Are you in a situation where you need a little extra time to get your policy in order? Many of us encounter unexpected challenges that can make adhering to deadlines tough. That's why it's important to know how to request a grace period for your policy, ensuring you can maintain your coverage without additional stress. Join us as we explore how to effectively compose your request and the essential elements to include!

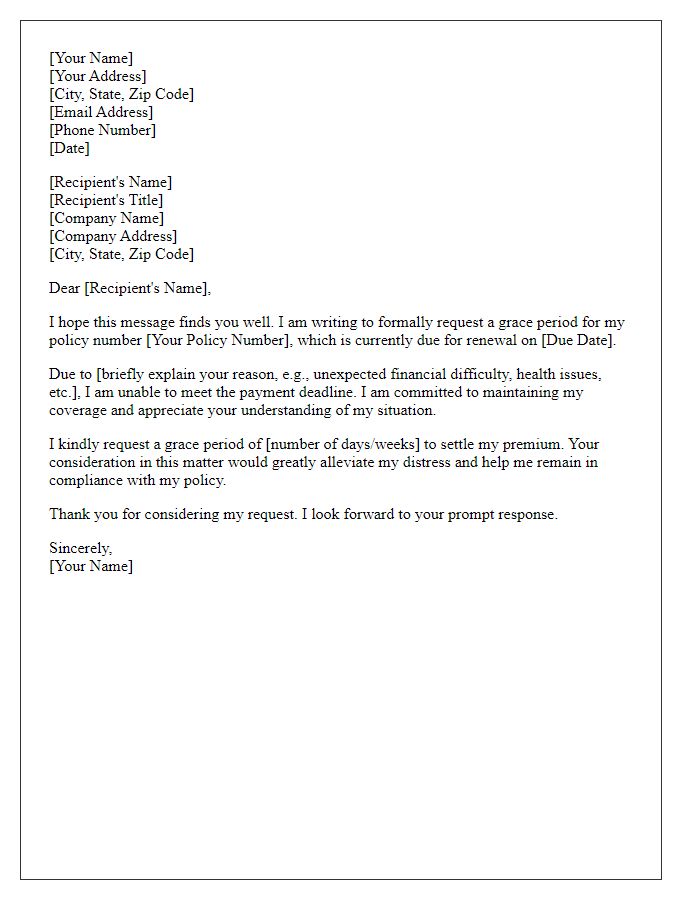

Policyholder Information

Policyholders facing unexpected circumstances may request a grace period for their insurance policy payments. Factors such as financial difficulties or personal emergencies might create a temporary inability to meet payment deadlines. The grace period typically allows for a specified duration, often 30 days, to remit overdue payments without losing coverage. Policyholders should clearly provide their policy number, relevant dates, and specific reasons for the request. Communicating promptly with the insurance provider can potentially ease stress during challenging times, ensuring continued protection under the policy.

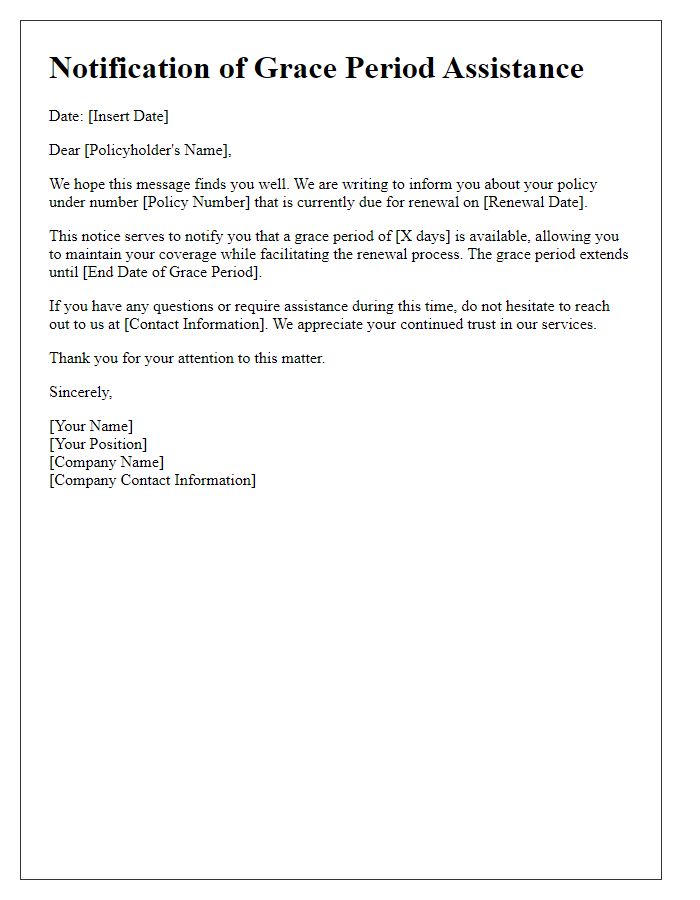

Policy Details

Insurance policies often come with specific guidelines regarding payment deadlines and renewal processes. A grace period refers to the extra time granted to policyholders, allowing them to make payments without penalties or lapse of coverage. In many cases, grace periods range from 10 to 30 days depending on the insurance provider and type of policy. For instance, health insurance policies typically allow a 30-day grace period for premium payments before coverage suspension, while auto insurance policies may have a shorter 10-day window. When requesting a grace period, it is essential to include crucial details such as policy number, effective dates, and reason for the request. Proper documentation can lead to favorable consideration from the insurance company, maintaining continuity of coverage without incurring additional fees or risking exposure to uncovered claims.

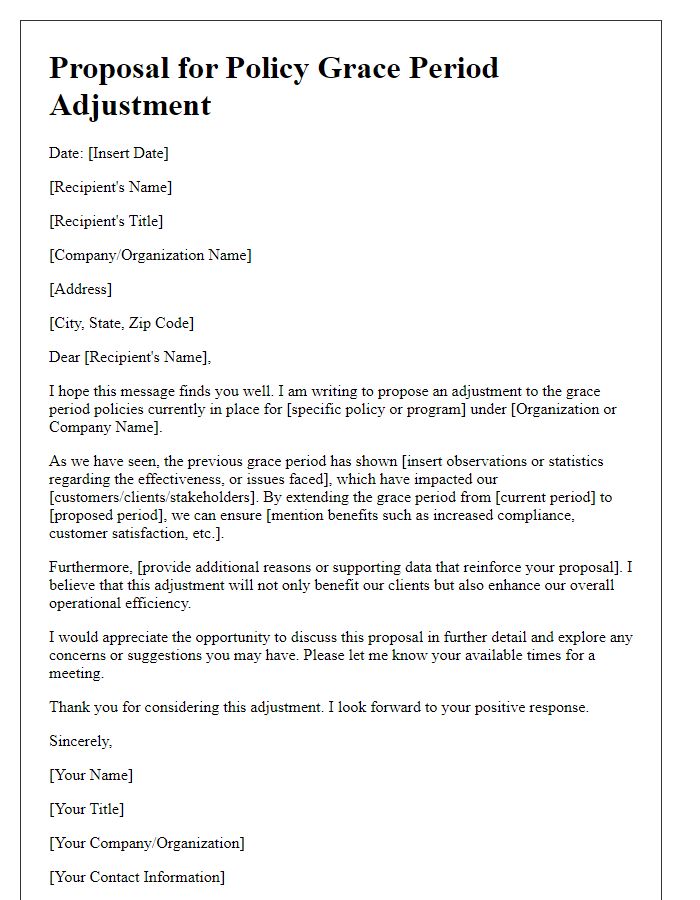

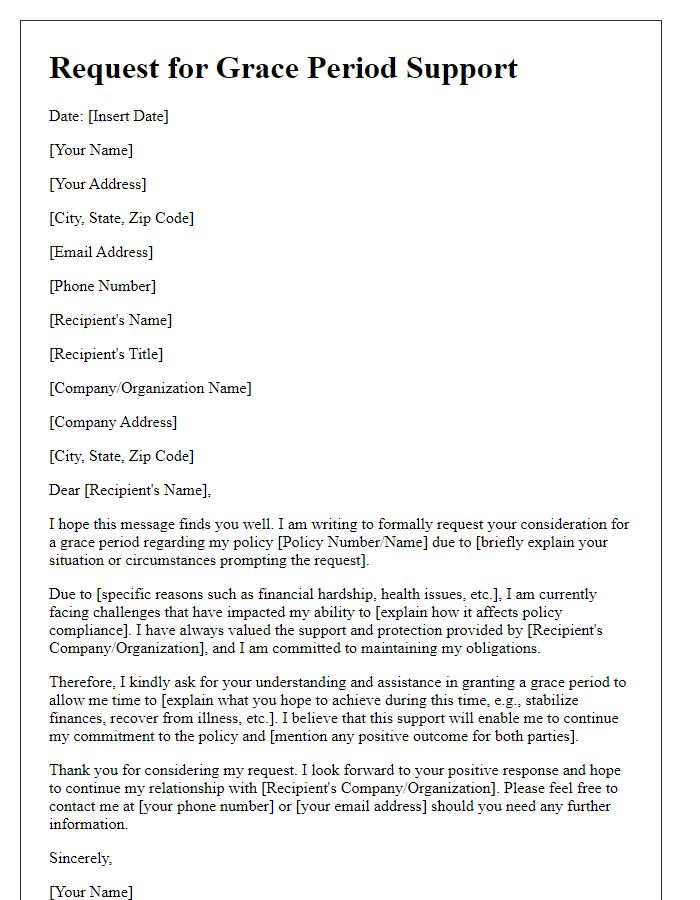

Reason for Grace Period Request

Requesting a policy grace period can be essential for maintaining coverage during unforeseen circumstances. Circumstances such as financial distress, health issues, or unexpected job loss can create challenges in meeting payment deadlines. For instance, a sudden medical emergency requiring an extensive hospital stay could significantly impact an individual's financial situation, making it difficult to pay insurance premiums on time. Insurance providers often allow grace periods of 30 days or more, giving policyholders crucial time to arrange for payment without risking cancellation of their policies. It's important to clearly communicate the situation to the insurance company, providing any necessary documentation to support the request, ensuring a smooth and transparent process.

Specific Extension Timeframe

Many insurance companies provide policyholders a grace period during which premium payments can be made without incurring a lapse in coverage, typically ranging from 30 to 60 days, depending on the insurer and policy type. During this timeframe, it is essential for policyholders facing financial difficulties, such as job loss or medical expenses, to communicate directly with their insurance provider. Specific requests for an extension can be beneficial, as every situation is unique. Additionally, policyholders might reference any applicable state laws, such as the Insurance Code, which can influence grace period regulations and extend the time allowed for payment. It is crucial for policyholders to document their communication with the insurance company to ensure clarity regarding timelines and any agreements reached.

Contact Information for Follow-up

A request for a policy grace period typically includes essential details regarding the policyholder's information, policy number, and the specific reasons for the request. Many insurance providers allow grace periods of typically 10 to 30 days, depending on the policy type, allowing policyholders to make overdue payments without losing coverage. Clear articulation of the situation, such as financial difficulties or unforeseen circumstances, may strengthen the request. Including specific contact information, such as a personal phone number and email address, is crucial for facilitating prompt follow-up communication from the company regarding the request. Providing a comprehensive explanation can pave the way for a favorable response from the insurer, helping maintain the policyholder's insurance coverage.

Comments