Are you navigating the often perplexing world of pet insurance claims? It can be frustrating when a claim is denied, especially when you're trying to cover your furry friend's medical expenses. In this article, we'll provide you with a helpful, easy-to-use letter template to appeal your pet insurance claim. Ready to turn your claim denial into a successful appeal? Let's dive in!

Clear Policy Details

A thorough understanding of pet insurance policies is crucial for filing successful claims. Key details to focus on include the policy number, which uniquely identifies the contract between the owner and the insurance provider. Coverage type, such as accident-only or comprehensive plans, significantly impacts the admissibility of claims. Annual coverage limits often dictate the maximum amount reimbursed within a policy year. Important exclusions, like pre-existing conditions or specific breeds, can influence the claim outcome. Additionally, having access to the policy's terms and conditions can provide clarity on the claims process, required documentation, and timelines for submitting appeals. Understanding these aspects ensures a more effective appeal and increases the likelihood of receiving deserved reimbursements for veterinary expenses.

Specific Claim Denial Reasons

When submitting an appeal for a pet insurance claim denial, it's important to address the specific reasons provided by the insurance company clearly and effectively. For example, if a claim for a veterinary procedure, such as surgery for a torn ligament, is denied due to a pre-existing condition, the appeal should include detailed documentation from the veterinarian. This documentation can outline the timeline of the pet's health history, any prior treatments, or examinations conducted, establishing that the condition was not pre-existing at the time of policy activation. Additionally, if the denial cites a lack of coverage for a specific procedure or incident, it may be beneficial to include policy documentation that supports the claim, highlighting any relevant sections that cover the treatment sought. Clear and concise records from veterinary professionals, along with a firm understanding of the insurance policy terms, bolster the appeal's chances of acceptance.

Detailed Medical Records

Submitting a pet insurance claim appeal for medical expenses can be essential for obtaining coverage for veterinary care, especially involving detailed medical records from veterinarians. Well-documented records, including diagnosis, treatment plans, and itemized invoices, serve as vital evidence in claiming reimbursement. For instance, detailed accounts of veterinary visits at facilities such as the Animal Hospital of Anytown, including medical history (Vaccination records, Pre-existing conditions), and specific procedures conducted (e.g., surgeries, vaccinations) strengthen the case. Additionally, clear communication from veterinarians about the necessity of treatments can further substantiate claims, providing context for decisions made regarding the pet's health care. Key components like the date of service and treatment details should be consistently organized to facilitate a smoother appeal process.

Point-by-Point Appeal Arguments

Pet insurance claim appeals often require a methodical approach to address specific concerns raised by the insurance provider. Start by clearly identifying the claim number and date of submission, ensuring that all relevant documents are attached for reference. Articulate the first point, referencing policy terms that support your claim, such as coverage limitations or exclusions. Highlight key medical details, including the specific veterinary procedures performed, the diagnosis made by the veterinarian (notable conditions like hip dysplasia or pancreatitis), and the estimated costs associated with treatments. Emphasize any discrepancies you found in the initial denial rationale, using precise language to clarify or contest the provider's interpretation of policy terms. Incorporate supportive documentation, such as the veterinary invoice, medical records that substantiate the claim, and additional expert opinions if available. Closing statements should reiterate the deductible amounts already met and the importance of the timely resolution of the claim for the welfare of the pet.

Supporting Documentation and Evidence

In the process of appealing a pet insurance claim, submitting supporting documentation is crucial. Essential documents include veterinary records detailing diagnostics and treatments for the specific condition (e.g., a medical condition like chronic ear infections), invoices outlining costs associated with veterinary visits, medications, and tests (which can range from $50 for a simple check-up to over $2,000 for complex procedures), as well as photographs of the pet's condition to demonstrate the severity (e.g., swollen ears or significant discomfort). Additionally, statements from the veterinary practice (a well-known clinic such as VCA Animal Hospitals) can serve as testimonials regarding the necessity of the treatments provided. If applicable, previous claim responses from the insurance company should be included, highlighting discrepancies in reasoning or findings. This thorough compilation of evidence (potentially referred to by insurance adjusters) supports the argument for reconsideration and increases the likelihood of a successful appeal.

Letter Template For Pet Insurance Claim Appeal Samples

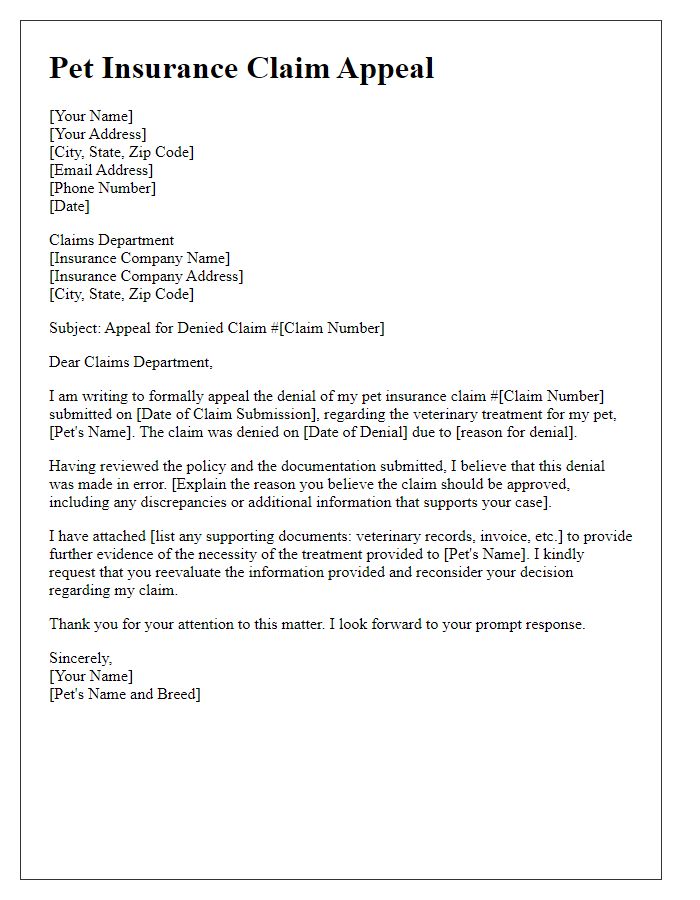

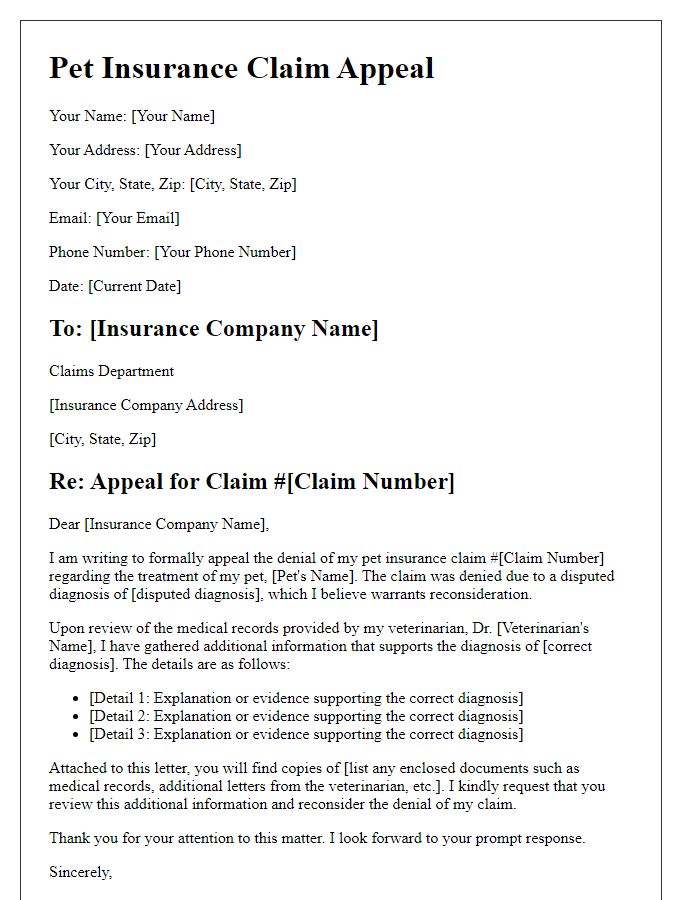

Letter template of pet insurance claim appeal for veterinary treatment denial.

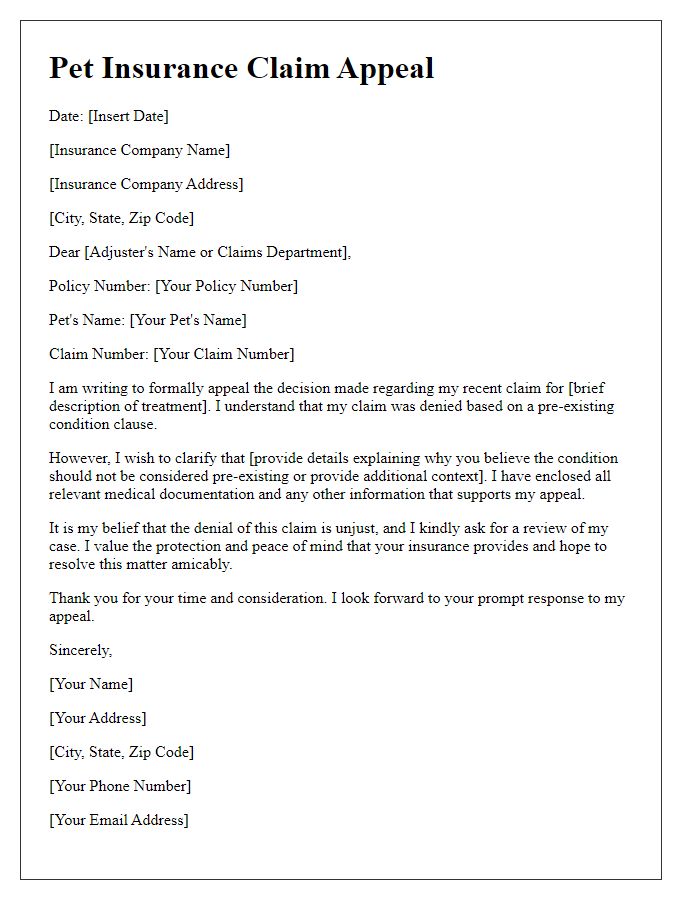

Letter template of pet insurance claim appeal for pre-existing condition rejection.

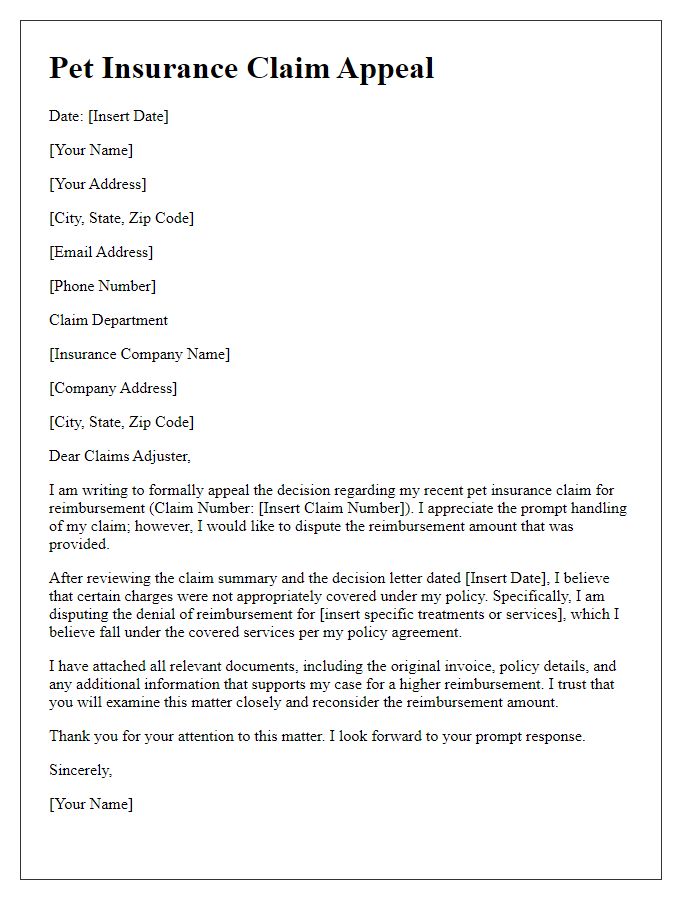

Letter template of pet insurance claim appeal for reimbursement amount dispute.

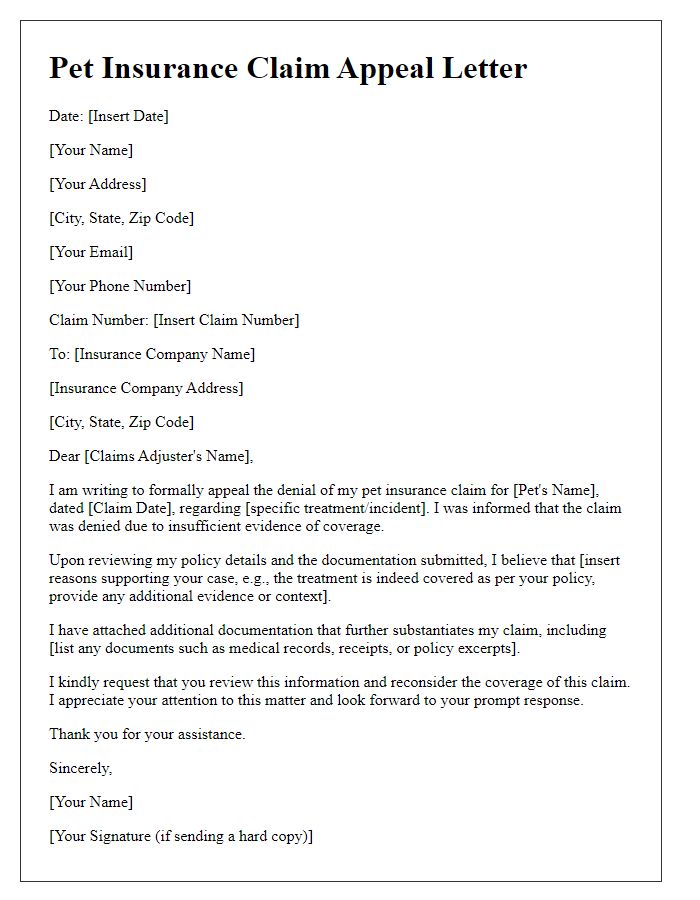

Letter template of pet insurance claim appeal for insufficient evidence of coverage.

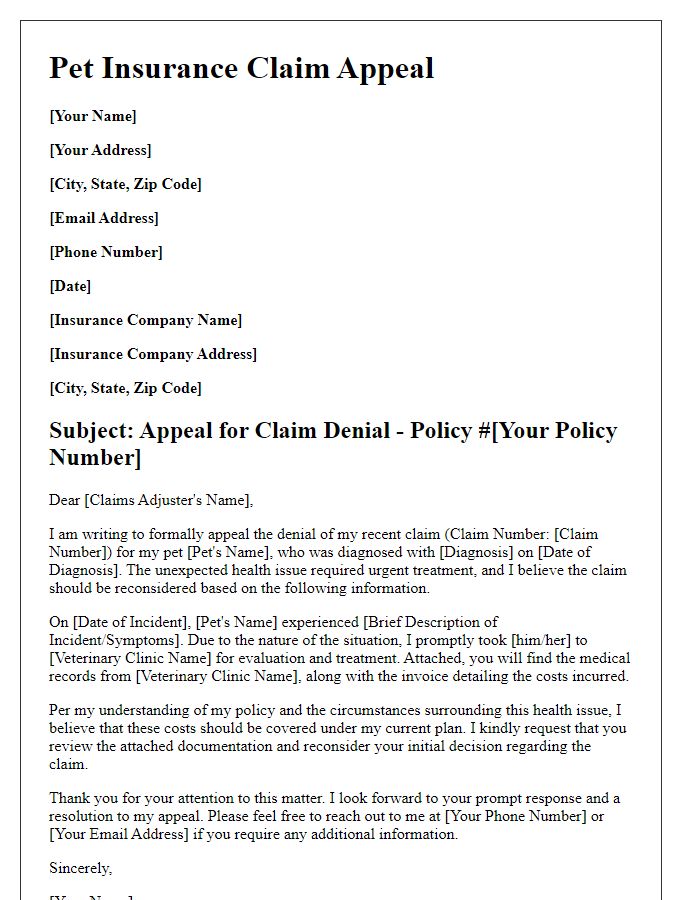

Letter template of pet insurance claim appeal for unexpected health issue.

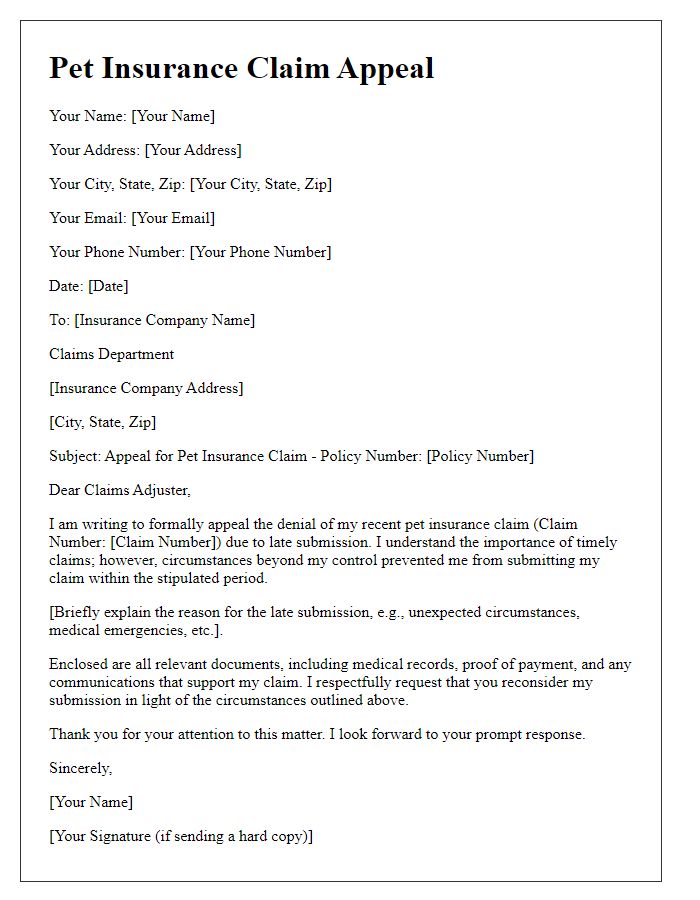

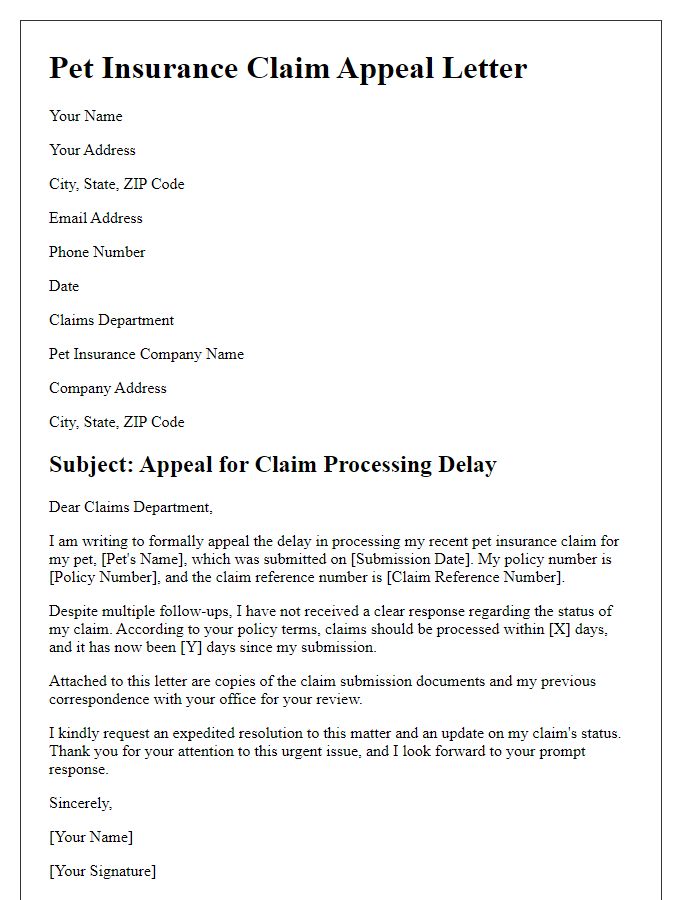

Letter template of pet insurance claim appeal for late submission issues.

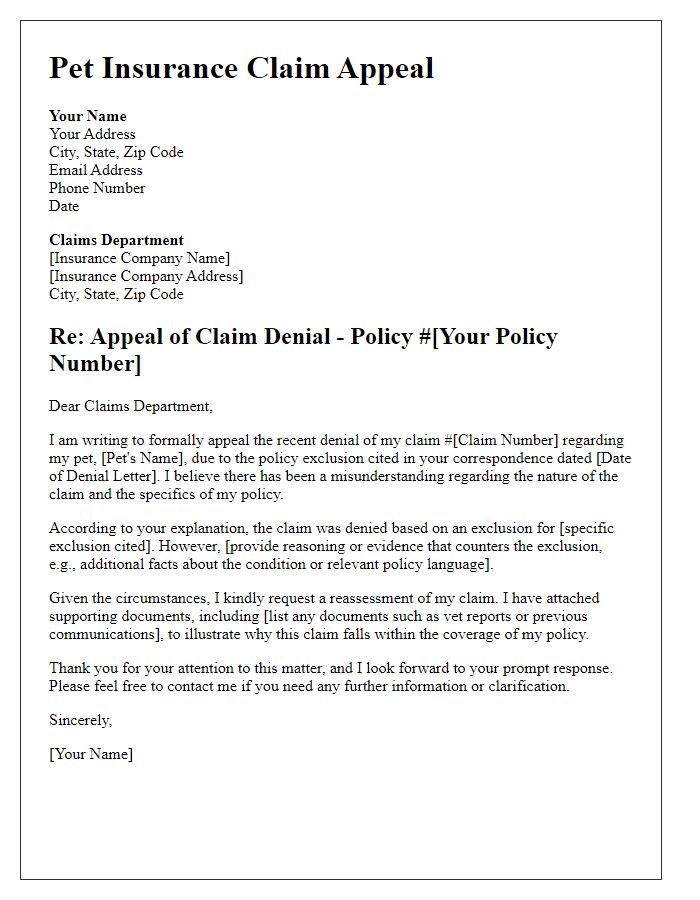

Letter template of pet insurance claim appeal for policy exclusion misunderstanding.

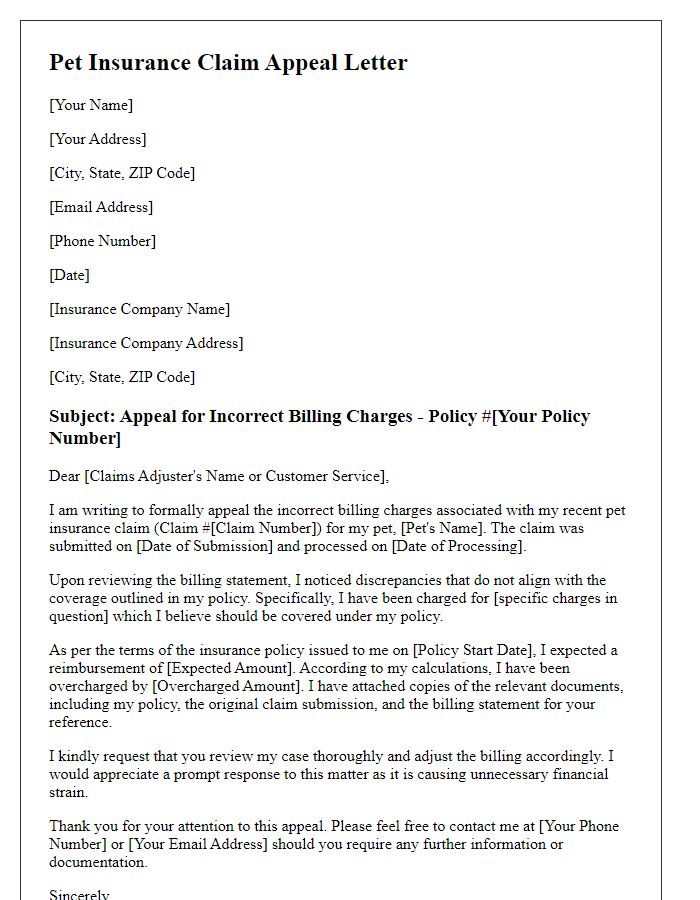

Letter template of pet insurance claim appeal for incorrect billing charges.

Comments