Are you ready to take charge of your insurance journey? Understanding the intricacies of your insurance plan is crucial for securing your peace of mind and financial stability. In this article, we'll break down the essential components of insurance plan details, ensuring you know exactly what you're signed up for. So, let's dive in and discover how to confidently confirm your insurance plan details!

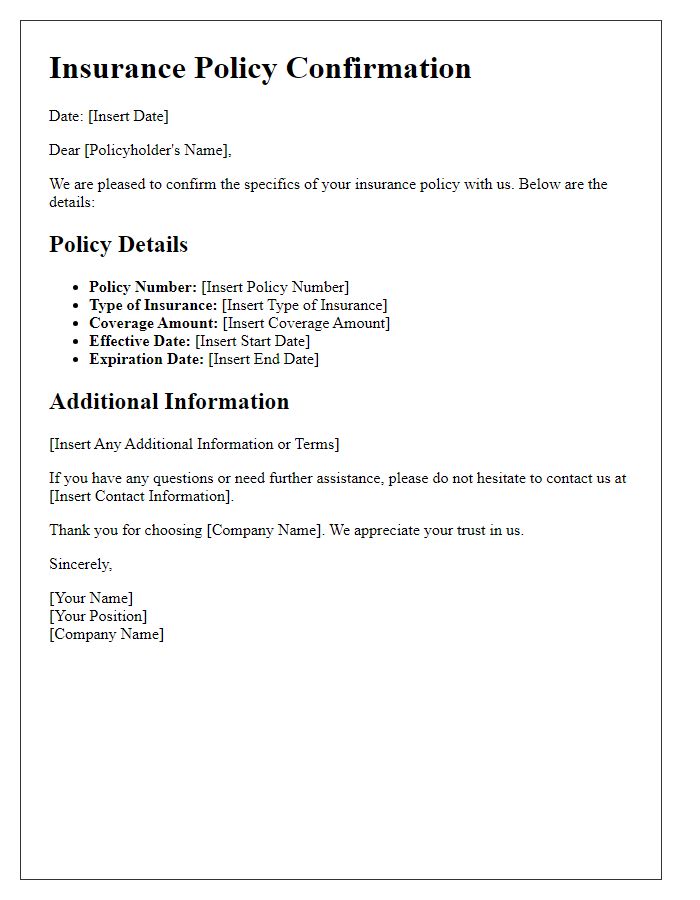

Policy Information

The insurance policy details encompass critical information regarding coverage, premiums, and specific terms. A typical policy number might appear as an alphanumeric string, such as INS12345678, uniquely identifying a customer's agreement with the insurance provider. Coverage limits specify the maximum amount payable in the event of a claim, often expressed in monetary values like $500,000 for property damage. Premium payment schedules detail the frequency of payments, often monthly or annually, important for maintaining policy validity. Additionally, deductibles, which range from $500 to $2,500 depending on the plan, represent the out-of-pocket costs that policyholders must pay before the coverage kicks in. Specific events covered, such as natural disasters or theft, are outlined in sections of the policy document, providing clarity on what is included. Furthermore, exclusions denote conditions or scenarios, like pre-existing health issues in health insurance policies, that might lead to reduced compensation or a denial of claims. Understanding these elements ensures comprehensive knowledge and effective management of insurance needs.

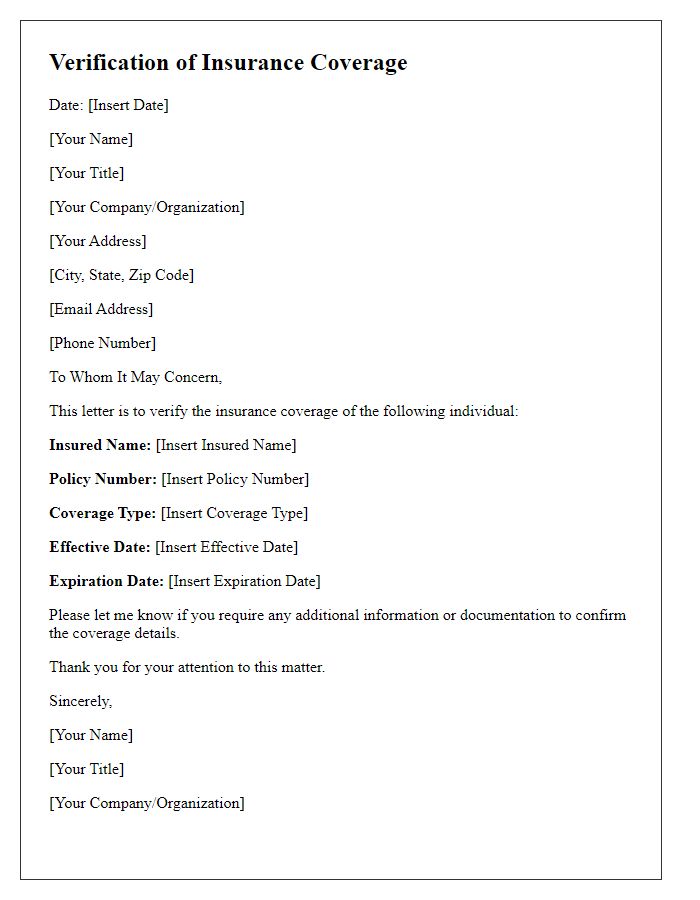

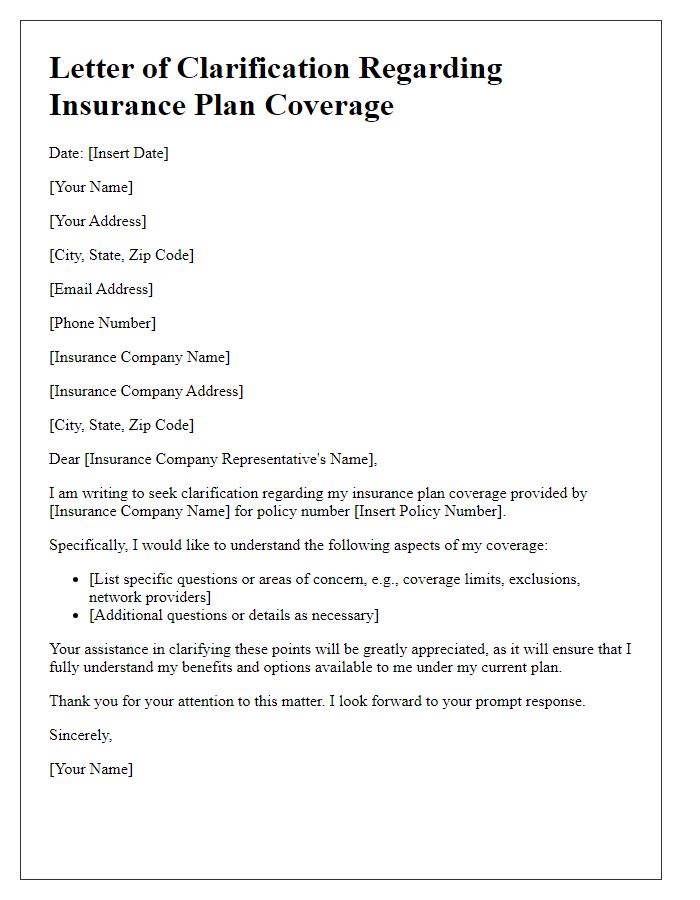

Coverage Details

Insurance plans often include specific coverage details that define the extent of financial protection against various risks. For instance, a health insurance plan might cover hospital stays, outpatient services, and preventive care, ensuring individuals receive necessary medical attention without incurring significant out-of-pocket costs. These plans often have deductible amounts, such as $1,000, which must be paid before the insurance kicks in, and co-payments, like a $20 fee for each doctor visit. Additionally, coverage might vary based on networks, with in-network providers offering lower rates compared to out-of-network ones. Understanding these details is crucial for policyholders to make informed decisions and effectively manage their healthcare expenses.

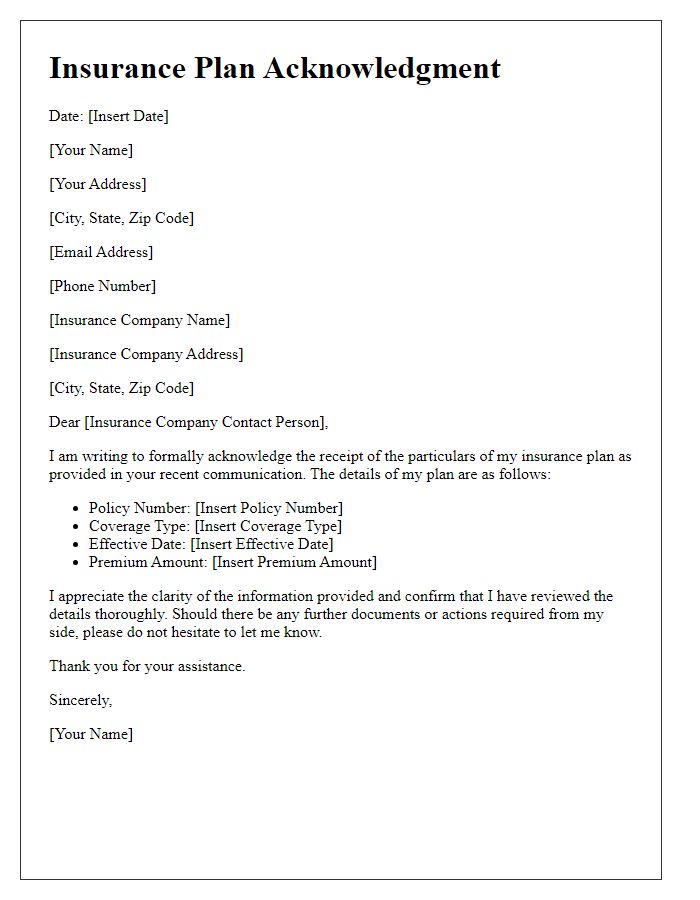

Premium and Payment Terms

Insurance plans typically outline critical details regarding premium amounts and payment terms for policyholders. Premiums represent the monetary obligation required regularly, often monthly or annually, as dictated by the insurance provider, which could be as low as $50 or as high as $500, depending on coverage levels. Payment terms specify the duration of the coverage and methods allowed, such as automatic bank drafts or credit card transactions, ensuring seamless ongoing protection. Policies also include grace periods, commonly 30 days, for late payments before a policy lapses, which is crucial for maintaining coverage continuity. Understanding these elements ensures policyholders are well-informed about their financial commitments and coverage timelines.

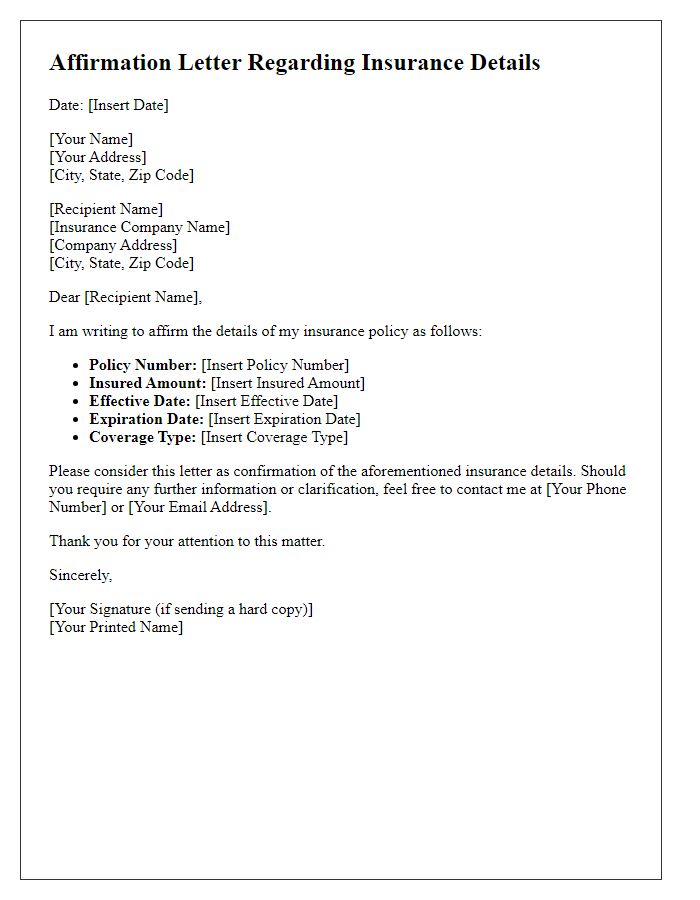

Policy Duration and Renewal

Insurance policy durations typically range from one year to multi-year agreements, depending on the provider and coverage type. Finalizing a policy duration ensures consistent coverage and protection against potential risks. Renewal processes often involve reviewing coverage options, adjusting premiums, and assessing any changes in personal circumstances. Informative details related to renewal dates should be provided in advance to allow adequate preparation for any necessary adjustments. Insurance providers like Allstate or State Farm may offer various options regarding automatic renewals to streamline the process for policyholders. Understanding the implications of policy duration and renewal options is crucial for maintaining uninterrupted insurance coverage.

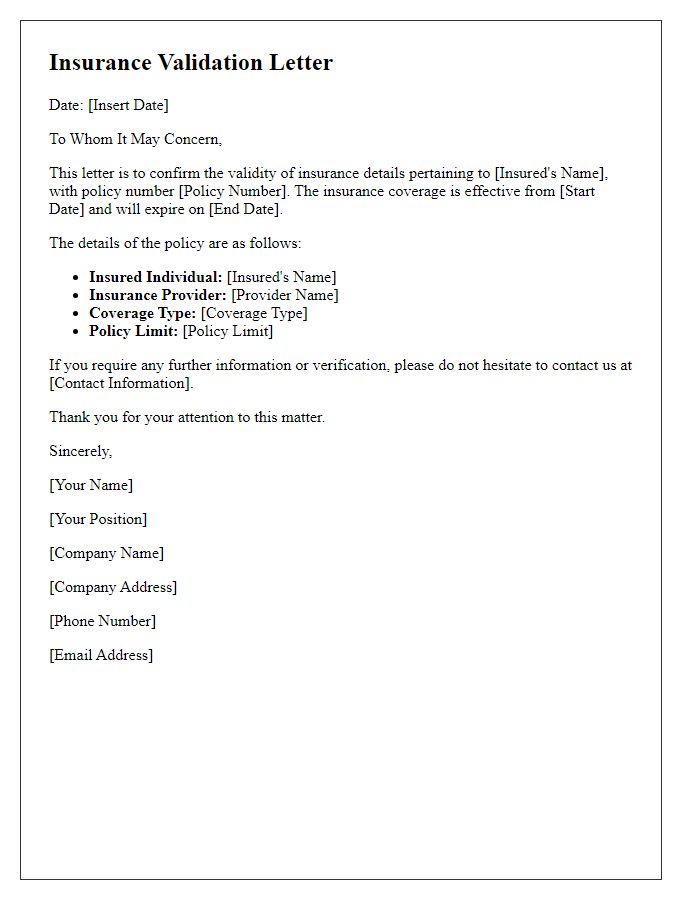

Contact Information for Support

Insurance plan details serve as a crucial framework for understanding coverage, premiums, and benefits. Each plan outlines specific information, including policyholder names, coverage amounts, deductibles, and co-pays. Contact information for support typically includes customer service phone numbers, email addresses, and dedicated support portals for inquiries. Insurance companies like Aetna, Blue Cross Blue Shield, and UnitedHealthcare provide these resources to ensure clients can easily access assistance. Having direct access to support representatives can facilitate the resolution of claims-related issues or questions about specific coverage terms. Accurate contact details enhance customer experience and ensure seamless communication regarding policy queries.

Comments