Are you curious about how your premium adjustments in insurance work? Understanding these changes can feel overwhelming, but it doesn't have to be! In this article, we'll break down the essentials of premium adjustments, including the factors that influence your rates and how you can effectively navigate these changes. So, let's dive into the detailsâread on to learn more!

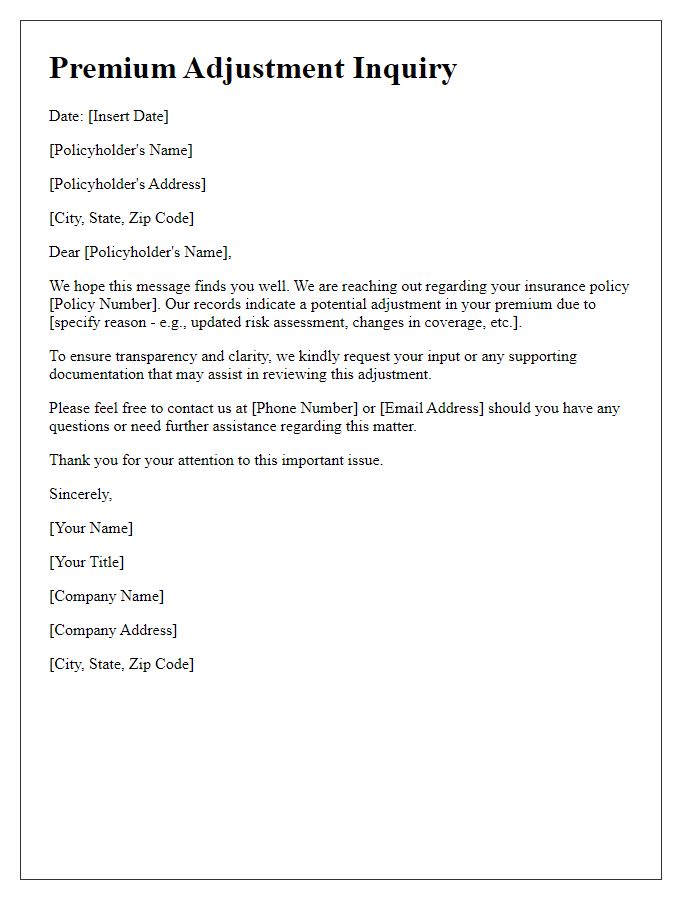

Policy Information

Policy information regarding premium adjustments in insurance typically includes essential details such as the policyholder's name, policy number (a unique identifier for tracking coverage), effective dates (start and end of the policy term), and coverage limits (the maximum amount the insurer will pay for a covered loss). Additionally, relevant endorsements (modifications to the original policy) and the specific terms affecting premium rates, including deductibles (the amount paid out of pocket before insurance kicks in) and risk factors, should be noted. Changes in circumstances, such as property value fluctuations, claims history (record of prior claims made), or changes in coverage needs, can also influence premium adjustments.

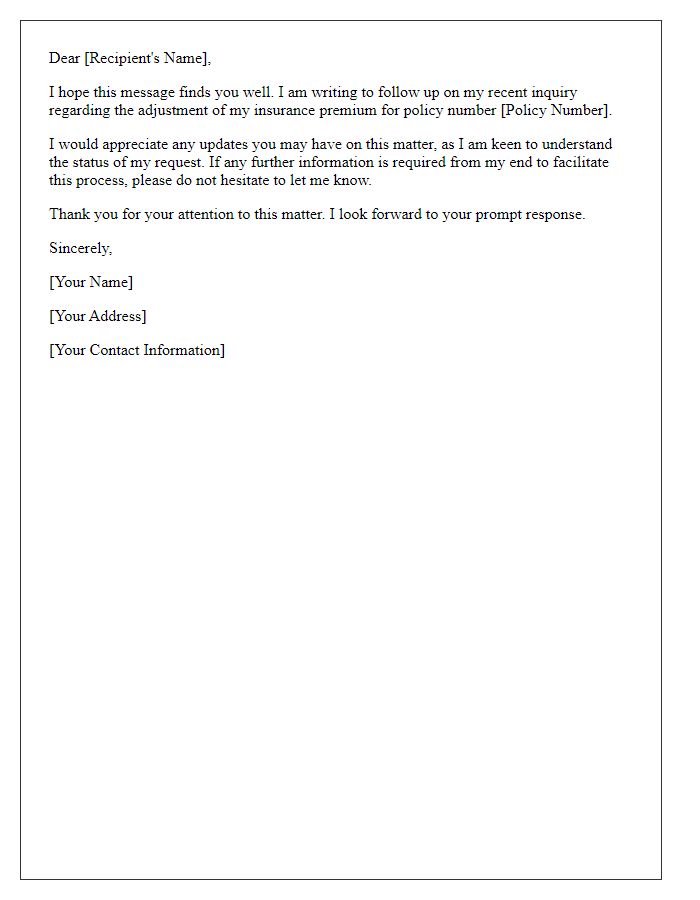

Contact Details

Premium adjustments in insurance policies can arise due to various factors such as changes in coverage or alterations in risk assessment. Policyholders seeking clarification may provide contact details, including full name, policy number, and an active phone number. This information ensures streamlined communication with insurance representatives, facilitating a prompt response to inquiries related to recent adjustments. Understanding the reasoning behind any change in premium can help clients make informed decisions regarding their coverage options. Additionally, clear contact details enable efficient handling of potential follow-up questions or required documentation during the inquiry process.

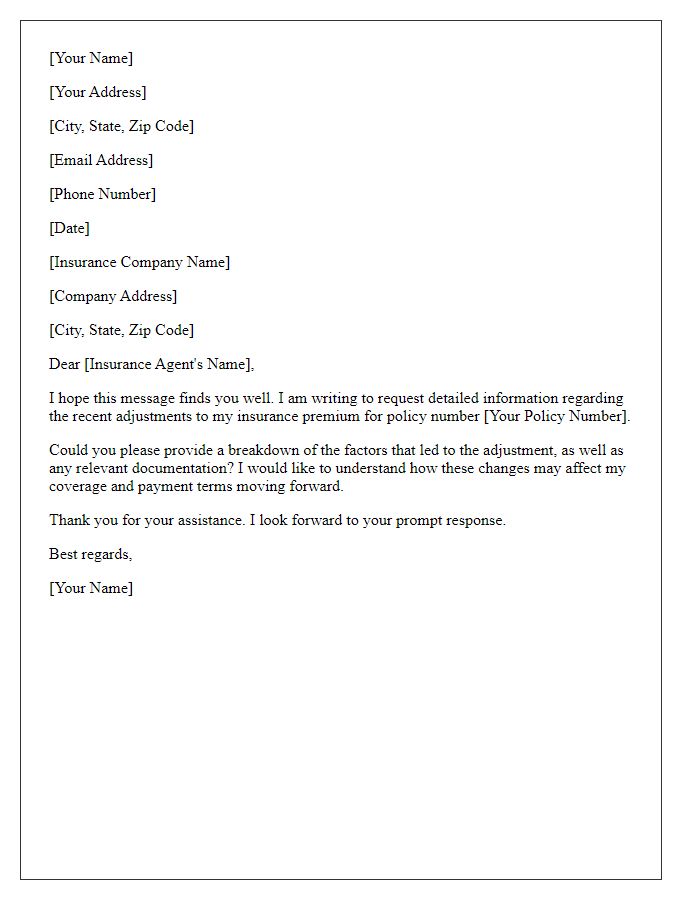

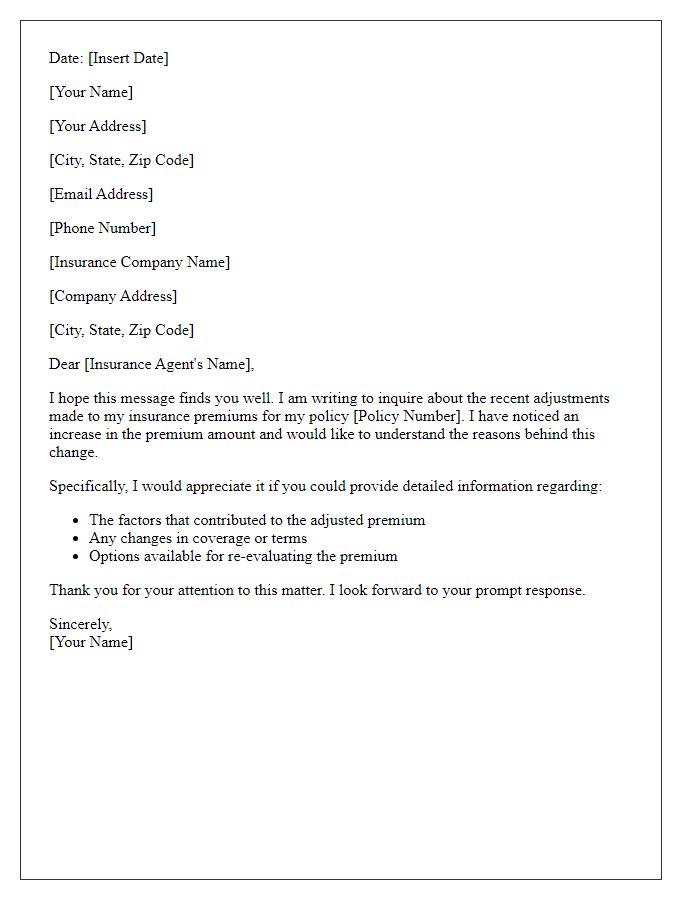

Clear Subject Line

Premium adjustments in insurance policies often reflect changes in coverage risk or other underwriting factors. Policyholders may see fluctuations in their premiums (amounts charged for insurance) based on personal circumstances such as increased claims history, changes in property value, or shifts in market trends. For instance, homes in flood-prone areas may experience higher premiums post-natural disasters such as hurricanes. Additionally, factors like age, credit scores, and even geographical location--like living in urban settings with higher crime rates--can drive premium costs higher. Understanding these nuances is crucial for effective communication with insurance providers, ensuring inquiries about potential adjustments are informed and relevant.

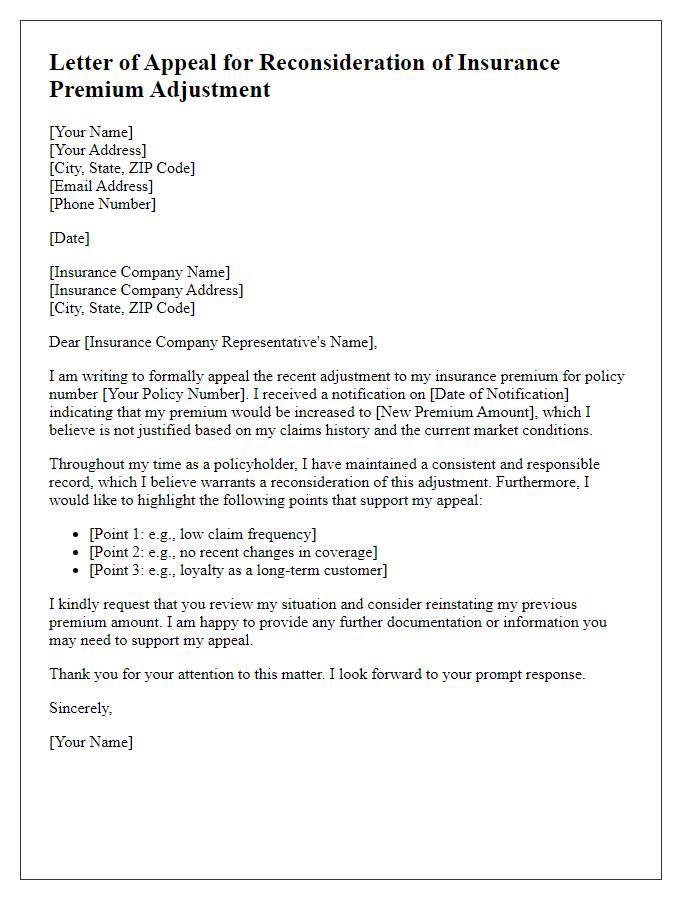

Reason for Inquiry

Premium adjustments in insurance often stem from factors such as claims history, market trends, and changes in underwriting guidelines. For instance, a significant claim could increase premiums by 20-30%, while market conditions may lead to a general adjustment of rates across similar policies. Additionally, geographic considerations, like living in a high-risk area for natural disasters, can influence premium changes. Insurers might also adjust premiums based on the policyholder's risk profile, which includes factors like age, credit score, and driving record. Understanding these factors is crucial for policyholders to navigate their premium adjustments effectively.

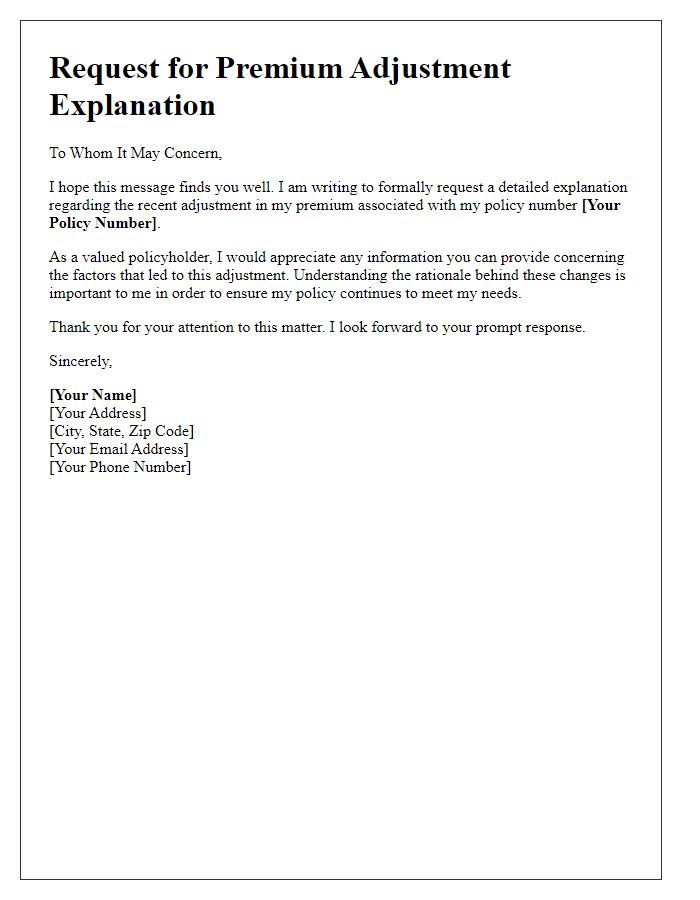

Request for Detailed Explanation

Premium adjustments in insurance policies can arise from various factors, including changes in risk assessments, claims history, and coverage modifications. When an insurance provider recalibrates premiums, clear communication is essential for understanding the rationale behind these financial adjustments. Requesting detailed explanations regarding the alterations can help policyholders comprehend the specific criteria impacting their rates. Common elements influencing adjustments may include geographic risks (such as natural disasters affecting certain regions), the insured item's value, and trends in loss ratios. Engaging with an insurance representative to clarify these points can aid in better financial planning and coverage decisions.

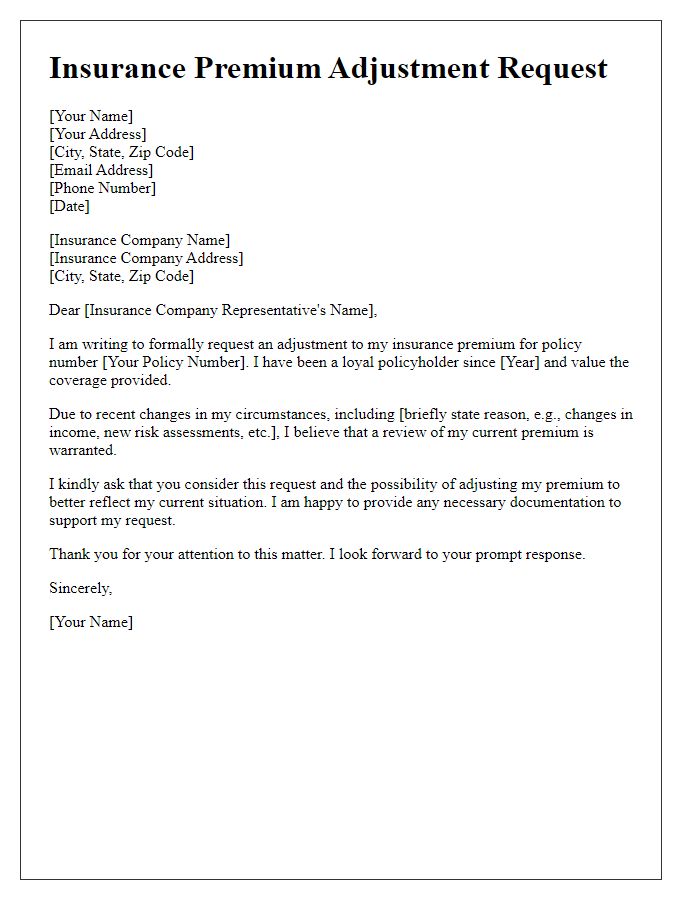

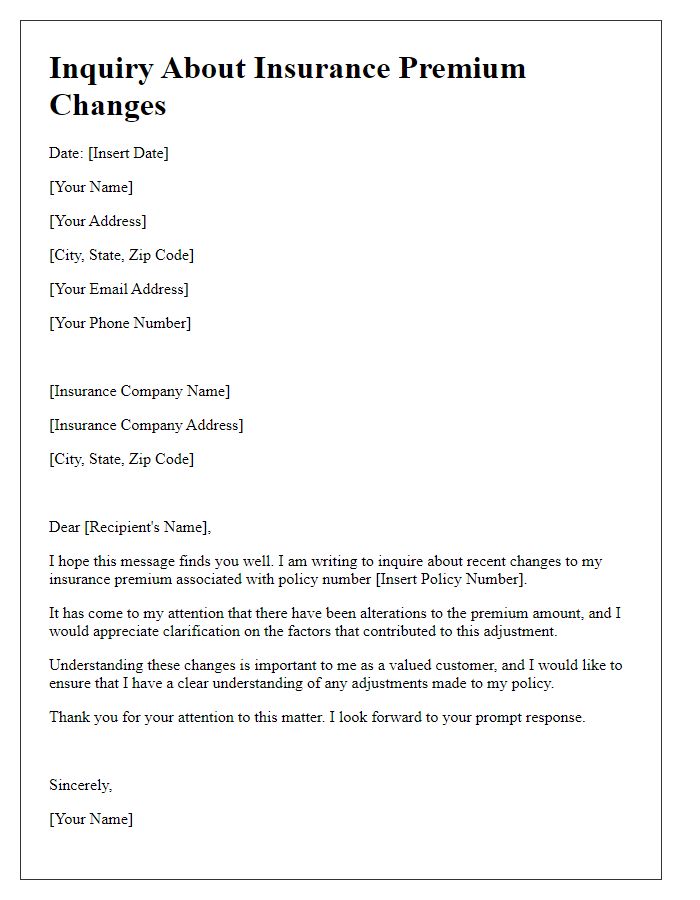

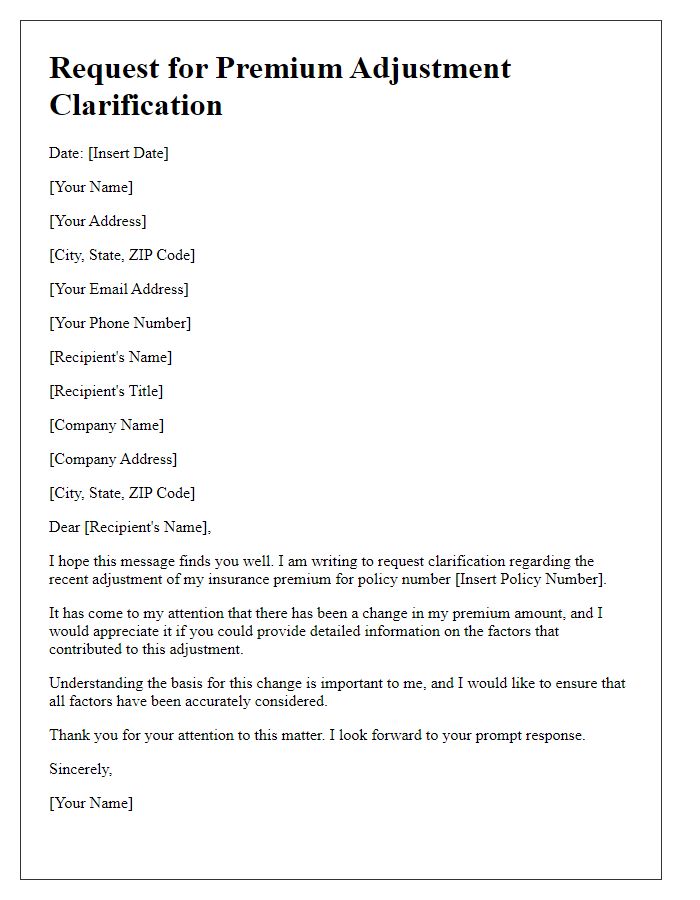

Letter Template For Premium Adjustment Insurance Inquiry Samples

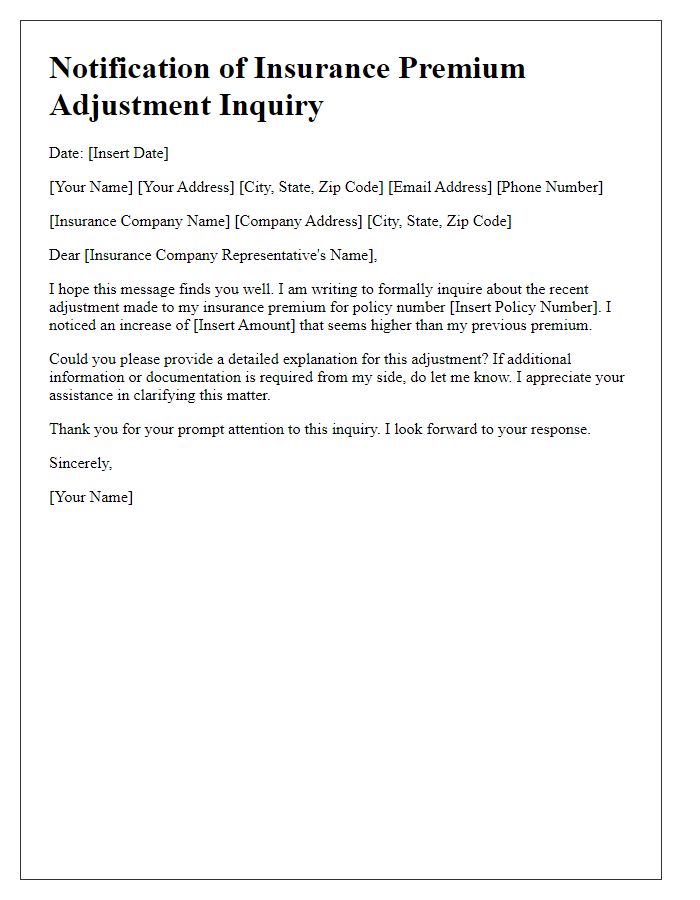

Letter template of notification for insurance premium adjustment inquiry

Comments