Are you navigating the complexities of actuarial insurance data requests? Whether you're a seasoned professional or new to the field, understanding how to craft an effective letter can make all the difference in obtaining the information you need. In this article, we'll break down the essential components of a well-structured request, ensuring you capture the recipient's attention while clearly outlining your needs. So, let's dive in and enhance your letter-writing skills to streamline your data collection process!

Contact Information and Credentials

Actuarial insurance data requests require precise and complete contact information and credentials to ensure data integrity and confidentiality. Key components include a full name, organizational affiliation, professional designation (such as Associate of the Society of Actuaries or Fellow of the Casualty Actuarial Society), email address, and phone number. It is essential to specify the purpose of the data request, as well as any applicable regulations or agreements that govern data usage. Furthermore, including a brief background on the actuarial analysis intended can enhance understanding and facilitate smoother communication with the data provider.

Specific Data Requirements

Actuarial insurance analyses depend on precise data sets, such as claims history, policyholder demographics, and exposure data. Claim frequency (number of claims per 1,000 policies) helps assess risk, while claim severity (average payout per claim) provides insights into potential financial liabilities. Additionally, a detailed age distribution (for example, policyholders segmented by decade) can reveal trends in risk assessments. Geographic information, such as urban versus rural policyholder counts, may influence underwriting decisions. Moreover, data regarding loss ratios (ratio of claims paid to premiums earned) over several years can help model future profitability. These elements are crucial for constructing predictive models and ensuring informed decision-making within the insurance sector.

Purpose of Data Use

Data usage in actuarial insurance primarily involves analyzing risk factors associated with various policies. This analysis incorporates statistical models to predict future claims based on historical data from specific demographic segments. The data utilized may include policyholder information, claim histories, and external factors such as economic conditions or health trends. Data integrity and accuracy are critical, as they influence underwriting decisions and premium calculations. Adhering to regulatory guidelines is essential to protect policyholder privacy while ensuring that analytical insights support effective risk management practices.

Data Privacy and Compliance

Actuarial insurance data requests require strict adherence to data privacy regulations such as GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act). These regulations mandate that personal and sensitive information must be handled with utmost care and transparency. When making a data request, specify the purpose, define the data needed (such as policyholder demographics or claims history), and emphasize compliance protocols to ensure all operations respect individuals' rights. Document the security measures in place for data transmission and storage, like encryption and access controls, to assure stakeholders of data safety during the request process. Consideration of retention policies becomes essential, outlining how long the data will be kept before securely disposed of or anonymized.

Deadline and Response Expectations

The actuarial insurance data request must adhere to strict deadlines to ensure compliance with industry regulations. Reports are expected by November 15, 2023, to facilitate timely analysis before year-end evaluations. Data sets, including historical claims data and underwriting statistics from the past five years, should be comprehensive and accurate to enable precise risk assessment. Communication with stakeholders will clarify any uncertainties regarding data interpretation or submission requirements. Furthermore, late submissions may result in additional penalties or delays in processing, potentially impacting the overall project timelines.

Letter Template For Actuarial Insurance Data Request Samples

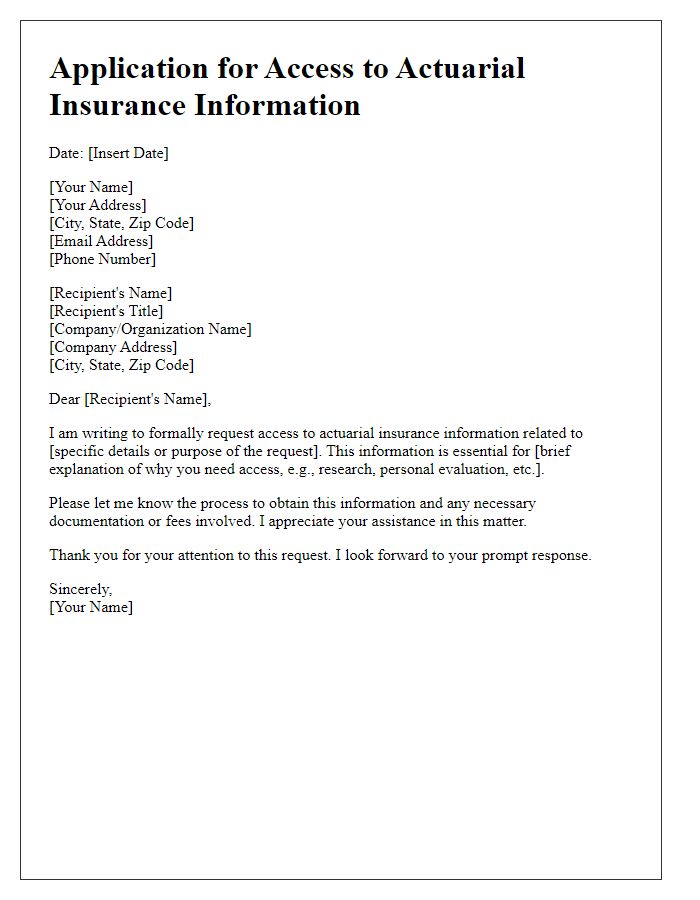

Letter template of application for access to actuarial insurance information

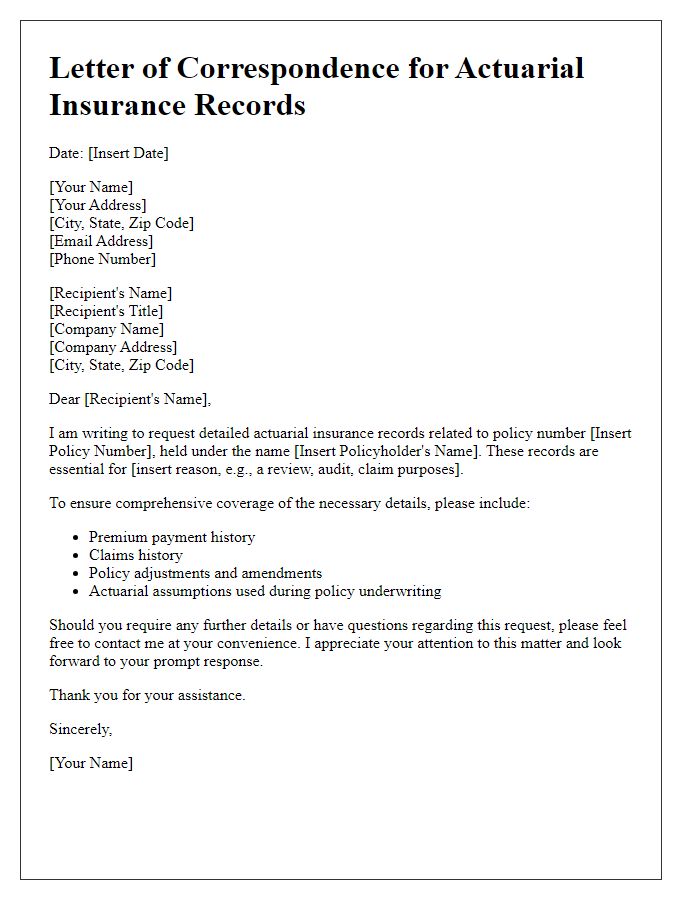

Letter template of correspondence for detailed actuarial insurance records

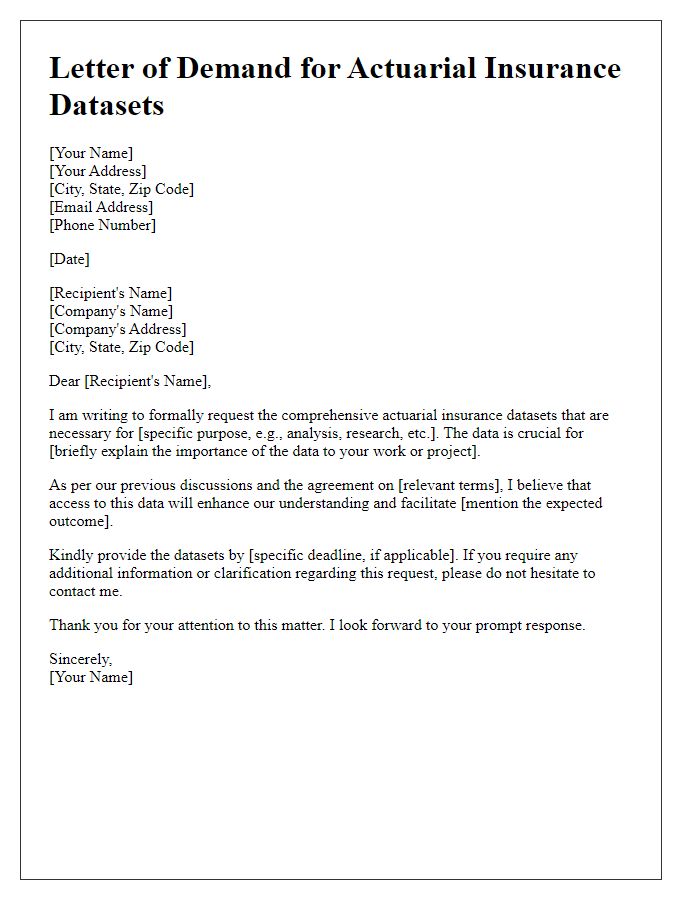

Letter template of demand for comprehensive actuarial insurance datasets

Letter template of proposal for collaborative actuarial insurance data review

Comments