Are you feeling overwhelmed by the idea of liability coverage insurance? You're not alone! Many people find the various requirements and checklists daunting, but understanding the essentials can make the process smoother. In this article, we'll break down a simple liability coverage insurance checklist, so you can easily navigate your optionsâread on to discover the key elements you need to consider!

Coverage Limits

Liability coverage insurance aims to protect individuals and businesses from financial losses due to legal claims or lawsuits. Coverage limits refer to the maximum amount an insurance policy will pay for covered damages or legal expenses. Understanding your coverage limits is essential for effective financial risk management. For instance, the state of California requires minimum liability coverage of $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage. Higher coverage limits can significantly increase premiums but provide greater protection in the event of serious claims. Properly assessing personal or business needs helps determine appropriate coverage limits to mitigate potential liabilities associated with accidents, injuries, or property damage. Regularly reviewing these limits, particularly after significant life events or changes in business operations, ensures adequate protection against evolving risks.

Policy Exclusions

Liability coverage insurance policies often come with specific exclusions that define circumstances in which the insurance will not provide coverage. Common exclusions include intentional acts, such as fraud or vandalism, which disqualify claims resulting from purposeful harm. Certain activities, like extreme sports or high-risk jobs (construction, firefighting), may be excluded based on the policy terms and conditions. Damage to specific property types, such as personal vehicles or rental properties, may not be covered under a general liability policy. Additionally, exclusions may apply to contractual liabilities, typically involving agreements that extend beyond normal legal obligations. Insurance providers often detail these exclusions in policy documentation to ensure policyholders understand the limitations of their coverage.

Claim Procedures

The liability coverage insurance checklist for claim procedures outlines essential steps to navigate the claims process effectively. Policyholders should document the incident details, including date, time, and location, as well as collect evidence such as photographs of damages and witness statements. Inform the insurance provider promptly, ideally within 24 hours after the incident occurs, ensuring compliance with specific state regulations. Fill out the required claim forms, providing clear descriptions of the events leading to the claim. Maintain records of all correspondence, including emails and phone calls, while also keeping track of medical bills or repair estimates associated with the claim. Finally, follow up diligently on the claim's status to expedite the processing time and receive compensation per the policy terms.

Premium Details

Liability coverage insurance requires careful consideration of multiple premium details to ensure comprehensive protection. Different coverage limits, such as $300,000 or $1 million, impact the overall premium cost. Factors like deductible amounts, often ranging from $500 to $5,000, influence out-of-pocket expenses in the event of a claim. Geographic location plays a role in premium calculations, with regions prone to higher risk events, such as natural disasters or high crime rates, potentially incurring elevated costs. The insured's claims history significantly affects premium rates; a history of frequent claims may lead to higher premiums. Lastly, payment options, including annual or monthly installments, provide flexibility but may also alter the total premium due to financing fees.

Additional Insureds

Liability coverage insurance policies often require a checklist to ensure all necessary Additional Insureds are included. The checklist should encompass entities such as subcontractors, vendors, or property owners (large construction companies might list several). Specific details should be captured, such as the relationship to the primary insured, effective dates of coverage, and any required endorsements. Certain criteria must be met for entities to qualify as Additional Insureds, based on contractual agreements or written requests. Reviewing documents such as insurance certificates and policies is essential to maintain compliance with state regulations and industry standards, as failure to list Additional Insureds could result in significant financial liability in case of events such as accidents or property damage.

Letter Template For Liability Coverage Insurance Checklist Samples

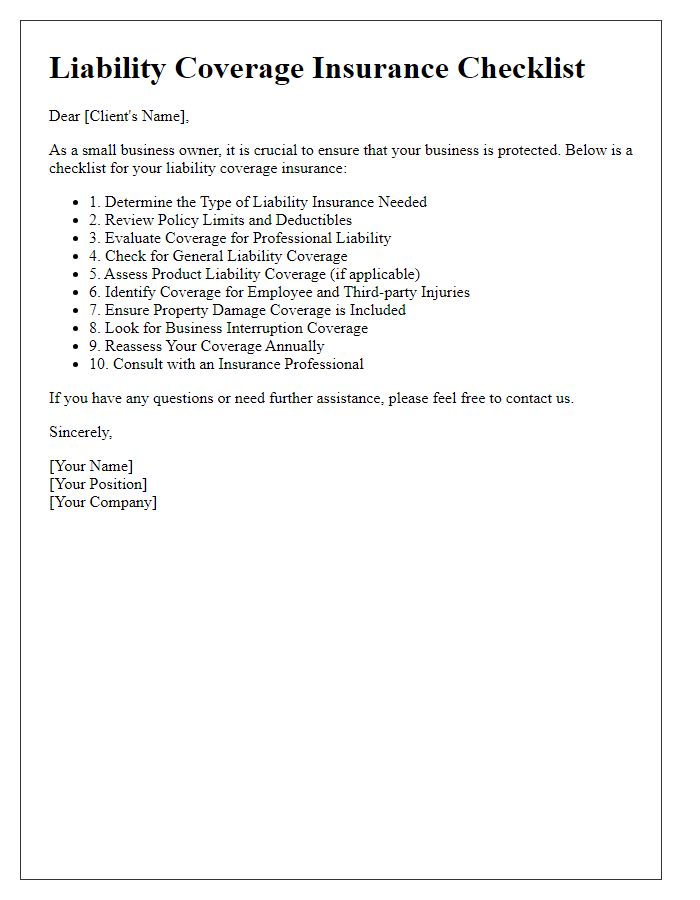

Letter template of liability coverage insurance checklist for small businesses.

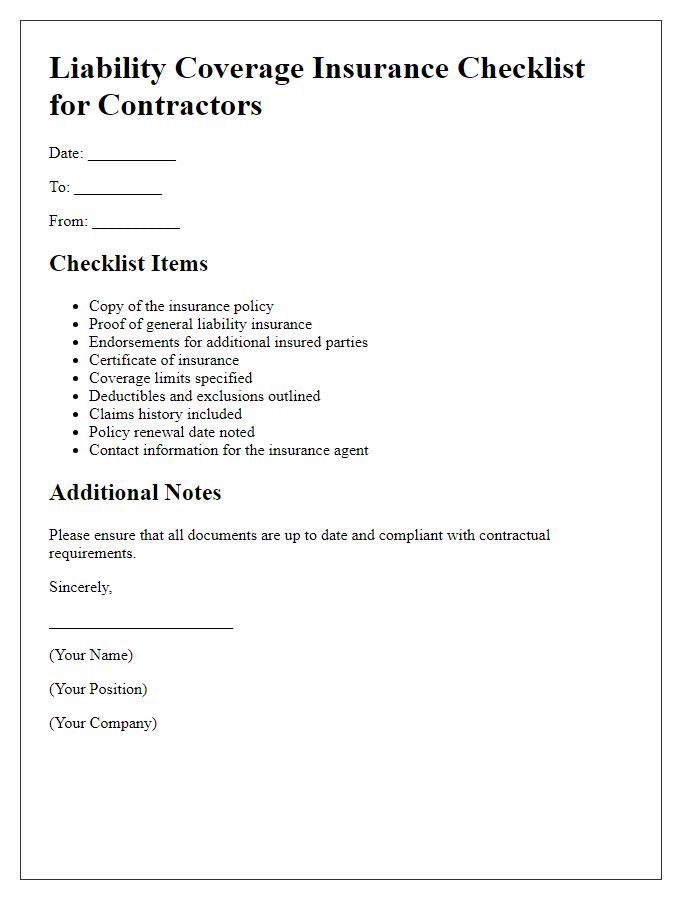

Letter template of liability coverage insurance checklist for contractors.

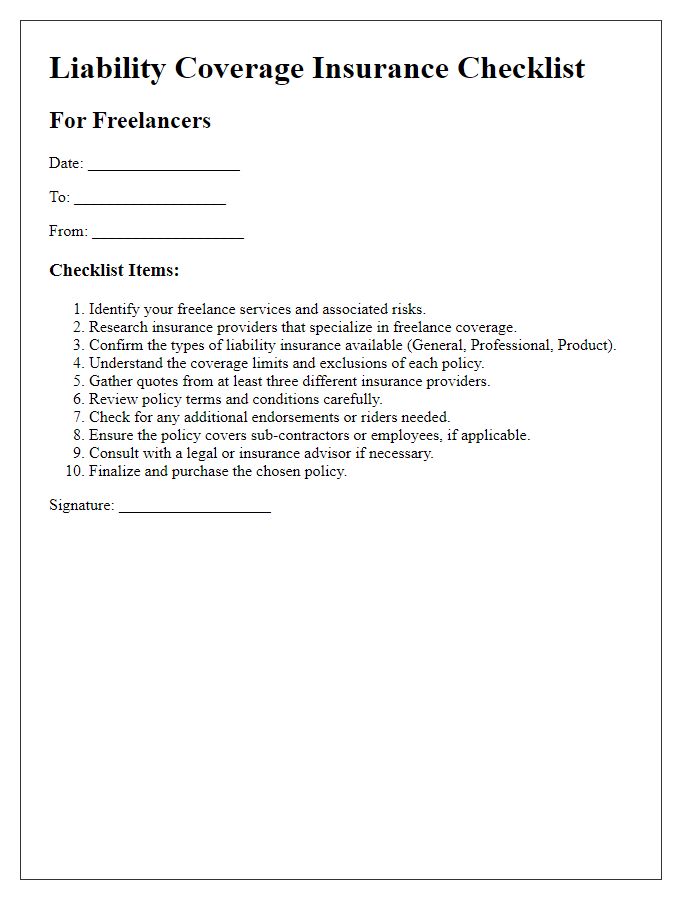

Letter template of liability coverage insurance checklist for freelancers.

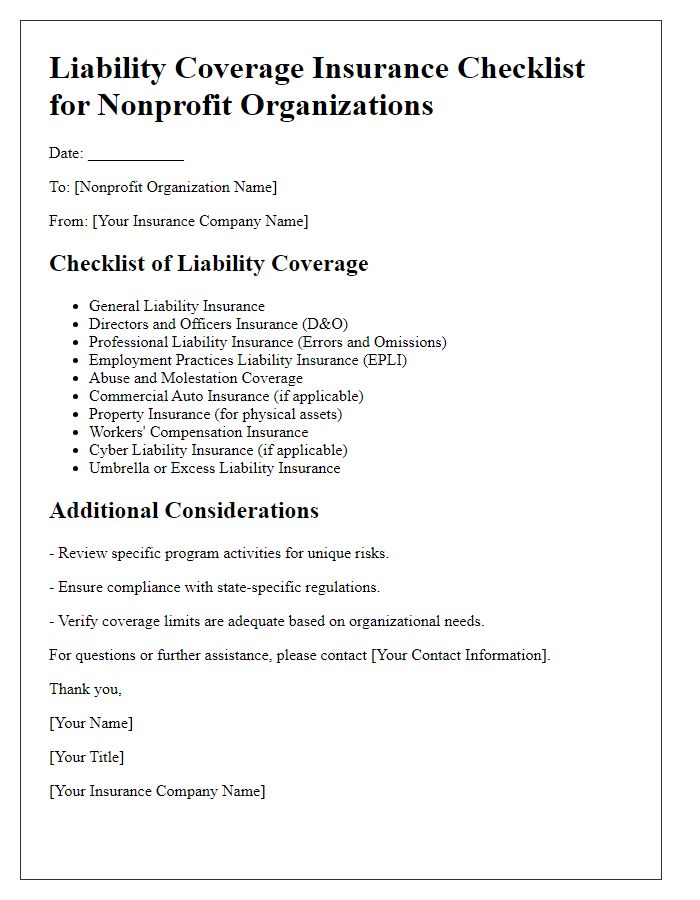

Letter template of liability coverage insurance checklist for nonprofit organizations.

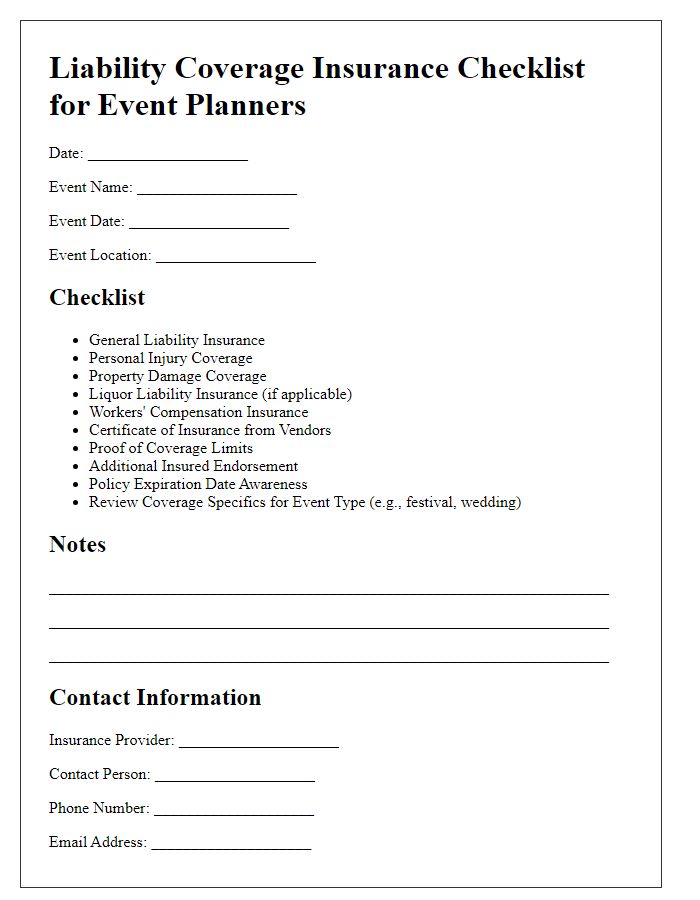

Letter template of liability coverage insurance checklist for event planners.

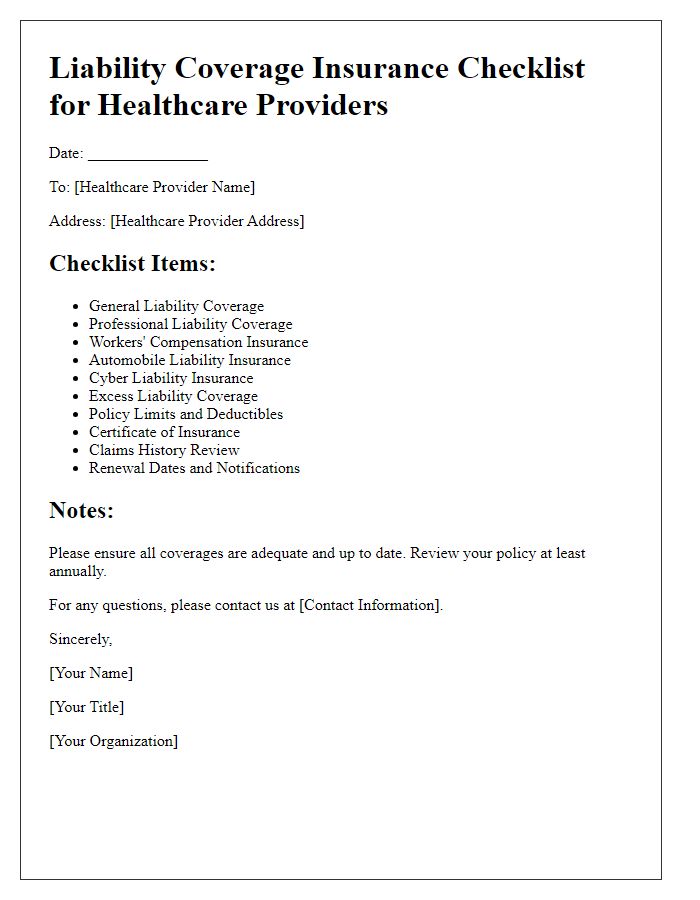

Letter template of liability coverage insurance checklist for healthcare providers.

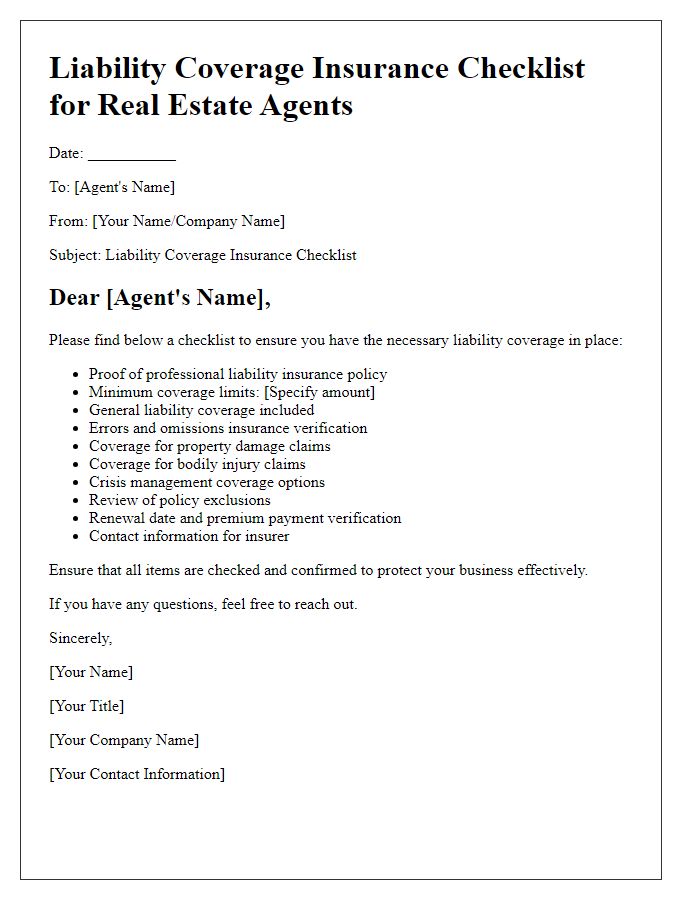

Letter template of liability coverage insurance checklist for real estate agents.

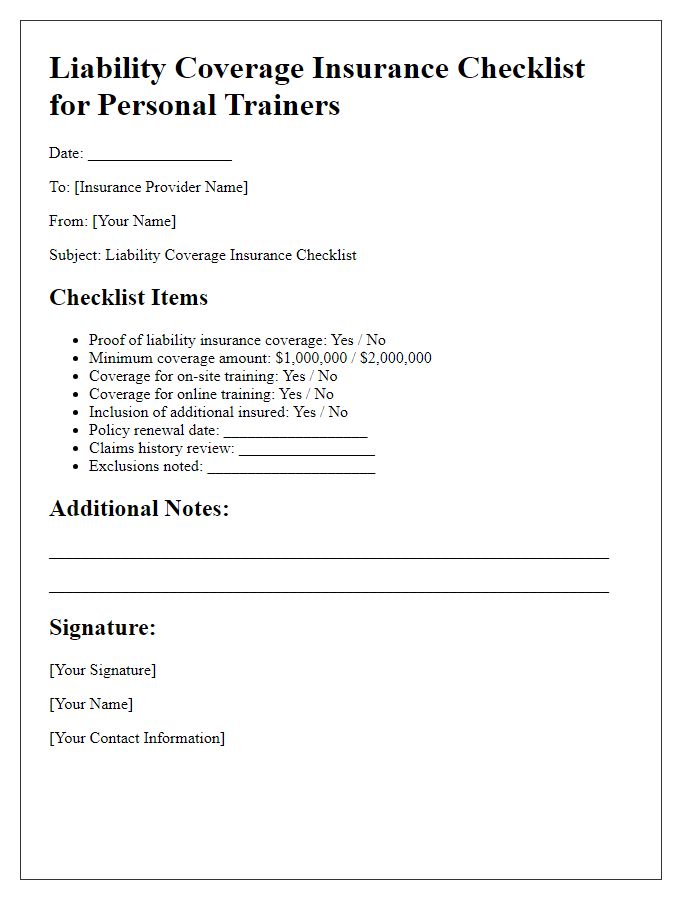

Letter template of liability coverage insurance checklist for personal trainers.

Letter template of liability coverage insurance checklist for e-commerce businesses.

Comments