Are you navigating the often complex world of insurance claims? It can feel overwhelming, especially when you're trying to secure a fair settlement. This article will guide you through an adjusted insurance claim settlement letter template designed to make the process as smooth as possible. So, grab your pen and let's dive in to discover how to ensure your voice is heard and your claims are honored!

Clear Policy Reference

In the submission of an adjusted insurance claim settlement, having a clear policy reference is essential for accuracy and transparency. The insurance policy number, typically consisting of alphanumeric characters (such as AB1234567), must be prominently displayed at the top of the claim documentation. This reference links the specific claim to the policyholder's coverage details, which is crucial in evaluating the claim by the insurance company, like State Farm or Progressive. Including the claim number provided by the insurer, which is often a unique identifier (e.g., 987654321), facilitates tracking within the insurer's systems. Clear communication of the policy date, coverage limits, and specific endorsements will further support the claim and ensure all relevant terms are considered during the settlement process. Accurate documentation fosters effective resolution, minimizes disputes, and accelerates the path to compensation for the claimant.

Detailed Explanation of Adjustments

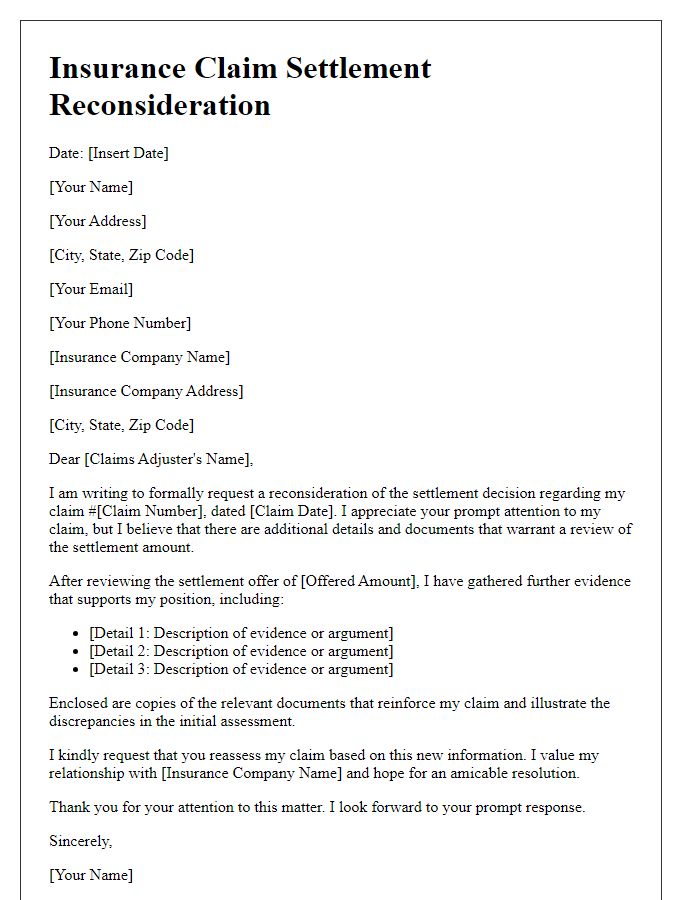

Adjustments in insurance claim settlements can significantly impact the final compensation amount, as seen in cases involving property damage or personal injury. For instance, a homeowner's claim for water damage in Miami, occurring during Hurricane Irma in September 2017, required detailed evaluation of structural integrity and repair costs. Adjusters meticulously assessed the necessary repairs, totaling approximately $15,000, while considering factors like labor rates in Florida and material availability post-storm. Health-related claims, such as those filed after accidents, necessitate thorough documentation of medical expenses, where billing records could exceed $30,000 for treatments including surgeries and rehabilitation. These adjustments ensure fair assessment based on prevailing costs, local market conditions, and adherence to policy terms.

Comprehensive Claimant Information

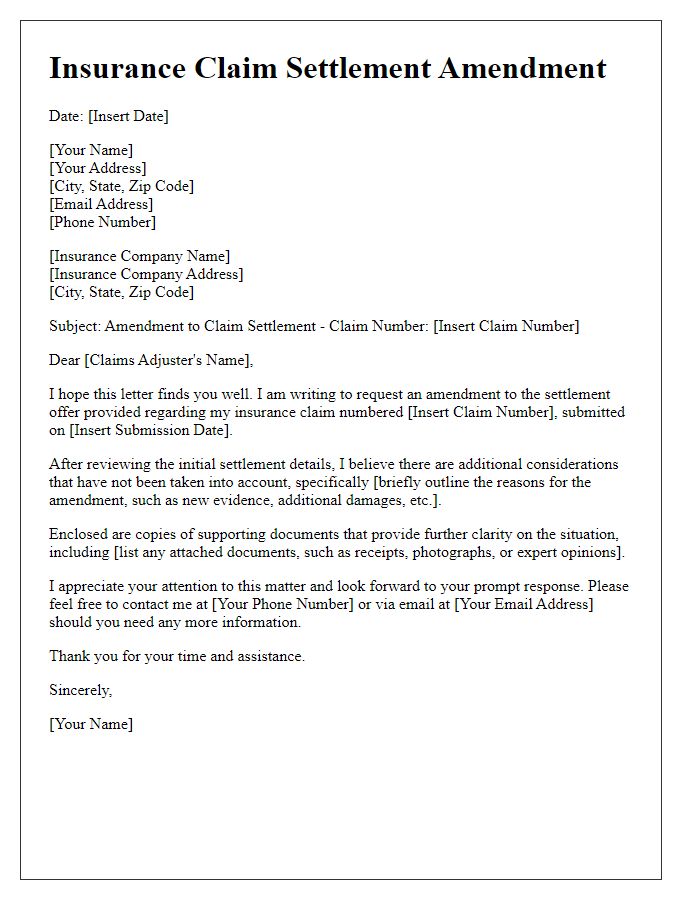

An adjusted insurance claim settlement requires comprehensive claimant information to ensure accuracy and expedite processing. This includes essential personal details such as the claimant's full name, residential address, phone number, and email address. Important identifiers like the policy number, claim number, and date of loss also play a crucial role in tracking the claim's progress. Descriptive documentation related to the incident, including police reports for accidents, photographs of damages, and receipts for expenses incurred, strengthens the claim's validity. Additionally, clear statements regarding medical expenses in case of personal injury claims and repair estimates for property damage provide necessary context for evaluators. Accurate and detailed information facilitates a smoother settlement process, reducing delays and increasing satisfaction for all parties involved.

Concise Settlement Amount Breakdown

An insurance claim settlement can involve a concise breakdown of the total amount and its components. For instance, a claim for water damage restoration might total $10,000. This figure could comprise $6,000 for structural repairs (including drywall replacement and flooring), $2,000 for mold remediation services (utilizing EPA-approved treatments), $1,500 for personal property replacement (such as furniture and electronics), and $500 for additional living expenses incurred during the restoration process (like temporary housing). Each category reflects the impact of an unforeseen event, demonstrating a detailed allocation of resources paid out by the insurance company.

Contact Information for Further Assistance

Adjusting the insurance claim settlement can be a complex process, often requiring effective communication with your insurance provider. Relevant documentation includes the claim number, policy number, and the date of the incident. For further assistance, it is crucial to have up-to-date contact information for the claims representative assigned to your case, including their phone number and email address. Additionally, having a record of previous correspondence and any supporting documents, such as photos from the incident or estimates for repairs, can streamline the process. Clear communication can facilitate a prompt and fair resolution to your insurance claim.

Comments