Life is full of changes, and one of the most significant can be your marital status. Whether you're celebrating a new beginning or navigating a transition, it's essential to keep your insurance policies up to date to ensure you have the right coverage. Updating your marital status not only affects your policy but can also influence your premiums and benefits. If you're curious about how this change impacts your coverage, keep reading for all the details!

Personalized Greeting

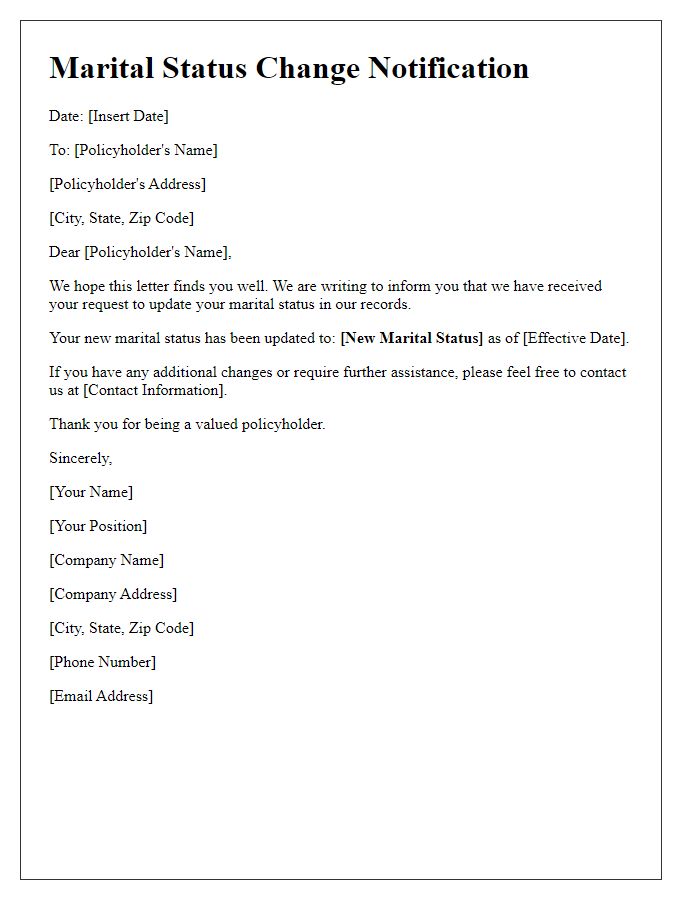

Updating marital status can have significant implications for insurance policies and coverage options. A change in marital status, whether due to marriage or divorce, can influence premium rates, beneficiary designations, and coverage needs. For instance, married policyholders may qualify for discounted rates or bundled policies, while those divorcing may need to reevaluate their current coverage. Accurate and timely updates in marital status are essential to ensure that benefits and coverage accurately reflect the policyholder's current situation, preventing potential claim complications and ensuring compliance with policy terms.

Policyholder Information

Updating marital status is crucial for maintaining accurate insurance records. When a policyholder experiences a change in marital status, such as marriage or divorce, this information impacts coverage, beneficiaries, and premiums. Accurate updates ensure compliance with state regulations and promote effective customer service. Proper documentation may include a marriage certificate or divorce papers as proof of status change. Insurance policies, such as health, life, and auto insurance, may require immediate updates to reflect the new marital dynamics accurately, ensuring continued protection and aligning benefits with the policyholder's current situation.

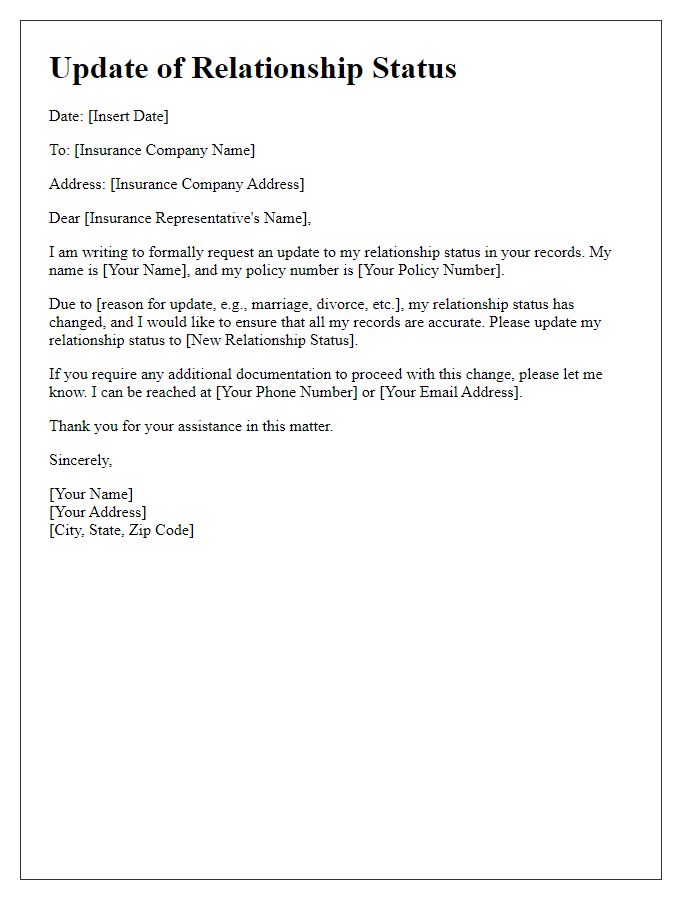

Reason for Update

Updating marital status is essential for ensuring accurate reflection of personal circumstances within insurance policies. Marital changes, such as marriage or divorce, can significantly affect coverage needs, premiums, and beneficiaries. For instance, adding a spouse may require adjustments in coverage limits for life insurance policies. Conversely, a divorce may necessitate the removal of an ex-spouse from coverage, thereby impacting dependency considerations. Maintaining current records helps insurance companies provide appropriate product recommendations and ensures that policyholders receive the necessary support aligning with their updated familial situation.

Required Documentation

Updating marital status for insurance policies requires specific documentation to ensure accurate records. Essential documents include a certified copy of the marriage certificate, which serves as proof of the union and date of marriage. In cases of divorce, a finalized divorce decree may be necessary to update beneficiary information and policyholder details. If applicable, documentation may also include a death certificate of a spouse to update the policy. Submitting these documents helps maintain seamless communication and ensures entitlements are appropriately assigned in accordance with the policy terms.

Contact Information

Updating marital status is crucial for insurance policies to ensure coverage accuracy. Policyholders must provide up-to-date contact information, including primary phone number (preferably a mobile number for rapid communication), email address for digital correspondence, and home address for official documentation. Policyholders should also note the date of the marital status change, specifying whether it involves a marriage, divorce, or any other relevant change. Accurate update of this information facilitates appropriate adjustments in policy benefits and ensures beneficiaries are correctly designated, thereby enhancing the overall integrity of insurance coverage.

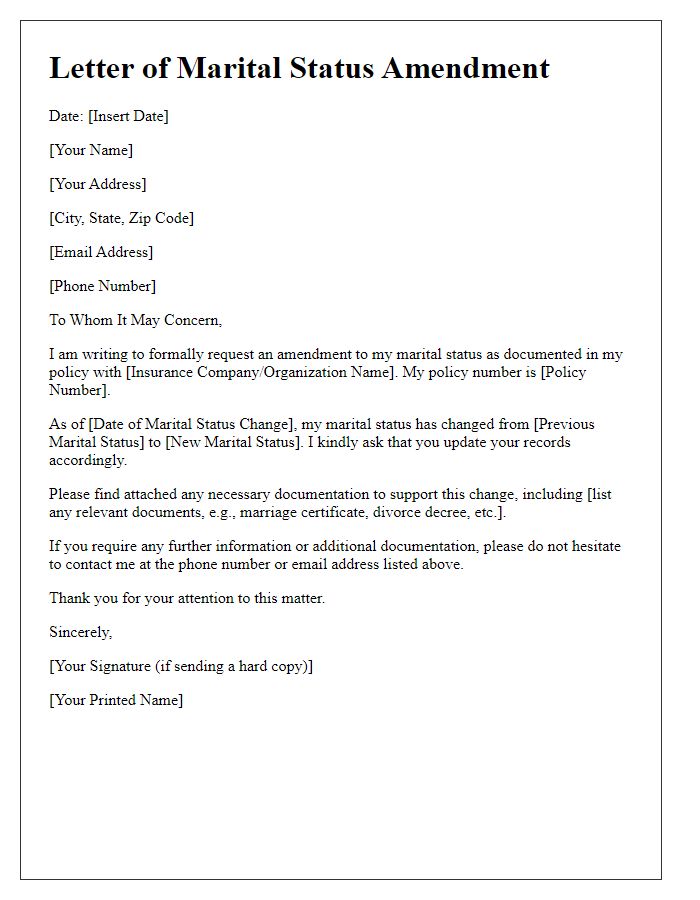

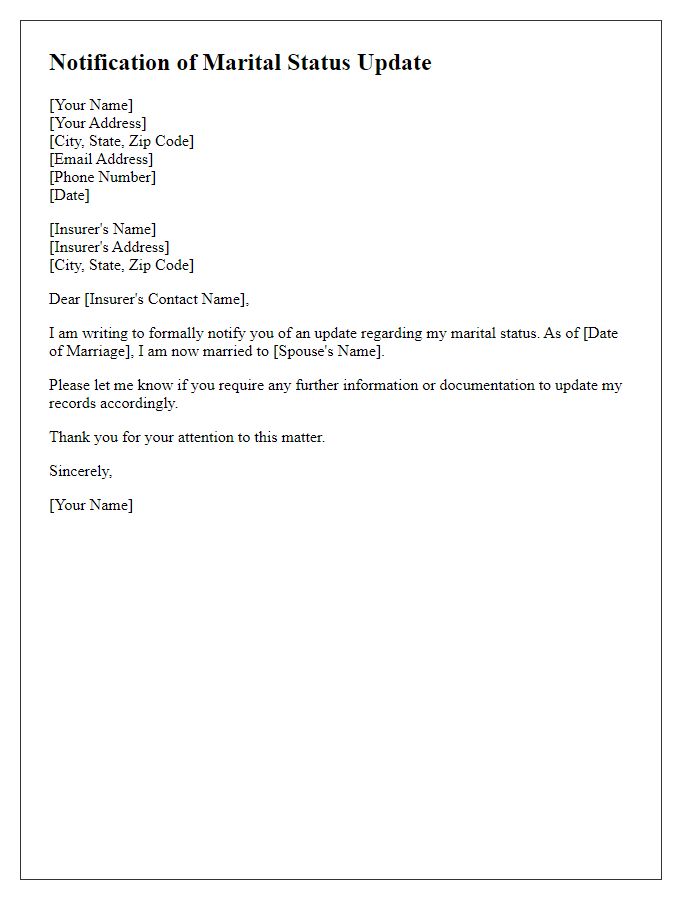

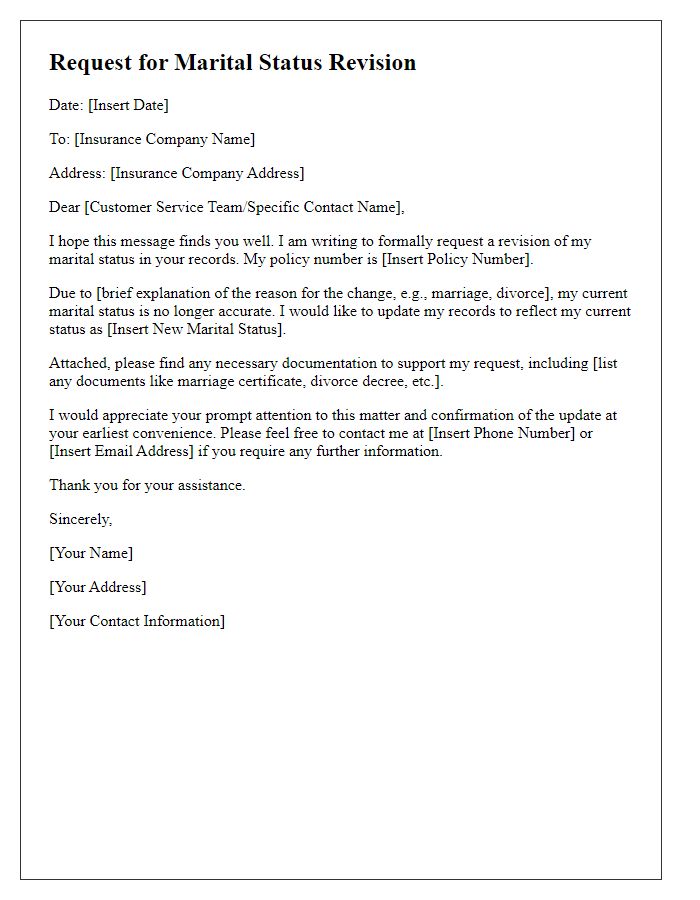

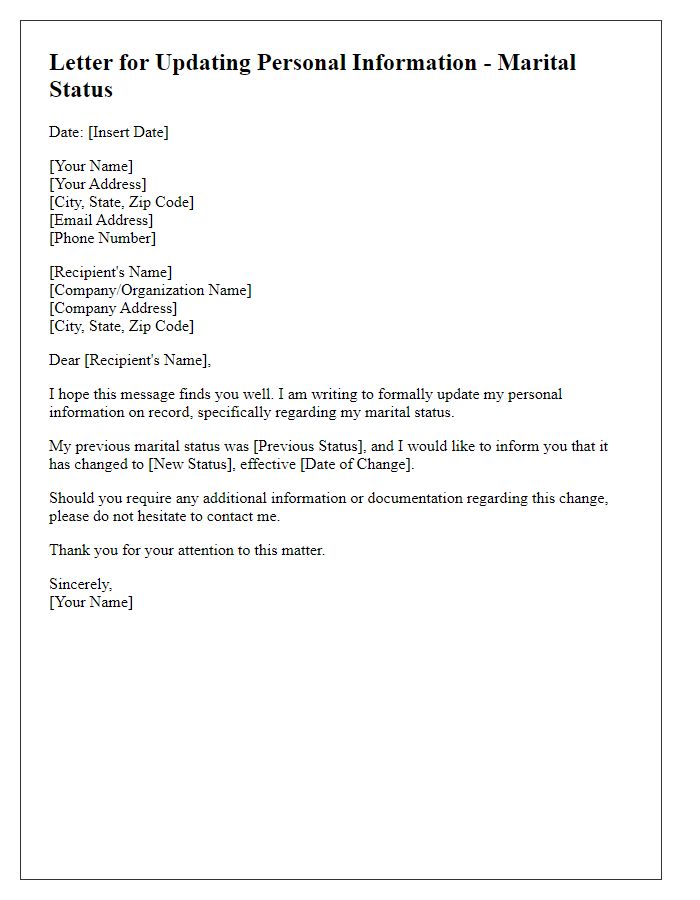

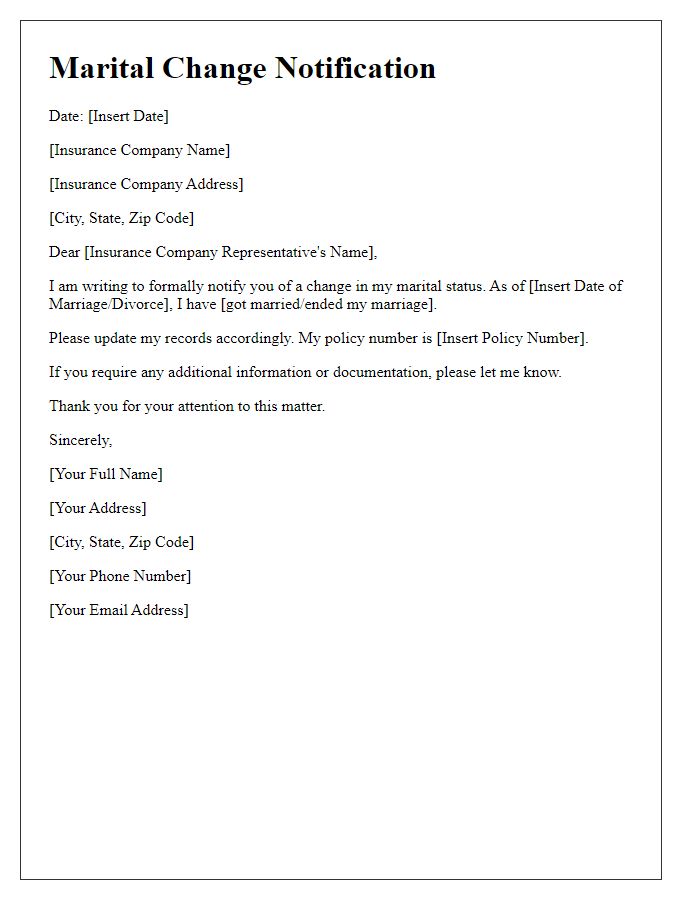

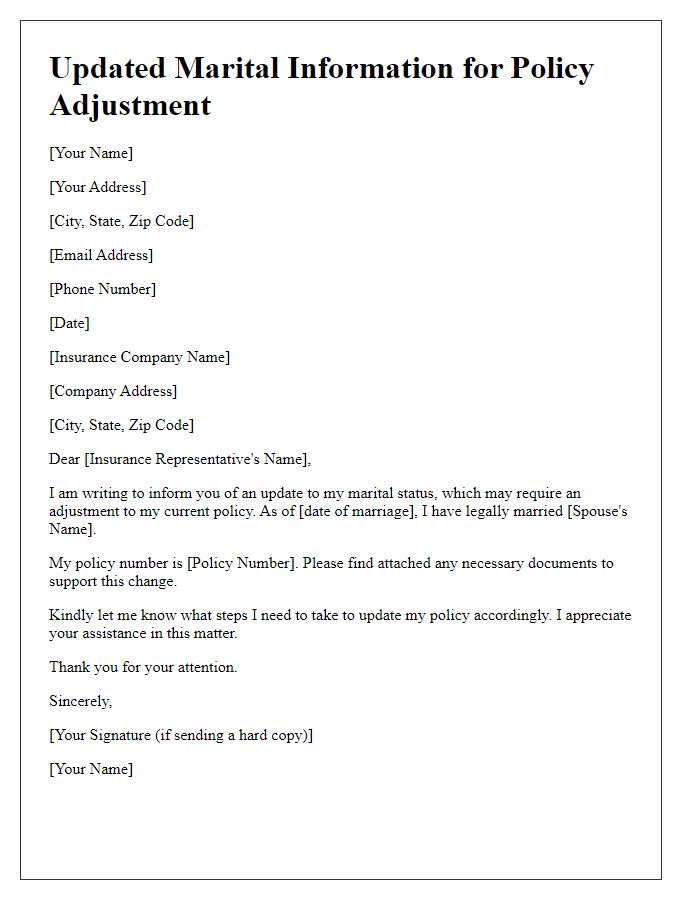

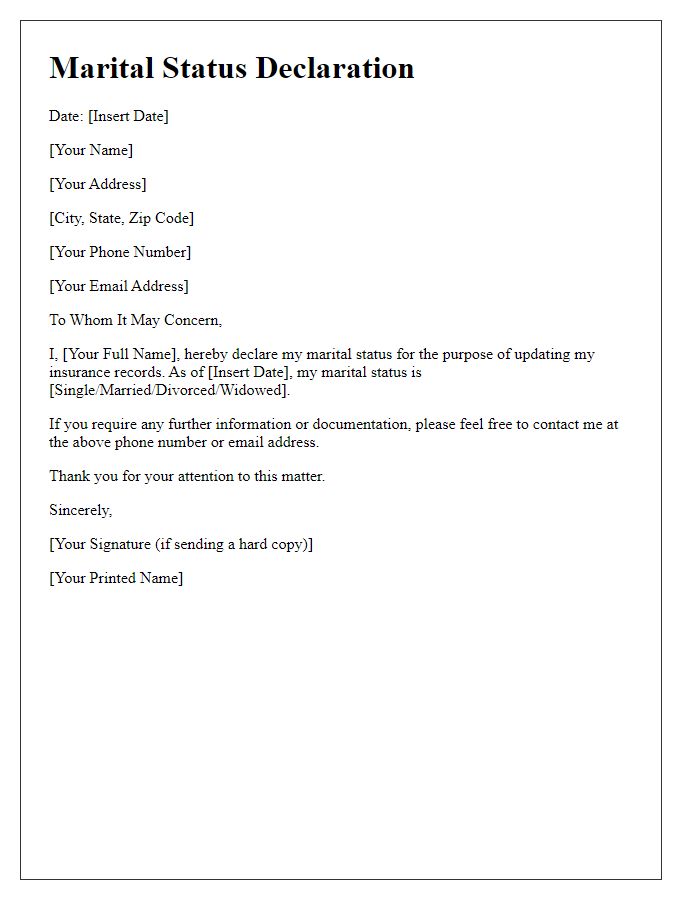

Letter Template For Updating Policyholder Marital Status Samples

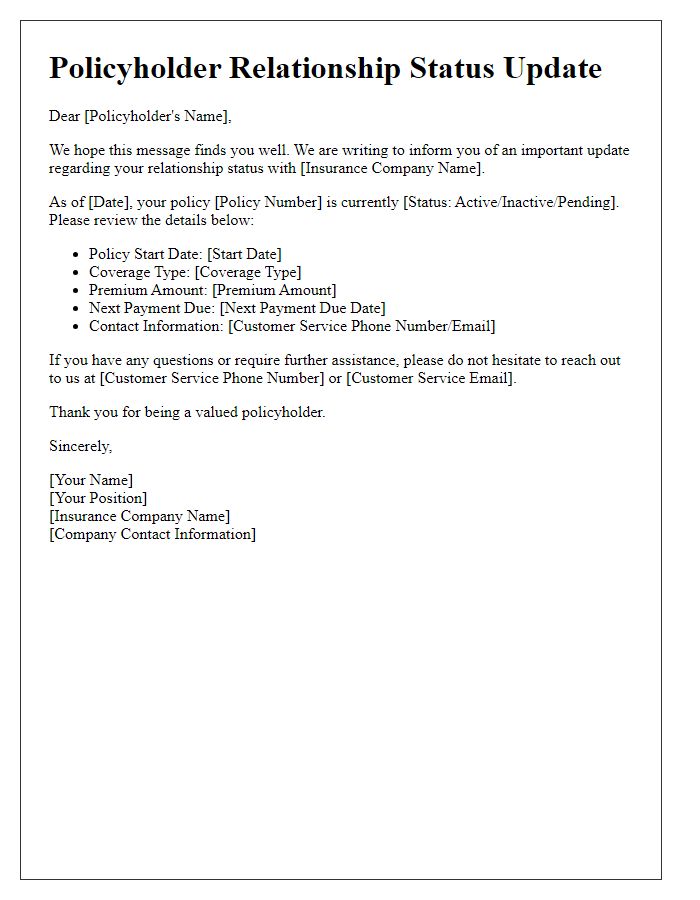

Letter template of policyholder relationship status update communication

Comments