Are you feeling a bit confused about insurance collision coverage? You're not alone! Many people find themselves uncertain about what their policy truly entails and how it can protect them in the event of an accident. Join us as we break down the key aspects of collision coverage and clarify all those pesky detailsâyour understanding of insurance will be crystal clear in no time!

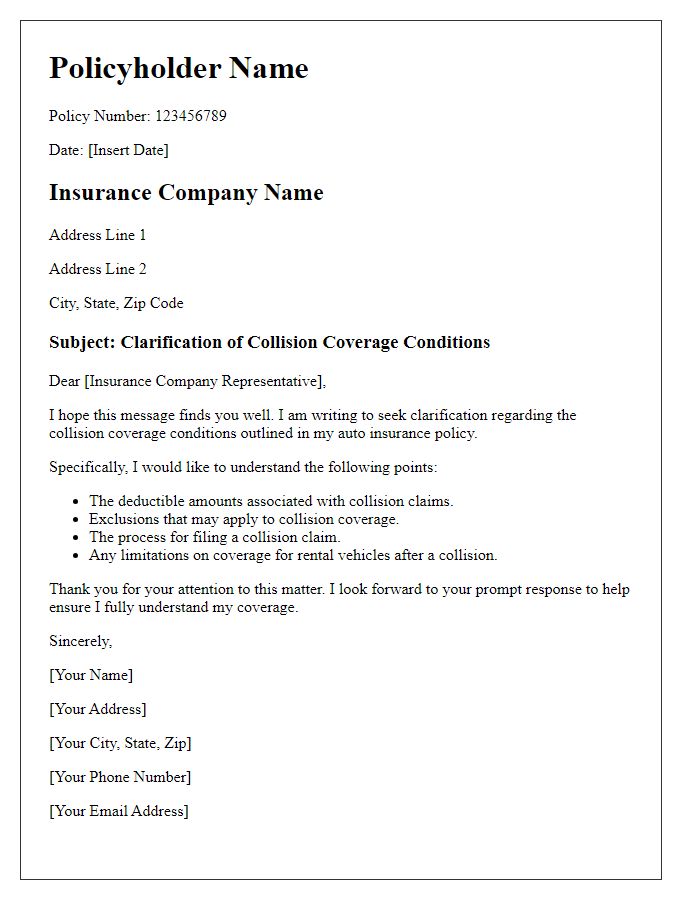

Policy Number and Personal Information

Insurance collision coverage provides essential financial protection in the event of automotive accidents, covering damage to vehicles regardless of fault. For clarity, policyholders need to reference their specific policy number, which serves as a unique identifier for their insurance coverage. Personal information, including full name, contact details, and vehicle details such as make, model, and year, plays a crucial role in ensuring that claims are processed efficiently. Additionally, understanding deductibles and limits associated with collision coverage is vital, as it determines out-of-pocket expenses in various accident scenarios. Inquiries about coverage specifics can be directed to the insurance provider's customer service for comprehensive assistance.

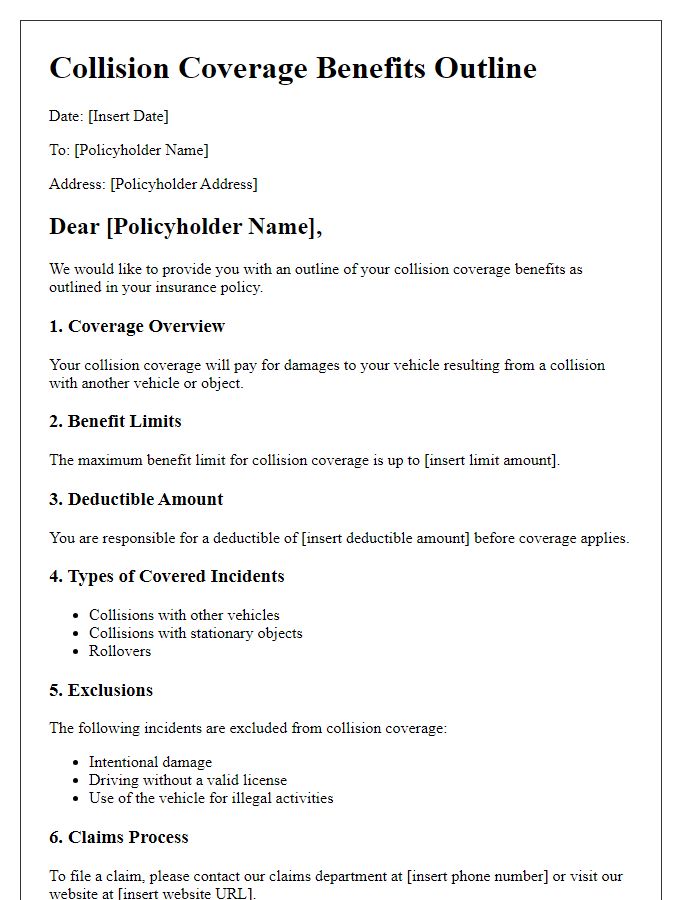

Collision Coverage Terms and Conditions

Collision coverage, an essential component of auto insurance policies, protects vehicle owners against damage resulting from collisions. This type of coverage typically applies to accidents involving other vehicles, stationary objects, and even scenarios like rollovers. Policies may include deductibles, which can range from $250 to $1,000, affecting the payout in the event of a claim. Additionally, factors like the vehicle's market value, the insured's driving history, and premium rates can influence overall coverage costs. Understanding the terms and conditions, such as coverage limits and exclusions--commonly associated with driving under the influence or using a vehicle for commercial purposes--is crucial for every policyholder. In 2022, there were approximately 6 million vehicle crashes reported in the United States, highlighting the importance of comprehensive coverage to safeguard against potential financial loss.

Detailed Incident Description

In a recent traffic incident, a 2022 Toyota Camry was involved in a collision (January 15, 2023) at the intersection of Maple Street and Oak Avenue, known for its frequent accidents. The vehicle, traveling at approximately 25 miles per hour, was struck by a 2019 Ford F-250 that ran a red light. The impact caused significant damage, estimated at $8,000 to the Camry's front end, affecting crucial components such as the radiator and air conditioning system. Additionally, the deployment of airbags indicated the severity of the collision, prompting immediate medical evaluation for the driver due to possible whiplash. Local law enforcement filed an accident report, documenting the event and assigning fault to the driver of the F-250. The collision coverage provided by the insurance policy is crucial for addressing repair costs and potential medical expenses stemming from this incident.

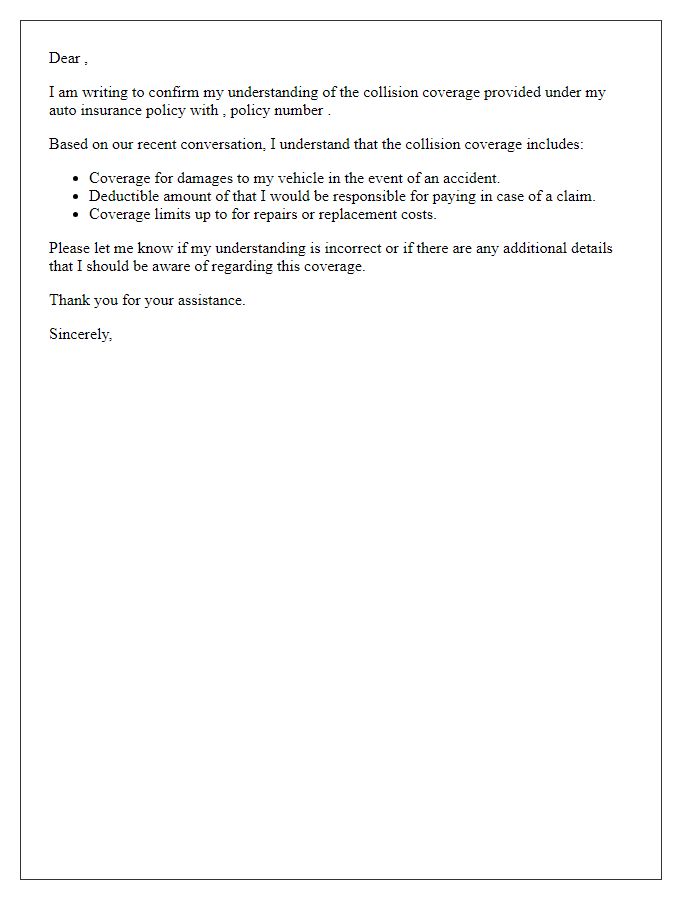

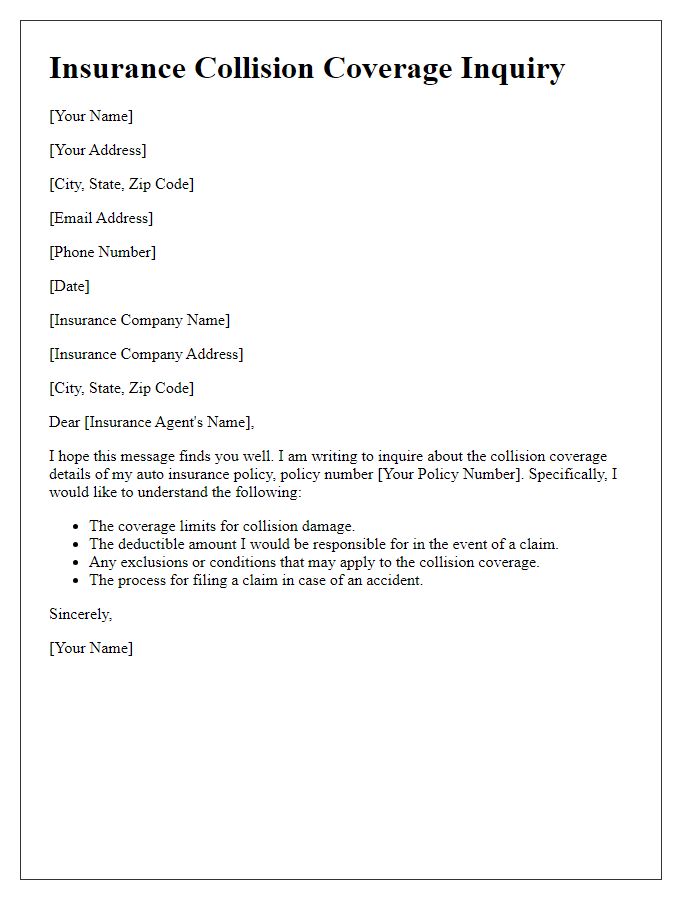

Request for Clarification or Additional Information

Insurance collision coverage provides financial protection for vehicle damage resulting from accidents. Coverage typically includes costs for repairs or replacement of damaged vehicles, depending on policy terms. Most policies have a deductible amount, often ranging between $250 to $1,000, which policyholders must pay out-of-pocket before insurance payouts commence. Additional factors influencing coverage include the insured vehicle's market value, driving history, and the nature of the accident. Understanding the specifics of collision coverage is essential for maximizing benefits during claims, ensuring clarity on terms such as total loss, salvage value, and liability limits. Policyholders should regularly review their coverage details to avoid misunderstandings during critical situations.

Contact Information for Follow-Up

Insurance collision coverage provides essential financial protection for vehicle owners involved in accidents. This coverage generally includes damage repairs, replacement costs, and sometimes even rental vehicle expenses during the repair process. An annual premium, usually ranging from $300 to $1,200 depending on factors such as driver's age and vehicle type, must be paid to maintain this coverage. Policyholders should thoroughly review their individual policy documents to clarify specifics like deductible amounts, usually set between $500 to $1,000, which dictate out-of-pocket expenses in the event of a claim. Additionally, understanding how collision coverage interacts with liability coverage and comprehensive coverage is crucial for making informed decisions. Engaging with a licensed insurance agent can provide personalized guidance and resolve any uncertainties regarding collision coverage terms.

Letter Template For Insurance Collision Coverage Clarification Samples

Letter template of insurance collision coverage conditions clarification.

Letter template of insurance collision coverage understanding confirmation.

Comments