Are you feeling frustrated with a recent insurance approval denial? You're not alone; navigating the insurance maze can be challenging and overwhelming for many. In this article, we'll walk you through a simple and effective letter template that can help you request a reconsideration for your insurance approval. Join us as we explore the best strategies to make your case appealing and improve your chances of success!

Policy Details

Submitting a reconsideration request for insurance approval necessitates the clear presentation of relevant policy details integral to the case. Policy Number, such as 123-456-789, represents the unique identifier for the coverage agreement. The Insured's Name, traditionally the primary policyholder, establishes ownership and responsibility for the terms outlined in the document. Coverage Type, like "Comprehensive Health Insurance," defines the extent of protection against medical expenses. Claim Number, for instance, CL-987654321, is critical for tracking specific incidents associated with the policy. Furthermore, providing the Date of Incident, such as January 15, 2023, enables the insurance provider to reference when the event occurred, potentially impacting coverage considerations. Each of these details supports a robust case for reconsideration, ensuring thorough evaluation by the insurance authority.

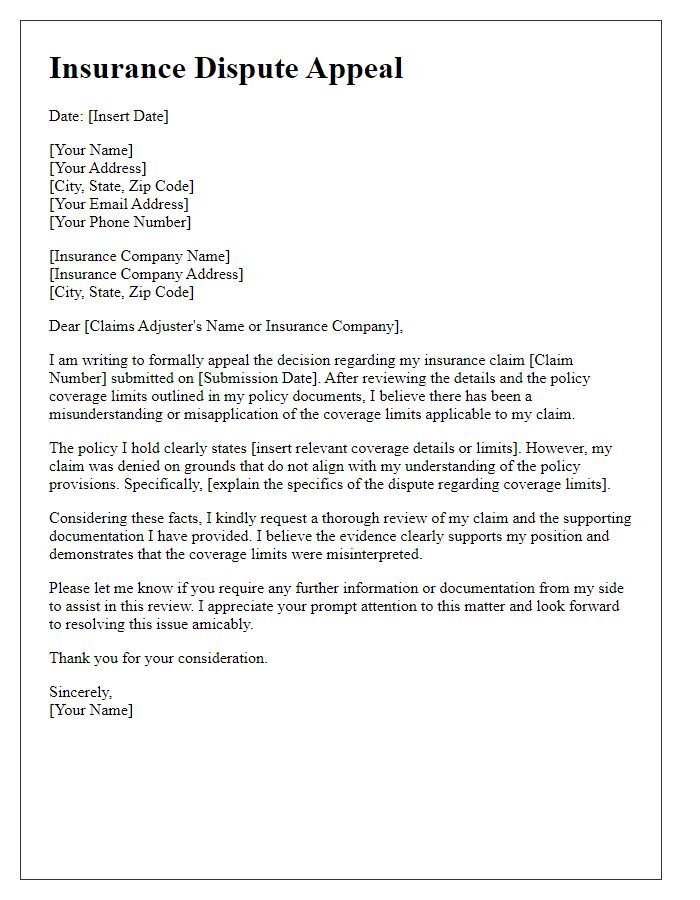

Reason for Reconsideration

Insurance policyholders often seek reconsideration for denied claims due to various reasons such as insufficient documentation or misinterpretation of policy terms. When an insurance claim is rejected, the primary reason often revolves around inadequate evidence supporting the claim's legitimacy, which may include medical records or repair estimates. Alternatively, the denial could stem from a misunderstanding regarding the coverage definitions specified in the policy document. Policyholders may also find discrepancies in the way their claims have been evaluated compared to similar claims processed by the insurance company. Providing additional information, clarifying misunderstandings, and referencing relevant policy clauses can significantly bolster the argument for approval upon reconsideration.

Supporting Documentation

When seeking reconsideration for insurance approval, providing supporting documentation is crucial for presenting a compelling case. Key documentation includes medical records (detailed notes from healthcare providers like physicians and specialists) that validate the necessity of the requested treatment or service. Additionally, detailed bills (itemized statements showing costs incurred) and previous claim denials (formal letters outlining reasons for denial) strengthen the argument. Incorporating personal statements (narratives explaining the impact of the denied service on daily life) offers insight into the necessity for coverage. Finally, relevant policy documents (insurance contracts outlining covered services) guide discussions on entitlements and obligations. These elements collectively create a robust submission aimed at persuading the insurance company to review the case favorably.

Clear ART Claim Justification

An insurance approval reconsideration request requires a clear justification for the ART (Assisted Reproductive Technology) claim. Detailed documentation regarding medical necessity is crucial, particularly diagnoses such as infertility (defined as failure to conceive after 12 months of unprotected intercourse) that may include conditions like Polycystic Ovary Syndrome (PCOS) affecting hormone levels. Relevant treatment history detailing previous attempts, including medications like Clomid and procedures such as Intrauterine Insemination (IUI), should be presented. Statistical success rates for ART, approximately 40% for women under 35 based on data from the Centers for Disease Control and Prevention (CDC), substantiate the case for treatment. Additionally, referencing insurance policy specifics, including covered services and maximum allowable costs, reinforces the argument for reconsideration. Proper documentation and an updated medical letter from a fertility specialist can significantly enhance the claim's chances of approval.

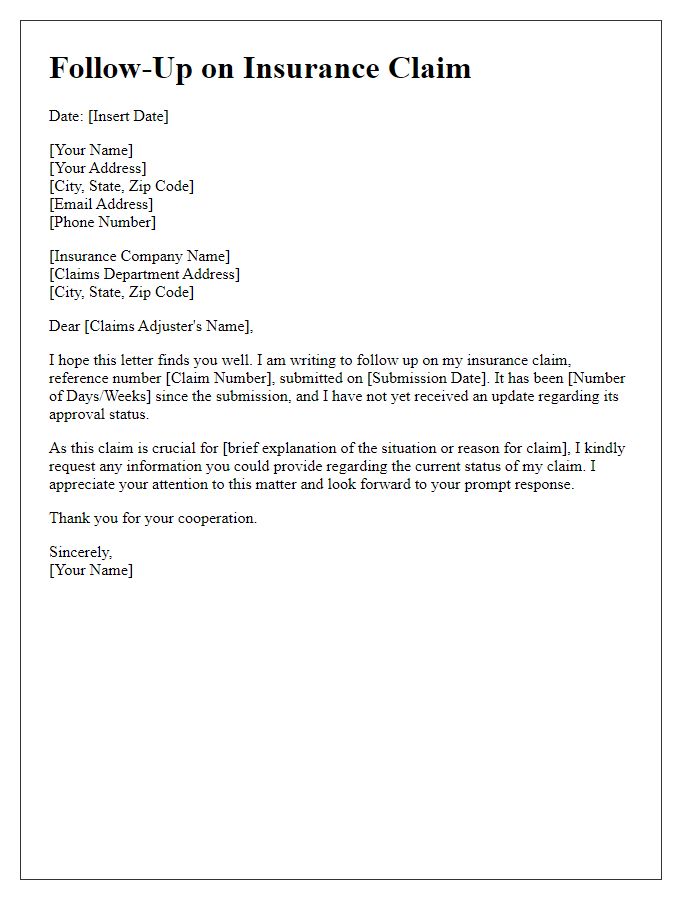

Contact Information

Contacting the insurance company requires accurate information for efficient processing. Policyholders need to provide essential details such as full name, policy number, and claim number in correspondence. Including a current mailing address ensures that any responses or notifications reach the intended recipient without delay. Additionally, a direct phone number allows for quick communication, enabling representatives to address any concerns swiftly. Email addresses can facilitate faster exchanges, ensuring any documents or clarifications required by the insurer can be shared promptly. It is vital to include these key pieces of information for a smooth reconsideration process.

Letter Template For Insurance Approval Reconsideration Samples

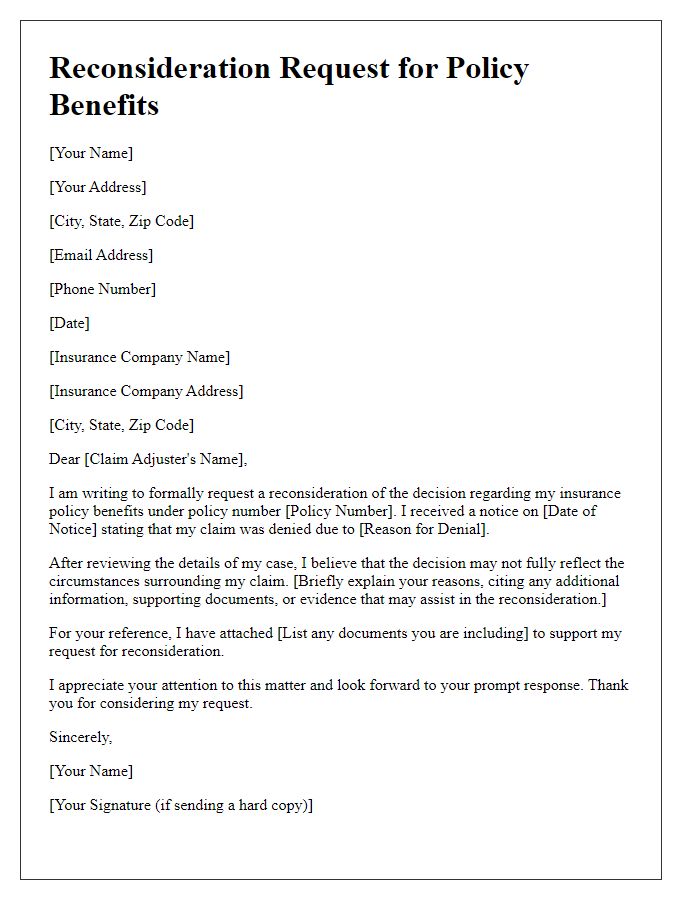

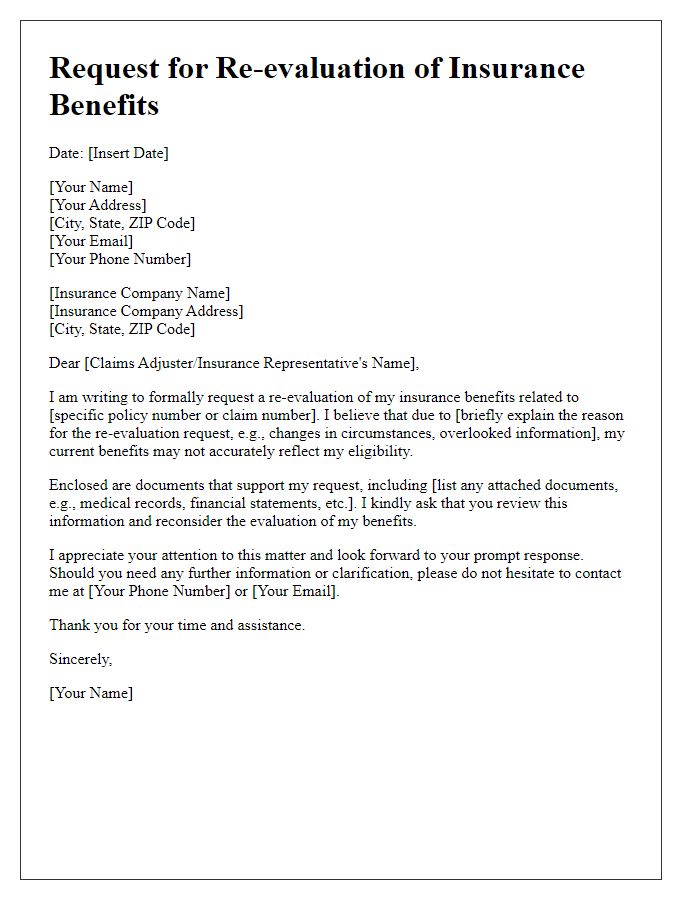

Letter template of insurance reconsideration request for policy benefits

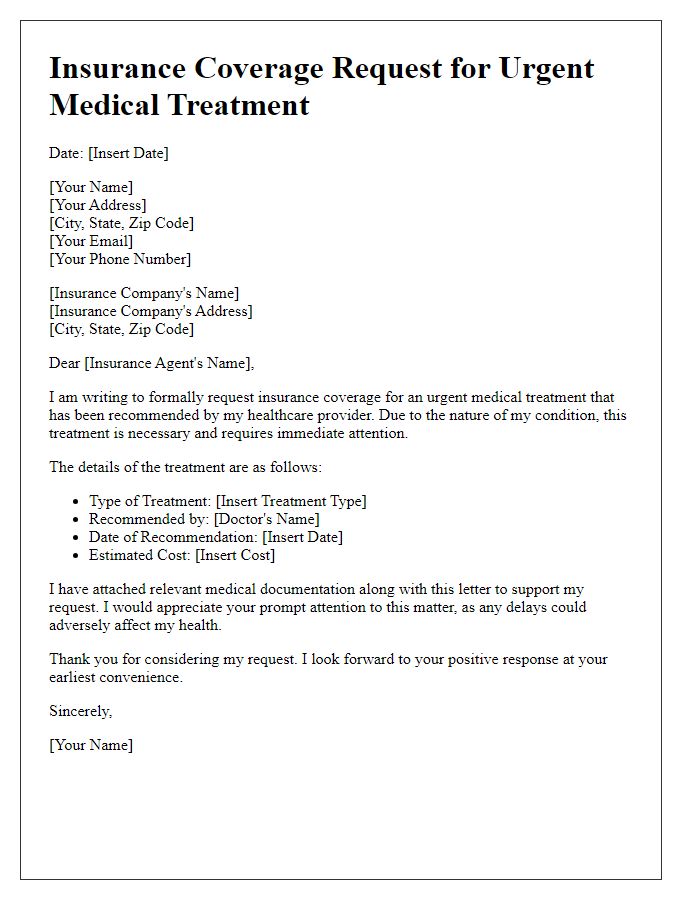

Letter template of insurance coverage request for urgent medical treatment

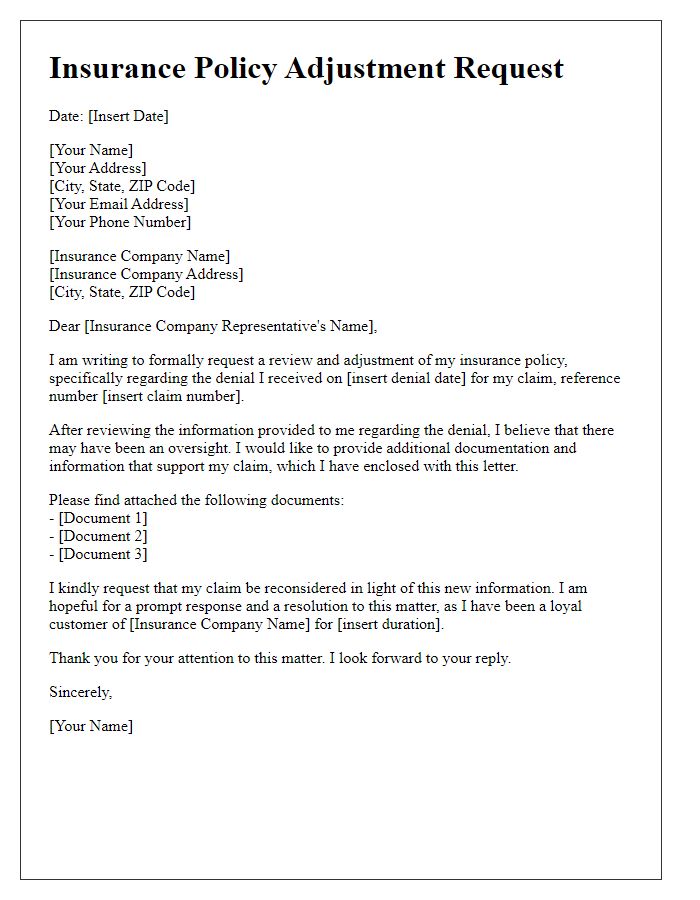

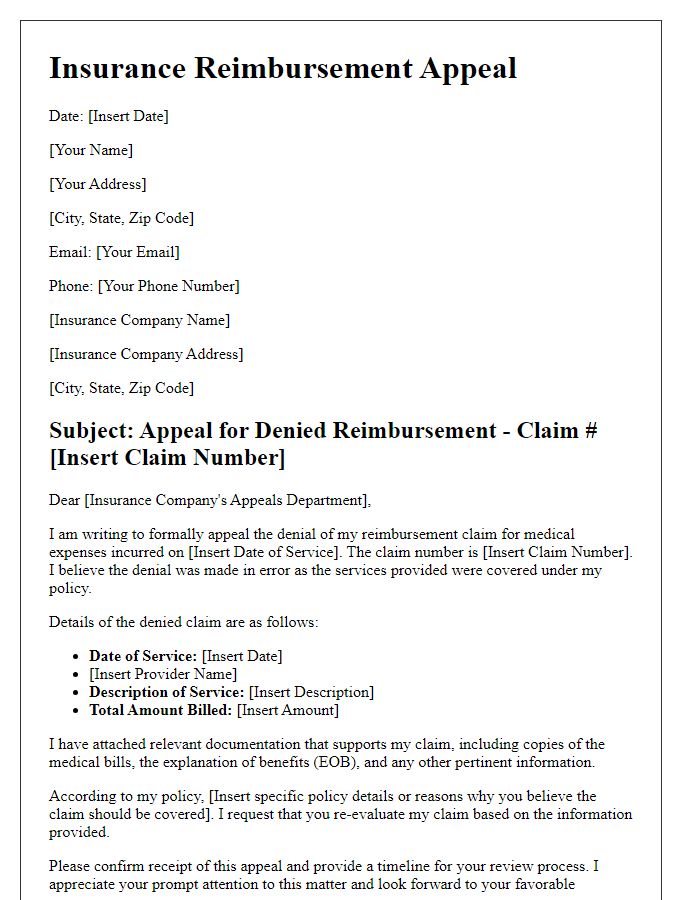

Letter template of insurance policy adjustment request after initial denial

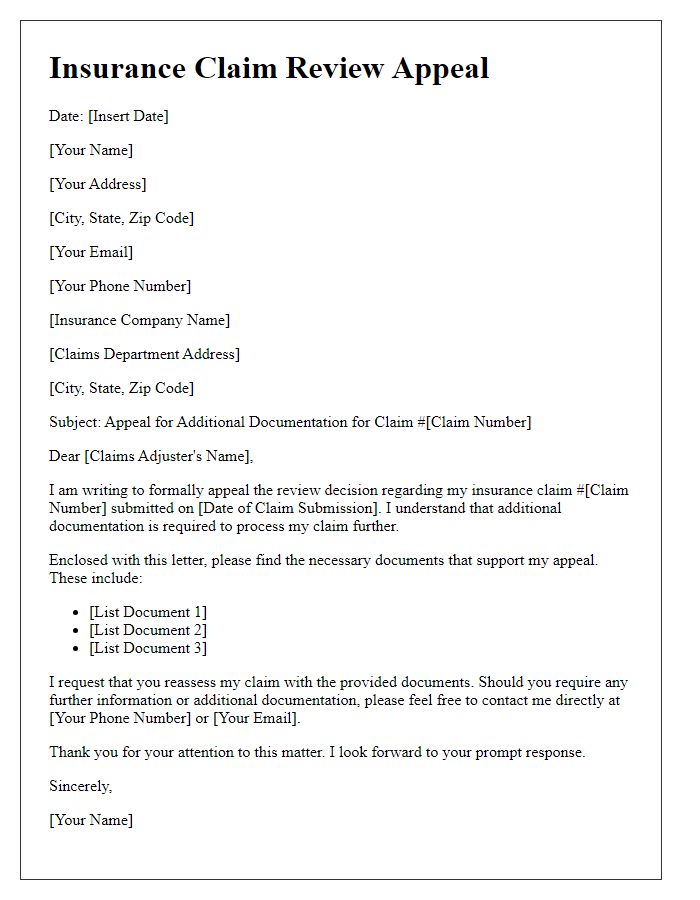

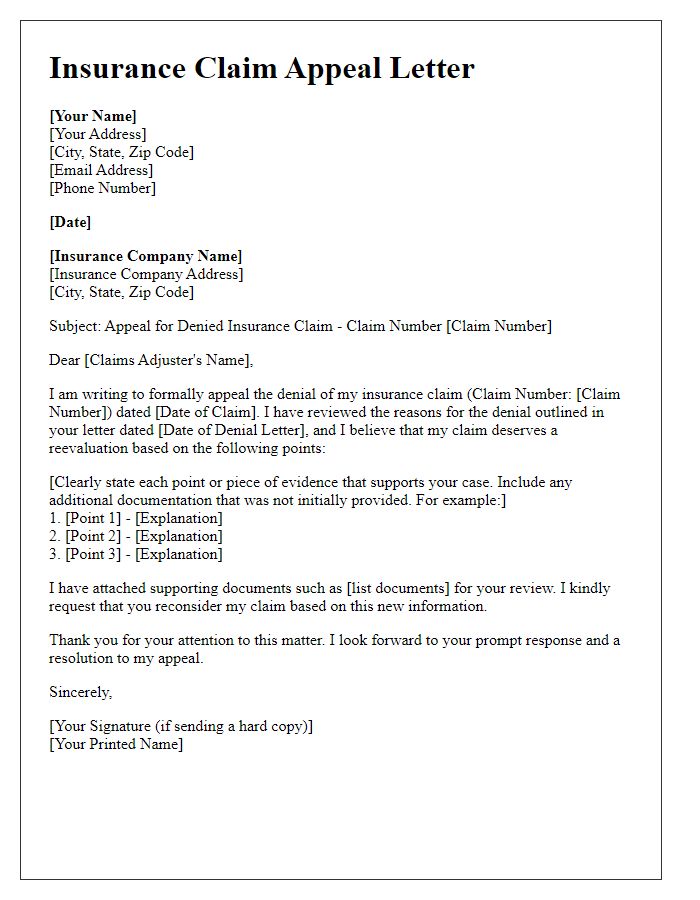

Letter template of insurance claim review appeal for additional documentation

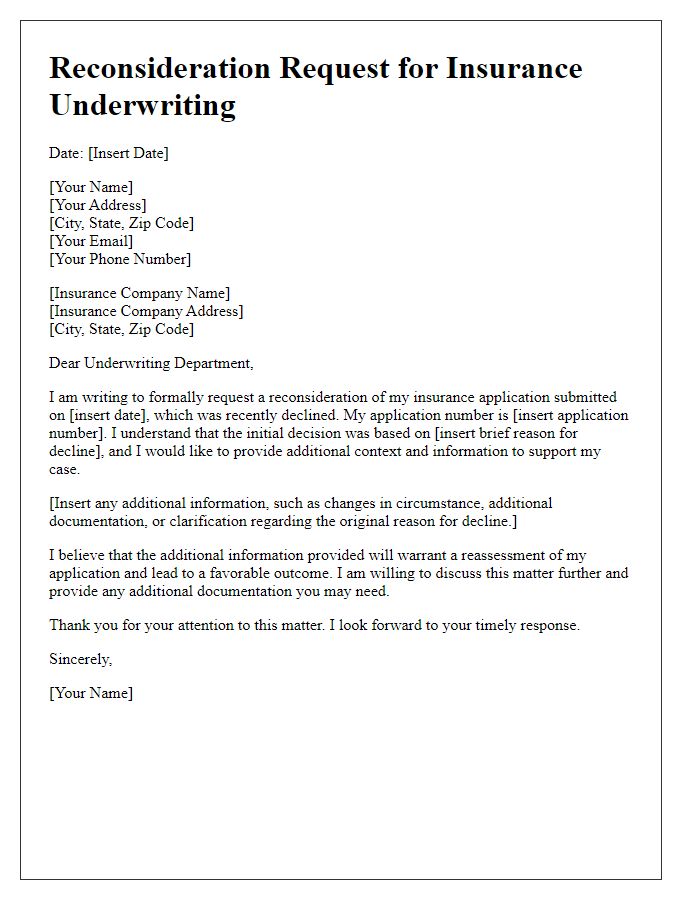

Letter template of insurance underwriting reconsideration after policy decline

Comments