Are you ready to streamline your insurance verification process? In this article, we'll explore an effective letter template designed to maximize the benefits of insurance verification for your practice. Having a clear and comprehensive approach not only saves time but also enhances communication with insurance providers. So, let's dive in and discover how you can create a letter that gets results!

Policyholder Information

Insurance verification for maximum benefit policies requires accurate details from the policyholder. Key information typically includes the policyholder's full name, date of birth, and Social Security number for identity verification. The insurance policy number is essential, clearly indicating the specific plan associated with the policyholder. The issuing insurance company's name should be included, ensuring easy identification of the insurance provider, such as Blue Cross Blue Shield or Aetna. Additionally, the effective date of the policy and any pertinent coverage details, such as benefits and copayment amounts, are crucial for comprehensive verification. Providing a contact number facilitates swift communication for any required clarifications regarding the verification process. Note that every insurer may have unique requirements, so ensuring completeness enhances the efficiency of the verification procedure.

Insurance Company Details

Insurance verification is essential for ensuring coverage before medical services are rendered. During the verification process, insurance companies, such as Aetna (founded in 1853) or Blue Cross Blue Shield (established in 1929), assess eligibility based on plan details. Key elements include member ID numbers, policy effective dates, and provider network status. Accurate verification can prevent unexpected out-of-pocket expenses for patients and ensures that healthcare providers receive timely reimbursement. It is crucial to gather all relevant patient information, medical codes for services intended, and to contact the insurance company directly, often through dedicated verification hotlines, to confirm coverage specifics.

Policy Number and Coverage Dates

Maximum benefit insurance verification requires accurate identification of crucial details including the policy number assigned by the insurance company and specific coverage dates that outline the duration of active benefits. For instance, a policy number like XYZ-123456789 could indicate a unique insurance account often used by providers for claim processing. Coverage dates, such as January 1, 2023, to December 31, 2023, signify the timeframe in which services are covered under the plan, ensuring that both patients and providers understand the limits of financial support. A thorough verification process is essential for confirming the eligibility of benefits and safeguarding against potential out-of-pocket expenses.

Request for Specific Coverage Information

Insurance verification for maximum benefit coverage ensures that individuals receive the appropriate financial support for medical expenses. This process typically involves contacting the insurance provider, such as WellPoint or Aetna, to gather detailed information about the specific coverage limits, co-pays, and out-of-pocket maximums associated with a particular health plan. It may also include verifying network participation for healthcare providers, meaning ensuring that the chosen providers are within the insurance company's coverage network to avoid additional costs. In addition, understanding pre-authorization requirements for specific services or procedures is crucial, as it often impacts the ability to access certain treatments. Accurate information helps patients make informed decisions regarding their healthcare options and potential costs associated with treatments or consultations.

Contact for Further Communication

In the realm of maximum benefit insurance verification, establishing clear communication channels is crucial for ensuring efficient processing and resolution of claims. Key players, such as healthcare providers and insurance representatives, must exchange detailed information about policy coverage, eligibility criteria, and claim status. Accurate documentation, including patient identification numbers and specific dates of service, plays a vital role in this process. Utilizing a dedicated communication platform, such as secure messaging systems or direct phone lines to claims adjusters, can streamline inquiries and expedite verification. Consistent follow-up interactions foster collaboration, allowing for timely updates and clarification on any potential discrepancies.

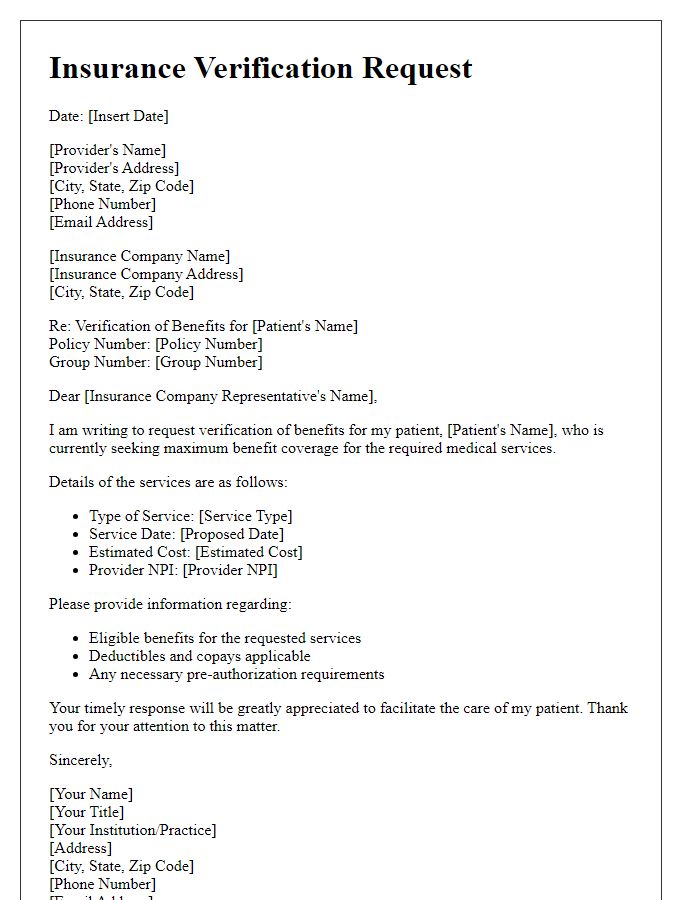

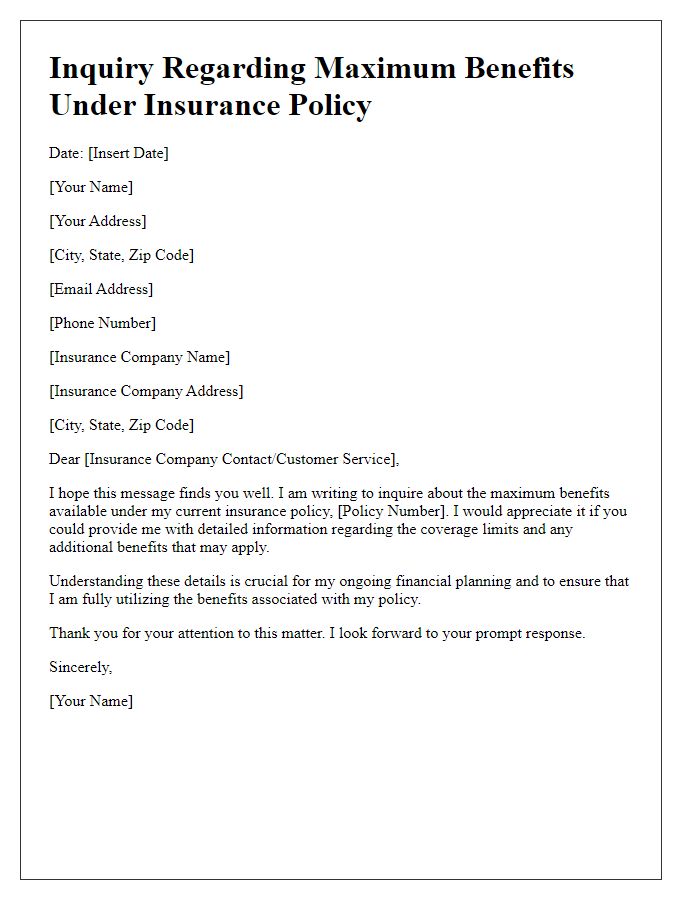

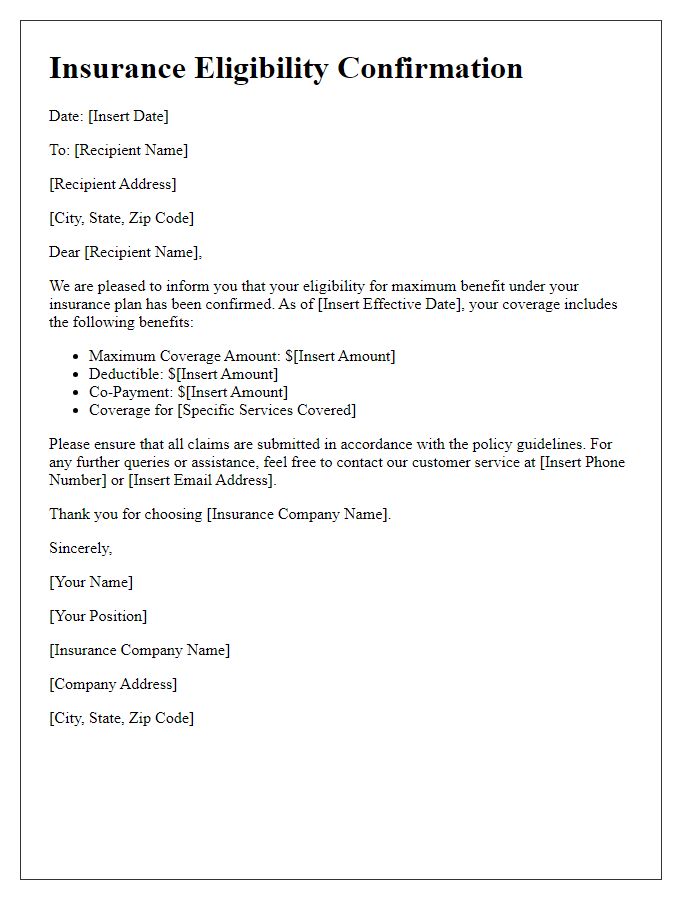

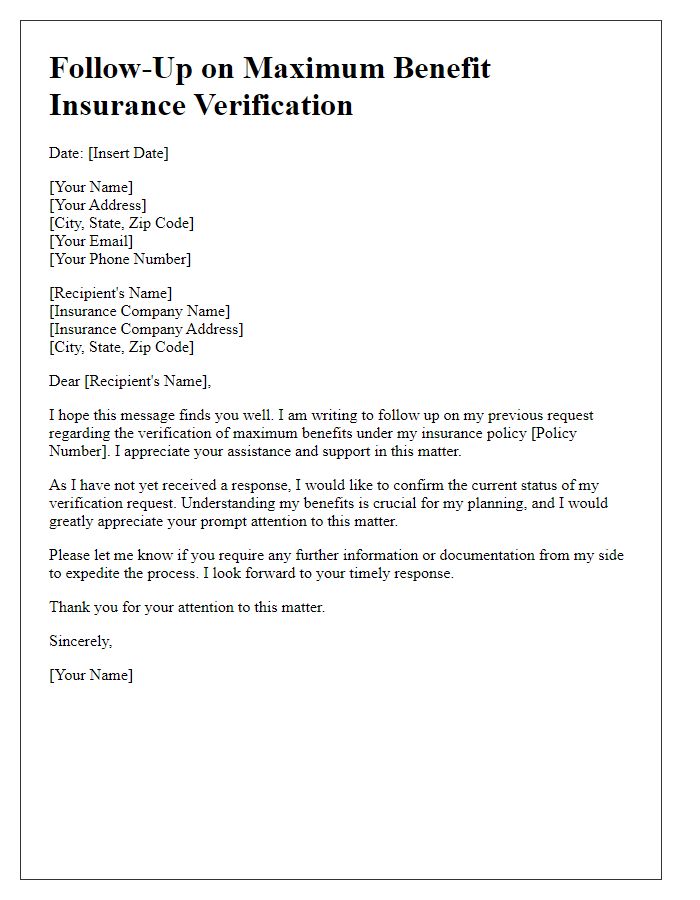

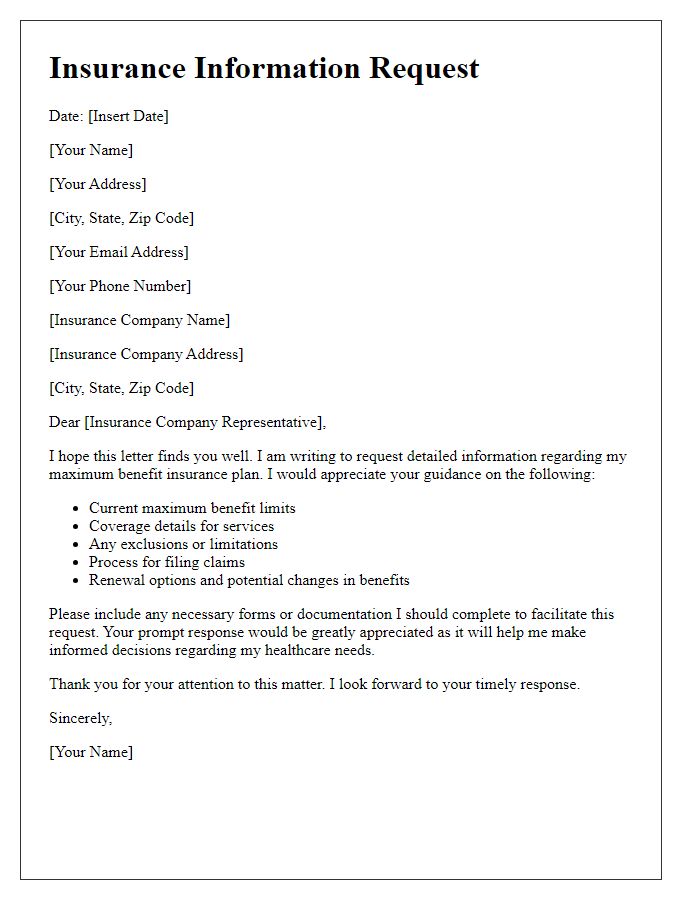

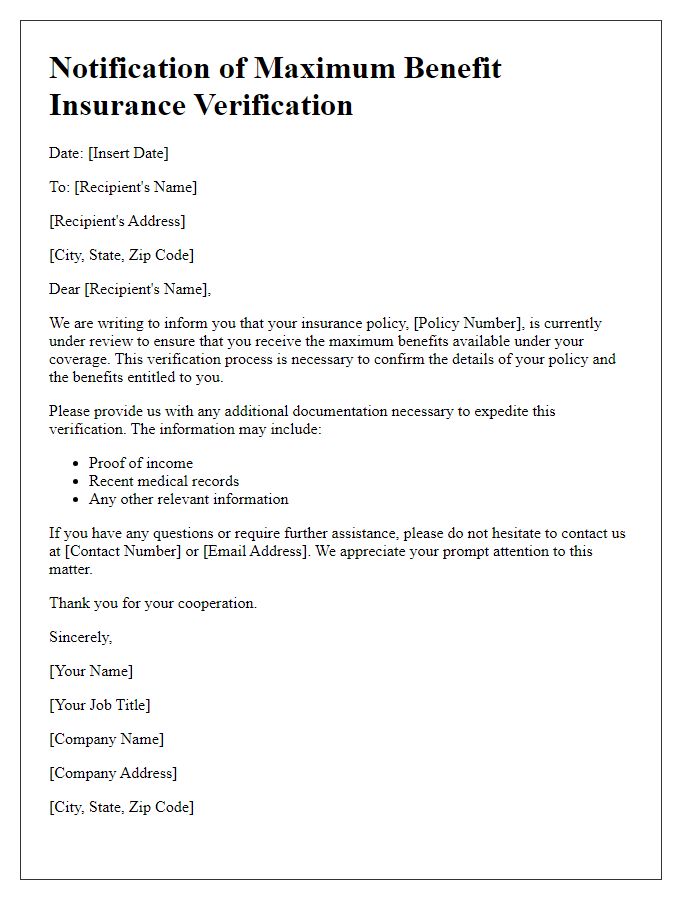

Letter Template For Maximum Benefit Insurance Verification Samples

Letter template of insurance verification request for maximum benefit coverage.

Letter template of inquiry regarding maximum benefits under insurance policy.

Comments