Are you on the verge of retirement and feeling a bit overwhelmed by the process of securing your benefits? You're not alone! Navigating retirement benefits and insurance can be tricky, but with the right information, it can become a much smoother experience. Dive into our article for a comprehensive guide that will help clarify your options and empower you during this significant transition.

Details of the Retirement Plan

Retirement benefits insurance plays a crucial role in securing financial stability during one's golden years, typically commencing upon reaching the age of 65 in many countries. Specific retirement plans, such as 401(k) and pension plans, vary widely in terms of contributions, with many employers matching employee contributions up to 6% of annual salary. The retirement plan documents, often provided by financial institutions such as Fidelity or Vanguard, detail the investment strategies, withdrawal limits, and penalties for early distribution. Additionally, the projected monthly benefit calculations accommodate factors like average salary and years of service, utilizing actuarial tables to estimate life expectancy and fund longevity. Understanding these intricate details ensures informed decisions and optimal utilization of retirement benefits, safeguarding against unforeseen medical expenses or market fluctuations that may arise post-retirement.

Eligibility Requirements

Retirement benefits insurance eligibility requirements can vary significantly across different organizations and policies. Typically, age thresholds (often 65 years for government pensions) and minimum service years (commonly 10 or 20 years) are standard criteria. Some plans may offer early retirement options, allowing individuals to retire as early as 55, albeit with reduced benefits. Additionally, vested statuses (the percentage of the retirement plan that belongs to the employee) influence eligibility. Employers may also consider factors such as contributions made to the plan and the employee's employment status at the time of retirement. Understanding these detailed criteria is essential for potential retirees to ensure they meet specific qualifications for receiving benefits.

Benefits Coverage and Limitations

Retirement benefits insurance offers financial security for individuals transitioning into retirement, often covering essential areas like healthcare and income replacement. Policies typically include coverage for medical expenses, such as hospitalization and outpatient treatments, with limits that vary by provider; for instance, some plans cover up to $1 million in lifetime medical expenses. Limitations exist as well, including waiting periods and specific exclusions like pre-existing conditions, often defined in the policy documents. Understanding these details is crucial for retirees, as geographical restrictions may also apply, affecting availability in certain states or countries, impacting access to healthcare services and facilities.

Claims Process and Timelines

Retirement benefits insurance encompasses various plans designed to secure financial stability for retirees. The claims process typically involves submitting required documentation, which may include proof of employment, retirement dates, and medical records in some cases. Upon submission, the insurance provider, often a major company such as Aetna or Prudential, initiates an internal review process that can take anywhere from 30 to 90 days. This timeline can vary based on plan specifics and the complexity of the claim. Policyholders must also communicate with customer service representatives to clarify aspects of the process, especially related to eligibility, potential benefits, and any necessary follow-up actions. Understanding these details enhances the likelihood of a smooth claims experience, ultimately ensuring timely access to retirement funds.

Contact Information for Inquiries

Retirement benefits insurance inquiries often involve essential details, including policy numbers and employee identification numbers (EIN). Insurance providers typically have dedicated customer service departments, which can be reached via specific phone numbers (often listed in policy documents), or email addresses. It's crucial to provide your current contact information, including phone numbers (home or mobile) and email addresses, to facilitate quicker communication. Many organizations now encourage using their official websites' inquiry forms, ensuring efficient handling of requests. Additionally, including details about any prior correspondence, such as claim numbers or dates of previous inquiries, can streamline the process and lead to faster resolutions.

Letter Template For Retirement Benefits Insurance Inquiry Samples

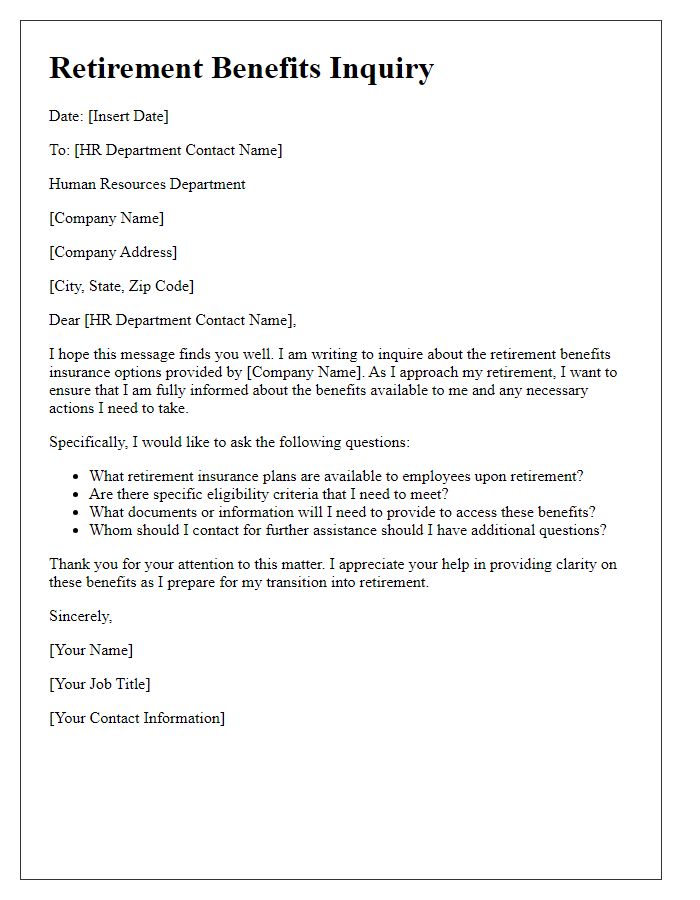

Letter template of retirement benefits insurance question for HR departments.

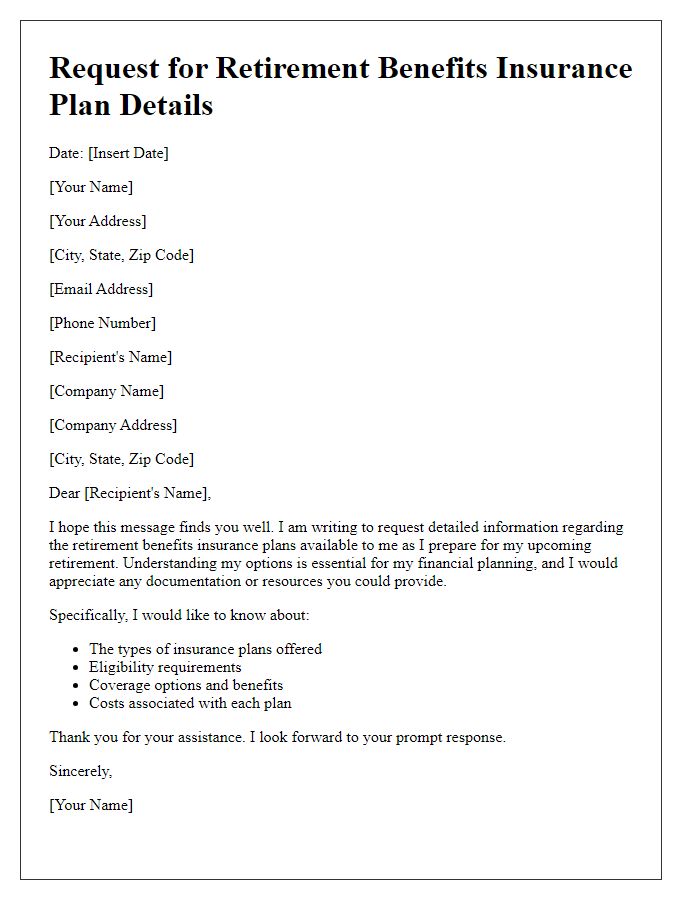

Letter template of retirement benefits insurance request for plan details.

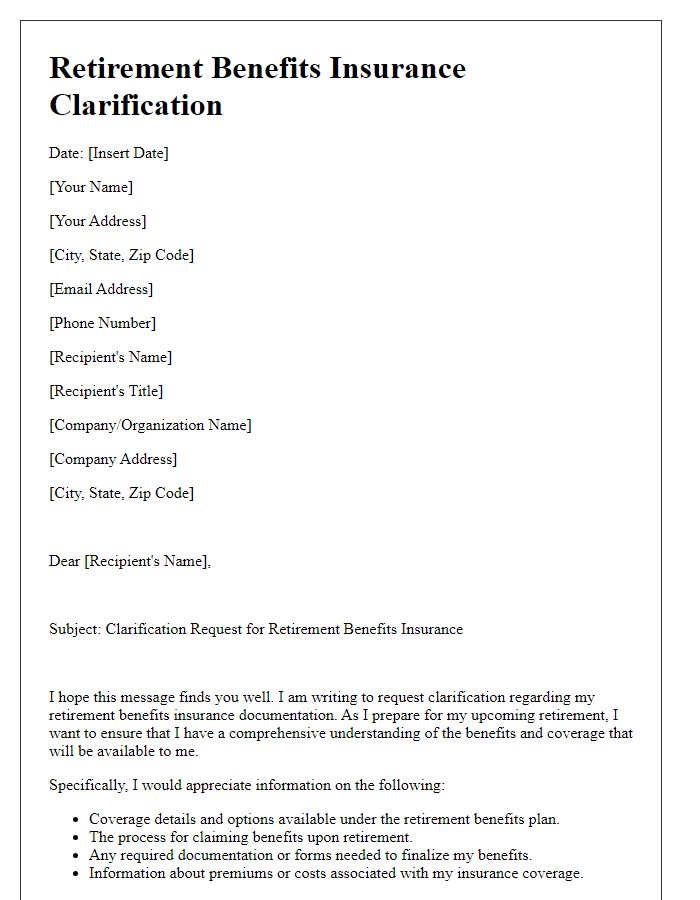

Letter template of retirement benefits insurance clarification for documentation.

Letter template of retirement benefits insurance follow-up for pending information.

Letter template of retirement benefits insurance inquiry for spouse coverage.

Letter template of retirement benefits insurance question regarding eligibility.

Letter template of retirement benefits insurance request for premium breakdown.

Letter template of retirement benefits insurance clarification on payout processes.

Comments