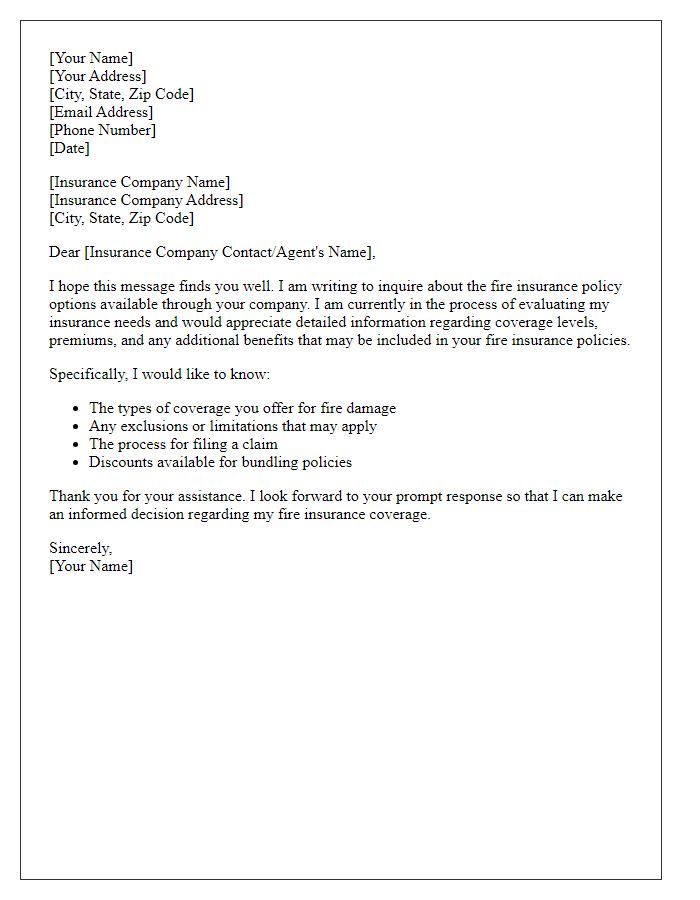

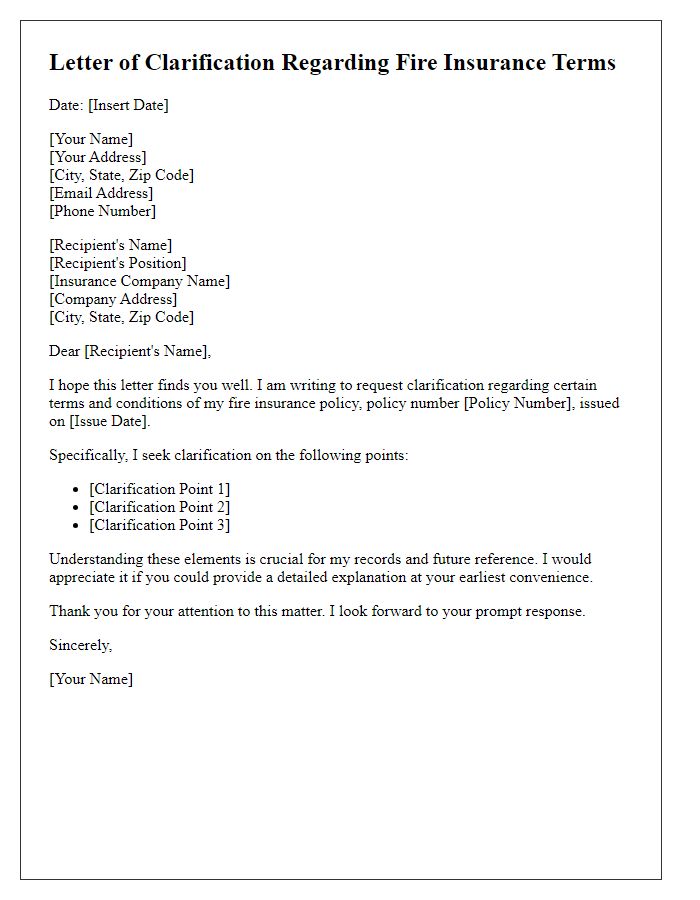

Are you feeling a bit confused about your fire insurance policy? You're not aloneâmany people find themselves seeking clarity on the specifics of their coverage. Understanding the ins and outs of your policy is crucial to ensure you're fully protected in the event of a fire. If you're looking for straightforward answers to common questions, keep reading to uncover valuable insights!

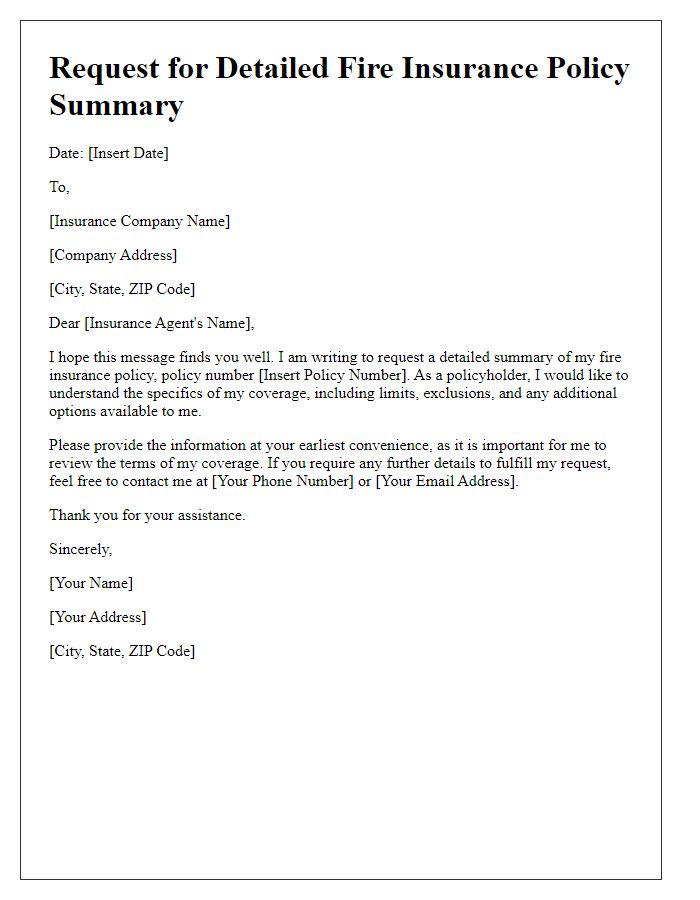

Policy Number

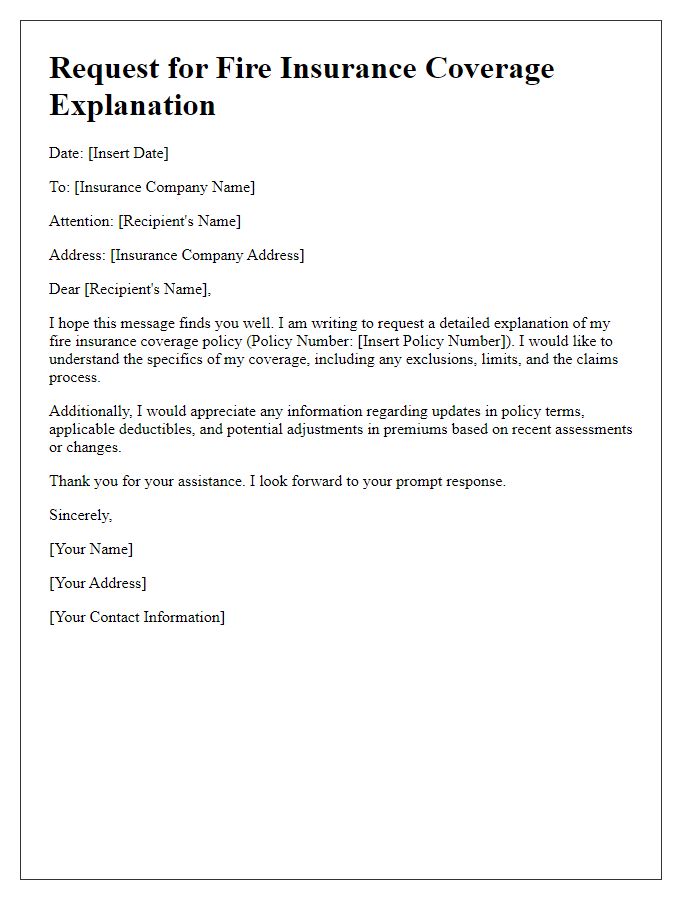

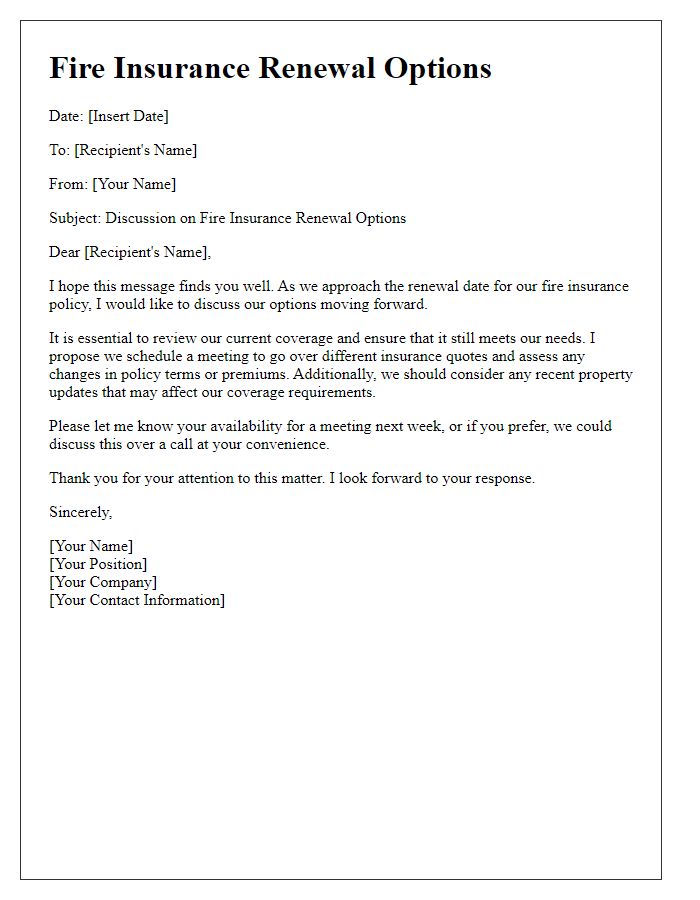

Fire insurance policies provide essential coverage for damages resulting from fire incidents in property such as homes and businesses, underlining the importance of understanding specific details. A policy number, a unique identifier assigned by the insurer, is crucial for accessing specific terms and conditions related to coverage limits (the maximum payout covered) and deductibles (the amount the policyholder must pay before the insurance kicks in). Fire incidents can vary in cause, including electrical failures, arson, or natural wildfire events, requiring clarity on exclusions (situations not covered) and included perils (specific risks covered under the policy). Regular updates to property value and risk assessments are vital to ensure that coverage remains adequate, reflecting market values and potential liabilities in the event of a claim. Understanding renewal periods and premium rates can also help manage financial expectations effectively.

Insured Property Details

Fire insurance policies cover specific properties against damage caused by fire, smoke, or related hazards. For accurate coverage, it is crucial to provide detailed information about the insured property, including the address, construction type, square footage, and the year built. High-value items like machinery, electronics, and furniture should be documented with their respective values. Additionally, understanding the location's fire risk, such as proximity to fire stations and historical data on local fire incidents, enhances the policy's effectiveness. Policyholders must ensure that all relevant details are updated regularly to maintain comprehensive coverage.

Coverage Limits

Fire insurance policies, such as those offered by major insurers, include critical coverage limits defining the maximum amount payable for property damage due to fire incidents. Standard policies may cover structures (up to $500,000), personal belongings (often capped at $100,000), and additional living expenses during restoration (typically up to 20% of dwelling coverage). Factors impacting these limits include location (high-risk areas may necessitate higher limits), type of construction (brick vs. wood), and policy endorsements (additional coverage options). Understanding these limits is essential for homeowners in ensuring adequate protection against potential losses.

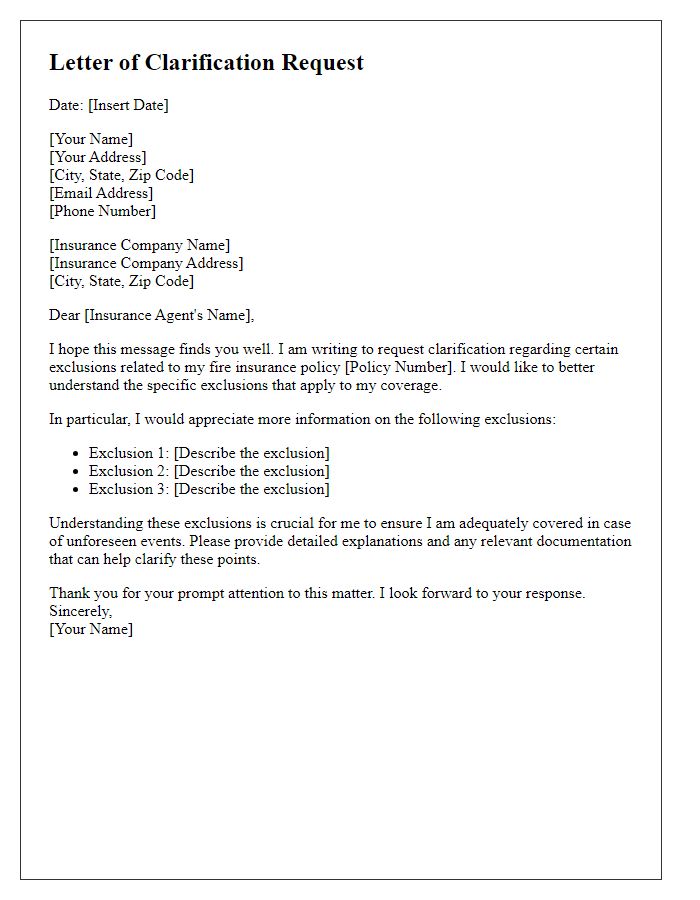

Policy Exclusions

Fire insurance policies can contain various exclusions that limit coverage. Common exclusions may include damage from wildfires (such as those seen in California's devastating 2020 fires), unauthorized construction (which might not comply with local building codes in places like New York City), and intentional acts causing damage. Further, certain natural disasters (like earthquakes or floods, often specifically noted in the National Flood Insurance Program) may also fall outside of coverage. It is crucial for policyholders to thoroughly review their fire insurance contracts to understand the specific exclusions that might impact their claims in the event of a catastrophe.

Claims Process Information

Fire insurance policies are vital for homeowners, ensuring financial protection against potential hazards such as wildfires, electrical fires, or even kitchen accidents. Understanding the claims process is crucial for policyholders to navigate efficiently in the aftermath of a fire incident. Typically, policyholders must report the fire damage to their insurance provider within 24 hours, fostering prompt investigation and assessment. Essential documentation includes photographs of the damage, a detailed inventory list, and any police or fire department reports. Additionally, insured property often encompasses both the dwelling and personal belongings, such as furniture or electronics, each requiring meticulous evaluation by claims adjusters. Following submission, the insurer usually communicates the claim's status within 30 days, with any payouts contingent on policy limits, deductibles, and the specific terms outlined in the fire insurance agreement.

Comments