When it comes to navigating the complexities of subrogation recovery in insurance, understanding the nuances of the process is essential. A well-crafted letter can make all the difference in your pursuit of compensation, ensuring that your demands are both clear and persuasive. In our article, we'll share key elements that should be included in your letter template to enhance your chances of a successful recovery. So, if you're ready to take the next step in effectively communicating your claim, read on!

Claim Information and Insured Details

Subrogation recovery demand in insurance requires detailed information regarding the claim and the insured individual. A comprehensive description should include the claim number, which serves as a unique identifier for each case, alongside the date of the incident, typically critical in establishing the timeline of events. The insured individual's full name is essential, as is their policy number, which indicates their coverage agreement with the insurance company. The specific type of damage, such as property damage or bodily injury, must be clearly categorized, as it directly impacts the recovery process. Additionally, outlining the parties involved in the incident, including any liable third parties, helps define the context for legal actions and negotiations. This information collectively aids in expediting the recovery process for the insurance company, aligning with its financial interests and responsibilities to the insured.

Loss Description and Liability Basis

In the context of subrogation recovery demand in insurance, documentation of loss details is essential. Subrogation occurs when an insurance company seeks reimbursement from a third party responsible for a loss after the insurer has already compensated the insured. Proper identification of the event, such as the vehicle collision on June 15, 2023, in downtown Seattle, is crucial. Documentation should include insurance policy numbers, specific damage assessments (totaling $15,000 for vehicle repairs), and liability evidence such as police reports that establish fault. Recognizing the responsible party's insurance details can streamline recovery efforts. Additionally, emphasizing the legal grounds for recovery, based on negligence and the duty of care standards, clarifies the basis of liability in the subrogation process.

Demand Amount and Supporting Documentation

A subrogation recovery demand in insurance typically includes a clearly stated amount sought for recovery supported by detailed documentation. Such documentation should encompass the original claim file, including police reports and incident descriptions, as well as invoices reflecting damages (medical bills, repair costs, etc.). The demand amount generally reflects total costs incurred due to an incident involving a liable third party, along with any applicable interest or penalties as dictated by the insurance policy terms. This recovery process is essential to hold the at-fault party accountable while also ensuring insurers can recoup their expenses stemming from covered losses.

Legal References and Policy Terms

The subrogation recovery demand in insurance involves the transfer of the right to recover damages from the insured to the insurer following a loss event. In this case, the insurer, upon settlement or payment of the insurance claim to the insured, seeks to reclaim the paid amount from a third party responsible for the loss. Legal references such as state statutes and case law govern subrogation rights and responsibilities. Essential policy terms include "subrogation clause," detailing the insurer's rights to pursue recovery, and "policy limits," specifying the maximum amount the insurer can claim. Additionally, a "waiver of subrogation" may be noted, which can prevent the insurer from pursuing recovery against specific parties. Understanding these aspects is crucial in filing an effective demand for recovery in accordance with applicable laws and policy terms.

Response Deadline and Contact Information

Subrogation recovery demands in insurance are a critical process aimed at reclaiming costs from liable third parties. A detailed response deadline (typically 30 days) is established to ensure timely communication. This timeframe compels the responsible party to address the claim promptly, preventing unnecessary delays in recovery efforts. Clear contact information, including telephone numbers, email addresses, and mailing addresses of the claims adjusters or legal representatives, facilitates efficient correspondence. Accurate documentation of the incident (policy number, claim number) and specific losses incurred enhances the clarity of the demand, increasing the likelihood of a favorable response.

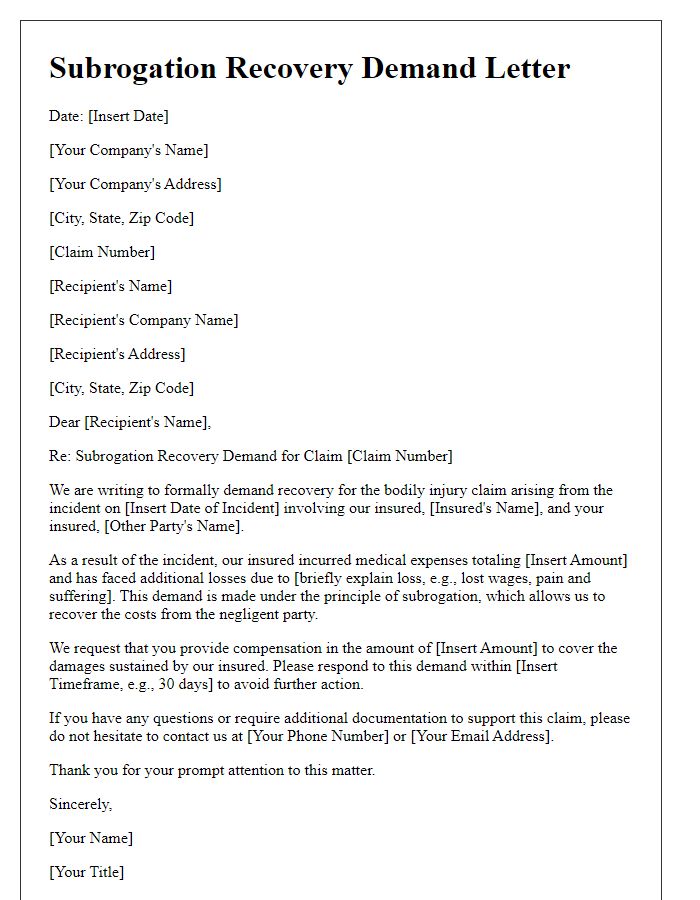

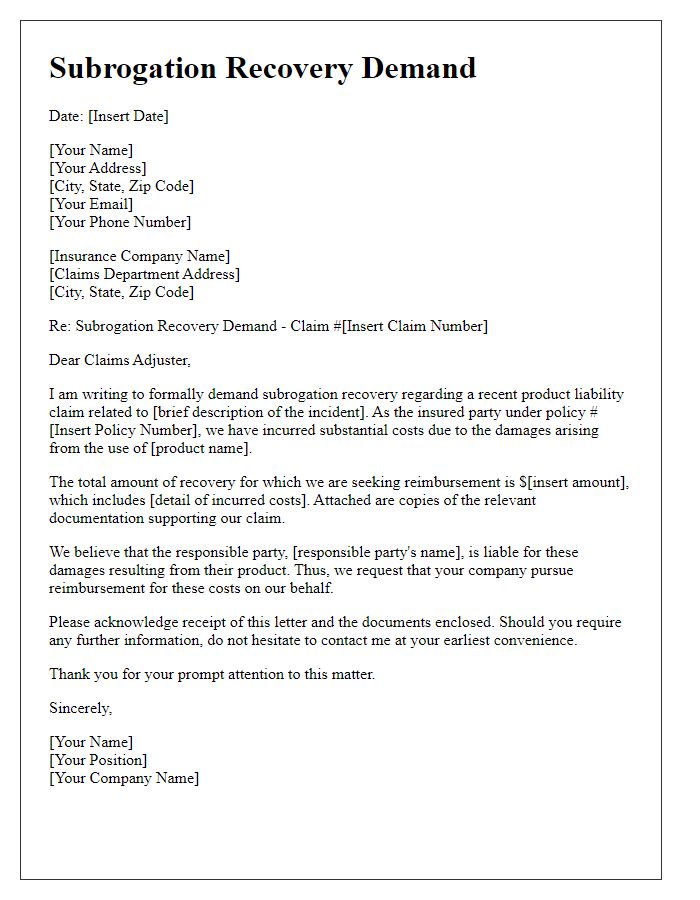

Letter Template For Subrogation Recovery Demand In Insurance Samples

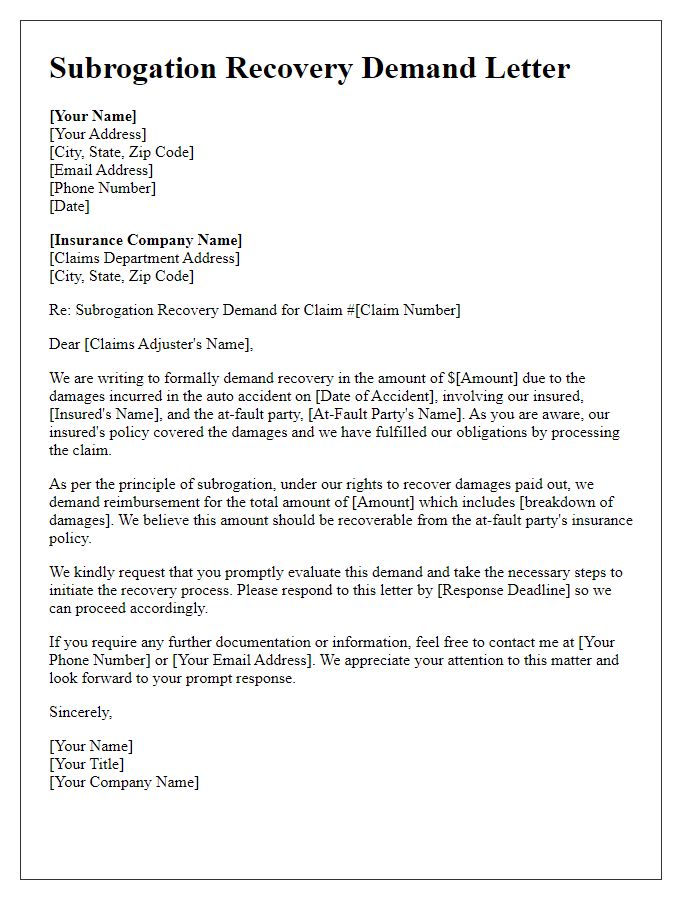

Letter template of subrogation recovery demand for auto insurance claims

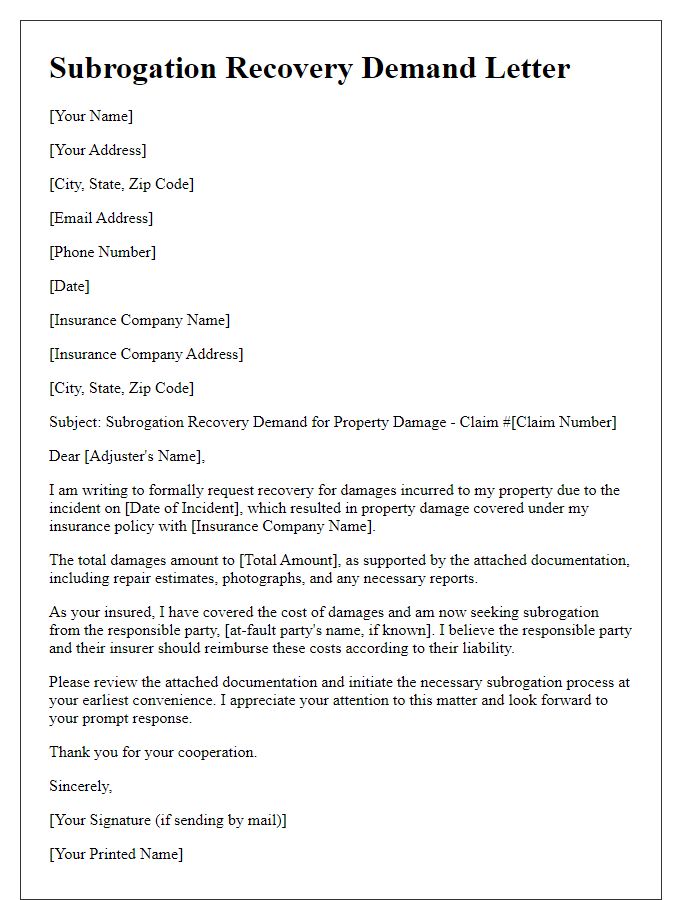

Letter template of subrogation recovery demand for property damage insurance

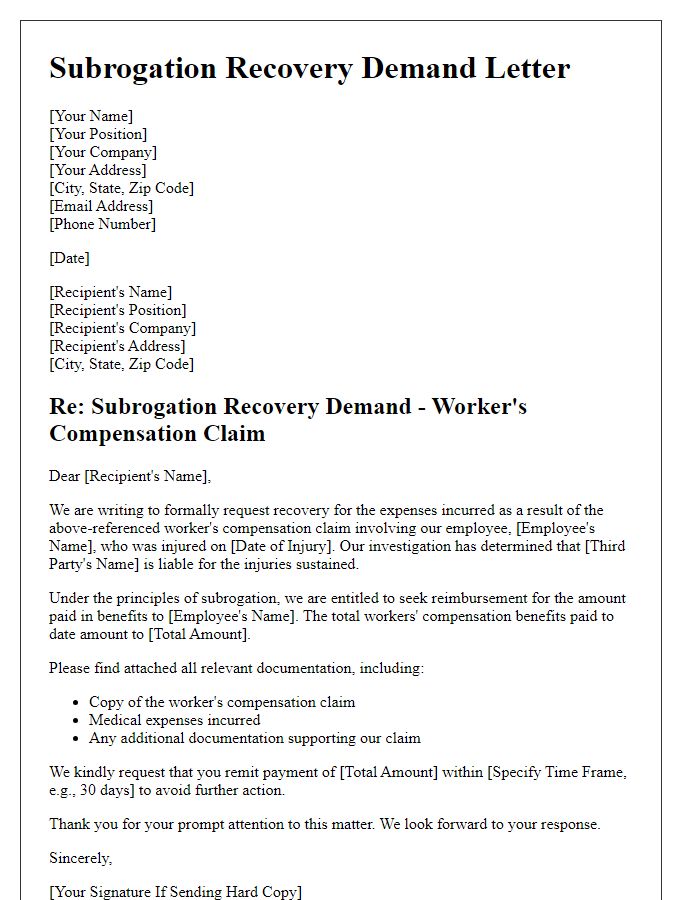

Letter template of subrogation recovery demand for worker's compensation claims

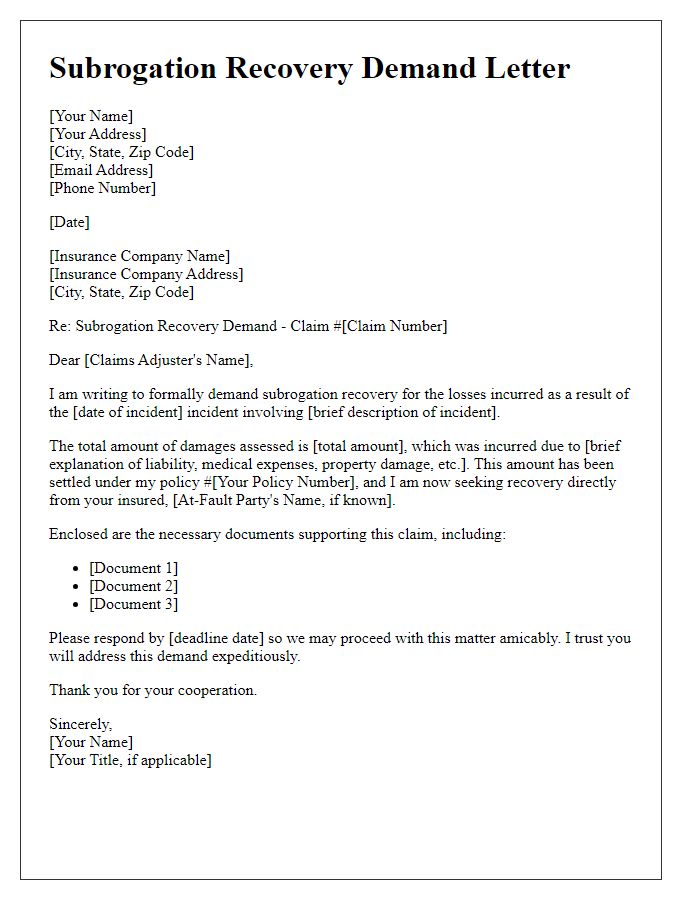

Letter template of subrogation recovery demand for liability insurance situations

Letter template of subrogation recovery demand for health insurance claims

Letter template of subrogation recovery demand for commercial general liability insurance

Letter template of subrogation recovery demand for theft or vandalism claims

Comments