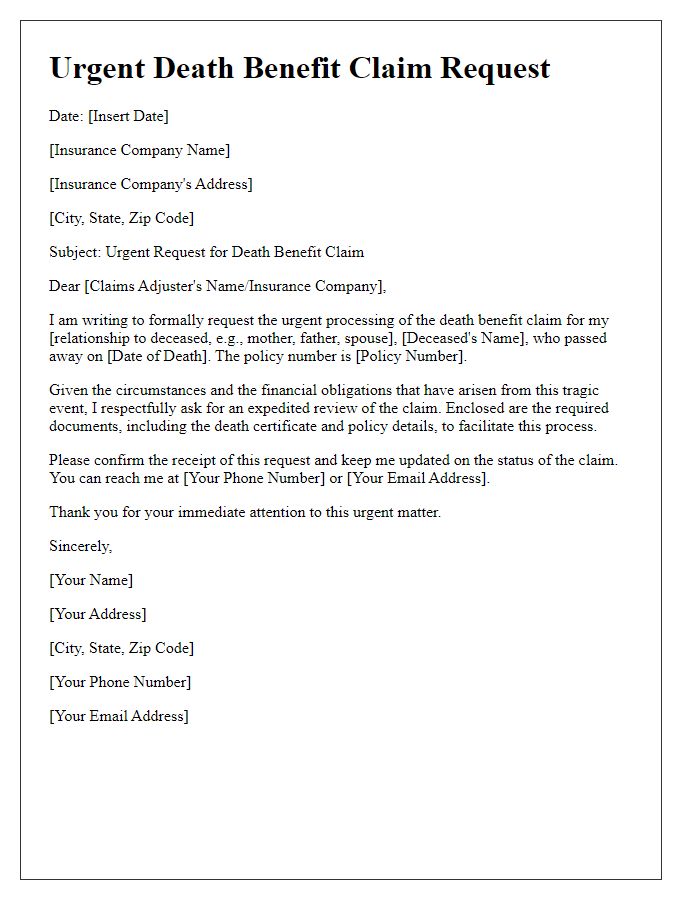

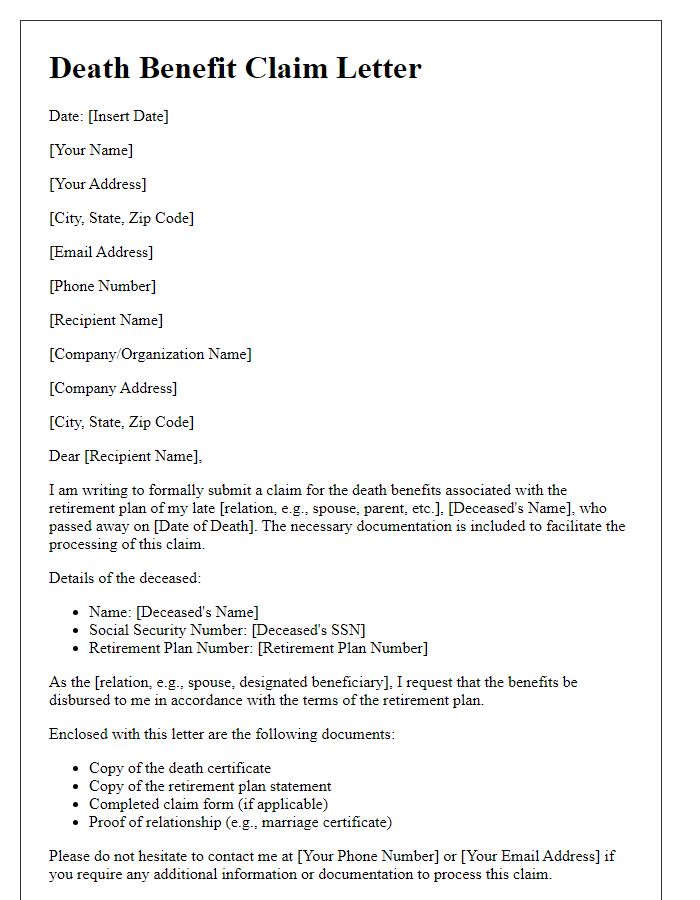

Proof of Death

In the unfortunate event of a policyholder's passing, submitting a death benefit claim application necessitates proof of death documentation, critical for processing claims efficiently. An official death certificate, issued by a recognized authority such as a healthcare provider or government agency, serves as the primary proof of death, containing essential details such as the decedent's name, date of birth, date of death, and cause of death. Additional documents like obituary notices published in local newspapers or funeral home records may also support the application. Ensuring these documents' accuracy and completeness can significantly expedite the claims approval process, helping beneficiaries, often family members, receive their entitled benefits under life insurance policies.

Contact Information

When filing a death benefit claim application, ensure accurate and complete contact information is provided. Include full name (e.g., John Doe), address (e.g., 123 Maple Street, Springfield, IL 62704), phone number (e.g., (555) 123-4567), and email address (e.g., johndoe@example.com). Make sure to specify both the primary contact and alternate contacts if applicable. Clearly indicate the relationship to the deceased (e.g., spouse, sibling) to facilitate processing. It is vital to keep records of submitted documents for future reference. Include any relevant identification numbers, such as Social Security or insurance policy numbers, to streamline communication with the claims department.

Comments