Are you feeling overwhelmed by the claims process for your insurance? You're not alone! Many people find navigating through the complexities of insurance claims to be a daunting task. In this article, we'll break down the steps and provide tips to help you get the most out of your claim experienceâso you can feel empowered and informed. Ready to dive in?

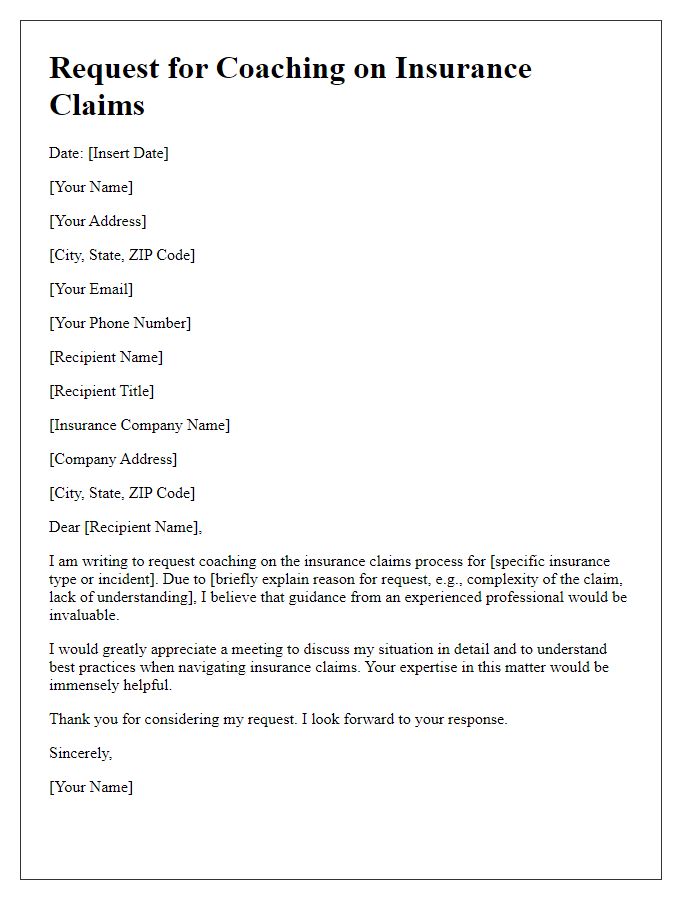

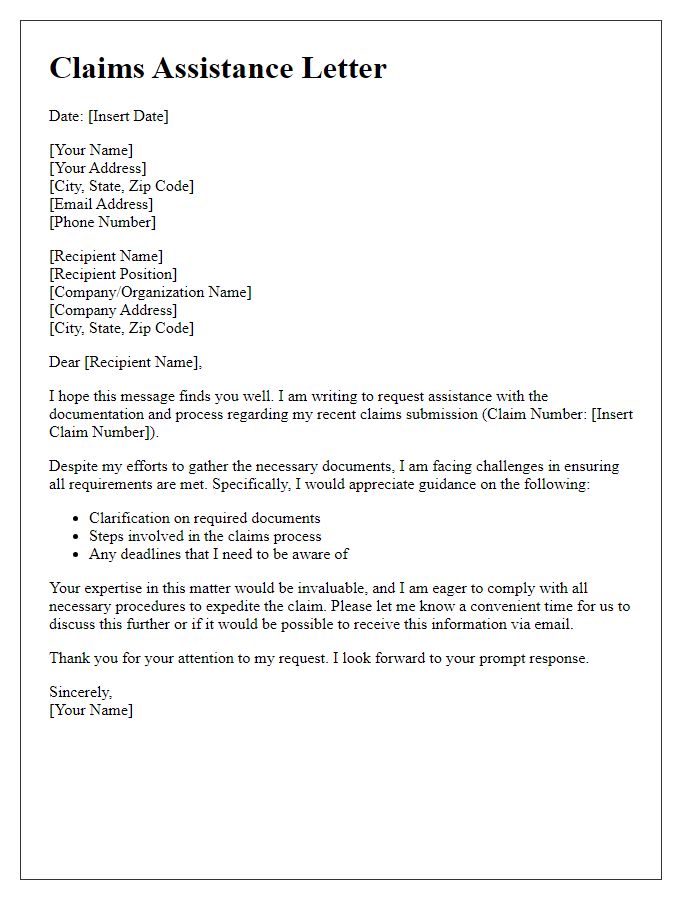

Clear subject line and purpose

Navigating the claims process in insurance can be overwhelming. An organized approach is crucial to ensure a successful outcome. A clear subject line (like "Guidance on Submitting Your Insurance Claim") sets a focused tone for communication. The purpose of coaching in this process includes understanding the specific claims requirements, gathering necessary documentation, and adhering to deadlines for submission (often within 30 days of the incident). Highlighting the importance of maintaining thorough records (such as photos, receipts, and witness statements) can significantly strengthen the claim. Moreover, explaining the potential follow-up actions after submission, including communication with the claims adjuster and tracking the status of the claim, is essential for effective navigation and resolution of insurance matters.

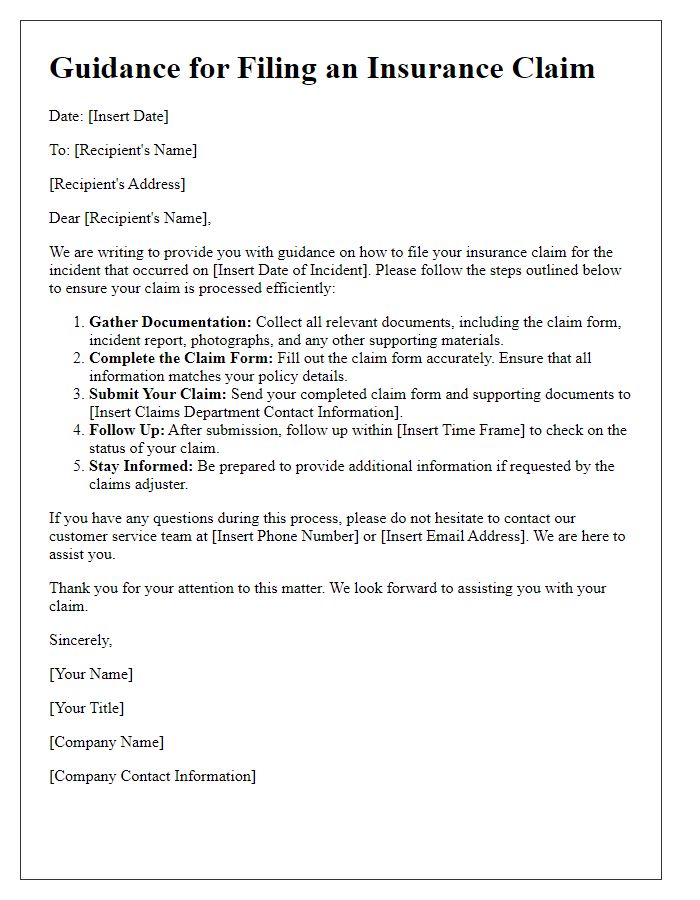

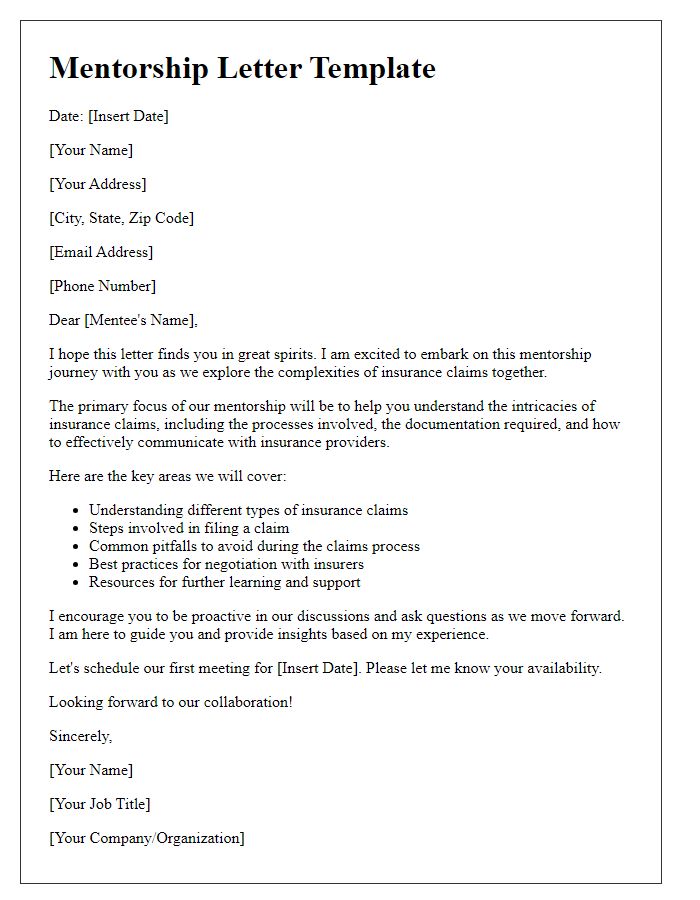

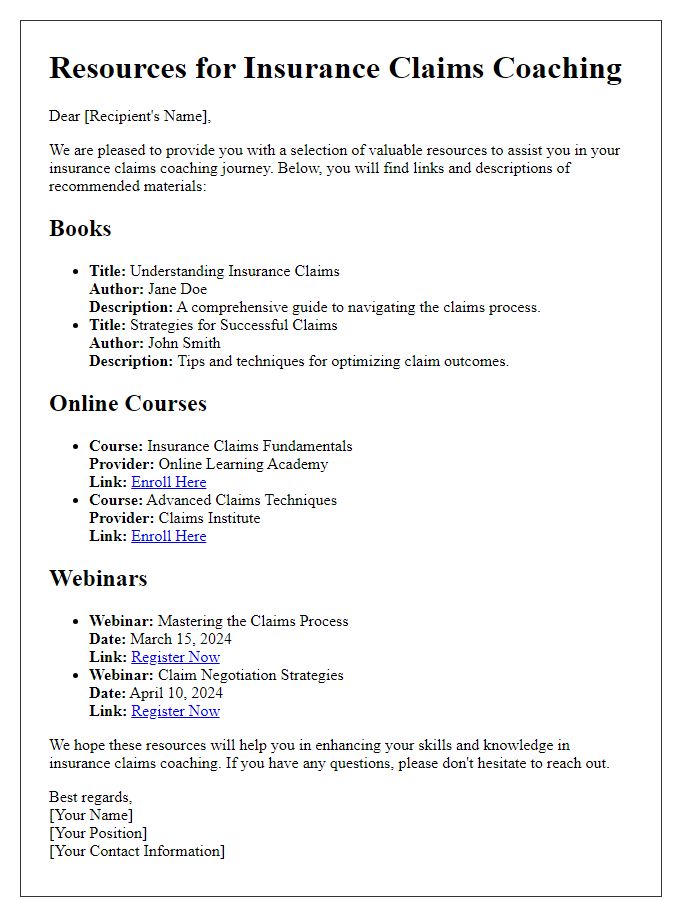

Detailed claim information

The claims process for insurance involves several critical steps, including the submission of detailed claim information to ensure a smooth and efficient evaluation. Essential elements of the claim include the policy number, a unique identifier representing the insurance agreement between the policyholder and the company, along with the date of the incident, which marks the timeline of the event. Additionally, a comprehensive description of the damage or loss is crucial, providing context to the situation, such as the type of claim--ranging from property damage to personal injury. Documentation like photographs of the damage, estimates for repairs, and all relevant receipts are necessary for substantiating the claim. Furthermore, any witness statements or police reports, particularly in incidents like accidents or theft, can further validate the claim's legitimacy. Finally, understanding the deductible amount, specified in the insurance policy, is vital for the policyholder, as it determines the out-of-pocket expense before the coverage applies.

Supporting documentation checklist

In the claims process for insurance policies, the supporting documentation checklist is essential to ensure a successful submission. Primary documents include a completed claims form (specific to the insurance company, e.g., State Farm or Allstate), a copy of the policy (detailing coverage limits, effective dates), and proof of loss (such as photographs or receipts related to the claim incident). Additional evidence like police reports (important for claims involving theft or accidents), medical records (for health-related claims), and witness statements (to validate circumstances of the claim) bolster the case. For property damage claims, estimates from licensed contractors or repair bills enhance credibility. Maintain a thorough record of all correspondence (emails, letters, phone calls) with the insurance provider to support your claim's progress. Adhering to this checklist can streamline the claims process and increase the likelihood of a favorable outcome.

Contact information for follow-up

Insurance claims coaching involves guiding individuals through the complexities of filing a claim to ensure optimal outcomes. Key elements include understanding policy terms, knowing required documentation, and following timelines. Clear contact information for follow-up aids in communication and ensures all inquiries are addressed promptly. Essential details often include the coach's full name, phone number, and email address, as well as the insurance company's contact information such as customer service numbers, claims department hours, and relevant claim reference numbers. Proper organization of this information can streamline the claims process, reducing stress for the claimant and increasing the efficiency of communications with insurance representatives.

Polite closing and next steps guidance

During the claims process for insurance, clear communication is vital for ensuring a smooth experience for all parties involved. After discussing your situation, it's essential to express gratitude to the claims adjuster or representative for their assistance. Additionally, outline the next steps to keep everyone informed, such as submitting required documentation or scheduling a follow-up call. Encourage the recipient to reach out for further clarification or support, ensuring they feel supported throughout the process. A polite closing statement reinforces the cooperative nature of the interaction and leaves the door open for ongoing communication.

Comments