If you're dealing with the aftermath of a flood, navigating the insurance claim process can feel overwhelming. Understanding the steps involved and having the right information at hand makes all the difference in ensuring a smooth experience. In this article, we'll guide you through creating a comprehensive letter template specifically for your flood insurance claim, helping you articulate your situation clearly and effectively. So, stick around to learn more about how to get the support you need during this challenging time!

Policyholder Information

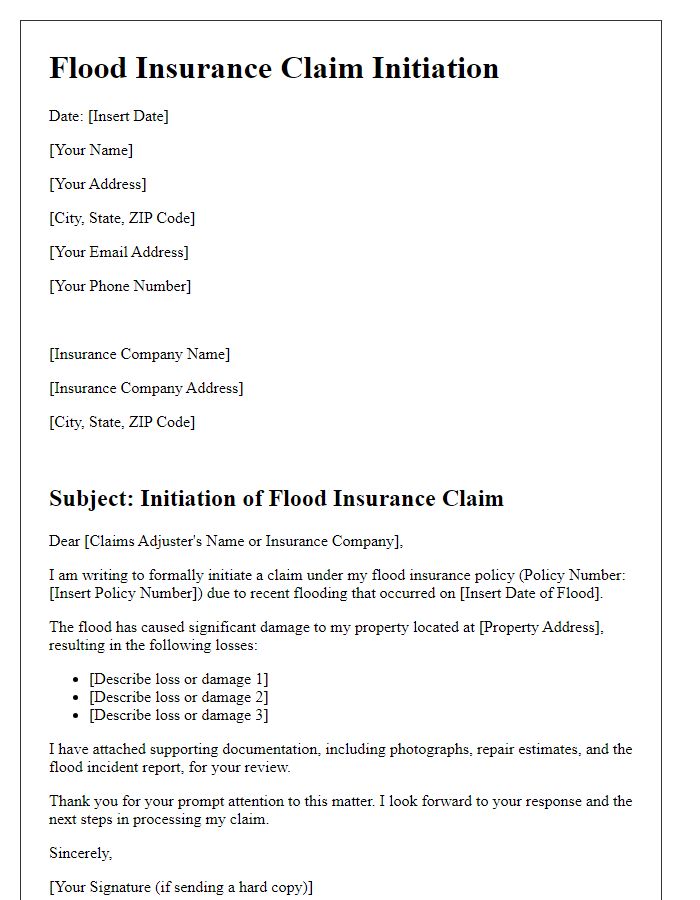

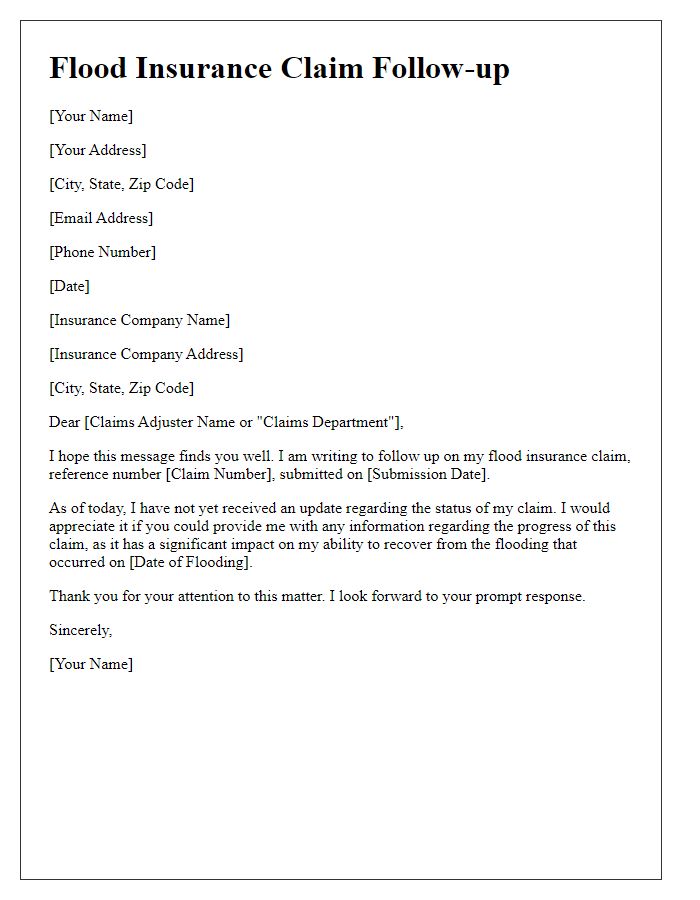

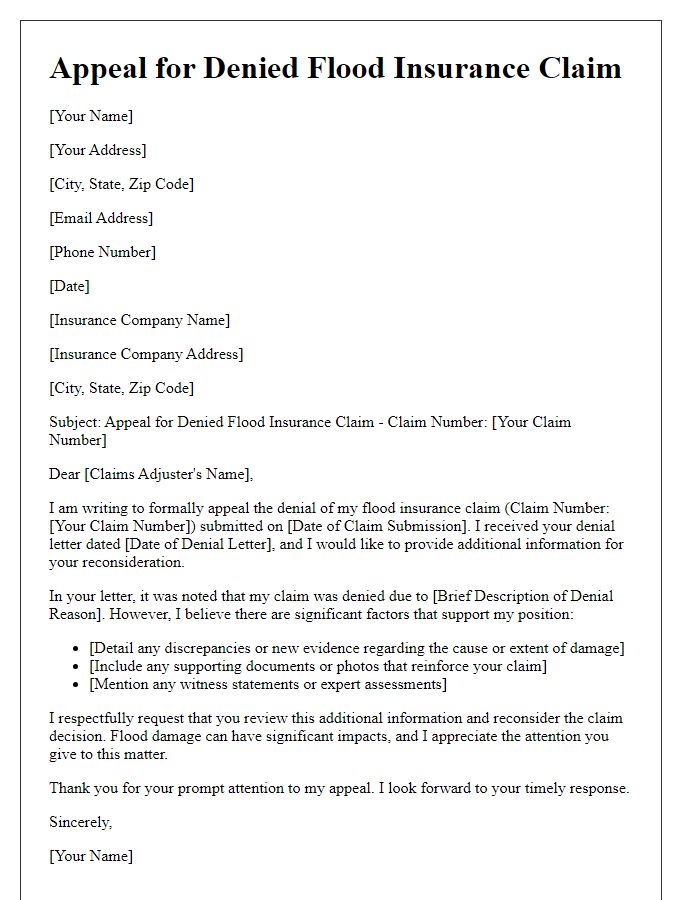

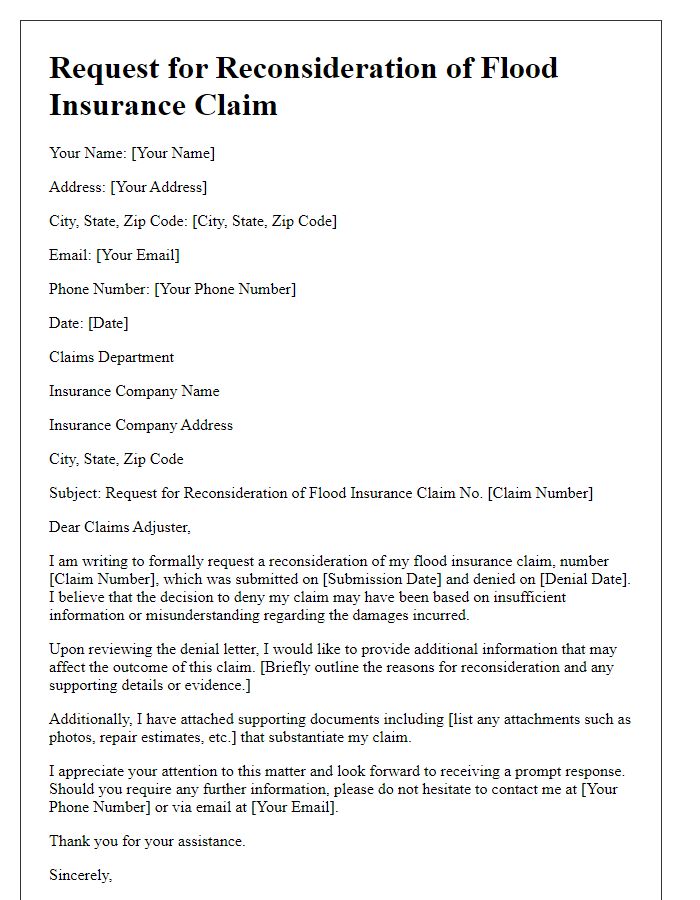

Submitting a flood insurance claim requires comprehensive information from the policyholder, which includes the full name, address (including specific city, state, and ZIP code), and contact details (such as phone numbers and email address), along with the insurance policy number. The documentation must include details about the flooded property (specifying square footage and type of residence, e.g., single-family home, condominium) and any structural damages incurred (like damage to flooring or foundation). Accurately noting the date and time of the flooding event is crucial for compliance with the National Flood Insurance Program (NFIP) guidelines. Associated repairs and estimated costs for restoration (including professional services and materials) should also be documented to substantiate the claim further.

Detailed Flood Damage Description

Heavy rainfall over a span of several days, particularly in late July 2023, resulted in significant flooding in areas such as New Orleans, Louisiana, causing widespread property damage. Numerous homes in the vicinity, particularly those built near levee systems, experienced water intrusion reaching levels exceeding three feet. Saturated soil contributed to structural issues, including foundation shifts and compromised drywall. Furniture and personal belongings were submerged, leading to irreparable damage, including mold growth on upholstery after water receded. Electrical systems sustained damage due to prolonged exposure to water, resulting in safety hazards. Insurance claims often require detailed documentation, including photographs of affected areas, descriptions of lost items, and repair estimates from certified contractors. Prompt action is crucial to ensure timely processing of claims and recovery efforts.

Supporting Documentation

Supporting documentation for a flood insurance claim process typically includes vital evidence to substantiate the claim. Photographs capturing damage to the property, such as submerged furniture and wall damage, should be taken shortly after the flood event, ideally within 48 hours. Repair estimates from certified contractors detailing the costs necessary for restoration provide a clear financial overview. A copy of the flood insurance policy, including coverage limits and endorsements, is essential for reference. Official reports from local authorities or emergency services, documenting the flood's impact (such as FEMA reports from the 2023 Hurricane Ian), are also crucial. Other supporting documents may include receipts for temporary housing expenses incurred due to displacement and records of previous property assessments or tax documents to establish property value prior to the flood.

Claim Amount Requested

Flood insurance claims can significantly impact the financial recovery process following natural disasters like hurricanes or heavy rain events. Policyholders must document claim amounts accurately to ensure fair compensation under the National Flood Insurance Program (NFIP). Detailed descriptions of damages, supported by photographs and repair estimates, enhance the credibility of claims. Required forms include the Proof of Loss, which must be submitted within 60 days of the incident, while coverage limits depend on policy specifics, often capping at $250,000 for residential dwellings. Compliance with local building codes during repairs may also be necessary for full reimbursement. Engaging professional adjusters can help navigate complex guidelines efficiently.

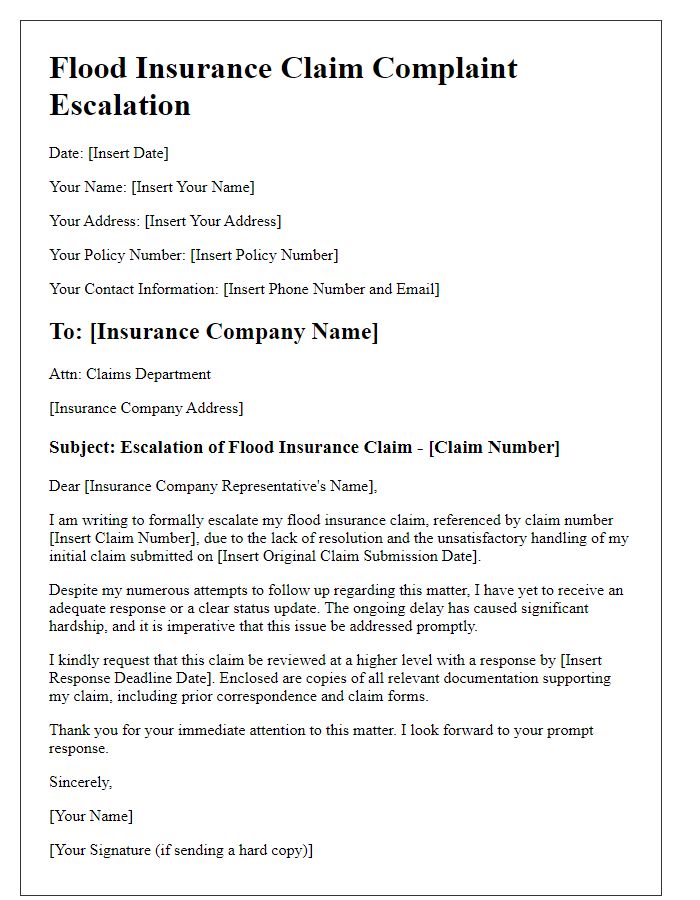

Contact and Response Information

Flood insurance claims require thorough documentation and clear communication with insurance providers to ensure proper processing. The initial step involves contacting the insurance company, typically through a dedicated claims hotline, providing the policy number and the date of the flood event. Following the report, the adjuster, an individual trained in assessing property damage, will be assigned to investigate the claim. Important contact information includes the claims department's phone number, protocol for submitting evidence of damages, and guidelines on deadlines for filing claims. Maintaining a detailed record of all correspondence, photographs, and repair estimates (preferably dated within a few days of the flood) can significantly aid in expediting the claims process. Understand the details of the National Flood Insurance Program (NFIP) to ensure compliance with federal flood insurance standards and rectify any potential issues timely.

Comments