When life throws unexpected challenges our way, like a catastrophic event, it's crucial to know how to navigate the insurance claim process. Understanding the nuances of your insurance policy and effectively communicating your situation can make all the difference in receiving the assistance you need. Whether you're facing property damage or loss, having a well-structured letter can help ensure your claim is processed smoothly. Ready to learn how to craft the perfect letter for your catastrophic event insurance claim? Let's dive in!

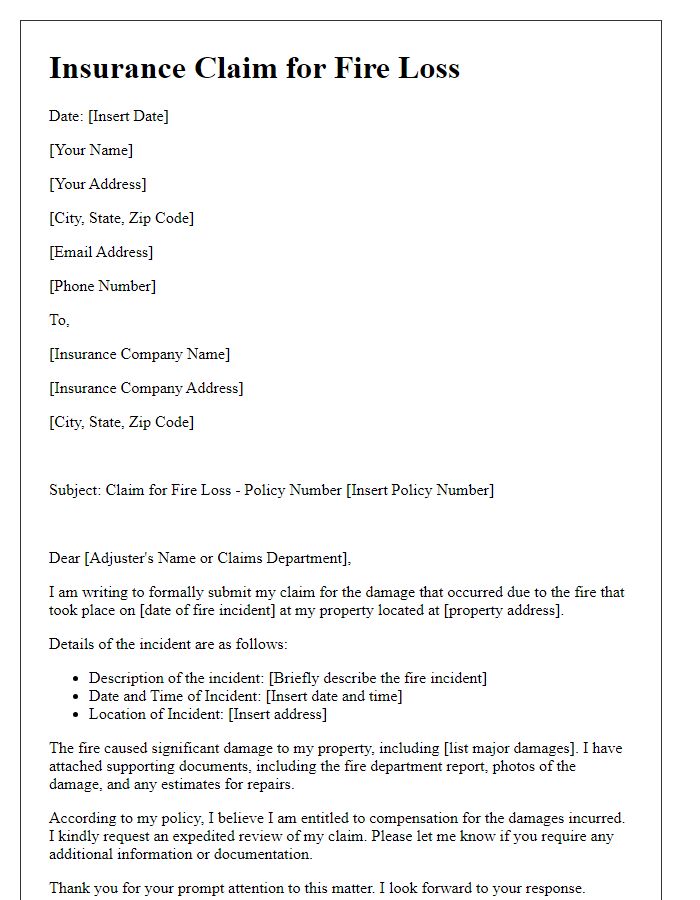

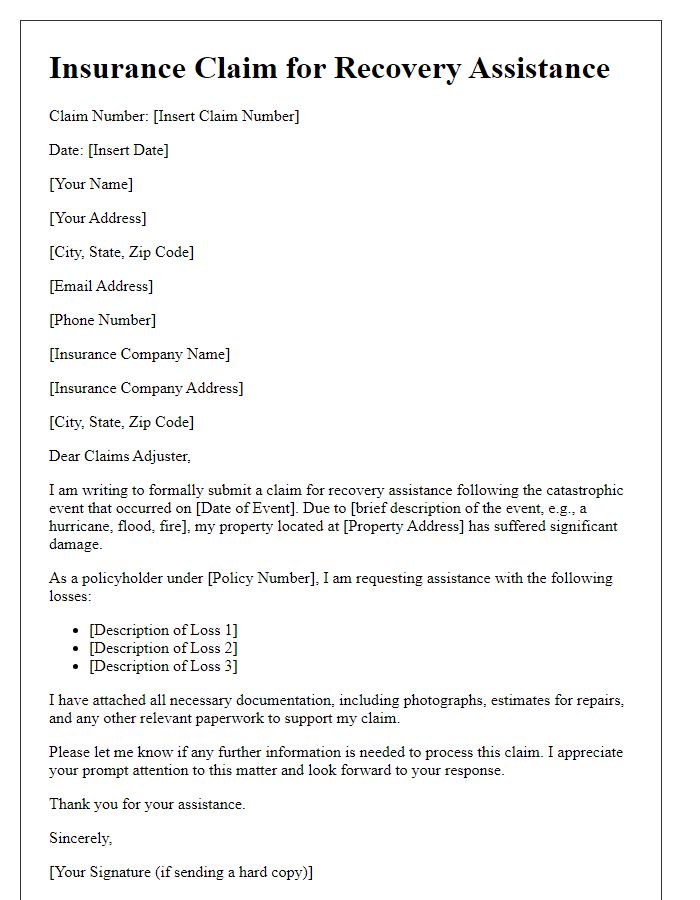

Policyholder Information

Catastrophic event insurance claims play a critical role in helping individuals recover from disasters, such as hurricanes, earthquakes, or wildfires. A policyholder's information includes essential details like their full name, policy number, contact information, and address, allowing insurance companies to efficiently process claims. Documentation of the specific event (e.g., Hurricane Katrina in 2005) is crucial, alongside evidence of property damage through photographs and repair estimates. Additionally, date and time of the event must be clearly noted, as well as descriptions of damages to personal property or real estate, which helps in the accurate assessment and validation of claims submitted for financial recovery.

Description of Catastrophic Event

A catastrophic event, such as Hurricane Ian in September 2022, can lead to severe property damage and significant financial loss for affected individuals. The hurricane made landfall in Florida, causing extensive flooding and wind damage exceeding 150 mph. Homes, businesses, and infrastructure suffered destruction, with over 100,000 properties submerged in water, leading to loss of personal belongings. Emergency services reported widespread power outages affecting millions, with repair efforts taking weeks to restore service. The aftermath includes a slow recovery process, where individuals face mounting repair costs, loss of income, and emotional distress from property upheaval, necessitating urgent assistance from catastrophic event insurance claims to alleviate financial burdens and aid in recovery efforts.

Detailed Damage Assessment

A thorough damage assessment following a catastrophic event, such as Hurricane Ida in August 2021, involves documenting the extent of destruction to property. Roof damage, often involving missing shingles or significant leaks, can lead to interior water damage estimated in thousands of dollars for repairs. Walls may exhibit cracks or warping, necessitating structural assessments and potentially extensive renovations. Furnishings, including furniture damaged by flooding or debris, could result in losses that significantly impact the homeowner's finances. Electrical systems, affected by water intrusion, may require rewiring to ensure safety standards are met. Detailed photographs of each affected area and receipts for damaged property should accompany the assessment to facilitate the claims process with the insurance provider. Collectively, this comprehensive approach ensures that all aspects of the damage are thoroughly documented, aiding in prompt and fair compensation.

Supporting Documentation

Supporting documentation is crucial for catastrophic event insurance claims, such as those arising from natural disasters like hurricanes, floods, and wildfires. Essential documents include the insurance policy (verifying coverage details), photographs of damage (time-stamped images showcasing extent of loss), repair estimates (quotes from licensed contractors in the area), and a comprehensive inventory list (detailed description of damaged or lost items with purchased value). Additionally, official reports (like police or fire department reports) documenting the event and any related correspondence with the insurance company should be included. Generated records (such as bank statements evidencing financial losses) and witness statements (providing accounts of the event) can further substantiate the claim, creating a robust case for recovery of losses sustained during the catastrophic event.

Contact Information for Follow-up

Catastrophic events, such as natural disasters, can lead to significant financial loss for individuals, impacting property and assets. During such events, maintaining accurate contact information is crucial for efficient follow-up regarding catastrophic event insurance claims. Ensure that your primary and secondary phone numbers (including area codes), email addresses, and mailing addresses are up to date with your insurance provider. In the aftermath of devastating events, such as hurricanes, earthquakes, or wildfires, timely communication can expedite the processing of claims, enabling policyholders to receive financial assistance for repairs or replacements. Keeping an organized record of contacts, including claims adjusters and customer service representatives, enhances the likelihood of a favorable outcome in the claims process.

Letter Template For Catastrophic Event Insurance Claim Samples

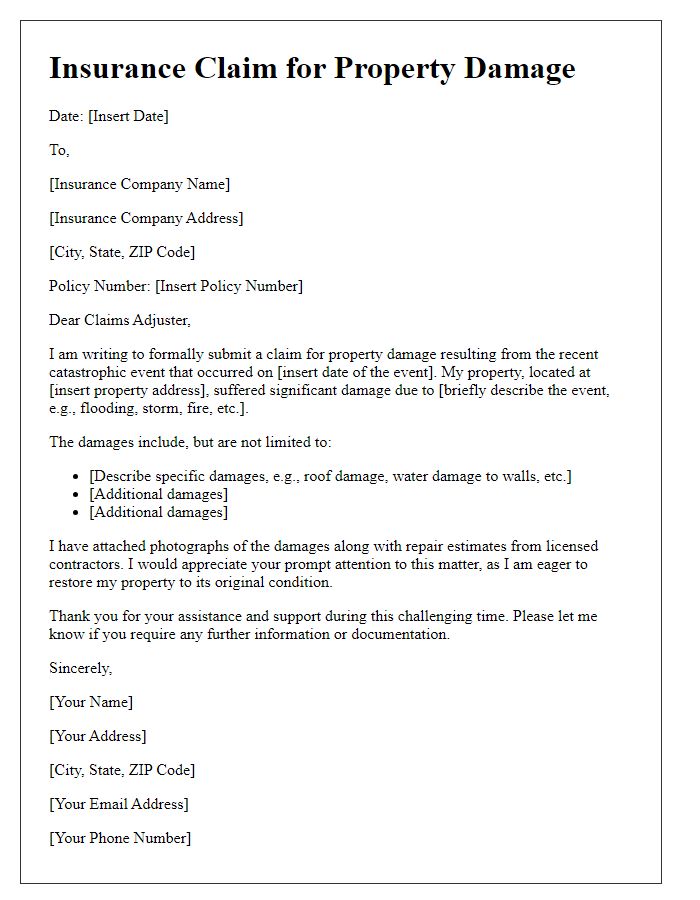

Letter template of catastrophic event insurance claim for property damage.

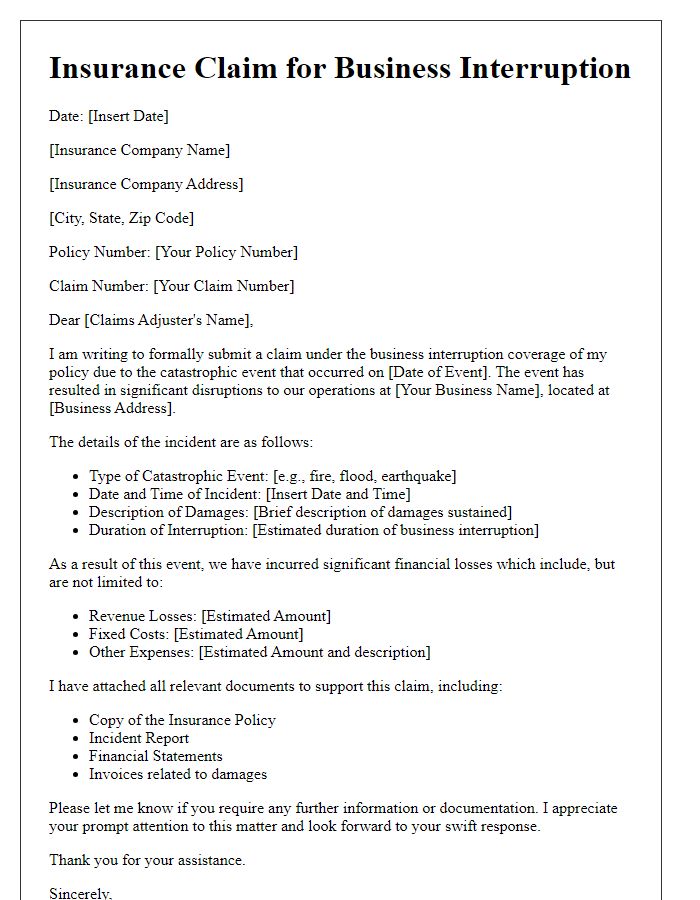

Letter template of catastrophic event insurance claim for business interruption.

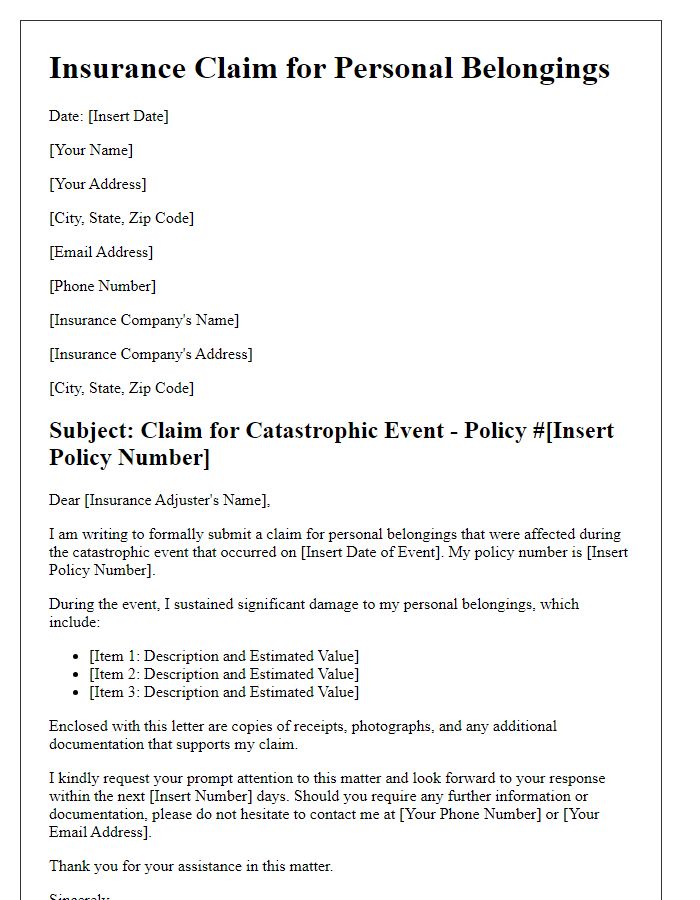

Letter template of catastrophic event insurance claim for personal belongings.

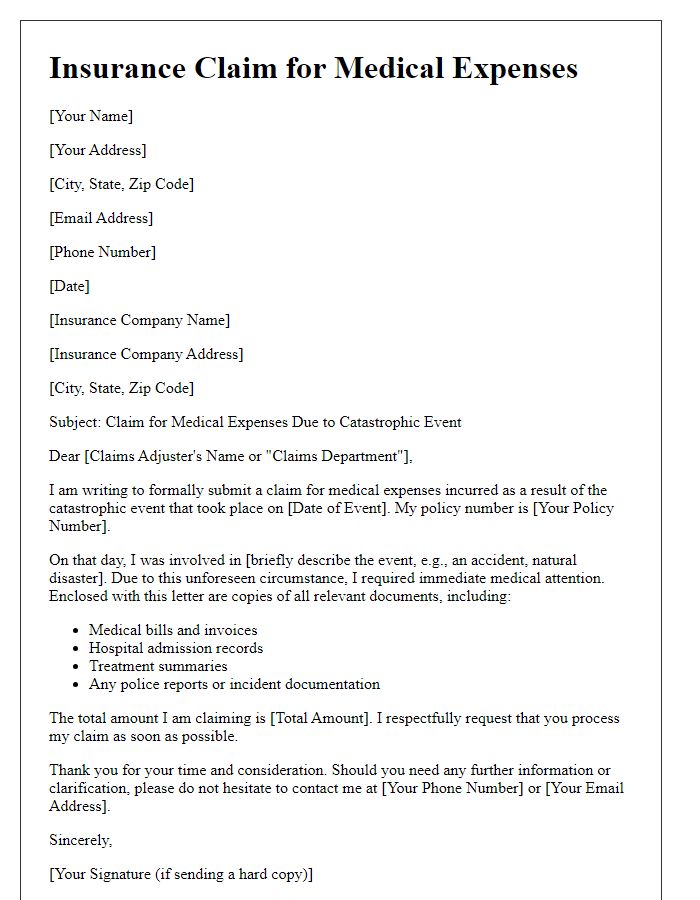

Letter template of catastrophic event insurance claim for medical expenses.

Letter template of catastrophic event insurance claim for natural disaster.

Comments