Are you tired of remembering to make your insurance premium payments every month? Setting up automatic premium payments can save you time and ensure that your coverage remains uninterrupted. It's a simple solution that takes the hassle out of managing your bills and keeps your peace of mind intact. To learn more about how to request this convenient feature, keep reading!

Personal Information

Automatic premium payments simplify managing insurance policies by facilitating consistent and timely payments. Insurers typically require personal information to enroll, including the policyholder's full name, address, date of birth, and contact information such as email and phone number. Additionally, banking details such as account number, routing number, and the type of account (checking or savings) are essential for setting up automatic withdrawals. This seamless process ensures that premiums are deducted on specified dates, preventing lapses in coverage and maintaining peace of mind for policyholders.

Insurance Policy Details

Automatic premium payments streamline the process of managing insurance policies, ensuring policyholders never miss a payment deadline. For an insurance policy issued by companies like Allstate or State Farm, the billing cycle typically occurs monthly or annually, depending on the chosen plan. By opting for automatic payments linked to a bank account or credit card, policyholders benefit from uninterrupted coverage and avoid late fees. Most insurers allow adjustments to payment dates and methods easily via their online platforms or customer service channels. The setup process generally involves providing banking information, verifying details, and confirming the authorization of automatic withdrawals.

Bank Account Details

Automatic premium payments facilitate timely premium settlements for insurance policies, such as life or health insurance. Policyholders often provide bank account details, including the account number and routing number, to authorize automatic deductions on specified dates. This process helps avoid lapses in coverage due to missed payments and ensures that clients maintain continuous protection against unforeseen events. Insurers typically require written consent alongside precise details about the account, enhancing trust and security in transactions. Regular premiums can be deducted monthly, quarterly, or annually, depending on the agreement between the policyholder and the insurer, ensuring financial peace of mind.

Authorization Statement

Automatic premium payments simplify the process of managing insurance policies, such as life insurance or health insurance, by allowing payments to be deducted directly from a designated bank account. This convenient method often ensures timely payments, avoiding lapses in coverage. Policyholders typically authorize these transactions by submitting a written request or form, which includes their policy number, banking details, and consent for automatic deductions. Companies may require specific information, such as the financial institution's routing number and account number, to process the authorization efficiently. Implementing automatic payments can also provide peace of mind, ensuring that premiums are consistently paid without the need for manual intervention each month.

Contact Information

Automatic premium payments streamline the process of ensuring timely insurance coverage. Policyholders can set up automatic withdrawals from their bank accounts, simplifying premium management for various insurance types, such as health, auto, or life insurance. This system is often facilitated through a variety of payment methods including ACH (Automated Clearing House) transactions or credit card payments. By enrolling in automatic payments, clients can avoid late fees, lapses in coverage, and the stress of manual payment reminders. Insurers, like Aetna or State Farm, usually provide online portals for setting up these arrangements, making access to payment settings quick and efficient.

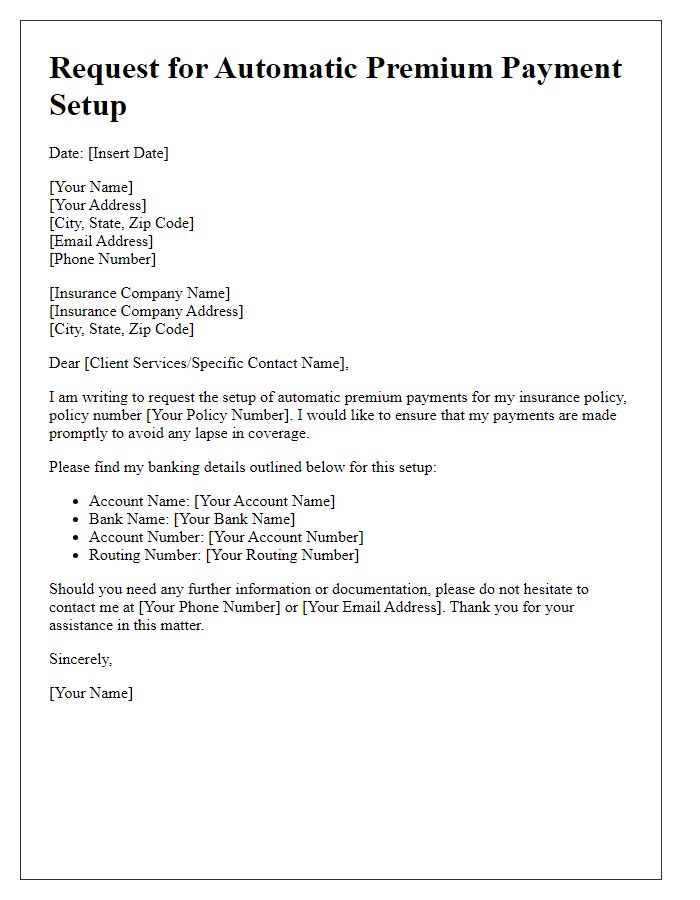

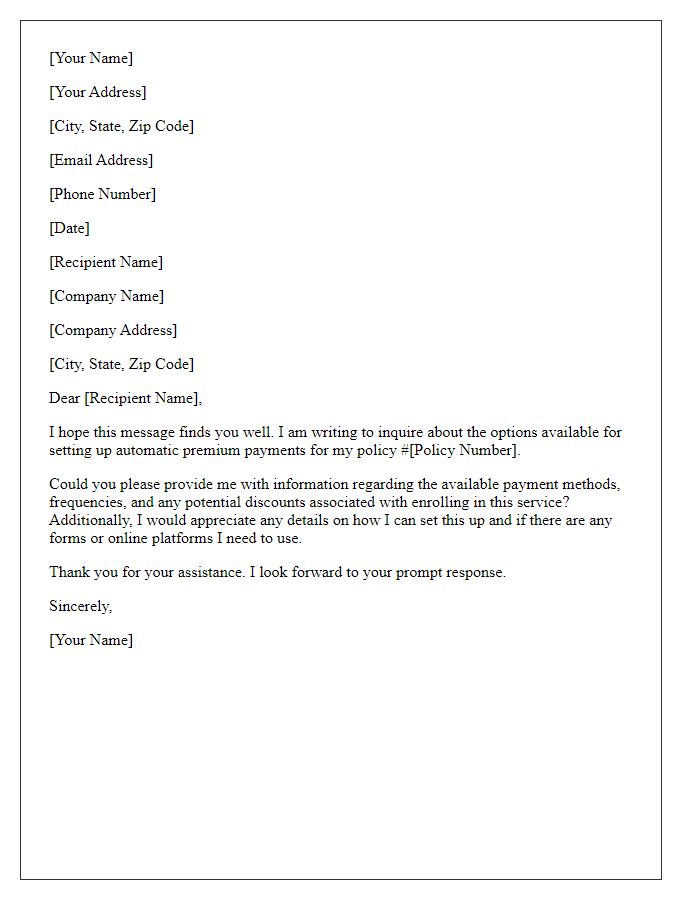

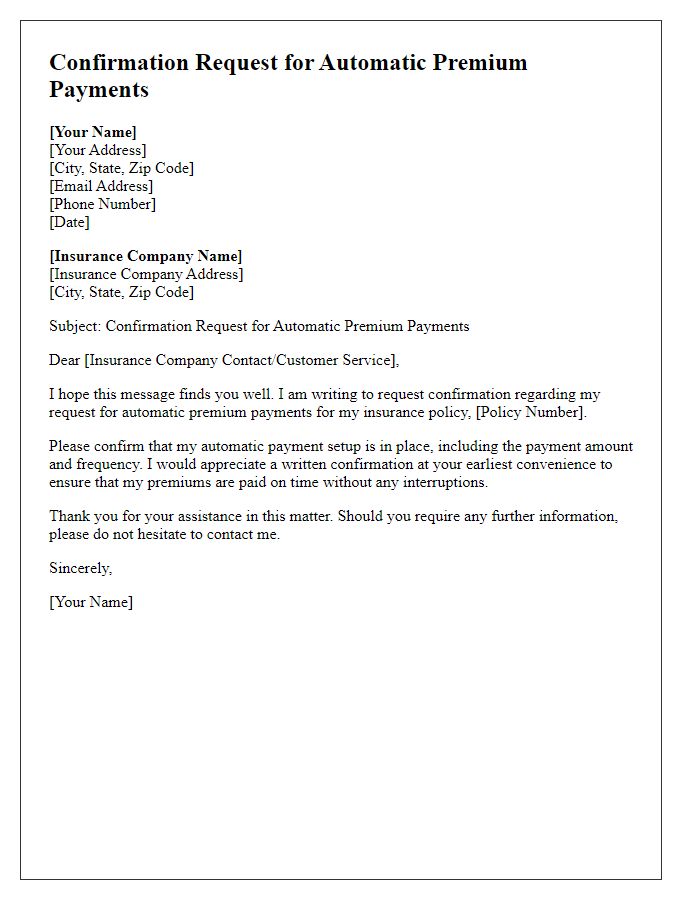

Letter Template For Requesting Automatic Premium Payments Samples

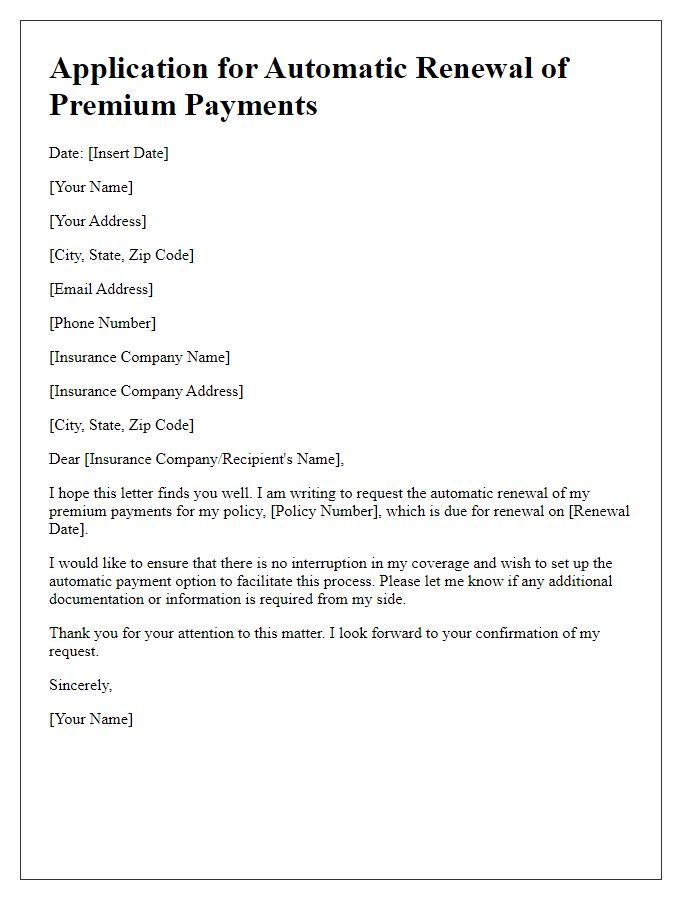

Letter template of application for automatic renewal of premium payments

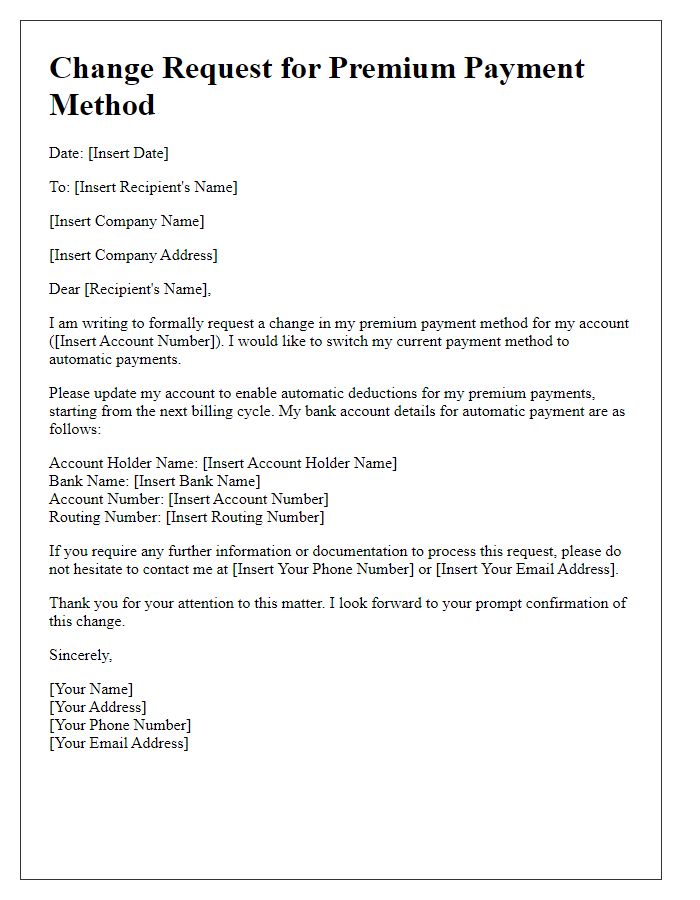

Letter template of change request for premium payment method to automatic

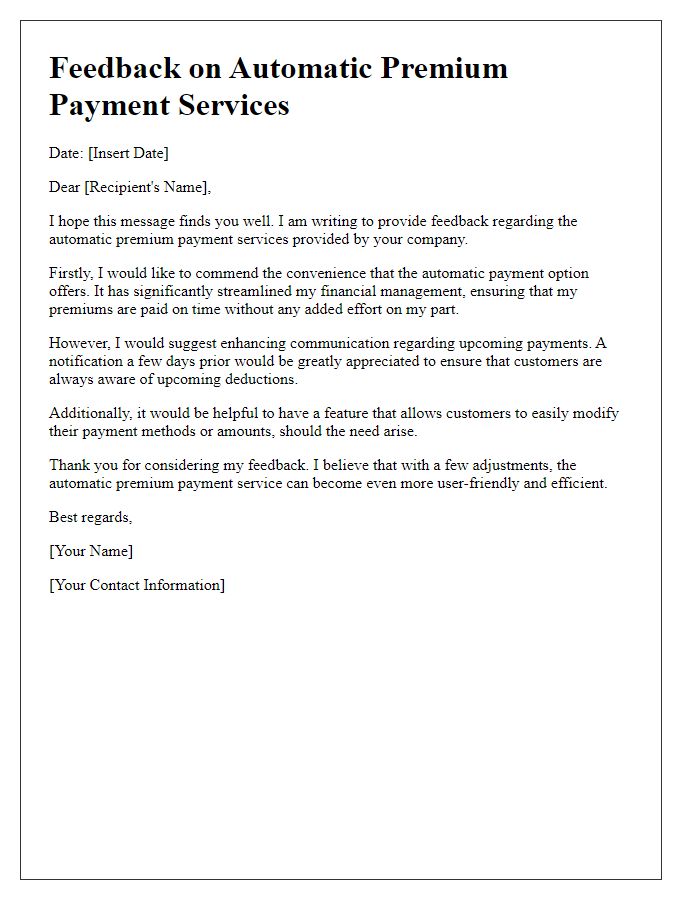

Letter template of feedback regarding automatic premium payment services

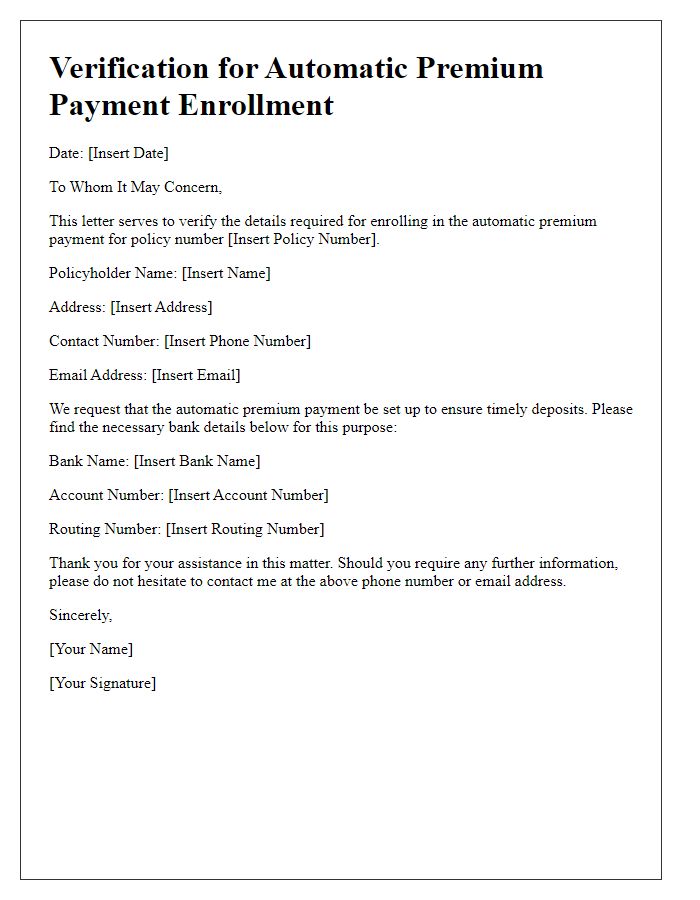

Letter template of verification needed for automatic premium payment enrollment

Comments