Are you feeling overwhelmed after an accident and unsure about how to start your insurance claim? Writing a letter to initiate your accident insurance claim can seem daunting, but it doesn't have to be. With the right template and a few key details, you can make the process smooth and straightforward. Join me as we explore the essential components of an effective claim letter, and let's get you one step closer to the support you deserve!

Policyholder Information

Accident insurance claims often require accurate policyholder information to ensure a smooth processing experience. Items such as full name of the policyholder, claim number associated with the specific policy, contact information including a valid phone number and email address, as well as address details should be rightfully included. Policy specifics like policy number and the date of purchase provide essential context to the case. Additionally, relevant dates, such as the incident date, are crucial as they help form a timeline for the claim processing. Understanding this information aids insurance companies in verifying coverage and addressing claims efficiently.

Incident Details

A vehicular collision on Main Street (location known for heavy traffic) resulted in physical injuries and property damage. The incident occurred on September 15, 2023, around 3:00 PM, involving a blue sedan (identified as a Toyota Corolla) and a red pickup truck (make and model: Ford F-150). Witnesses reported a sudden stop by the sedan due to a traffic light (signal malfunction suspected), leading to a rear-end collision with the pickup truck. Emergency services were called to the scene, with local authorities filing an accident report (reference number: #123456). Medical attention was required, with the driver of the sedan sustaining a concussion and the passenger suffering from a broken wrist. The damaged vehicles were subsequently taken to an auto repair shop (name: City Garage), with estimated repair costs exceeding $5,000.

Description of Accident

A collision occurred on Main Street in downtown Springfield, involving a blue 2019 Honda Civic to the left and a grey 2020 Ford F-150 on the right. At approximately 3:45 PM on July 14, 2023, the Honda Civic was traveling at 35 miles per hour when it collided with the pickup truck, which was parked, resulting in significant damage to the driver's side door. Factors contributing to the accident included wet road conditions due to a recent rainstorm, which had caused reduced visibility and slippery surfaces. Emergency services arrived promptly, assessed the situation, and documented the incident, noting visible injuries sustained by the driver of the Civic, including whiplash and bruising. A police report was generated, cataloging the circumstances and the involved parties' insurance information for follow-up claims processing.

Claim Amount and Justification

Accident insurance claims involve a detailed breakdown of the claim amount and justification for coverage. An example can illustrate the process. A claim amount of $15,000 is justified after a car accident on Main Street, resulting in three weeks of hospital treatment and physical therapy, contributing to substantial medical expenses. Medical bills totaled $10,000, including emergency services and follow-up care. Lost wages due to the inability to work for a month amounted to $5,000. The claimant must provide documentation such as hospital records, wage statements from the employer, and estimates for rehabilitation to support the claim effectively. A thorough justification enhances the likelihood of successful approval by the insurance company.

Contact Information for Follow-up

In the event of an accident, timely communication with the insurance provider is crucial. Ensure to include relevant contact details, such as the insurance policy number, which identifies the coverage type and limits associated with the claim. The policyholder's full name, as recorded in the policy documents, provides clarity to the insurer. A current address allows for efficient correspondence, while a phone number ensures quick follow-up discussions regarding claim status and documentation requirements. An email address offers an additional method for the insurance company to send important updates and requests for information electronically, streamlining the communication process. Providing this contact information accurately enables efficient management of the insurance claim, facilitating a smoother resolution.

Letter Template For Accident Insurance Claim Initiation Samples

Letter template of accident insurance claim initiation for personal injury.

Letter template of accident insurance claim initiation for property damage.

Letter template of accident insurance claim initiation for workplace accident.

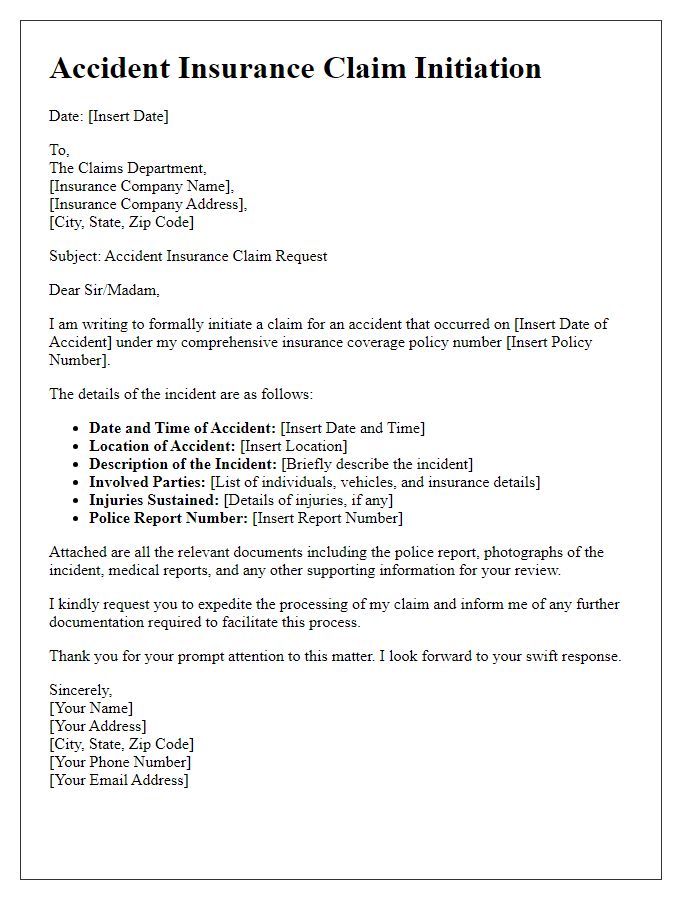

Letter template of accident insurance claim initiation for vehicle collision.

Letter template of accident insurance claim initiation for medical expenses.

Letter template of accident insurance claim initiation for third-party liability.

Letter template of accident insurance claim initiation for slip and fall incident.

Letter template of accident insurance claim initiation for travel-related accident.

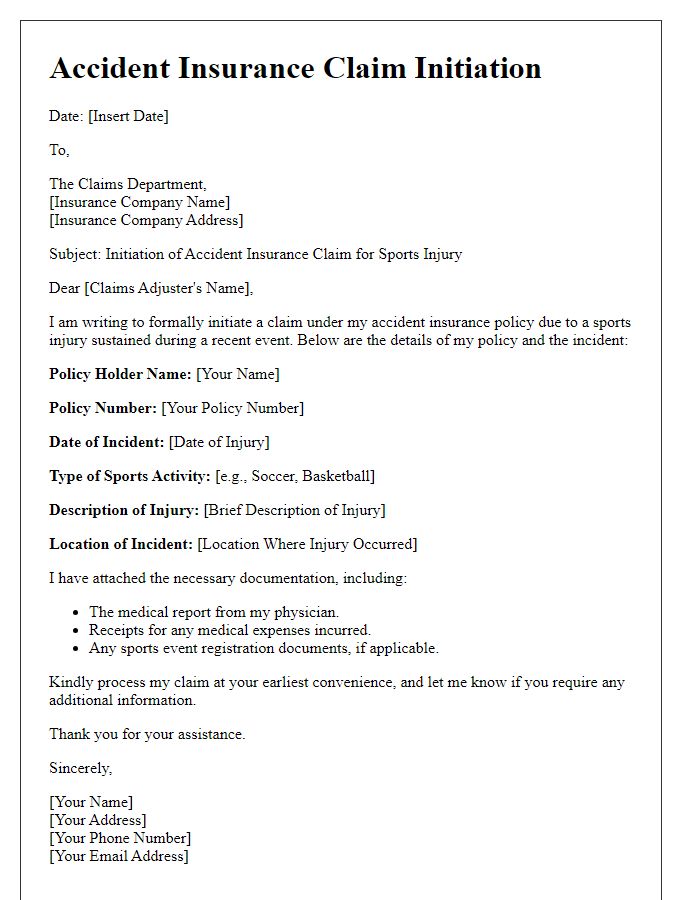

Letter template of accident insurance claim initiation for sports injury.

Comments