Are you feeling overwhelmed by your insurance deductible? You're not alone; many policyholders find themselves navigating the complexities of deductible adjustments and seeking relief. In this article, we'll guide you through the essential steps and helpful tips to craft an effective letter requesting an adjustment to your insurance deductible. So, grab a cup of coffee and join us as we dive into this important topic!

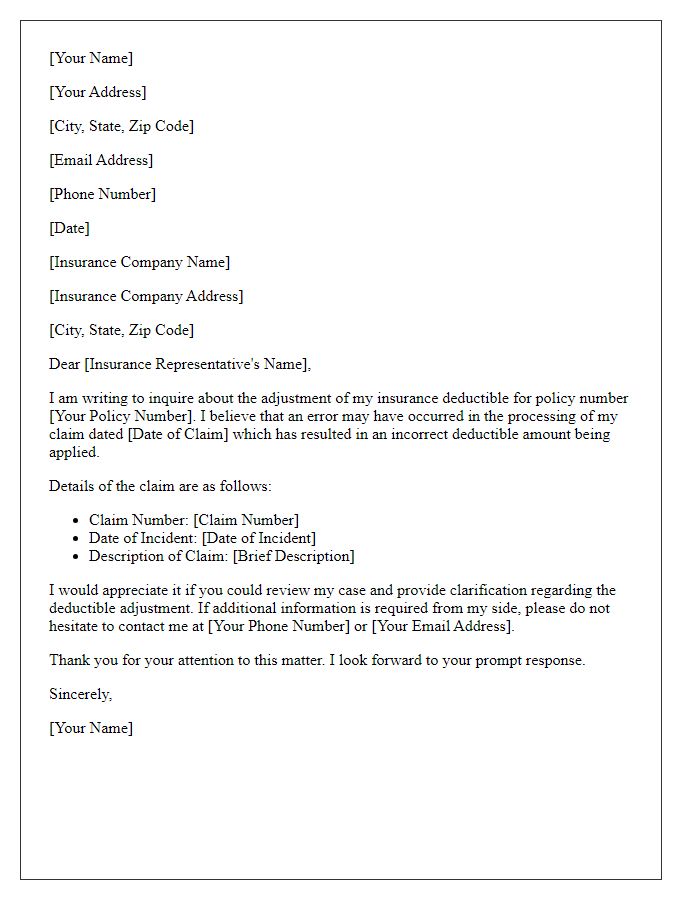

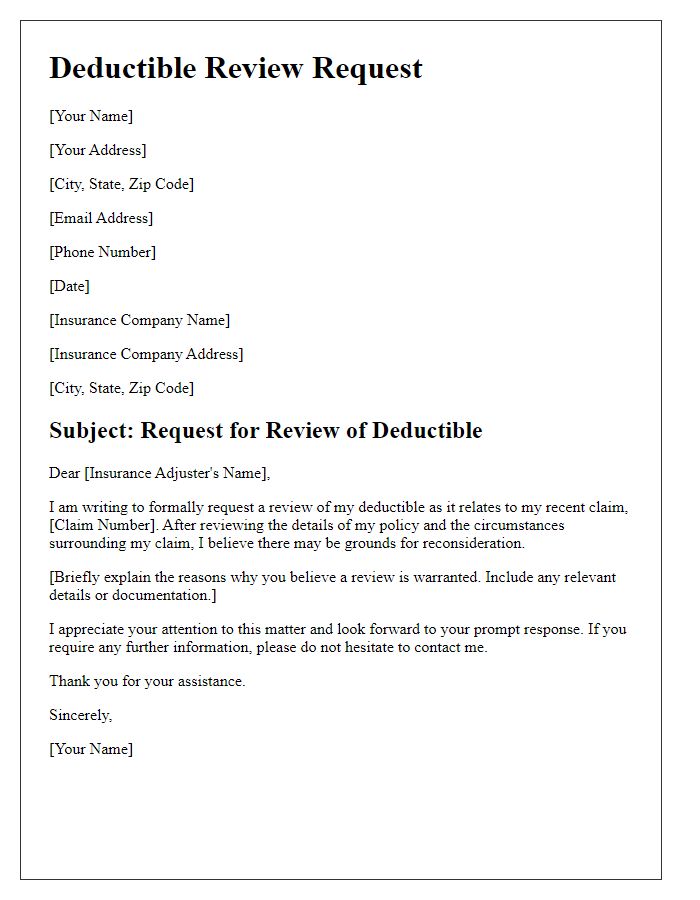

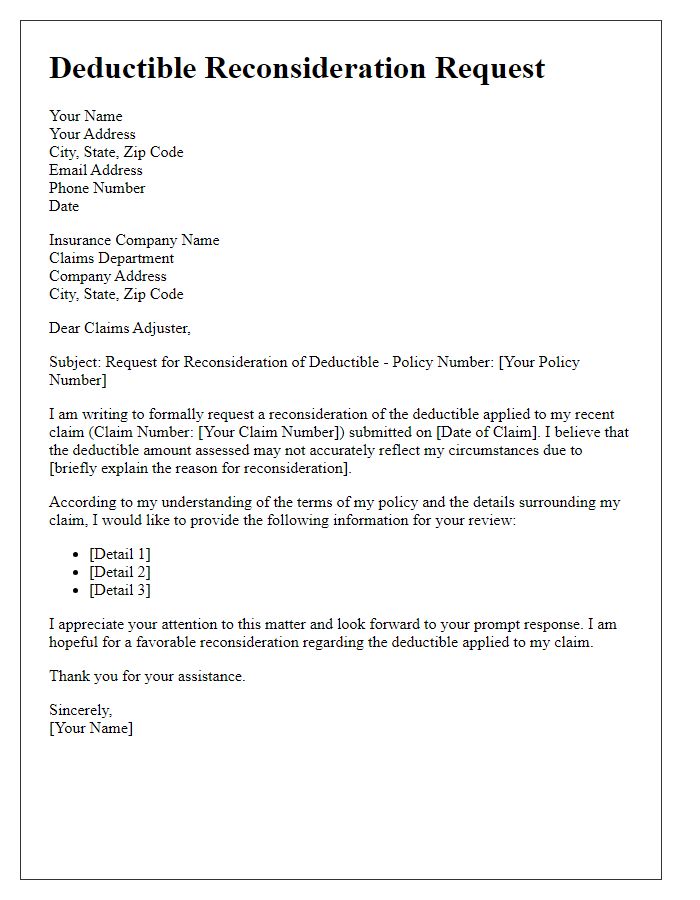

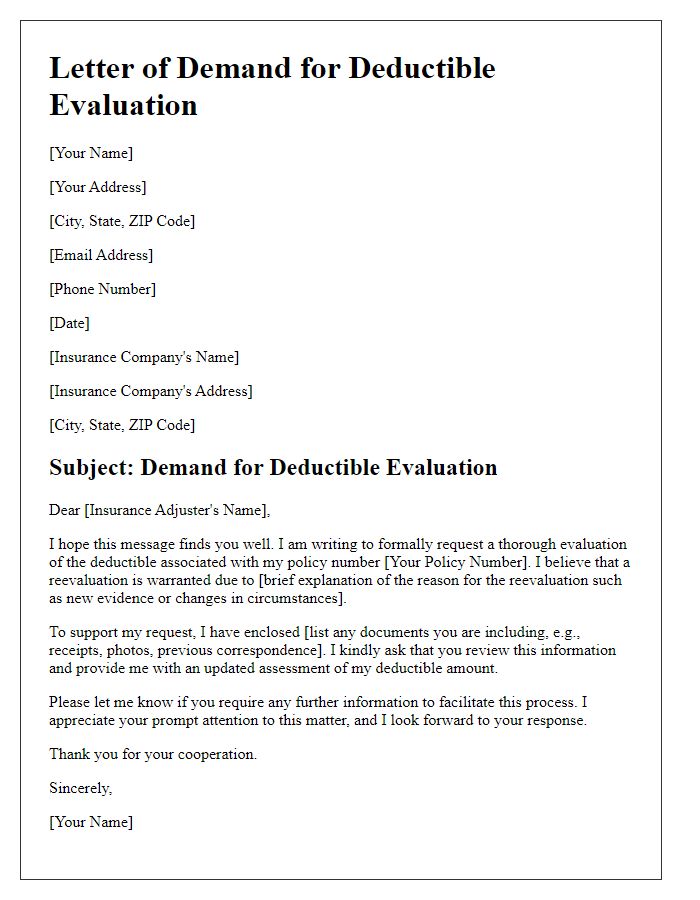

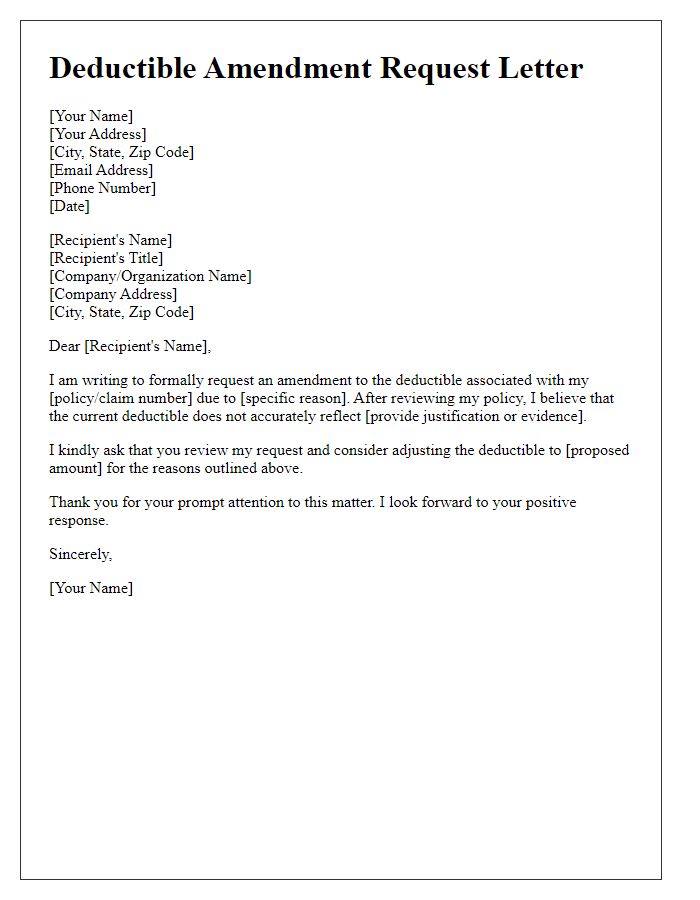

Policyholder Information

Insurance deductible adjustments can significantly impact the financial responsibilities of policyholders in various instances such as claims for property damage or medical expenses. Essential information includes policyholder name, policy number, and contact information. Policies may reference deductibles ranging from $500 to $5000, depending on the insurance type and claim severity. In states like California or Texas, regulations may influence the deductible adjustment process. Documentation supporting the need for an adjustment, including evidence of hardship or changes in circumstances post-claim, is critical for effective communication with insurance providers, such as State Farm or Allstate. Understanding the process can facilitate smoother negotiations and potentially reduce out-of-pocket costs.

Policy and Claim Details

Insurance policyholders often seek adjustments to deductibles following claims for damages or losses. The policy number, typically a unique identifier associated with the insurance agreement, serves as a reference for the insurer, ensuring accurate documentation. Claim details encompass the date of the incident, description of covered events, and the amount sought for reimbursement. Adjustments may occur due to factors like policyholder loyalty, claims history, or specific events influencing the deductible structure. Properly formatted requests typically accompany supporting documentation, such as repair estimates or accident reports, to substantiate the appeal for reconsideration of the deductible amount.

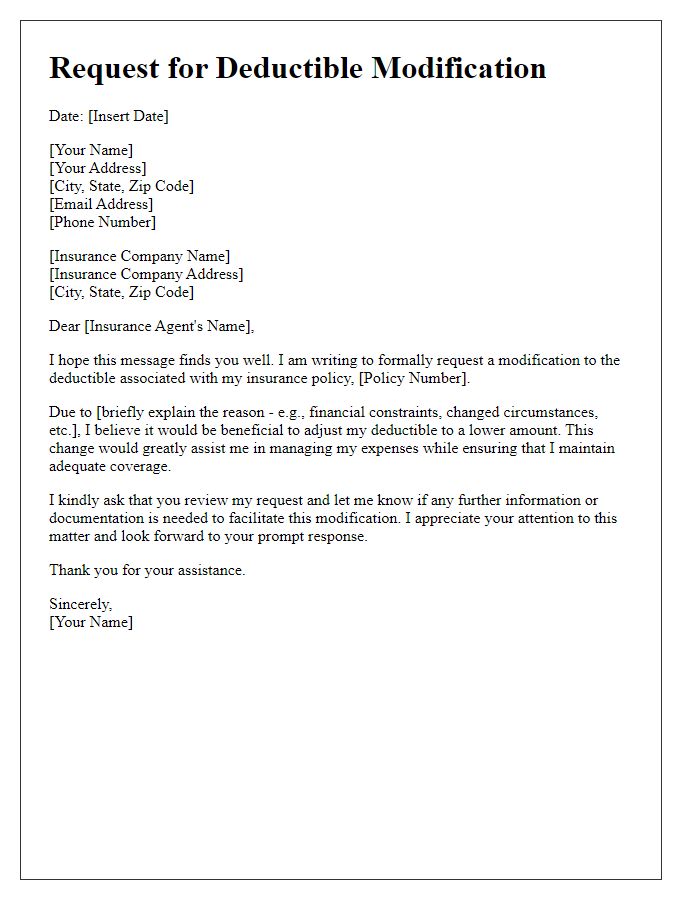

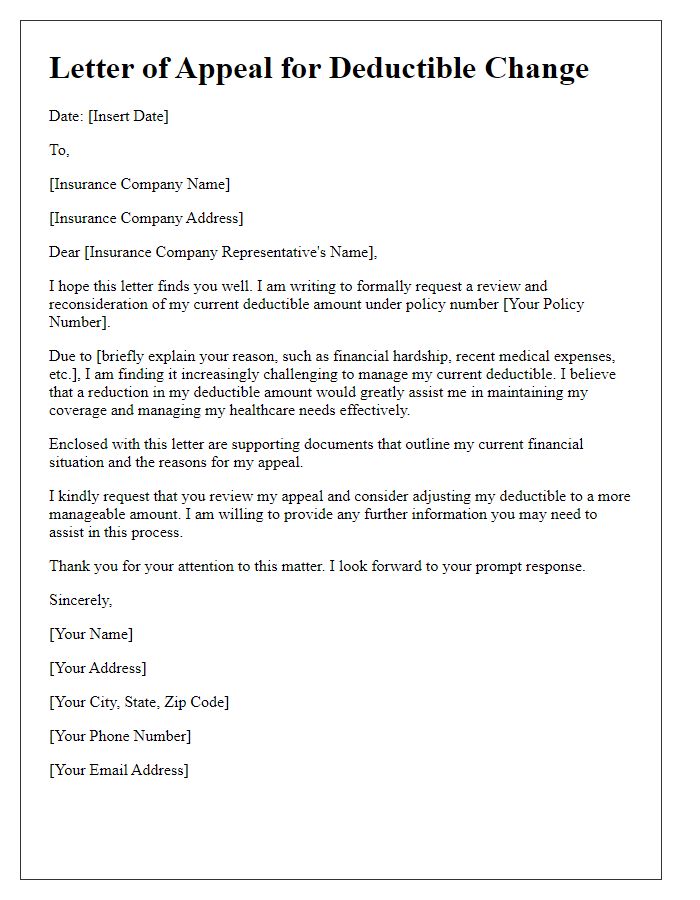

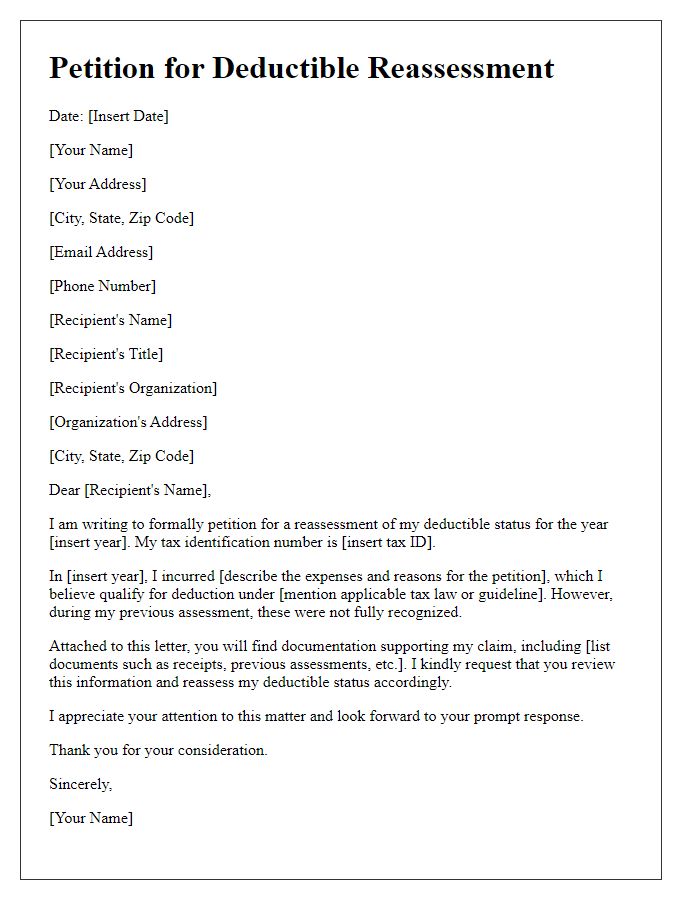

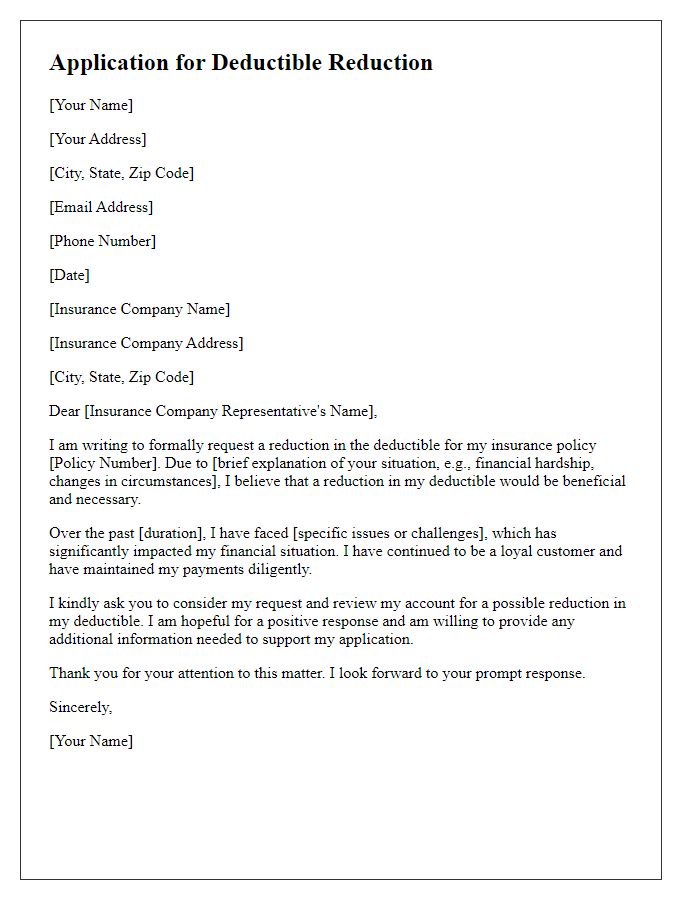

Justification for Adjustment

Insurance deductible adjustments frequently rely on various factors, including policy terms, claim history, and incident specifics. For example, in a car insurance claim involving a collision in New York City on June 15, 2023, a policyholder may request a deductible reduction due to the circumstances of the accident, involving a hit-and-run driver. Supporting documentation such as police reports, medical bills, and repair estimates strengthens the case for adjustment. Factors like a clean driving record, premium payments over the past five years, and prior claims history exhibit responsible policyholder behavior, reinforcing the argument for a reasonable adjustment to the deductible amount.

Supporting Documentation

When requesting an adjustment for an insurance deductible, appropriate supporting documentation is essential to strengthen the case. This may include medical bills from healthcare providers, itemized statements reflecting the total expenses incurred, and any correspondence with the insurance company highlighting previous deductible amounts. Photographs of property damage, repair estimates from licensed contractors, and police reports or incident documentation can also serve as crucial evidence. Clear organization of these documents ensures a coherent presentation of facts. Additionally, including a cover letter detailing the request and summarizing the attached documents allows for a more accessible review process. Properly formatted and legible documents facilitate prompt attention to the deductible adjustment request.

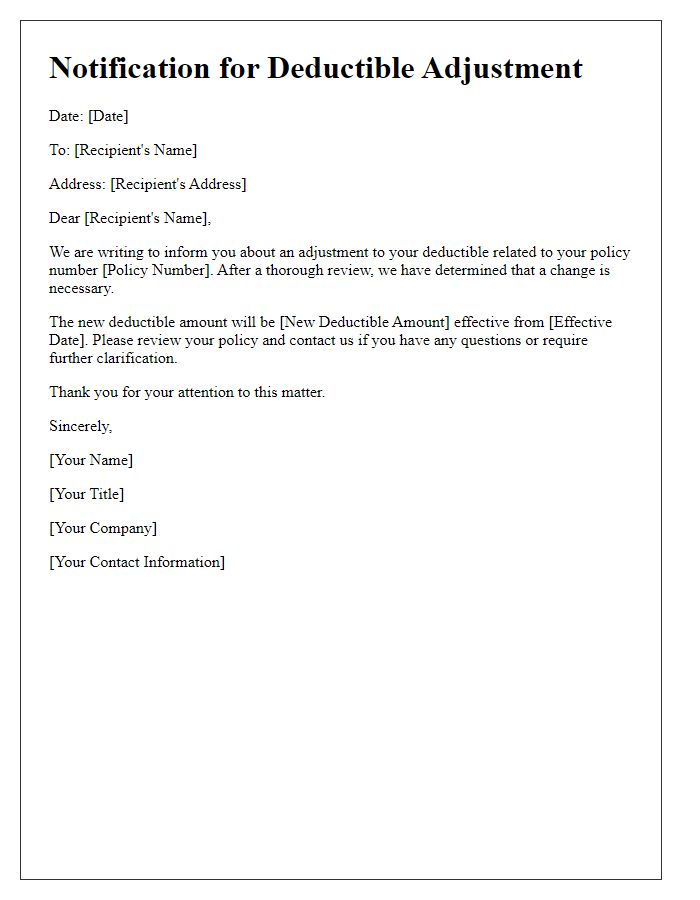

Contact Information for Follow-up

Contact information for follow-up regarding insurance deductible adjustments typically includes key details such as names, phone numbers, email addresses, and optional mailing addresses for further communication. Effective contact information ensures clear and direct access to claims representatives or insurance adjusters, which can expedite responses and clarify any outstanding questions regarding deductibles. Providing specific details such as claim numbers or policy numbers aids in quick reference and improves the efficiency of the adjustment process. It is crucial that the contact information remains up-to-date to maintain effective communication throughout the claims adjustment period.

Comments