Are you feeling a bit overwhelmed by your insurance policy and all the fine print it entails? Many of us can relate, as understanding the ins and outs of our coverage can sometimes feel like trying to decipher a foreign language. That's why taking the time to review your insurance policy is crucial â it ensures you're adequately protected and not missing out on potential benefits. So, join me as we delve deeper into the importance of a thorough insurance policy review and what you should be looking out for!

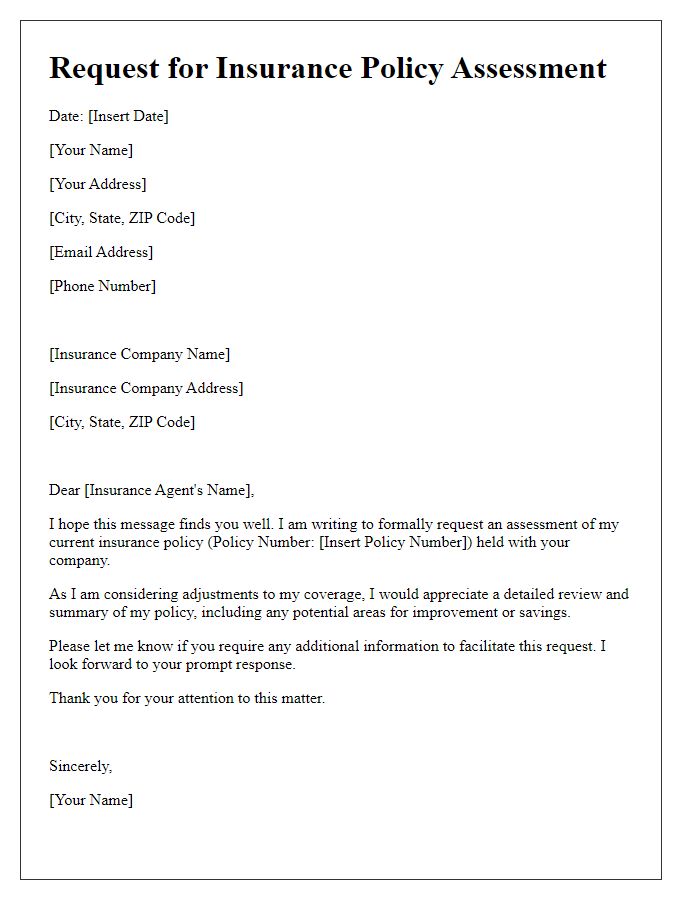

Policyholder Information

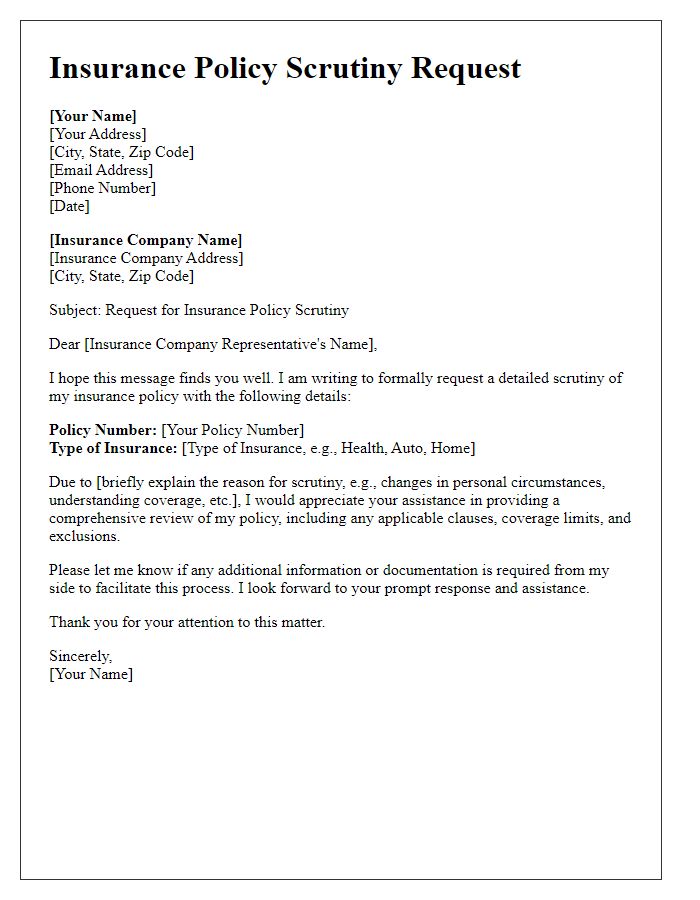

Insurance policy review requests often involve specific details about the policyholder and their insurance coverage. This includes critical information such as the policy number, which uniquely identifies the contract between the insurance company and the policyholder, and the effective date of the policy, indicating when coverage began. The policyholder's full name, address, and contact information (phone number and email) are important for identification and communication purposes. Coverage types such as auto, home, or life insurance should be specified to clarify which policy is under review. Additionally, any recent changes in personal circumstances, like marital status or address changes, may influence the review process and require updating the information in the policy records.

Policy Details (Policy Number, Type)

Insurance policy review requests are essential for policyholders seeking clarity on their coverage. Policy details such as policy number (a unique identifier for each insurance contract) and type (indicating the category of insurance, such as health, auto, or homeowners) are crucial. A thorough review can highlight terms and conditions, claim processes, and any potential adjustments necessary for optimal coverage. Additionally, understanding exclusions and limits can provide insight into risks and benefits associated with the policy, ensuring that policyholders make informed decisions regarding their financial protection.

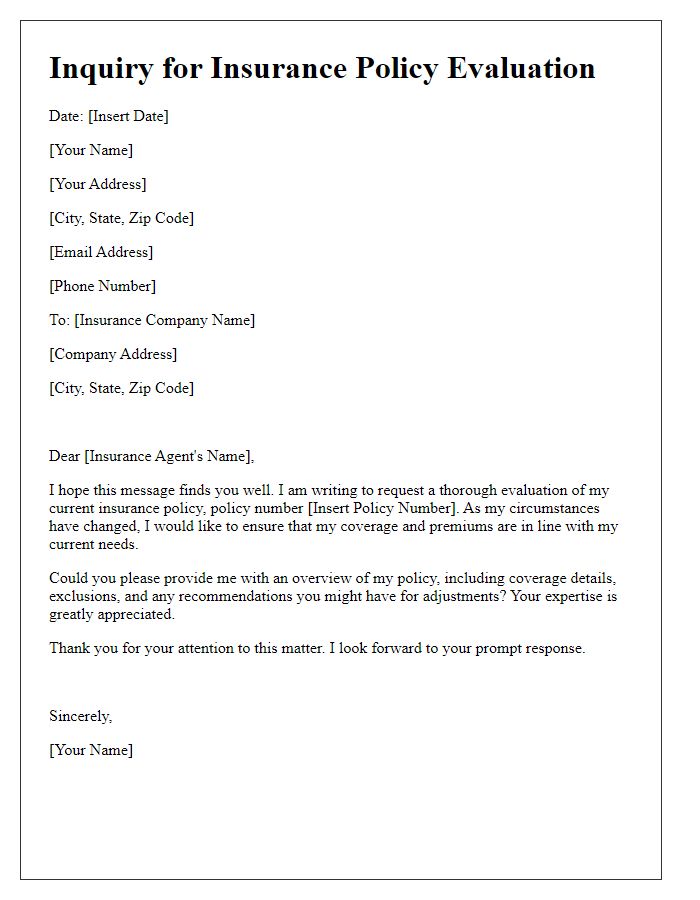

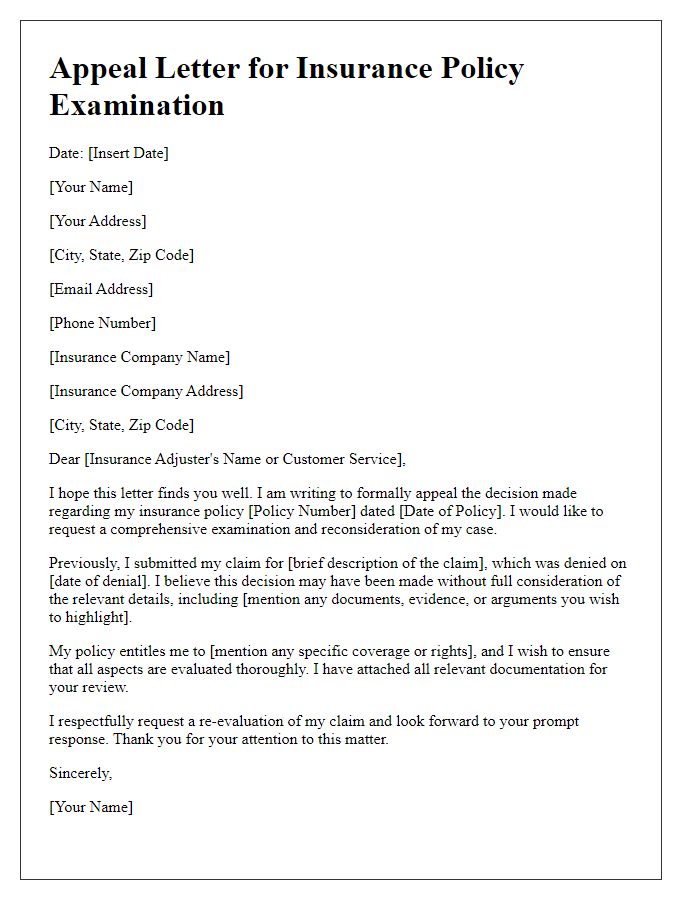

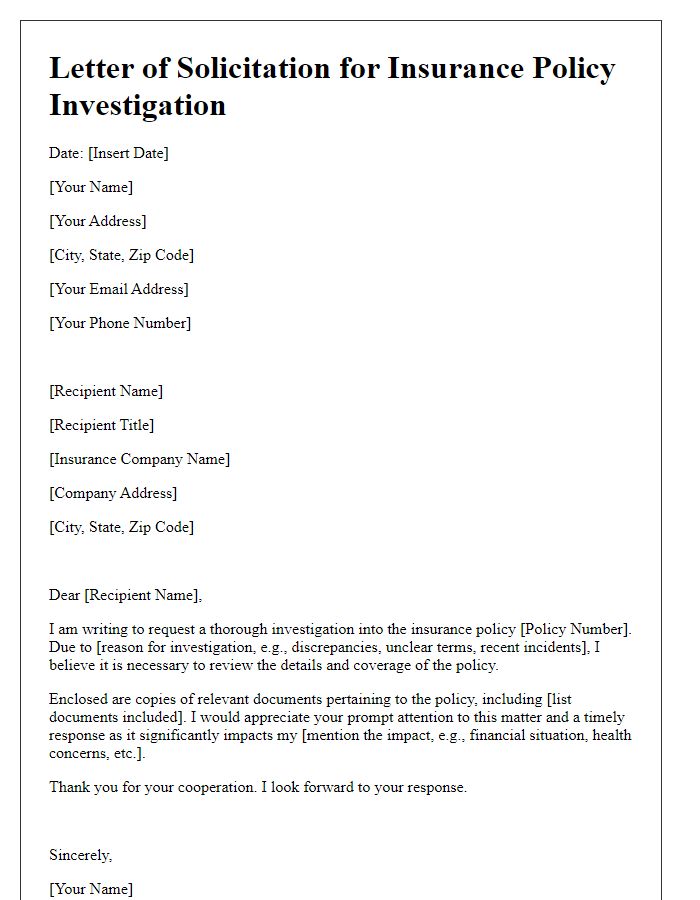

Purpose of Review

A comprehensive insurance policy review is essential for assessing coverage adequacy, identifying potential gaps, and ensuring alignment with current needs and circumstances. Factors such as changes in personal circumstances, including marriage, home purchase, or new job, may necessitate adjustments to coverage limits or types of policies, such as homeowner's insurance or auto insurance. Additionally, evaluating policy details like premium costs, deductibles, and exclusions can reveal opportunities for savings or enhanced protection. Market conditions may also introduce new insurance products or discounts, making it crucial to stay informed and proactive in managing risk effectively. Regular reviews can ultimately lead to a better understanding of one's financial security and peace of mind.

Specific Areas of Concern or Inquiry

A thorough insurance policy review, focusing on key aspects, can ensure adequate coverage and protection. Critical areas of concern could include liability coverage limits, such as the maximum second-person bodily injury claims coverage, typically ranging from $100,000 to $1 million. Property damage coverage should also be examined, with common limits around $50,000 or higher depending on the value of the insured property. Additionally, evaluating exclusions listed in the policy documents is essential, as some might cover specific disasters, such as flood or earthquake insurance, which are often omitted. Policy provisions regarding claims processes and associated timelines, like the standard notification period of 30 days after an incident, should be clarified to avoid complications. Lastly, inquiring about premium fluctuations or discounts tied to claims history or security systems could provide insight into long-term financial commitments.

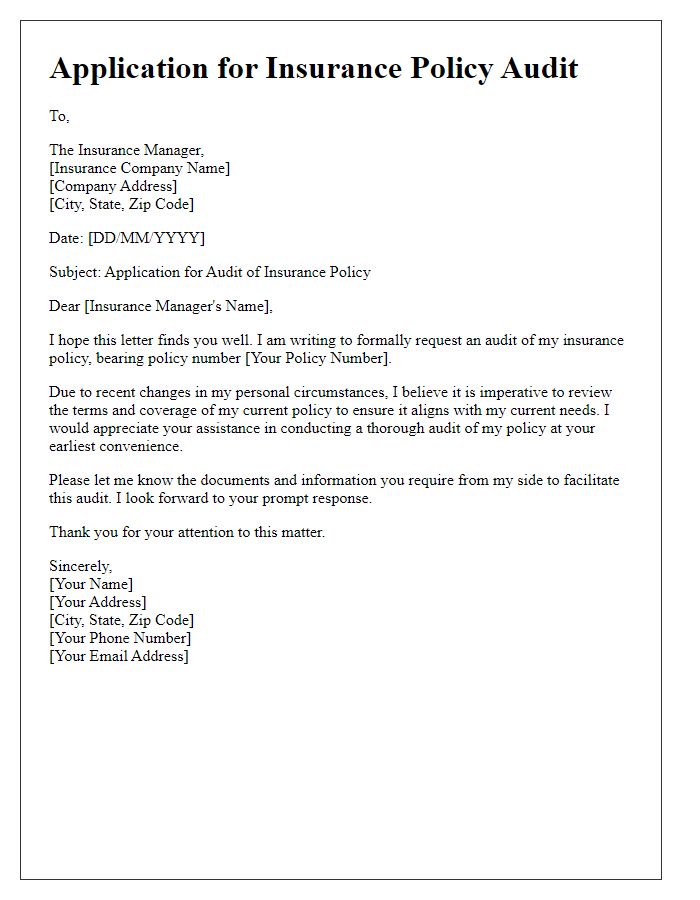

Contact Information and Preferred Response Method

Contact information is crucial in ensuring effective communication between the policyholder and the insurance provider. It typically includes full name, mailing address, email address, and phone number for quick reference. Preferred response method might vary, with options like email for detailed responses, phone calls for immediate feedback, or postal mail for formal documentation. This ensures the policyholder receives the information in the most convenient and efficient manner, enhancing overall satisfaction with the insurance service.

Comments