When it comes to understanding your comprehensive insurance policy, things can get a bit overwhelming. But don't worry, we're here to break it down for you in a simple and clear way. From deductibles to coverage limits, we'll explore each key component to help you grasp exactly what you're paying for and how it protects you. Ready to dive deeper into the details? Let's get started!

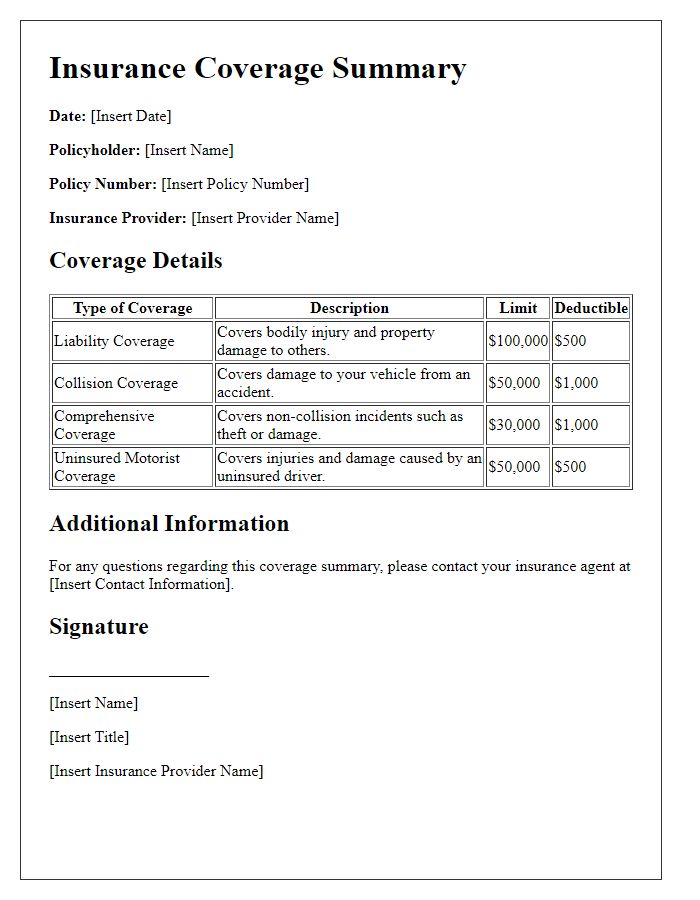

Policy Coverage Details: In-depth description of covered risks and events.

Comprehensive insurance policies offer extensive coverage against a variety of risks and unexpected events, including theft, vandalism, natural disasters, and accidents involving wildlife, such as deer collisions. For example, if an insured vehicle is damaged by hail during a severe weather event, usually categorized under force majeure events, the cost of repairs may be covered, ensuring financial protection for the policyholder. Additionally, losses due to fire or flood, which can escalate quickly, are typically included, allowing for replacement of damaged property or vehicles. Specific exclusions may exist, such as intentional damage or wear and tear, emphasizing the importance of understanding policy limitations. Each policy varies in terms of deductibles and claim processes, impacting the overall financial responsibility of the insured.

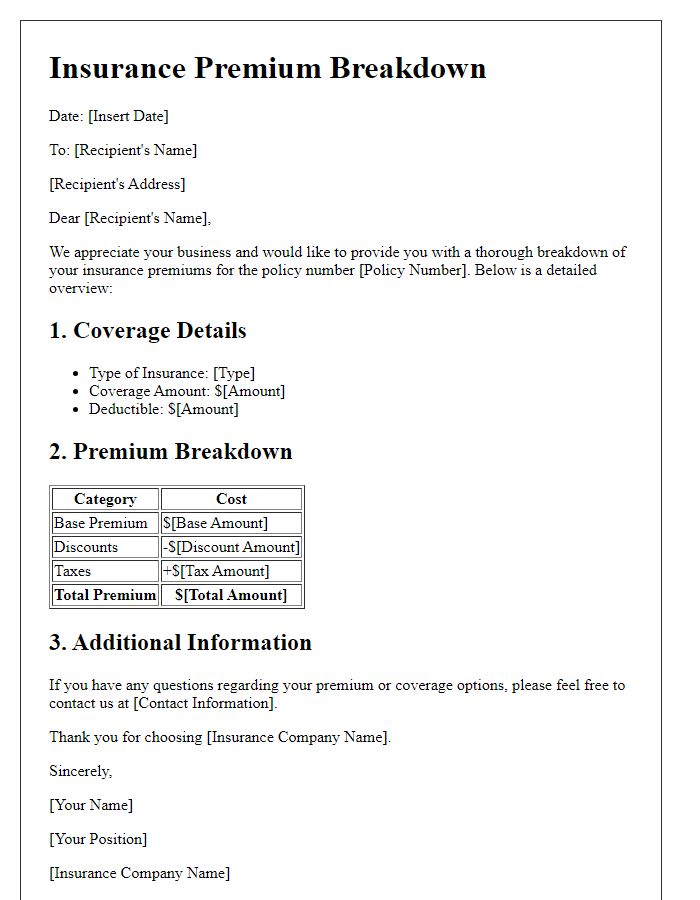

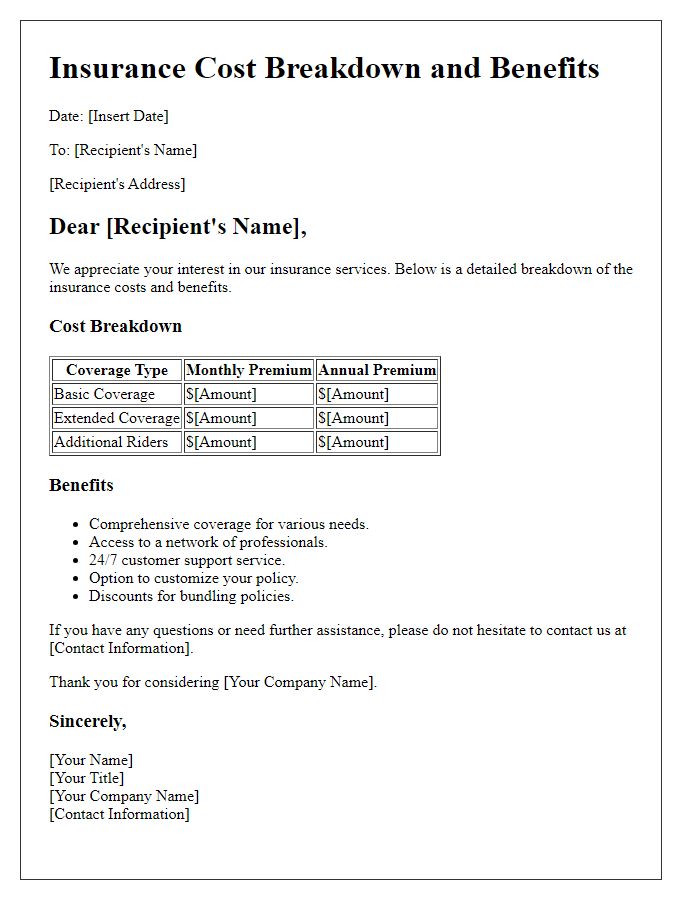

Premium Calculation: Explanation of factors influencing premium amount.

Comprehensive insurance premiums are calculated based on various factors that influence risk assessment. Key factors include the insured item's value; for example, a luxury vehicle valued at $50,000 will have a higher premium than a standard vehicle valued at $20,000. Driver's demographics play a critical role; age, gender, and driving history significantly affect premium rates, with younger, inexperienced drivers typically facing higher costs. Geographic location also matters, as urban areas with higher traffic volumes and greater theft rates lead to increased premiums. Coverage level selected impacts costs; opting for higher deductibles generally lowers premium amounts, while adding more comprehensive coverage options such as rental car reimbursement raises the cost. Finally, the insurer's claims history specific to the insured may influence premiums; a higher frequency of claims can lead to increases in future premium costs.

Claim Process: Step-by-step guide on filing a claim and necessary documentation.

Filing an insurance claim involves a detailed process requiring specific documentation to ensure a smooth handling of your request. Begin by contacting your insurance provider, such as Allstate or State Farm, to report the incident. Obtain the claim number, which will be essential for tracking your case. Gather necessary documents including the police report, photographs of the scene, and receipts related to the incident. If applicable, include medical records detailing injuries sustained during the event. Submit these documents through the insurer's preferred methods, which may include online portals or direct mail. Throughout the process, maintain copies of all correspondence and documentation for your records. Follow up regularly with your claims adjuster to stay updated on the status of your claim. Prompt response times and thorough documentation can significantly enhance the efficiency of the claim resolution.

Exclusions and Limitations: List of risks not covered under the policy.

Exclusions and limitations within a comprehensive insurance policy can significantly impact the coverage provided to policyholders. Common exclusions may include natural disasters, political unrest, and specific high-risk activities (such as extreme sports). For instance, damages resulting from floods (often requiring a separate policy) are typically not covered under standard policies, exposing homeowners in areas like New Orleans to potential financial losses. Additionally, limitations on coverage often apply based on the policy's terms, such as caps on reimbursement amounts for specific types of claims, which could vary by state or insurer. Understanding these exclusions is crucial for policyholders to properly assess their risk exposure and ensure they obtain supplemental coverage where necessary.

Policy Term and Renewal: Information on policy duration and renewal options.

Comprehensive insurance policies typically cover a wide range of risks, providing protection against various incidents like theft, vandalism, and natural disasters. The policy term usually spans one year, starting from the effective date indicated in the policy document. Renewal options become available 30 to 60 days prior to the policy's expiration date, giving policyholders the opportunity to review coverage limits and premiums. In many cases, insurers may offer multi-year renewal discounts or policy bundling options to optimize cost-efficiency. A policyholder must ensure that their contact information remains up to date, as notifications regarding renewal and possible coverage changes are essential for maintaining continuous coverage. Each state may have its unique regulations regarding insurance terms, and understanding these can be crucial for policyholders.

Comments