Are you feeling a little uncertain about your life insurance policy? It's completely normal to want a fresh look at your coverage, especially as life changes or goals evolve. A policy review can provide clarity on whether your current plan still meets your needs or if it's time to make adjustments. Let's dive in and explore how a comprehensive policy review can benefit youâread more to find out!

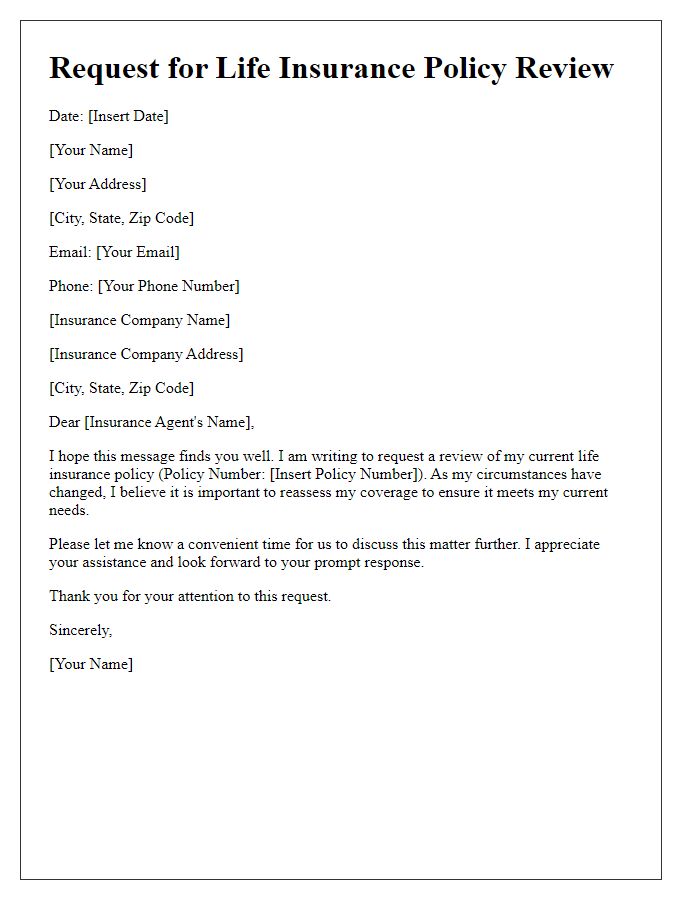

Policyholder Information

A life insurance policy review involves evaluating the terms and conditions of an active insurance contract, typically held by individuals aged 25 to 65. The purpose of a review is to ensure policyholders have adequate coverage, aligning with their current financial status, family size, and future goals. Important factors include the policyholder's age, health history, occupation, and lifestyle choices that may influence risk assessment. It is vital to note policy details, including coverage amounts, premium costs, and beneficiaries. A thorough review often highlights any necessary adjustments, ensuring the policy remains effective and relevant over time. Regular reviews can help policyholders avoid coverage gaps or excessive premiums, ultimately providing peace of mind regarding their financial security.

Policy Details

Life insurance policies typically include critical elements such as premiums, coverage amounts, beneficiaries, and terms regarding payouts. Premiums, often paid monthly or yearly, can vary based on age and health status, impacting overall affordability. Coverage amounts, generally referred to as face value, define the sum payable upon the policyholder's death, serving as a financial safety net for beneficiaries designated in the policy. Beneficiaries, often family members, receive the policy's benefits, providing financial support following a policyholder's passing. Additionally, terms concerning payouts, including exclusions and riders, can influence how benefits are distributed, necessitating a thorough review to ensure the policy aligns with current life circumstances and financial goals.

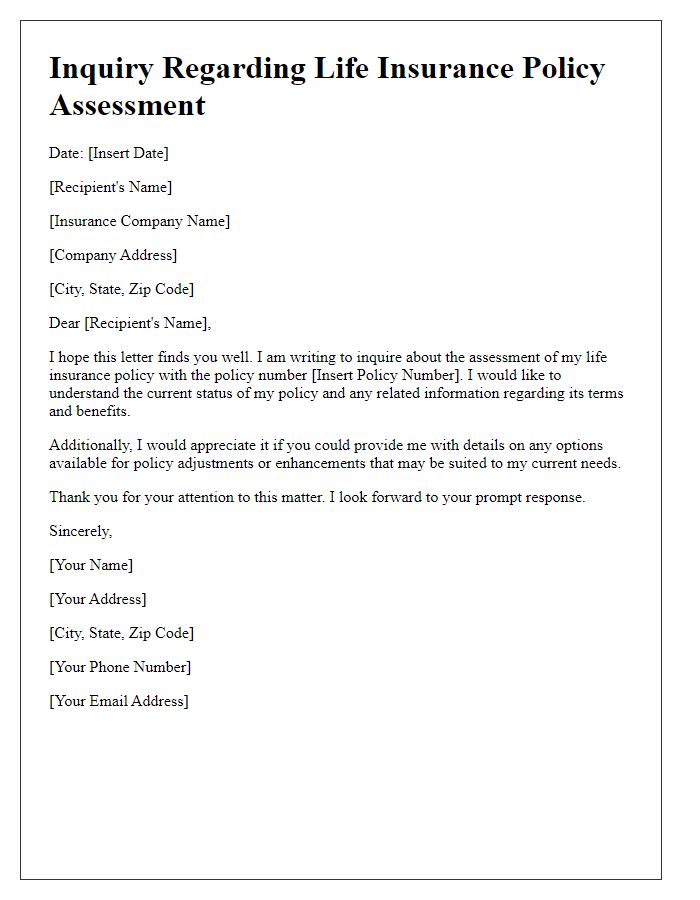

Coverage Review

A comprehensive life insurance policy review ensures adequate coverage for unforeseen circumstances, which is essential for protecting loved ones financially. Policies such as term life insurance provide temporary coverage, while whole life insurance offers permanent benefits. The review should assess the current coverage amount, typically ranging from $50,000 to several million dollars, depending on individual circumstances. Factors include the insured's age, health status, and financial obligations, like mortgage payments or children's education expenses. It is advisable to consider recent life events, such as marriage or the birth of a child, which might necessitate increased coverage. Additionally, evaluating the insurer's claims settlement ratio, preferably over 90%, guarantees reliability in processing future claims efficiently. Regular policy check-ups every one to three years can help adjust coverage to align with changing life situations.

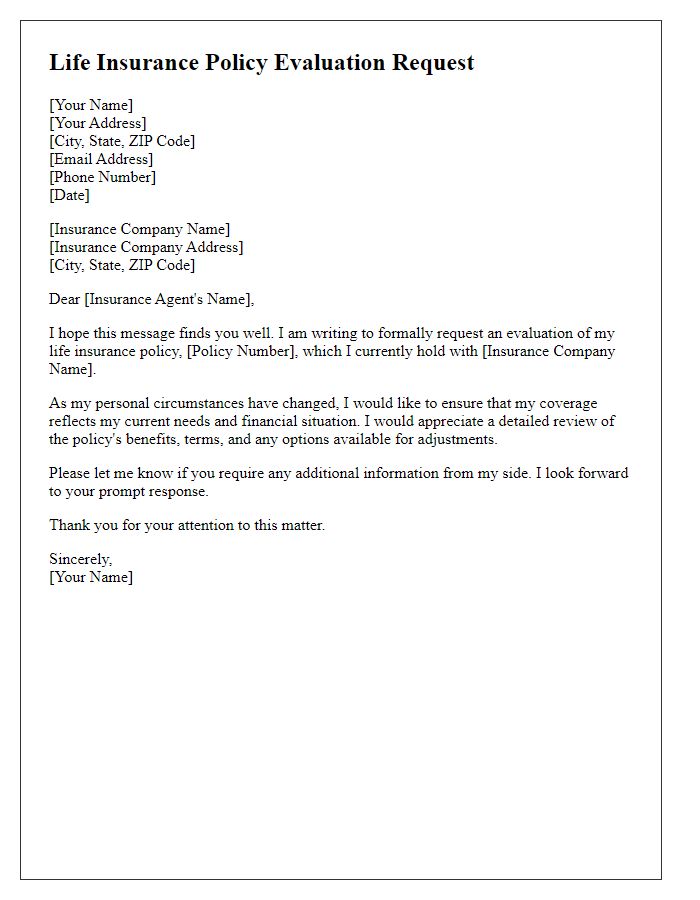

Beneficiary Update

A life insurance policy review highlighting beneficiary updates is essential for ensuring that the intended recipients receive benefits upon an individual's passing. Policyholders, often in their 30s to 50s, should regularly reassess their beneficiary designations, particularly after significant life events such as marriage, divorce, or the birth of a child. For instance, in a term life insurance policy from companies like Nationwide or State Farm, provisions exist to alter beneficiaries easily. Notably, a contingent beneficiary can be named to receive benefits if the primary beneficiary is deceased. Additionally, ensuring proper documentation is crucial, as it helps avoid probate complications, potentially saving time and costs in situations like unexpected deaths or disputes. Keeping records updated with life insurance agents is advisable to reflect changes accurately and promptly, ensuring peace of mind for families regarding financial security.

Contact Information

A life insurance policy review is essential for ensuring adequate coverage and alignment with personal circumstances. Policyholders, such as families or individuals with dependents, should examine details like coverage amount, beneficiaries, and premiums. Notably, if the policy was issued over five years ago, it might not reflect current financial responsibilities or life changes, like new family members or increased debts. It's also crucial to assess the insurance provider's reputation, financial stability, and customer service quality. Engaging with a licensed insurance advisor can help navigate these aspects, reviewing policy options like term life or whole life insurance, ensuring policyholders make informed decisions about their financial futures.

Comments