Are you looking to navigate the often complex waters of marine insurance coverage? Securing the right insurance is essential for protecting your valuable assets at sea, but understanding the nuances can be tricky. In this article, we'll explore the key elements of marine insurance coverage verification and how it safeguards your interests. So, grab a cup of coffee and join us as we dive into what you need to know!

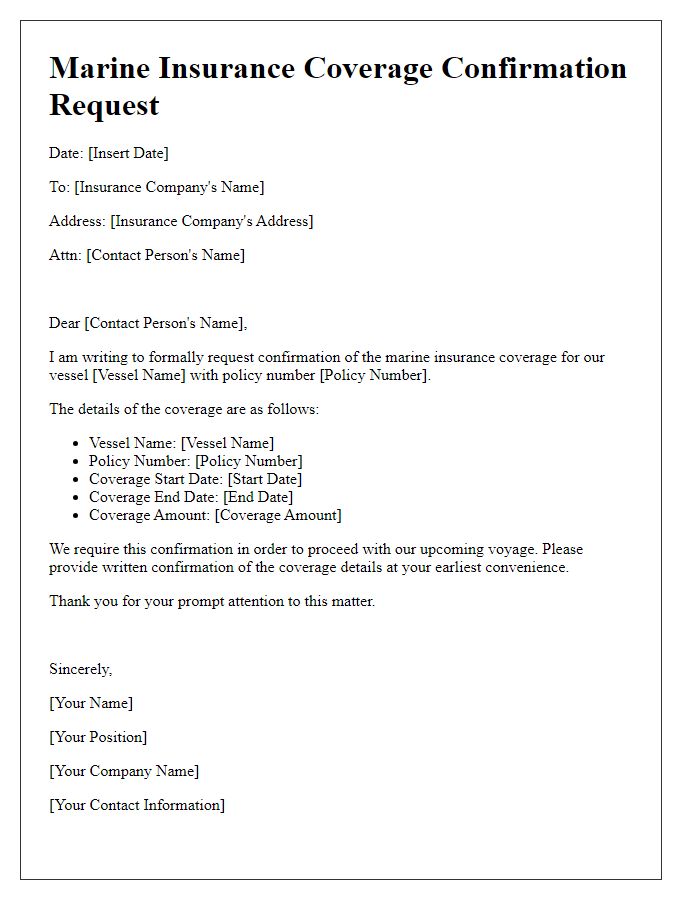

Policy Details and Insured Information

Marine insurance coverage verification requires precise documentation of policy details and insured information. Specific policy numbers (unique identifiers for coverage agreements), effective dates (the start and end dates for the insurance period), and the insured's name (the entity or individual covered under the policy) are critical to establish protection parameters. Vessel details (such as the name and type of the watercraft, registration number, and port of registry) provide clarity on what is covered under the marine policy. Additional elements like cargo description (including type, value, and quantity) and geographical coverage (specifying regions or routes included in the insurance) are essential for thorough underwriting assessment. Regular verification ensures compliance with maritime regulations and risk management protocols.

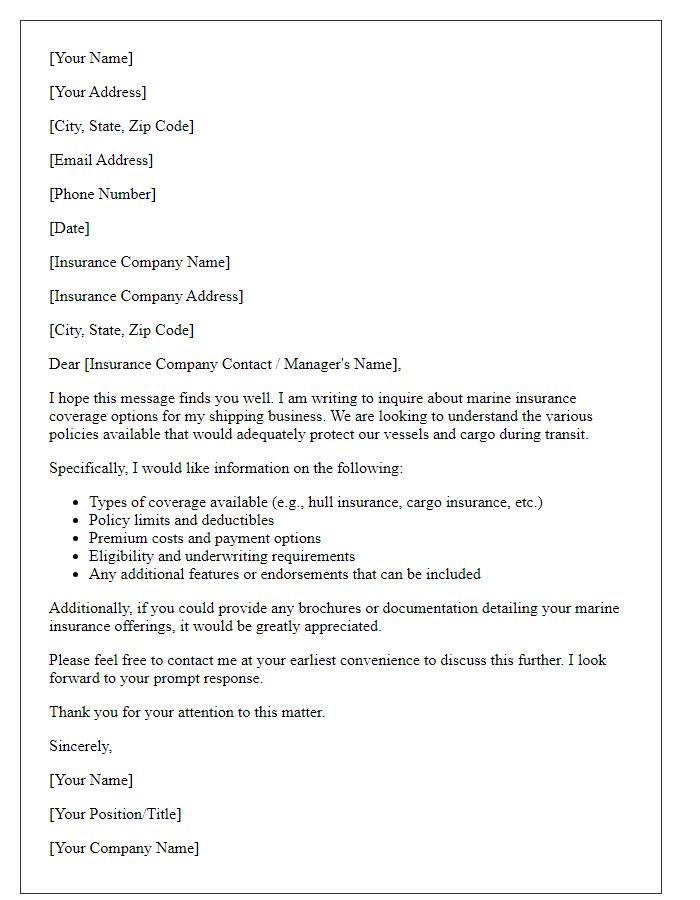

Coverage Types and Limits

Marine insurance coverage verification involves assessing specific policies to ensure adequate protection for vessels and cargo against marine-related risks. Common coverage types include Hull Insurance, which protects against physical damage to the vessel, and Cargo Insurance, safeguarding goods in transit over waterways. Liability coverage is crucial for protecting against legal claims arising from accidents or environmental damage during maritime operations. Specific limits may vary greatly; for example, Hull Insurance can have limits ranging from millions of dollars for commercial vessels to lower amounts for recreational boats. Additionally, protection against loss of hire due to accidents could range significantly. Understanding the exact terms, exclusions, and limits of each policy type is essential for ensuring comprehensive marine coverage.

Deductibles and Exclusions

Marine insurance coverage verification involves understanding key details surrounding deductibles and exclusions. Deductibles, typically expressed as a percentage of the insured value or a fixed amount, outline the portion of a claim that the policyholder must pay before the insurer handles the remaining balance, affecting overall claim management. Common exclusions in marine insurance policies can include specific types of damage such as wear and tear, equipment breakdown, or losses resulting from inherent vice, which refers to the natural characteristics of goods that may lead to deterioration. Understanding the exact terms within marine insurance policies, which are often guided by industry standards such as the Institute Cargo Clauses (A, B, or C), is crucial for shipowners and cargo shippers to mitigate risks effectively while navigating international waters.

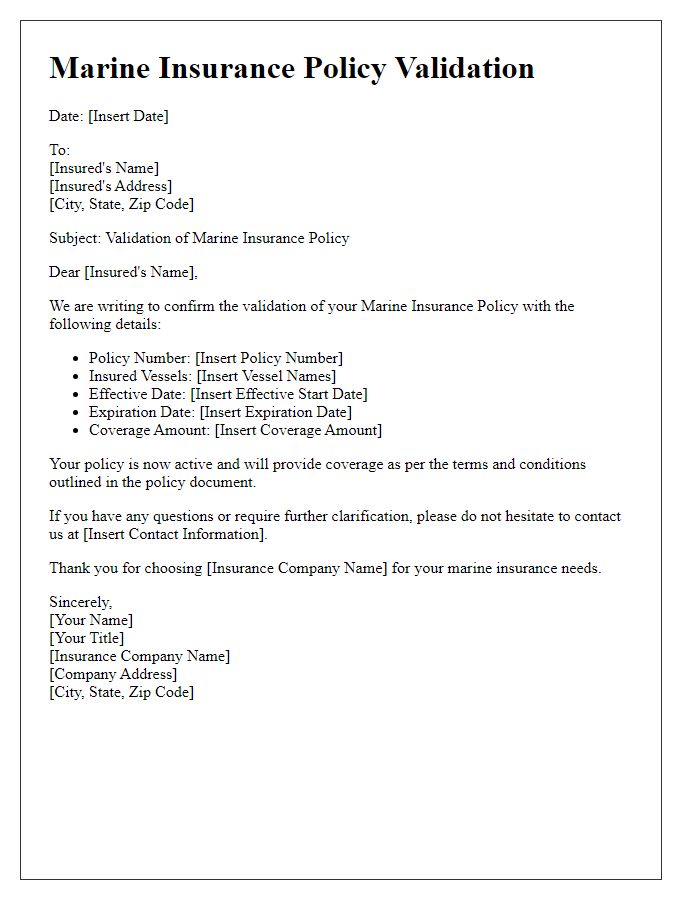

Policy Endorsements and Amendments

Marine insurance coverage verification involves reviewing policy endorsements and amendments that modify the terms of coverage for ships, cargo, and liabilities during transit. Key elements include specific endorsements like Institute Cargo Clauses (A, B, C), detailing the extent of coverage against perils such as fire, theft, and sinking. Amendments may address changes in the insured value, such as adjustments reflecting current market prices or added geographical limits for international voyages. The document also references relevant maritime laws, like the Hague-Visby Rules, governing the rights and responsibilities of cargo carriers. Accurate verification ensures that marine policies provide adequate protection and align with shipping needs and risk exposure, safeguarding assets worth millions during sea transport across global trade routes.

Contact Details for Claims Processing

Marine insurance coverage verification requires precise contact details for claims processing to ensure efficient handling of incidents at sea. It involves important entities such as the insurer (like Lloyd's of London), the insured party (ship owners or cargo interests), and relevant intermediaries (insurance brokers) for effective communication. Accurate reporting of claims (often categorized by type such as hull damage or cargo loss) can impact coverage validity. Providing direct contact information (phone numbers, email addresses, and claim reference numbers) allows for timely assessment of the coverage terms outlined in the marine policy. This process often occurs within specified timelines set by the insurer, emphasizing the necessity for clear and organized communication channels among all parties involved.

Comments