Hey there! If you've ever wondered about what casualty insurance can do for you, you're not alone. Many people find themselves puzzled by the options available and how they can protect their assets. Understanding how casualty insurance works and its benefits can be a game-changer in ensuring peace of mind and security for your belongings. So, let's dive in and unravel the details togetherâread on to learn more!

Subject line with specific policy inquiry.

Casualty insurance coverage encompasses various aspects designed to protect individuals and businesses against potential losses or liabilities. For instance, auto liability insurance provides coverage for damages caused by vehicular accidents (including bodily injuries) while homeowners insurance protects against property damage from events such as fires or theft. Each policy type has distinct provisions, premiums, and deductibles that dictate coverage limits. In 2022, insurers reported an increase in claims related to natural disasters, emphasizing the importance of comprehensive coverage. Understanding specific policy details (such as exclusions or coverage for personal property) is crucial for ensuring adequate protection in unpredictable circumstances.

Personal information and contact details.

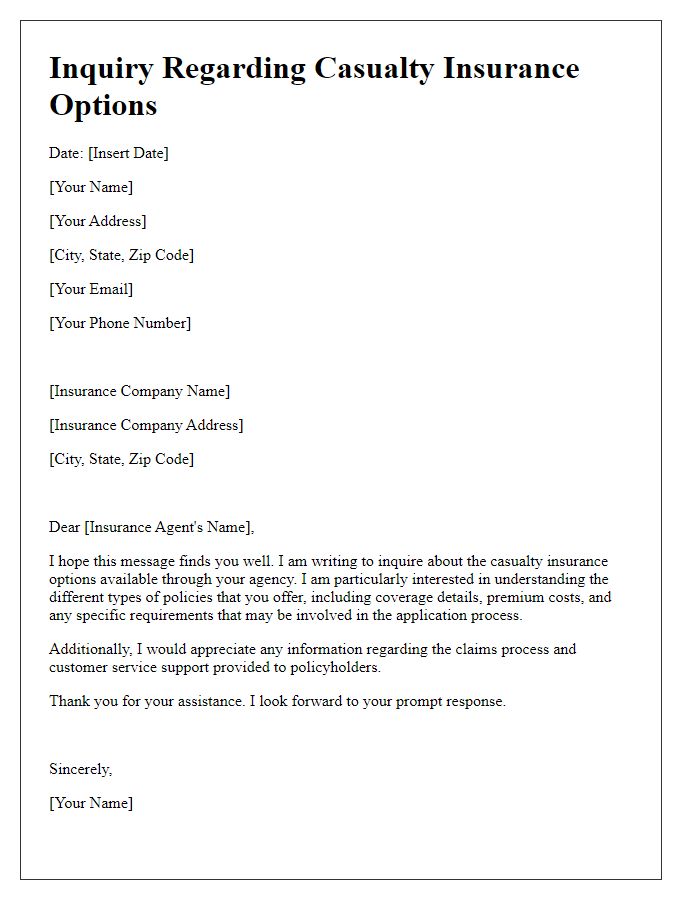

Casualty insurance coverage provides essential financial protection against potential losses caused by unforeseen events such as accidents, theft, or property damage. Understanding the details of a policy, including premiums and coverage limits, becomes critical for individuals seeking to safeguard their assets. Common types of casualty insurance include auto insurance, general liability insurance, and workers' compensation, which collectively cater to a wide range of risks. Specific requirements for personal information may vary by insurer, typically requiring details such as name, address, date of birth, and contact information to establish a comprehensive profile for tailored coverage options. Additionally, policyholders must be aware of the claims process, including necessary documentation and contact information for successful communication with the insurer. The inquiry process serves as an important step in securing appropriate coverage, mitigating financial risks associated with unpredictable events.

Detailed description of the incident or situation.

A minor automobile accident occurred on October 5, 2023, at the intersection of Main Street and Second Avenue in Springfield. A blue Toyota Camry, traveling at approximately 25 miles per hour, collided with a red Honda Civic that was making a left turn. No injuries were reported, but significant property damage resulted. The Toyota sustained front-end damage, requiring an estimated $5,000 for repairs, while the Honda incurred damage to the rear bumper, estimated at $3,500. Both vehicles were towed from the scene, and the police report (Report Number 789456) documented the incident and the exchange of insurance information between the involved parties. Witnesses, including a nearby shop owner, confirmed the sequence of events. The required coverage details need to be assessed to determine the appropriate compensation for the repairs under the applicable casualty insurance policy.

Policy number and relevant coverage details.

Casualty insurance coverage encompasses various protections against losses arising from accidents and other unforeseen events, which could impact personal or business assets. Key elements include liability coverage, often mandated by law, which covers legal claims resulting from injuries or property damage to others. Additional aspects consist of collision coverage, protecting against vehicle damage during an accident, and comprehensive coverage, safeguarding against non-collision-related incidents like theft or natural disasters. For those seeking specific policy details, referencing the unique policy number is crucial, as it specifies the terms, limits, and exclusions of coverage applicable to a particular individual or business entity. Understanding these components is essential for assessing permissible claims and ensuring adequate protection against potential financial liabilities.

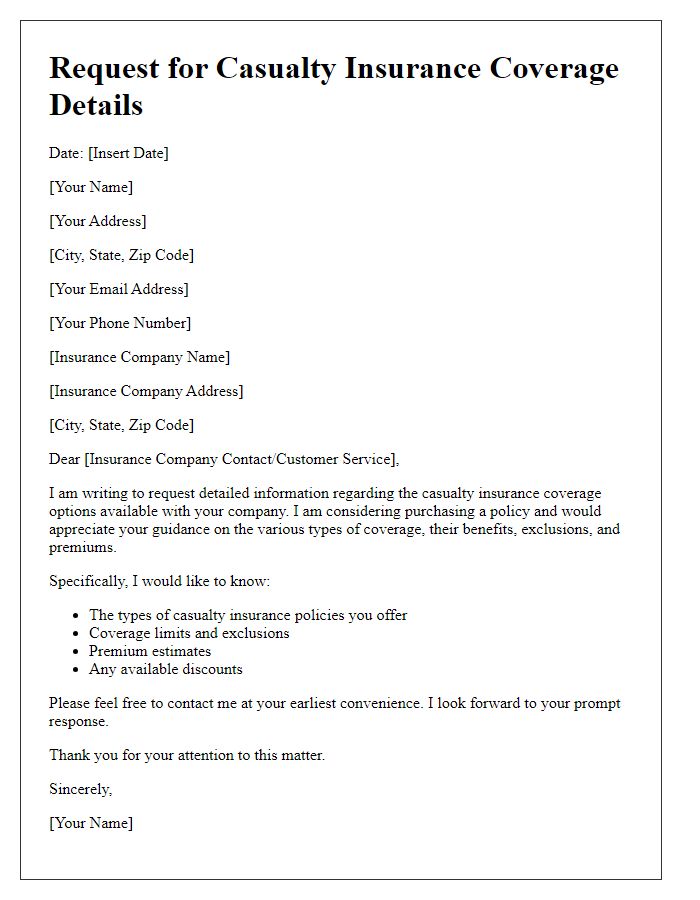

Specific questions and requests for clarification.

Casualty insurance coverage encompasses various policies that protect against unforeseen losses, including automobile accidents, property damage, and liability claims. Important details include the types of coverage offered, such as collision coverage (protects against vehicle damage in accidents), comprehensive coverage (covers non-collision-related incidents like theft or natural disasters), and liability coverage (protects against lawsuits for bodily injury or property damage). Additionally, specific inquiries might address the limits of coverage (maximum amounts an insurer will pay), deductibles (out-of-pocket expenses before coverage kicks in), and exclusions (situations not covered by the policy). Understanding claim procedures (steps to follow when filing a claim), premium adjustments (how adjusters evaluate risk), and policy renewal terms (conditions affecting continued coverage) are crucial parts of managing casualty insurance effectively.

Letter Template For Casualty Insurance Coverage Inquiry Samples

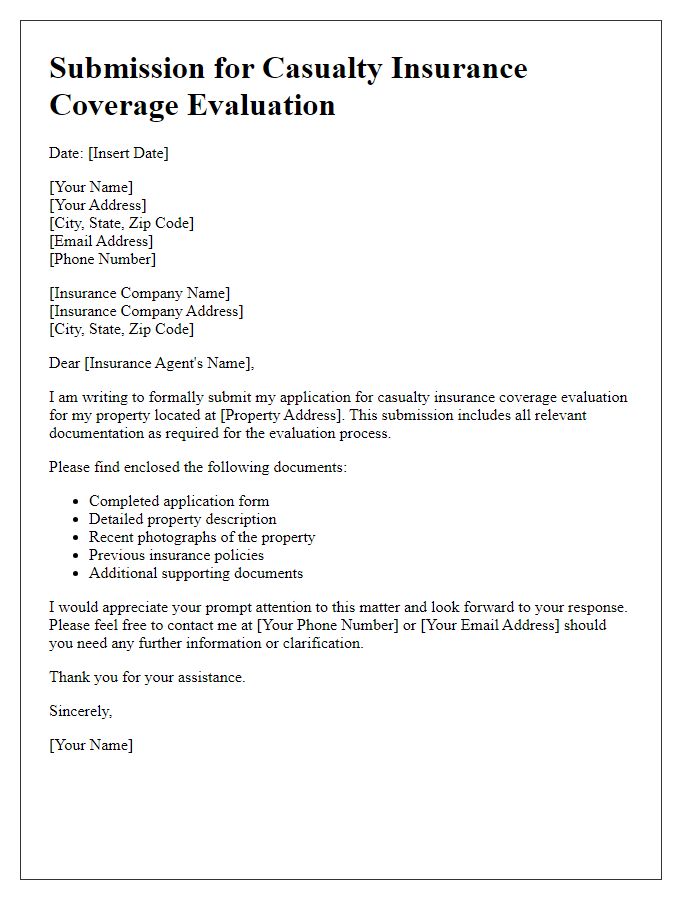

Letter template of submission for casualty insurance coverage evaluation

Comments