Navigating the complexities of a liability insurance claim can often feel overwhelming, but you don't have to go through it alone. Whether you're dealing with a minor incident or a significant loss, understanding your policy and the claims process is crucial for a smooth resolution. We're here to break down the essential steps and provide you with the guidance needed to successfully file your claim. So, grab a cup of coffee, get comfortable, and let's dive into the important details that can help you get the compensation you deserve.

Clear Identification: Full Name, Policy Number, and Contact Information.

Initiating a liability insurance claim consultation requires precise documentation. Clear identification includes full name of the policyholder to establish ownership of the insurance policy. The policy number acts as a unique identifier for the insurance coverage, ensuring smooth processing of the claim. Contact information such as phone number and email address facilitates prompt communication with the insurance provider. Providing accurate and complete details enhances the efficiency of the claims process and reduces potential delays.

Detailed Incident Description: Date, Location, and Nature of Incident.

On April 15, 2023, at approximately 3:00 PM, an incident occurred at the intersection of Main Street and Oak Avenue in Springfield, Illinois. A pedestrian accident took place when an individual, identified as John Doe, was struck by a vehicle while crossing the street at a marked crosswalk. The driver, a local resident named Jane Smith, reported that she was driving at a speed of 30 miles per hour when the incident occurred. Witnesses indicated that the traffic signal was green for the vehicle, but the pedestrian had entered the crosswalk moments prior to the crash. The police were called to the scene, and a report was filed, documenting the details of the incident and the statements from both parties involved. Emergency services arrived shortly afterwards, transporting the pedestrian to Springfield General Hospital for evaluation of potential injuries sustained during the collision.

Evidence Attachment: Photos, Documents, and Witness Statements.

During a liability insurance claim consultation, the submission of crucial evidence plays a central role in supporting the case. Photographic evidence captures the incident scene, offering visual documentation of property damage or bodily injury. Important documents such as police reports, medical records, and repair estimates provide factual timelines and costs incurred due to the incident. Witness statements from bystanders or involved parties serve as testimonies to corroborate claims, adding credibility to the narrative. All these elements combined create a comprehensive portfolio that strengthens the position of the claimant in discussions with the insurance adjuster.

Specific Claim Request: Type of Compensation or Coverage Sought.

Within the realm of liability insurance, individuals often seek consultation regarding specific claims that pertain to accidental damages or personal injuries. A common request involves seeking compensation for medical expenses (often exceeding $10,000) incurred due to an incident attributed to negligence. Additionally, the coverage sought may extend to property damages, where the costs associated with repairs (potentially totaling $5,000 or more) for affected belongings are addressed. Furthermore, individuals might pursue compensation for lost wages, often calculated on an hourly rate, as a result of time away from work due to the injury. Understanding the nuances of these claims, including applicable policy limits and exclusions, plays a critical role in effectively navigating the consultation process for successful resolution.

Professional Tone: Polite Language and Formal Structure.

Liability insurance serves as a critical safety net for individuals and businesses against potential legal claims. Such coverage protects against damages or injuries that may occur on one's property or as a result of one's actions, typically encompassing bodily injury and property damage. For example, a slip and fall incident at a retail store can lead to substantial financial losses. Filing a liability insurance claim involves documenting the incident, gathering necessary evidence such as photographs or witness statements, and submitting a formal claim to the insurance company. Timeliness is essential, as many policies have specific deadlines for filing claims, often within a few weeks of the incident. Understanding the terms and conditions of the policy, including coverage limits and exclusions, is crucial for ensuring a successful claim process.

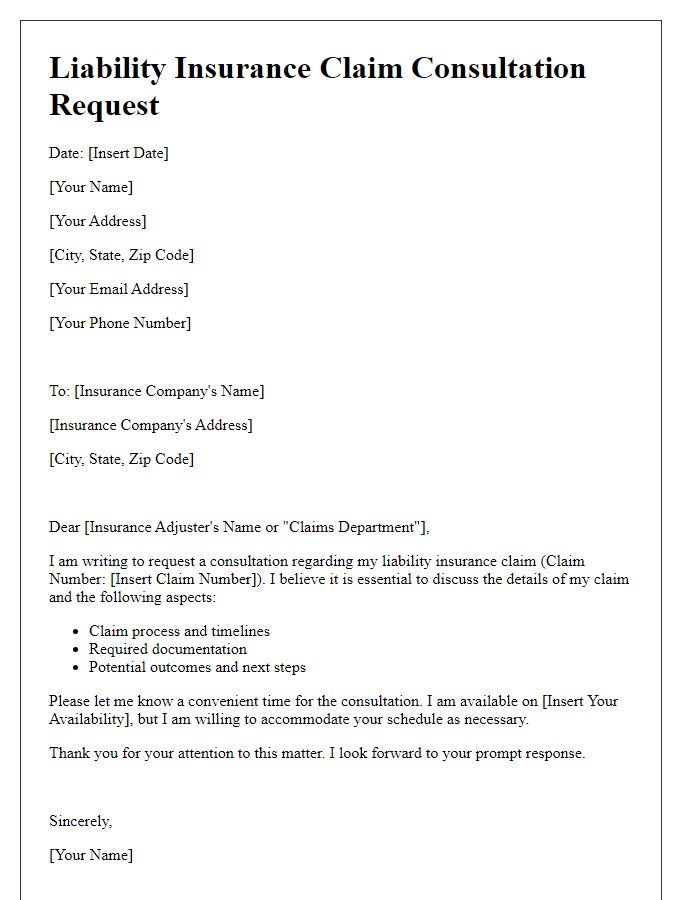

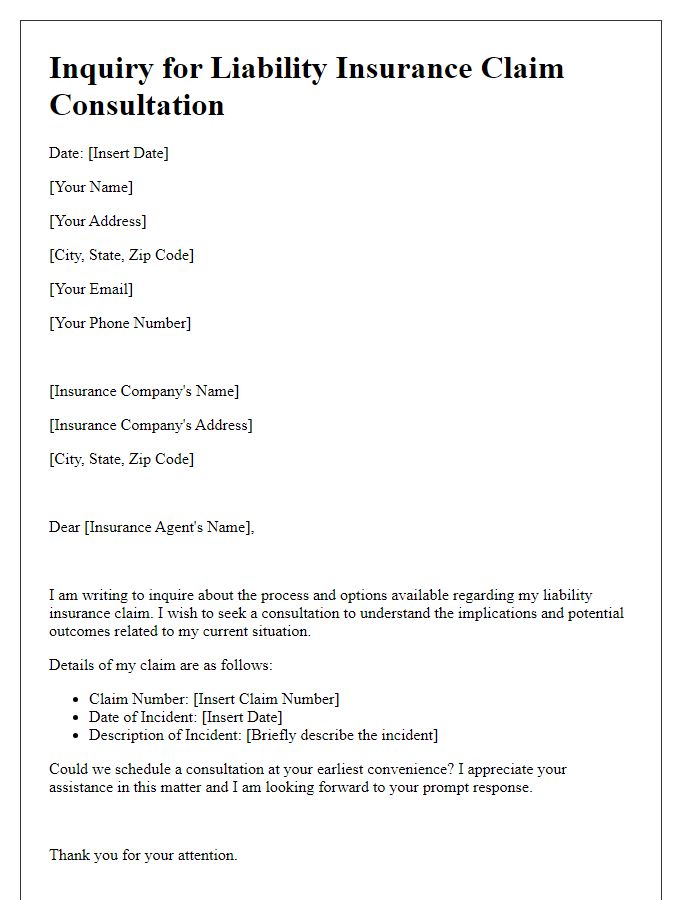

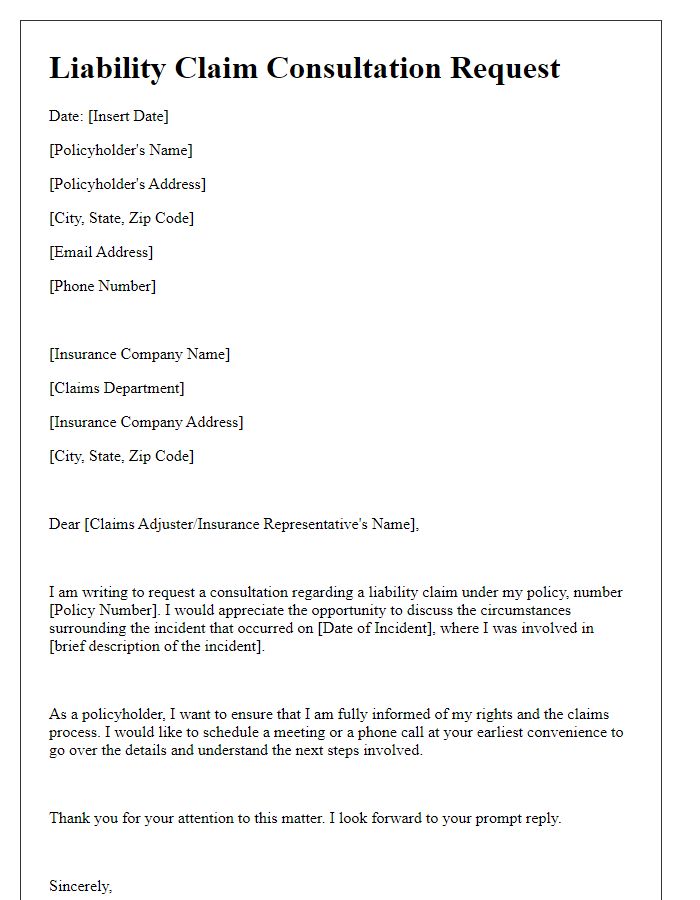

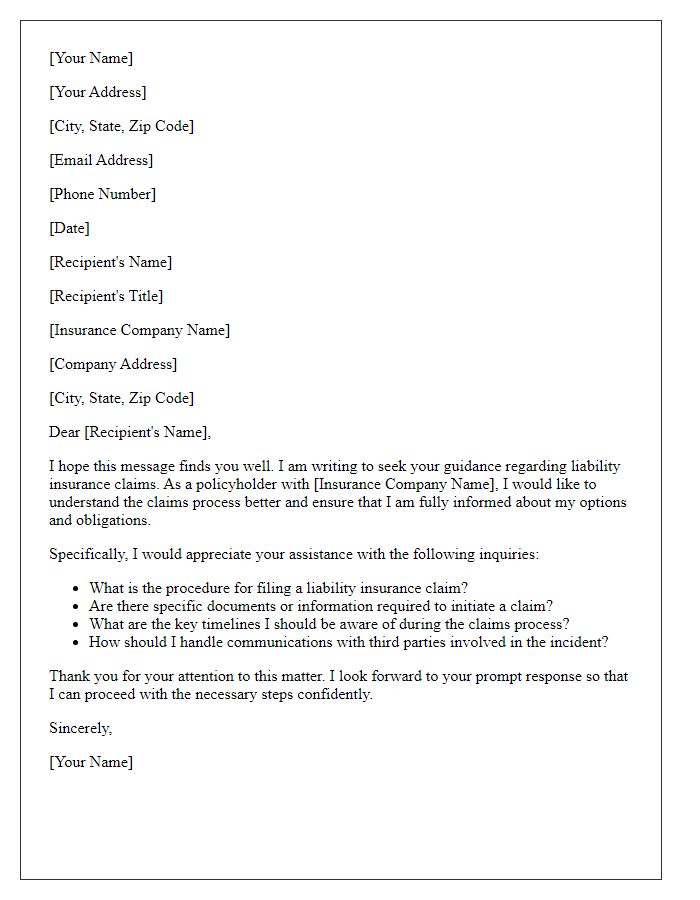

Letter Template For Liability Insurance Claim Consultation Samples

Letter template of consultation for liability insurance claim assistance

Letter template of appointment request for liability insurance claim consultation

Letter template of formal consultation request regarding liability claims

Letter template of asking for expert advice on liability insurance claims

Comments