Are you navigating the complex world of insurance claims and in need of guidance? Writing a letter to request documentation can seem daunting, but it doesn't have to be. In this article, we will walk you through a simple and effective letter template that ensures you get the necessary papers without the hassle. So, buckle up and get ready to streamline your claims processâread on to learn more!

Claimant's Full Name and Contact Information

Insurance claims for property damage often require detailed documentation to ensure a smooth process. The claimant's full name, such as Johnathan Smith, must be followed by accurate contact information, including a verified phone number (e.g., +1-555-123-4567) and a current email address (e.g., john.smith@email.com). Important for processing, supporting documents like photographs of the damage (timestamped), repair estimates from local contractors (for example, ABC Construction), and police reports (if applicable), should accompany this information. Each document should be labeled clearly to facilitate quick assessment by the claims adjuster. Prompt submission of complete documentation often expedites the resolution process, resulting in timely claim approval.

Policy Number and Claim Number

Insurance claims documentation requests typically require specific details. Affected parties need to provide the policy number, which uniquely identifies the insurance agreement, and the claim number, which designates the specific claim filed for damages or losses. Accurate documentation facilitates the processing of claims, ensures correct policy coverage is referenced, and assists in expediting resolution. Insurance companies often have particular forms or formats they request for such documentation, which may include receipts, photographs of damages, and police reports in case of accidents or theft. Compliance with these requests is crucial for timely claim approvals and financial compensation for the policyholder.

Detailed Description of Requested Documents

Insurance claims documentation requests often require precise and specific details to facilitate efficient processing. Essential documents may include the Claim Form, which outlines the nature of the claim, supporting identification documents such as a driver's license or social security card, and Medical Reports, detailing injuries or conditions treated, including dates and medical provider information. Furthermore, Receipts for expenses incurred related to the claim, such as repair bills or medical receipts, will substantiate monetary losses. Witness Statements, if applicable, provide third-party accounts related to incidents. Lastly, Police Reports may be necessary for claims involving accidents or theft, providing official documentation of events. Each of these documents plays a crucial role in validating and expediting the claims process.

Deadline for Submission and Handling Instructions

Insurance claims require specific documentation to ensure a smooth processing experience, often including forms like the Proof of Loss (POL), receipts, and detailed incident reports. Timely submission is crucial. Insurance companies typically set deadlines for submission, often ranging from 30 to 90 days after an event, depending on the policy details. Handling instructions may involve specific channels for submission: online portals, physical mail to designated claims adjusters, or designated email addresses, ensuring sensitive data remains secure. Each step plays a vital role in expediting claim reviews, aiding in a more efficient resolution.

Contact Details for Queries and Further Assistance

Contact details are crucial for effective communication regarding insurance claims documentation requests. Claimants should include full names, email addresses, and direct phone numbers for prompt inquiries. Insurance representatives, typically associated with companies such as State Farm or Allstate, may require this information to address specific concerns or provide further assistance. Additionally, including mailing addresses can facilitate the sending of physical documents. It is essential to clearly indicate preferred contact times to ensure timely and efficient communication, ultimately streamlining the claims process.

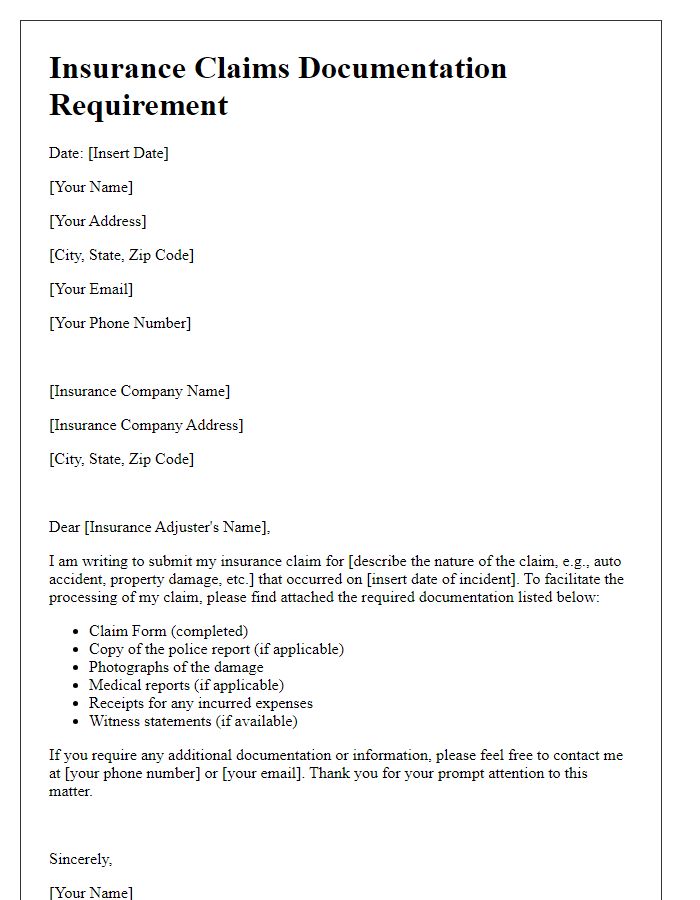

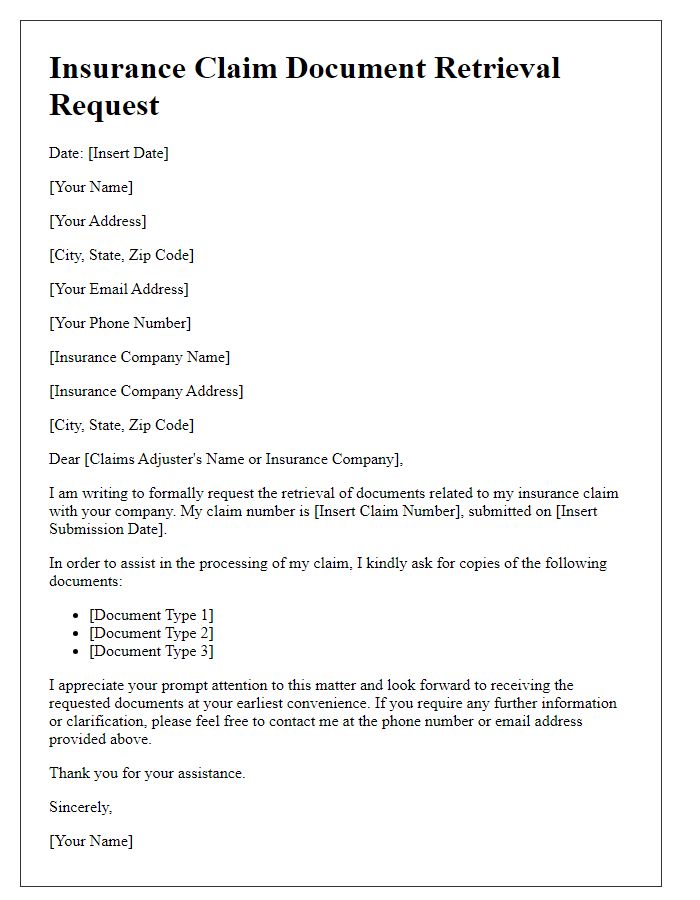

Letter Template For Insurance Claims Documentation Request Samples

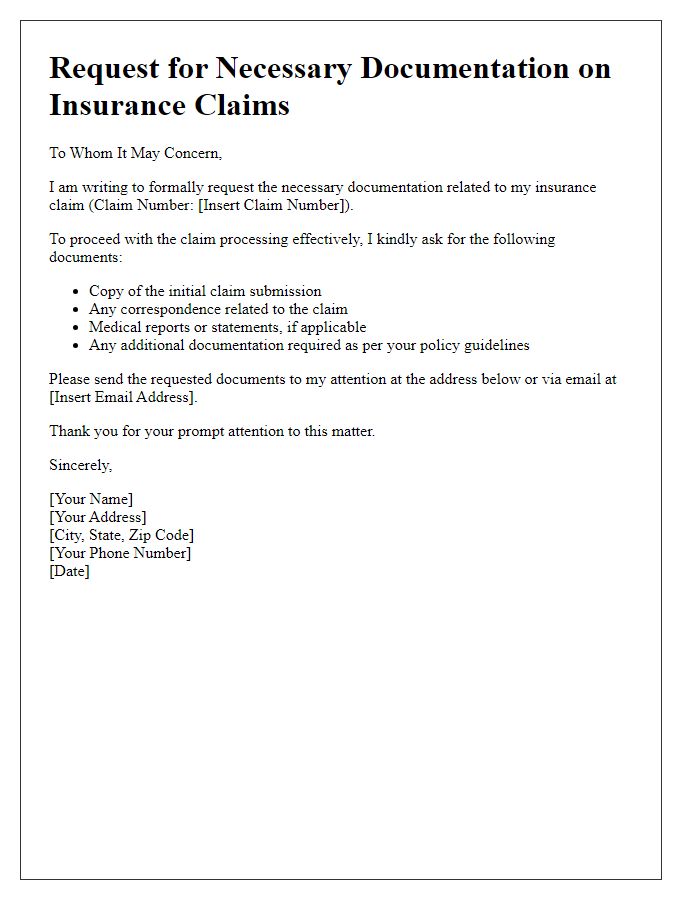

Letter template of request for necessary documentation on insurance claims

Comments