Are you considering surrendering your life insurance policy but don't know where to start? Understanding the process can feel daunting, but it's simpler than you might think. With the right guidance, you can navigate your options and make informed decisions that suit your financial needs. So, let's dive in and explore how to draft a life insurance surrender request that gets results!

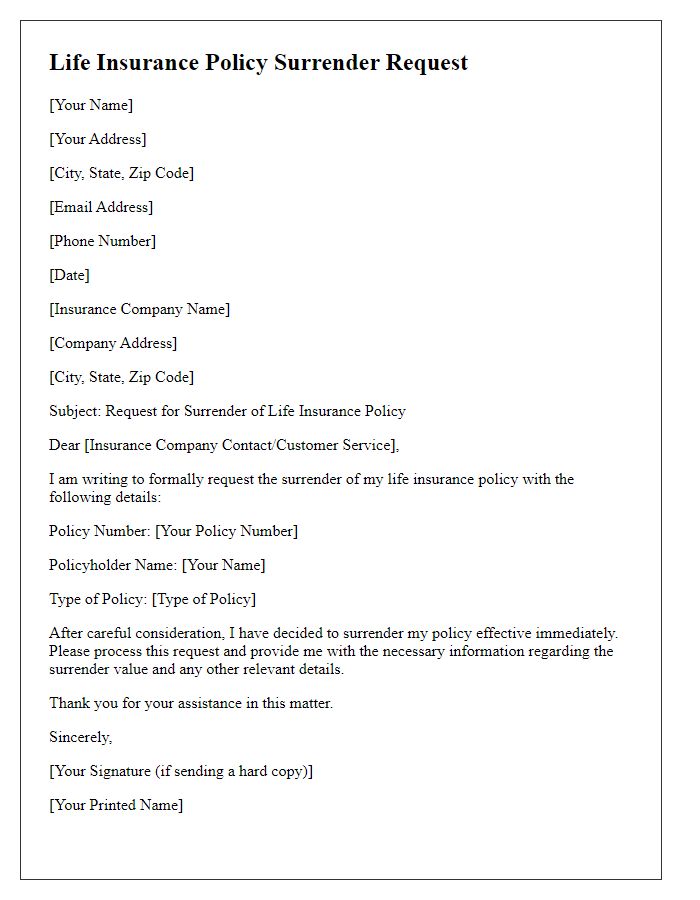

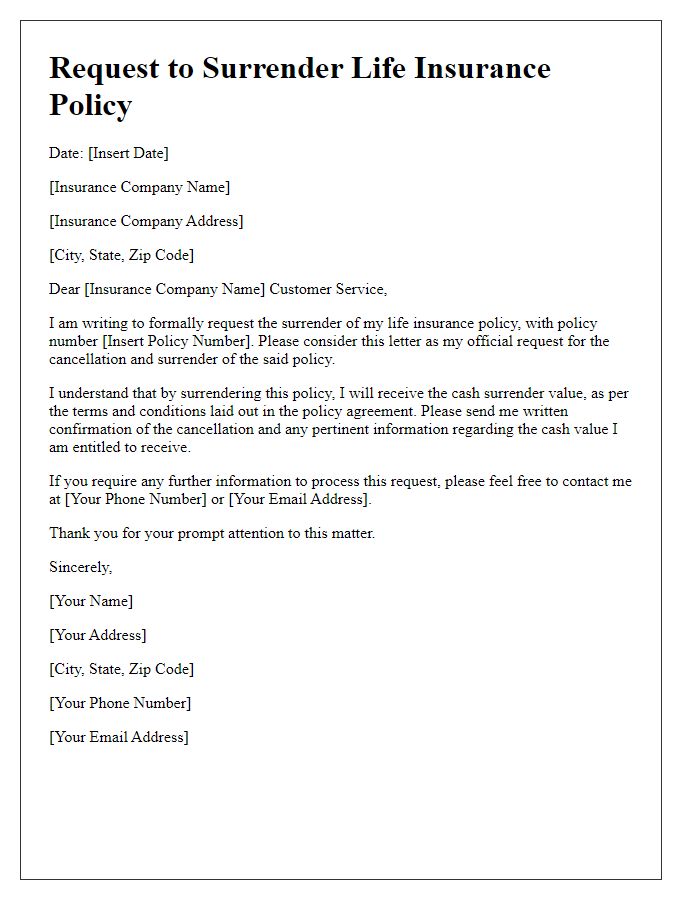

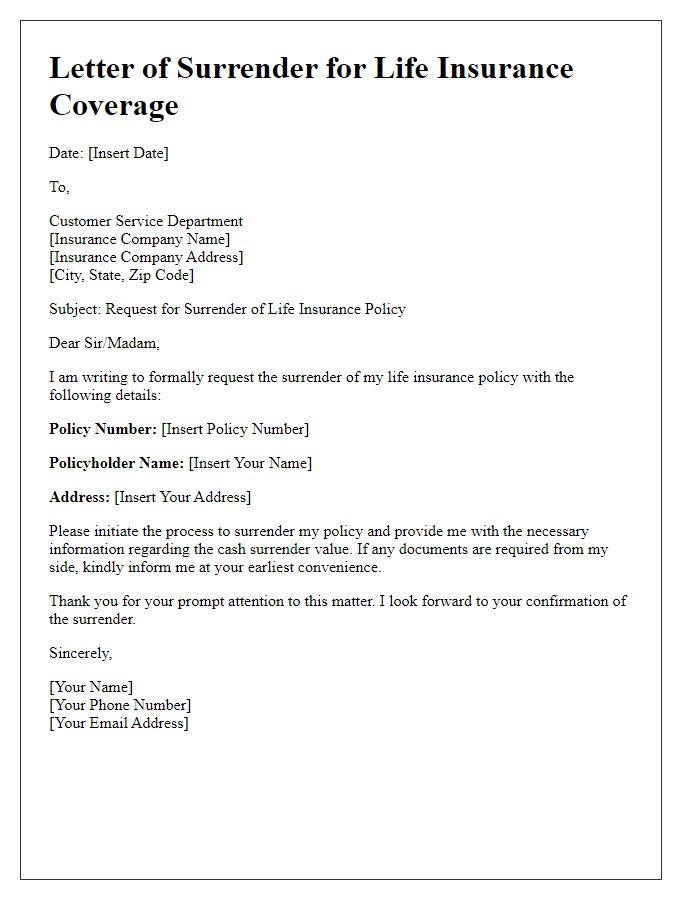

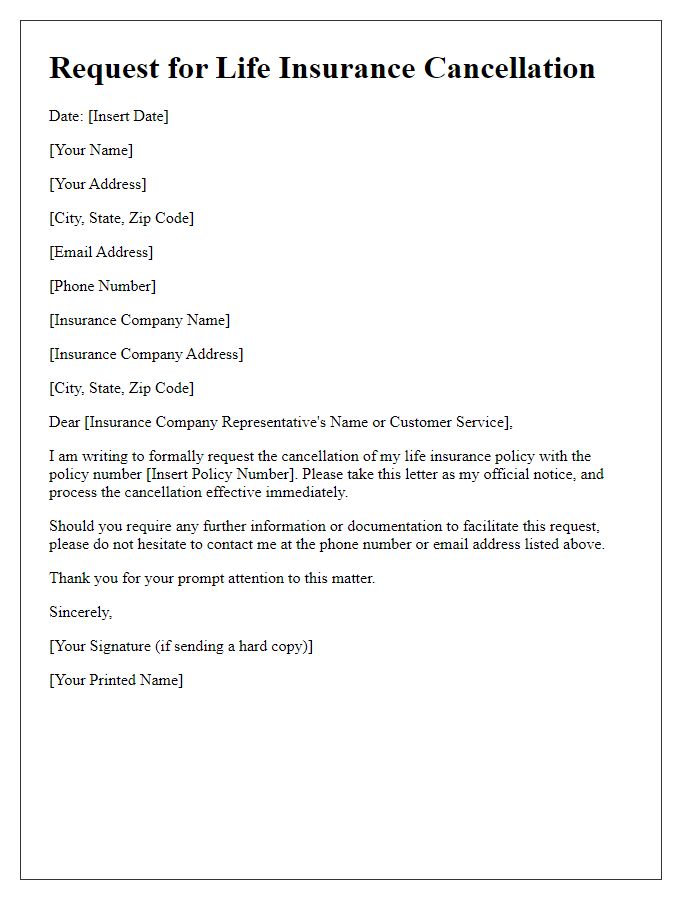

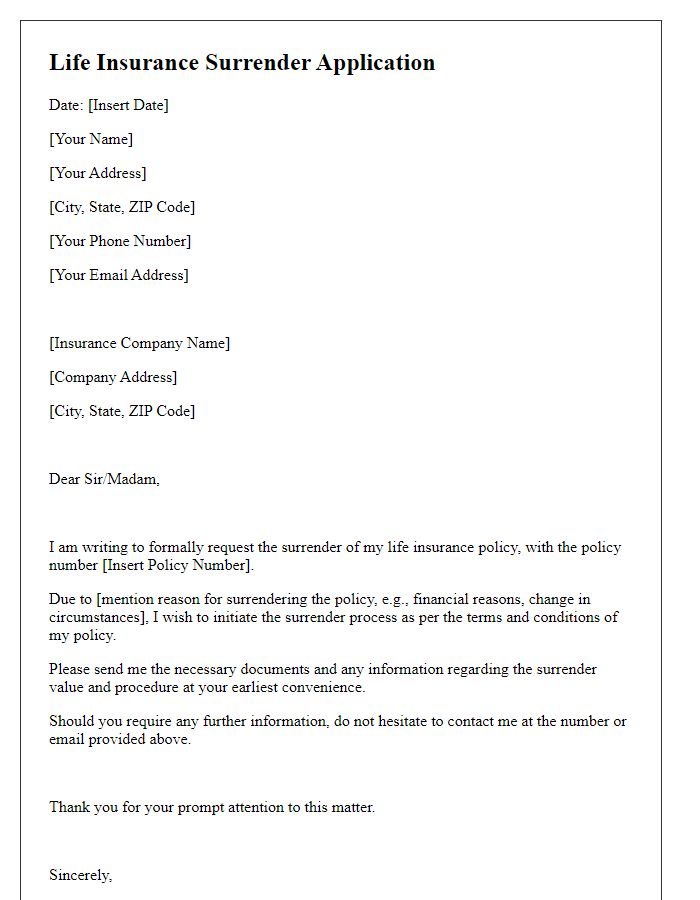

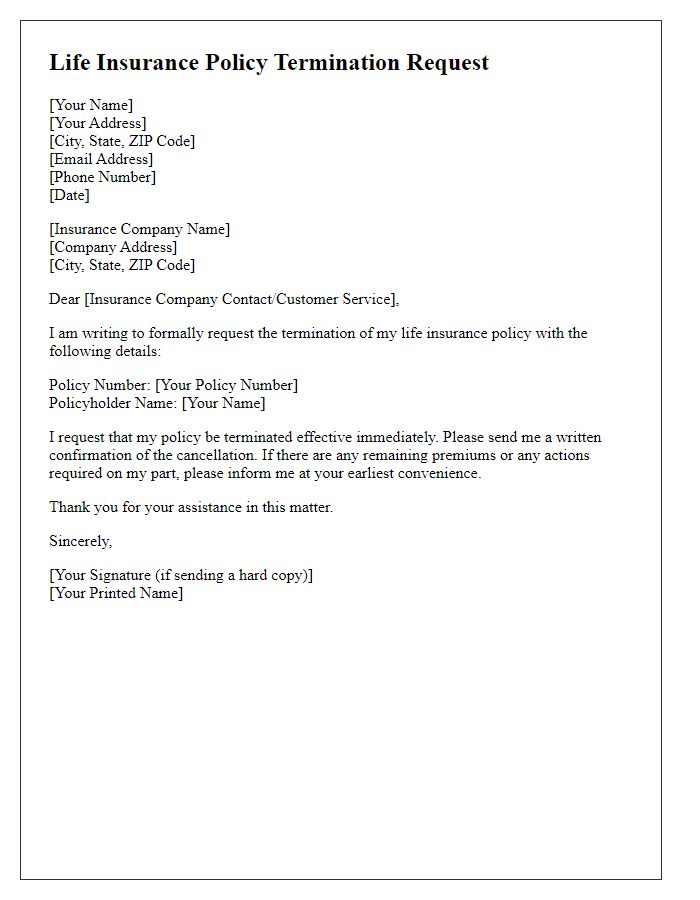

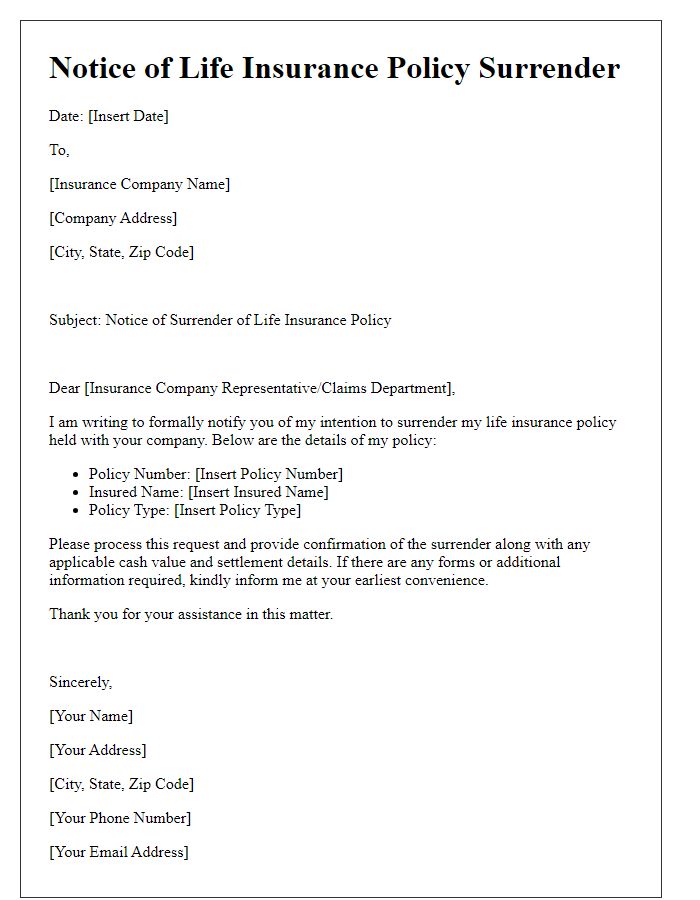

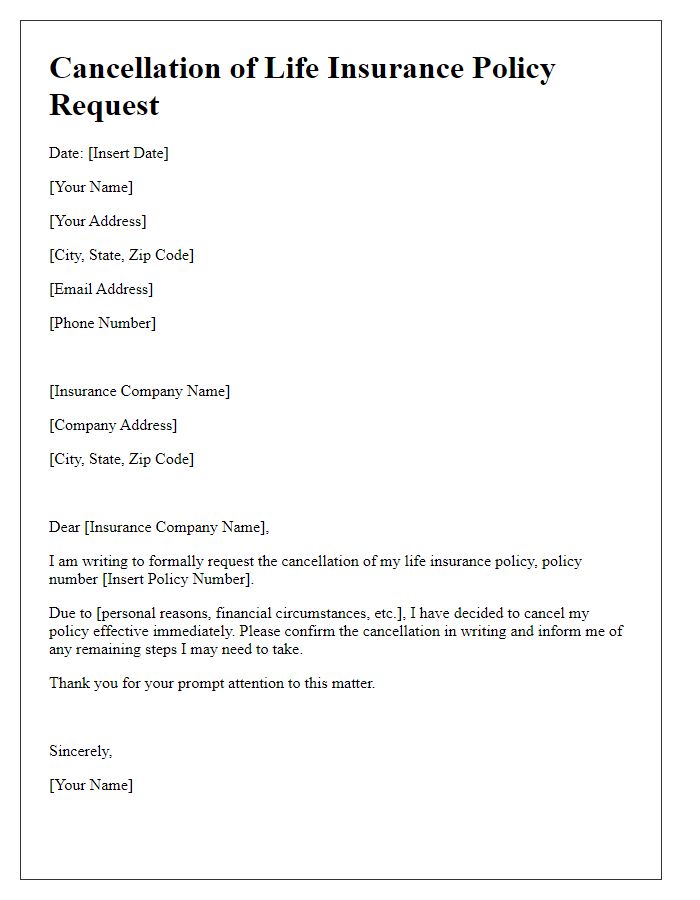

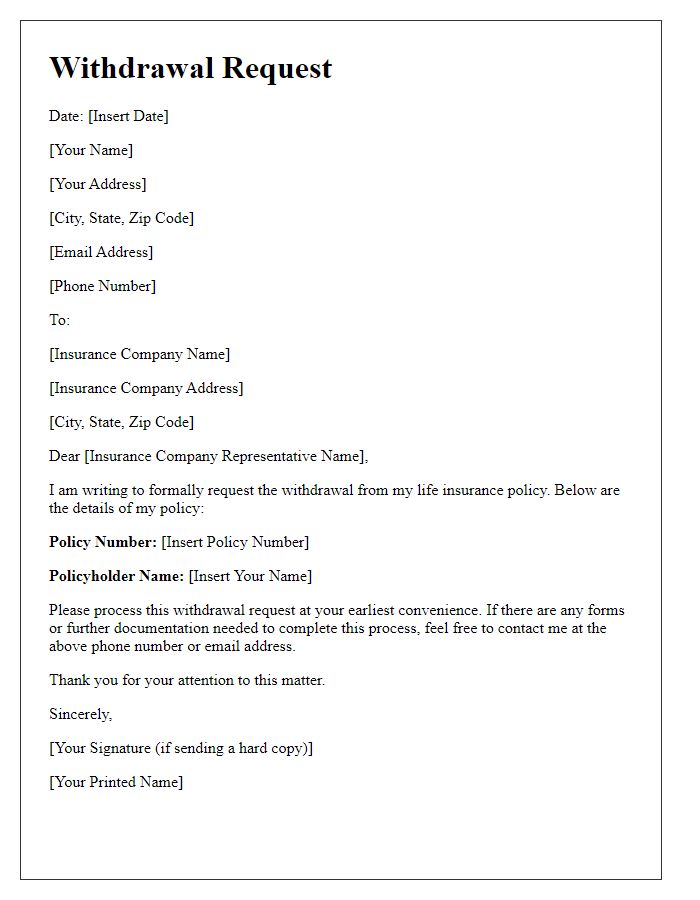

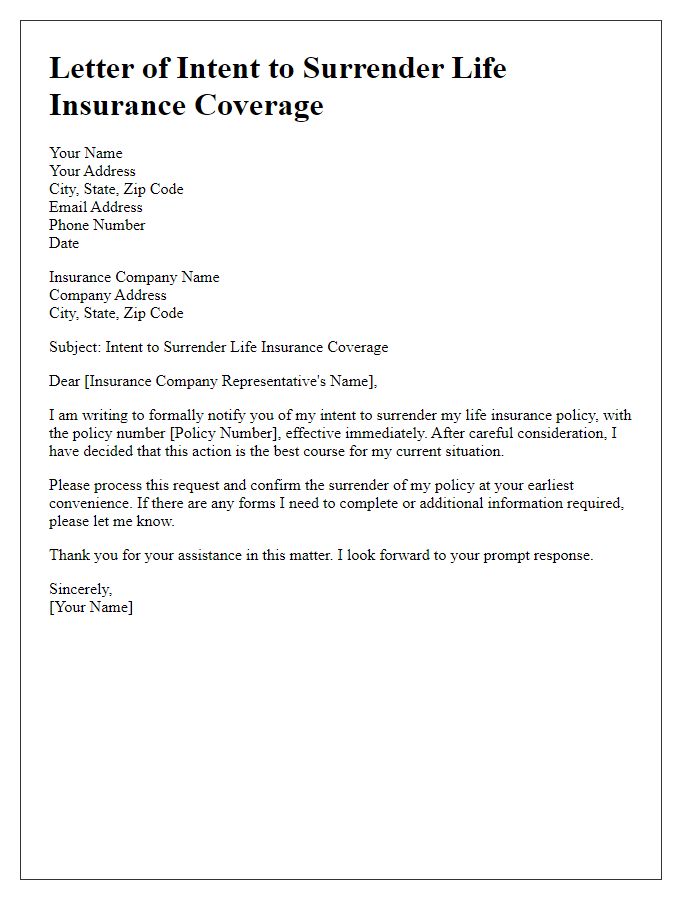

Policy Details

Life insurance surrender requests involve the formal process of terminating a policy to access its cash value. Policyholders often include specific details, such as the policy number (identification for the insurer's records), the policyholder's name (ensuring correct identification), and the effective date (establishing timeline relevance). Additionally, mention of the insurer's name, address (for proper routing of the request), and contact information can facilitate prompt processing. Providing the surrender reason (for example, financial changes or adjustments in coverage needs) adds contextual clarity to the request. Following the guidelines of the specific insurance provider is crucial to ensure compliance with their surrender policies.

Personal Information

When an individual decides to surrender their life insurance policy (like a whole life or universal life policy), several key pieces of personal information are typically required. This includes the policyholder's full name, which identifies the owner of the policy. The date of birth is essential for verifying identity and confirming eligibility for policy benefits. The policy number, a unique identifier assigned to the life insurance contract, is necessary for processing the surrender request accurately. The contact address helps insurance providers ensure they send correspondence to the correct location. A phone number enables quick communication regarding the surrender process or any questions that may arise. Lastly, the Social Security number may be requested to further validate the policyholder's identity and prevent fraud during the surrender process.

Surrender Reason

The decision to surrender a life insurance policy often stems from various personal financial changes or life circumstances. Some common reasons for such a move include the need for immediate liquidity, changes in income due to job loss or reduced working hours, and the ongoing premiums that may become burdensome. Additionally, policyholders might feel that their financial goals have shifted, leading them to prefer investments with potentially higher returns outside of the insurance framework. In other cases, individuals may find they no longer have a need for life insurance coverage due to changes in family structure, such as children reaching adulthood or the passing of a partner. Each reason carries its unique implications for long-term financial planning and should be carefully evaluated before proceeding with a surrender request.

Contact Information

Submitting a life insurance surrender request requires clear and precise contact information to ensure a smooth process. Include full name of the policyholder, address (street address, city, state, and zip code) to establish identity and residency, and phone number (mobile or home) for direct communication. Also, provide email address for electronic correspondence regarding the request. Additionally, include the policy number related to the life insurance plan, which serves as a unique identifier for the insurer to locate the account quickly. These details not only facilitate the surrender process but also protect the policyholder's interests, ensuring timely updates and confirmations from the insurance company.

Signature and Date

The process of surrendering a life insurance policy often involves submitting a formal request to the insurance company. Policyholders may need to provide crucial information, such as the policy number, personal identification details, and specific reasons for surrendering. Completing a surrender request form is typically required. Additionally, including a signature alongside the date of the request is necessary for verification purposes, ensuring that the company confirms the identity of the person requesting the surrender and the authenticity of the request. This procedure is essential for protecting both the policyholder and the insurance provider in transactions involving potentially large financial settlements.

Comments