Have you ever wondered what umbrella insurance really is and how it can enhance your existing coverage? This type of insurance acts as an extra layer of protection, safeguarding your assets from unexpected events. Many people overlook it, thinking their standard policy is sufficient, but umbrella insurance can make a significant difference in financial security. Curious to learn more about its benefits and how it works? Keep reading!

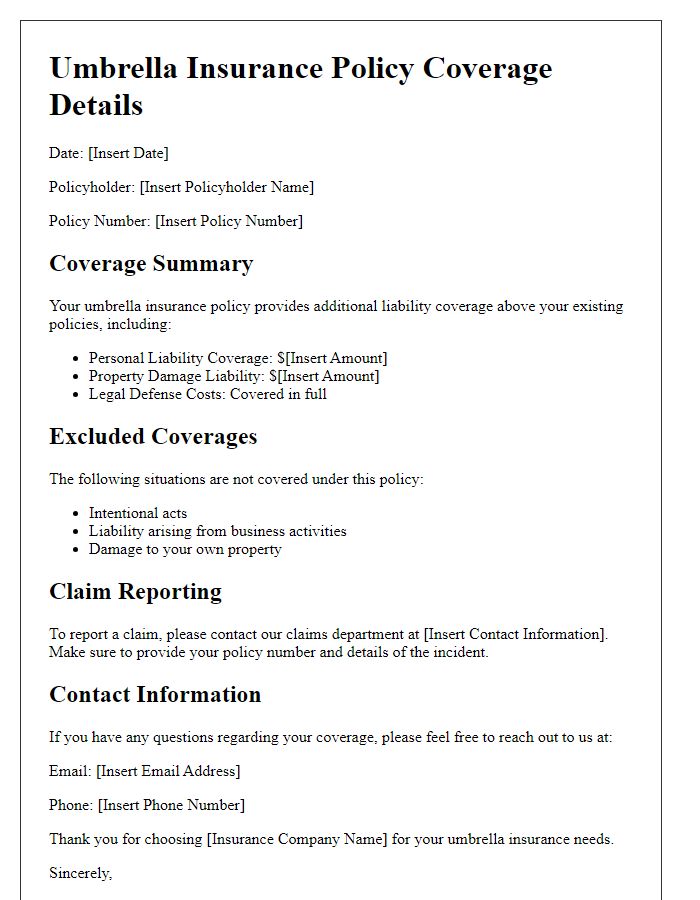

Clear Coverage Summary

Umbrella insurance provides an additional layer of liability protection beyond existing policies, like auto and home insurance. Typically starting at $1 million in coverage, this policy safeguards individuals from substantial financial losses arising from lawsuits, accident claims, or personal injury cases. For instance, if a homeowner faces a lawsuit due to an injury on their property, their primary home insurance may cover initial damages, but umbrella insurance can cover excess amounts exceeding that policy limit. Moreover, it protects against claims that may not be included in standard policies, such as libel or slander. This supplemental coverage is especially beneficial for high-net-worth individuals or those with significant assets to protect, offering peace of mind against unpredictable legal costs and potential judgments.

Benefit Highlights

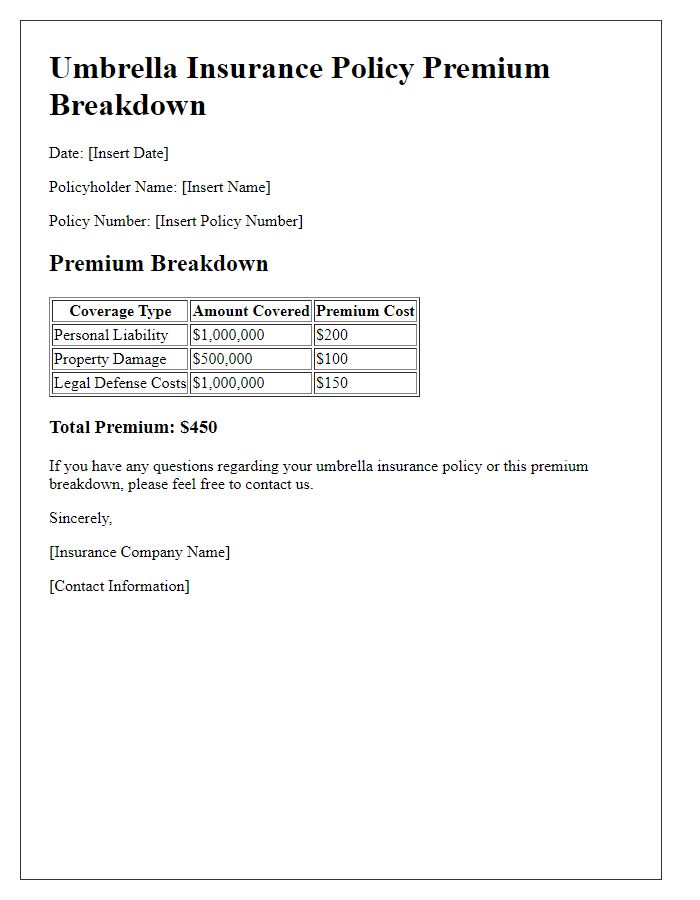

Umbrella insurance provides additional liability coverage beyond the limits of home, auto, and other specific insurance policies. This type of policy is essential for protecting assets from potential lawsuits. Coverage typically starts at $1 million, offering a safety net that addresses claims arising from incidents such as accidents, injuries, or property damage. Umbrella policies often extend to legal defense costs, which can be significant in high-stake legal battles. For example, a car accident resulting in severe injuries could lead to claims exceeding auto insurance limits, but umbrella insurance can cover these excess amounts, safeguarding financial stability. Additionally, umbrella insurance may include coverage for certain situations not covered by primary policies, such as slander or libel. This comprehensive protection proves invaluable for individuals with substantial assets or those at a higher risk of lawsuits.

Policy Exclusions

Umbrella insurance policies offer additional liability coverage beyond standard homeowners, auto, or renters insurance, protecting assets against significant claims. However, certain exclusions apply that limit coverage. Personal injury claims, such as those involving defamation, discrimination, or false arrest, are often excluded. Additionally, intentional acts, including criminal activity or bodily harm to others, do not qualify for coverage under these policies. Furthermore, business-related liabilities, such as injuries occurring on a commercial property or advertising-related claims, typically fall outside the purview of umbrella insurance. Understanding these exclusions is critical for policyholders seeking comprehensive protection.

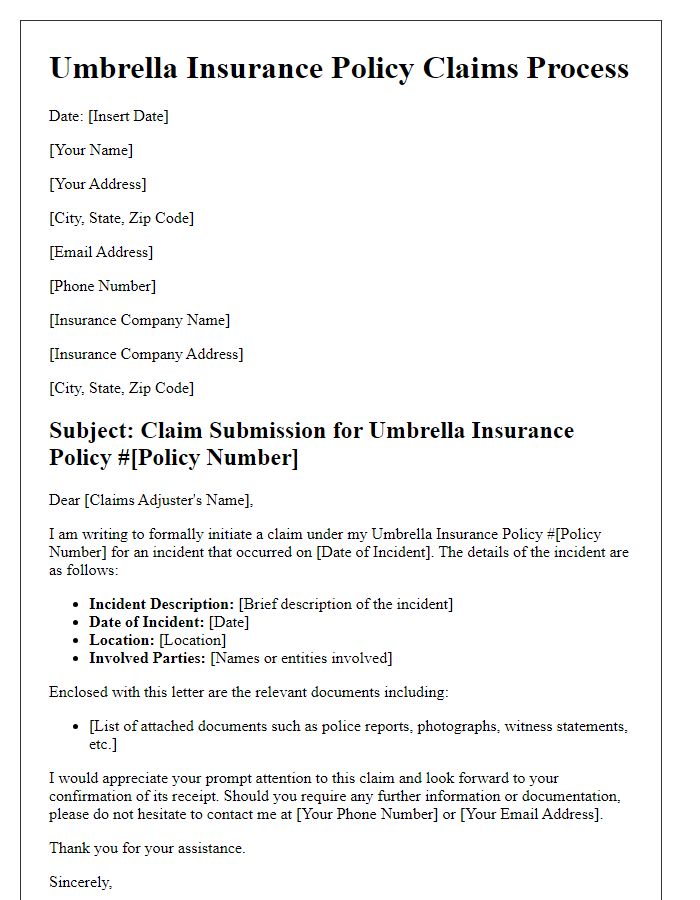

Claim Process Overview

Umbrella insurance policies provide additional liability coverage beyond standard policies, offering financial protection against significant claims or lawsuits. The claims process typically begins by reporting an incident, such as a vehicle accident or property damage, to your insurance agent or company. Upon notification, an adjuster is assigned to evaluate the claim's circumstances, requiring any relevant documentation like police reports or witness statements. Once the investigation concludes, compensation is determined based on the policy limits (often starting at $1 million) and the specifics of the incident. Timely communication with your insurer is crucial to adhere to any deadlines or requirements outlined in your policy agreement. Understanding this streamlined process can significantly alleviate stress during a challenging time.

Contact Information for Assistance

In today's unpredictable world, maintaining a comprehensive insurance strategy is crucial for safeguarding personal assets. An umbrella insurance policy offers additional liability coverage beyond standard home and auto insurance, typically starting at $1 million in coverage. This type of policy protects individuals from significant financial loss arising from claims such as personal injury, property damage, or legal fees, enhancing peace of mind. For policyholders seeking clarification on coverage specifics, claims processes, or premium adjustments, contact the customer service department directly. Representatives are available Monday through Friday from 9 AM to 5 PM EST at the toll-free number, ensuring timely and informative assistance for all inquiries related to umbrella insurance provisions.

Letter Template For Umbrella Insurance Policy Explanation Samples

Letter template of umbrella insurance policy for high-net-worth individuals

Comments