Have you ever received a denial for a claim you thought was straightforward? It can feel frustrating and overwhelming, especially when you're counting on that support. But don't lose hope just yet! In this article, we'll guide you through the essential steps to craft a compelling appeal letter that could turn things aroundâso keep reading to discover how to strengthen your case.

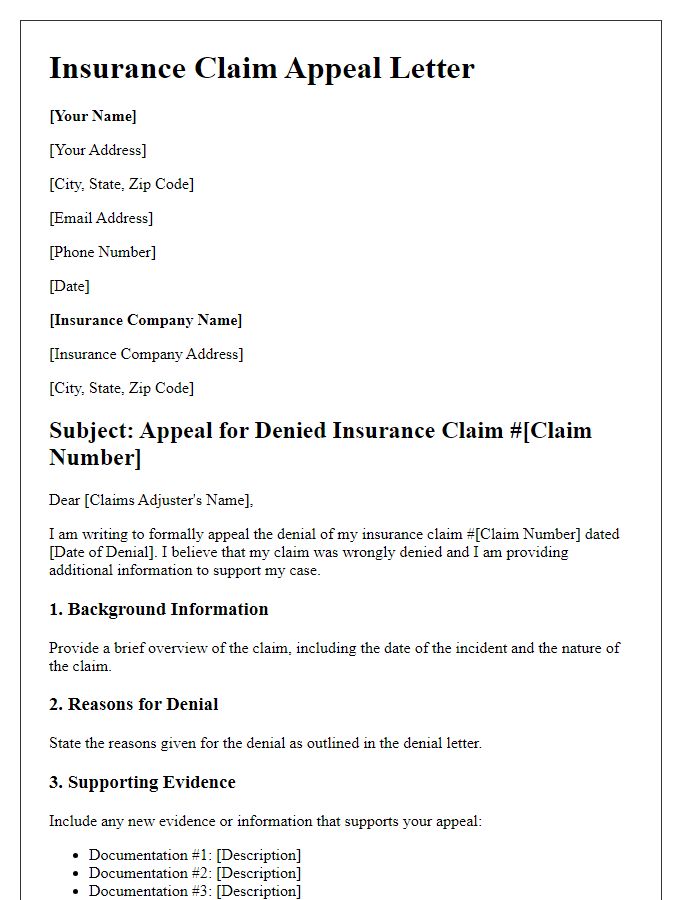

Clear and Concise Subject Line

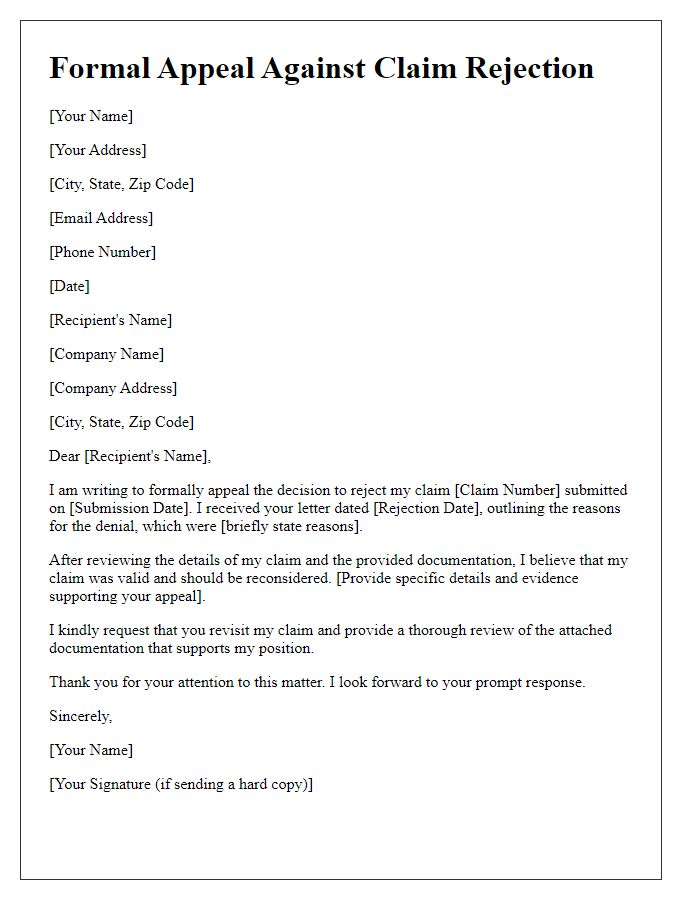

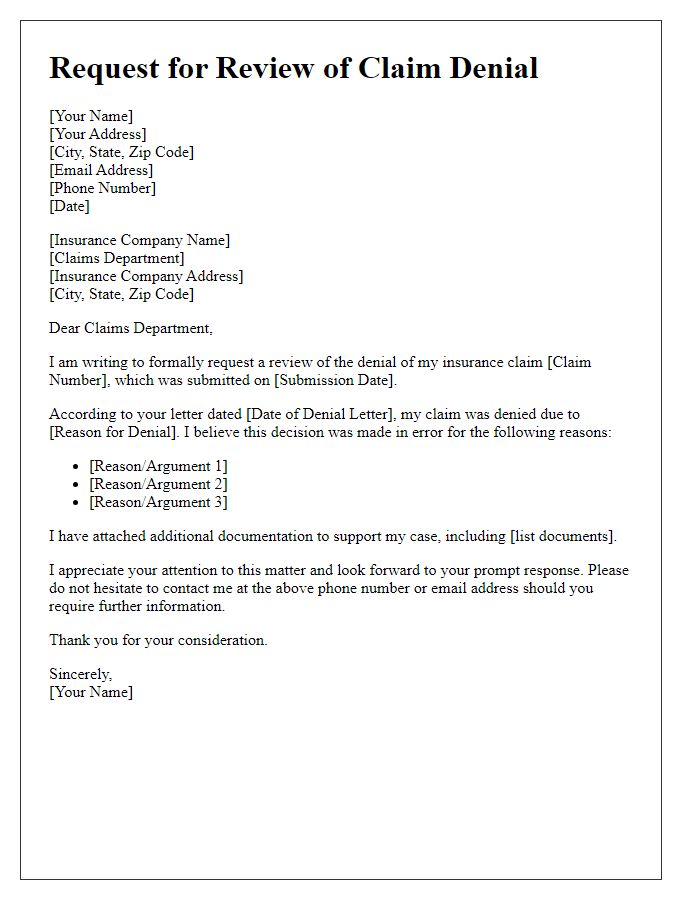

A clear and concise subject line for a claim denial appeal can significantly impact the outcome of the communication. Effective subject lines should include relevant details such as "Claim Denial Appeal for Policy Number 123456" or "Request for Review: Denied Claim for Medical Treatment on [Date]." Including specifics like the type of claim, policy number, and date ensures that the recipient immediately identifies the purpose of the correspondence. A well-structured subject line also facilitates quicker processing and review by insurance representatives, improving the chances for a favorable resolution. Aim for a professional tone to convey seriousness and urgency in your appeal.

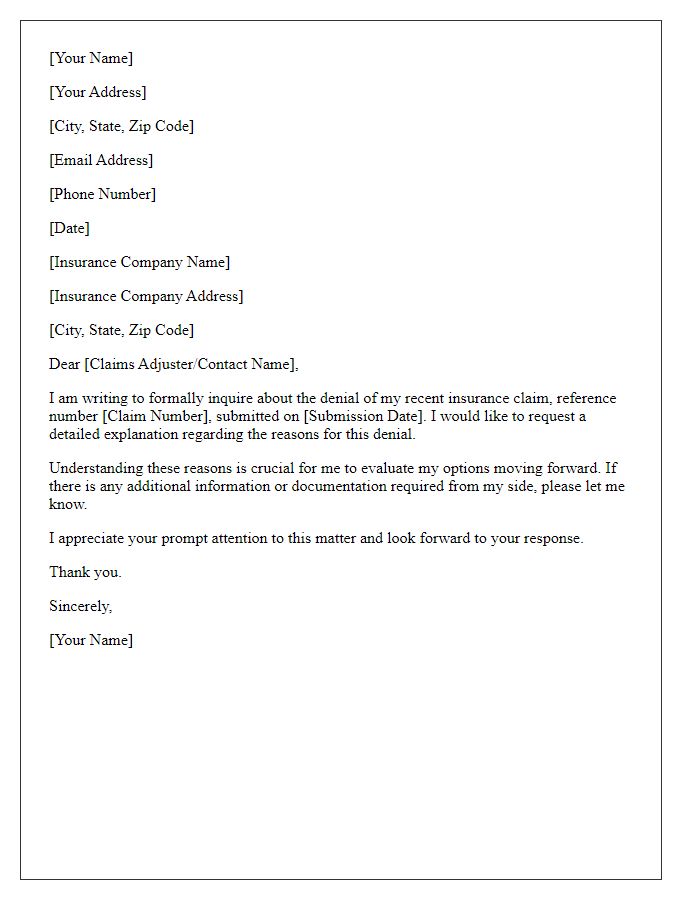

Policy Details and Claim Information

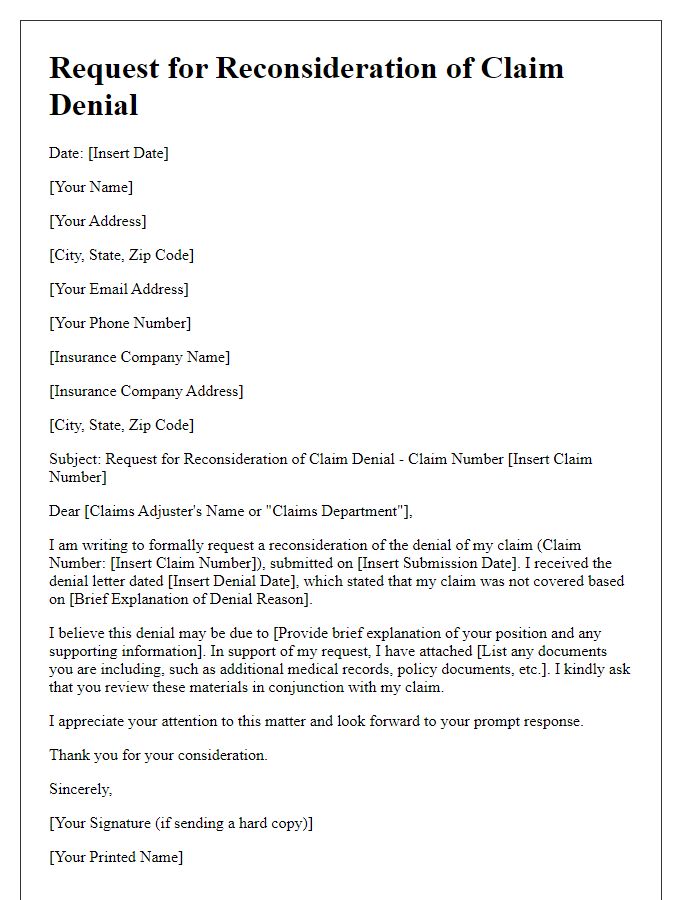

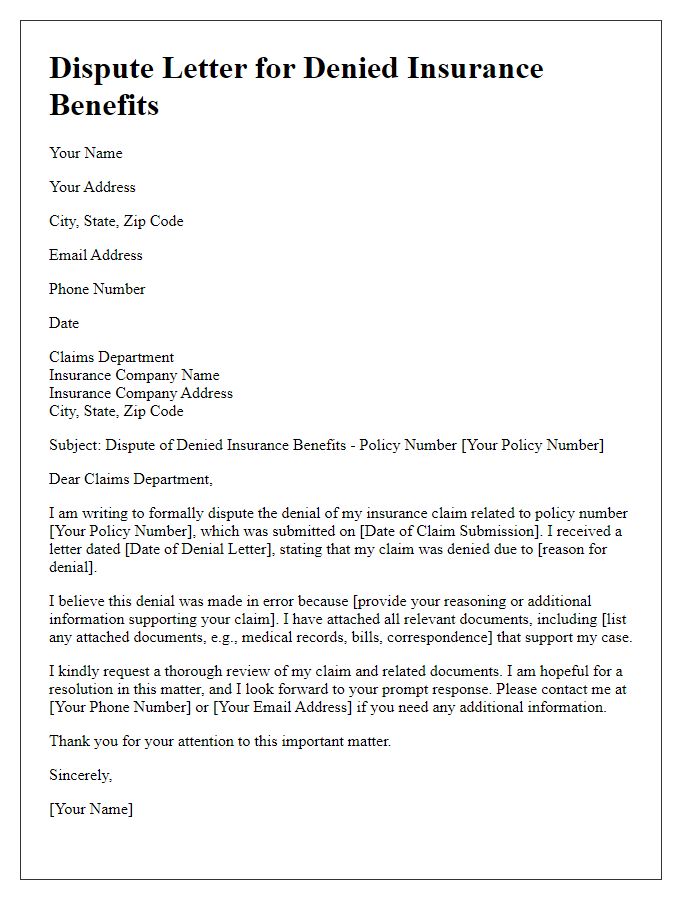

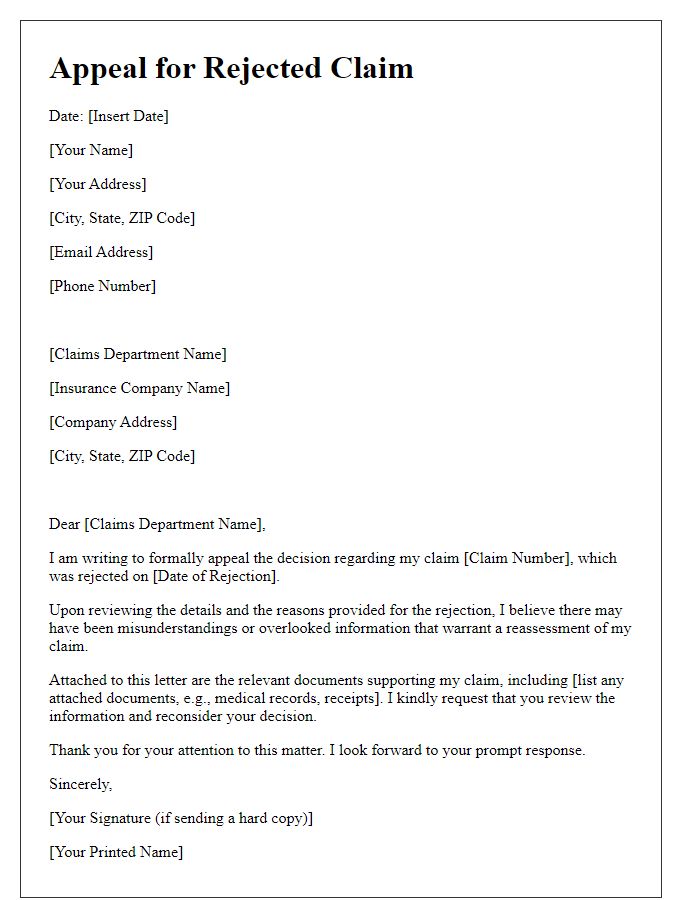

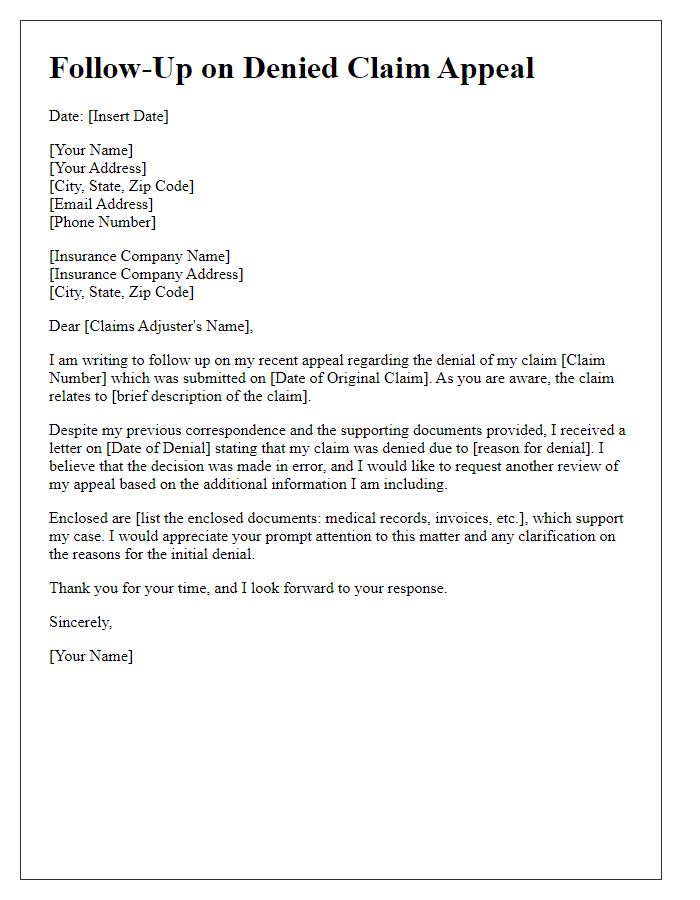

Disputes concerning claim denials revolve around policies issued by insurance companies, which may encompass diverse coverage types, including health, auto, or homeowners insurance. The policy number usually consists of alphanumeric characters, vital for identifying the specific agreement between the policyholder and the insurer. Claim information includes the date of submission, amount claimed, and a unique claim reference number that tracks the status of the request within the company's systems. Insurance providers often outline specific processes and requirements for appeals, emphasizing the importance of submitting additional documentation or evidence to support the claim. Deadlines for filing an appeal, frequently outlined in the policy documents, ensure that all disputes are addressed promptly, promoting fair resolution practices in the insurance industry.

Specific Reasons for Appeal

The denial of the health insurance claim for the surgical procedure performed on June 15, 2023, at St. Mary's Hospital has raised concerns regarding the justification provided. The procedure, laparoscopic cholecystectomy, was deemed necessary by Dr. Jane Smith, a board-certified surgeon with over 15 years of experience in the field. The insurance policy explicitly covers essential surgical interventions when deemed medically necessary, which aligns with the case's specifics. Supporting documentation, including the detailed operative report and pre-operative evaluations highlighting the diagnosis of gallbladder dyskinesia, was submitted but seemingly overlooked. Further, the appeal references the insurance company's own clinical guidelines confirming coverage for similar procedures. Additionally, a letter from a physician in the same specialty, dated July 10, 2023, emphasizes the necessity of the surgery based on the patient's health risks and symptoms, adding weight to the appeal. The timeliness and thoroughness of the submitted evidence warrant a re-evaluation of the initial denial for this claim.

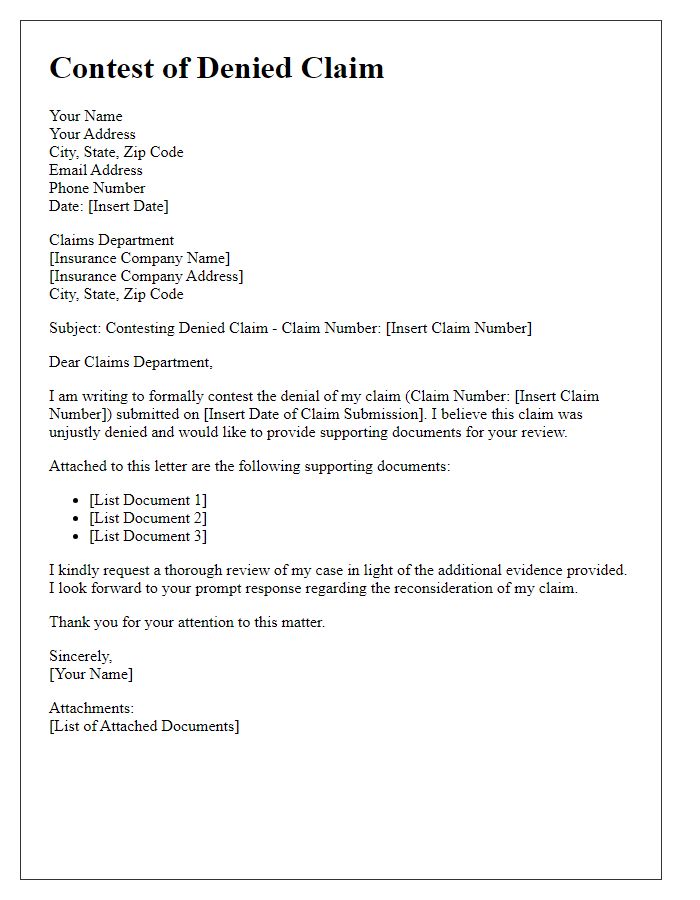

Supporting Evidence and Documentation

A successful appeal for a claim denial requires compelling supporting evidence and thorough documentation. Patients seeking coverage may include detailed medical reports from healthcare providers, emphasizing diagnoses based on the latest medical standards and clinical guidelines. Inclusion of billing statements illustrating costs incurred, like surgeries or consultations, can substantiate the financial impact of the denial. Testimonial letters from physicians may provide additional context regarding the necessity of treatments and medications. Furthermore, data from authoritative sources, such as research studies or FDA approvals, can reinforce the legitimacy of the claim. Accurate documentation, including policy details referencing benefits and exclusions, is essential for establishing that the denied services fall within the provided coverage parameters. Ensure all submission materials are organized chronologically for clarity, enhancing the likelihood of a favorable review.

Respectful and Professional Tone

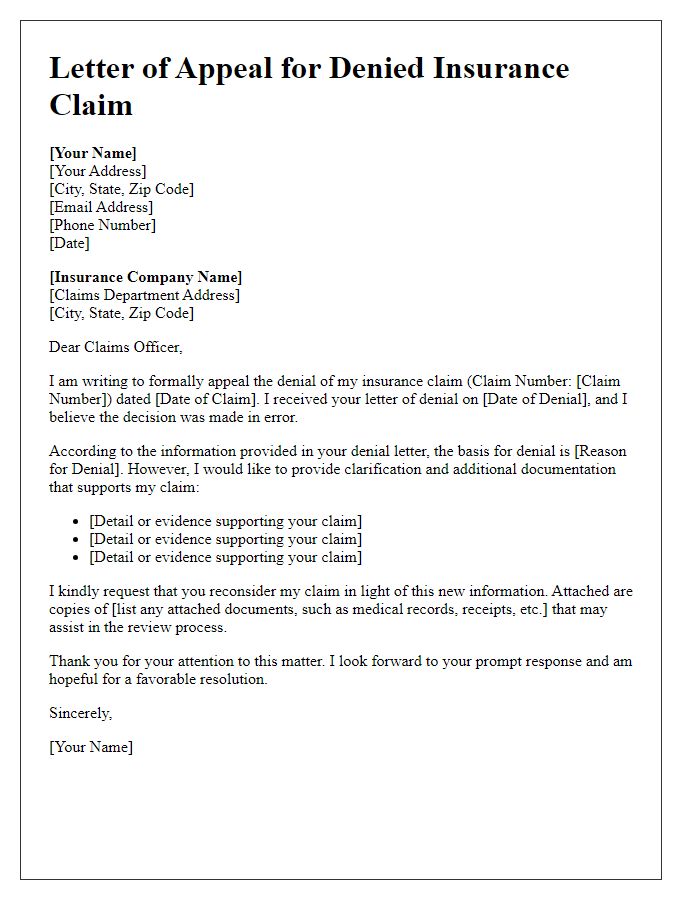

A claim denial appeal often requires careful articulation of specific details and supporting evidence. In crafting an appeal, the claimant should reference the original claim number, clearly outline the reasons for denial stated in the insurer's communication, and present additional evidence or documentation. Mention specific policy terms and conditions that support the claim's validity. Highlight any relevant medical reports, bills, or expert opinions that substantiate the appeal. Maintaining a respectful tone while firmly advocating for the claim can aid in facilitating a comprehensive review by the insurance adjuster. Aim for clarity and conciseness in presenting arguments, ensuring that all attachments are referenced properly.

Comments