Are you looking to get the most out of your insurance claim? Understanding the insurance investigation report can be crucial in navigating the often complex world of claims and coverage. In this article, we'll explore the importance of requesting this report and how it can empower you in your dealings with insurance companies. So, grab a cup of coffee and dive in to learn more about how to effectively request your insurance investigation report!

Policyholder Information

The insurance investigation report provides essential insights into the claims process, crucial for policyholders seeking clarity on their coverage. Information such as the policy number (typically a series of digits following a company prefix) identifies the insured agreement. Incidents covered by the policy, including theft (often involving law enforcement reports), accidents (like vehicle collisions with noted dates and locations), or natural disasters (referenced by specific weather events like hurricanes or floods), are key elements. The report can also contain details about the adjuster's findings, including photographs from the scene and expert testimonials, which enrich the context of the claim.

Claim Details

The insurance investigation report (IIR) serves as a critical component in discerning the validity of claims, providing a thorough analysis of circumstances surrounding incidents. Policyholders often request these reports following events such as car accidents, home damage, or theft. The investigation includes details such as claim number (often formatted with a numerical code), policyholder information, and specific incident date (often documented in the format DD/MM/YYYY). Investigators utilize photographs, witness statements, and expert assessments to compile data, ensuring all relevant evidence is evaluated meticulously. This report influences the determination of claim legitimacy, helping insurers make informed decisions regarding compensation amounts.

Specific Investigation Request

A specific investigation request can include critical details about the incident under review, such as the date of occurrence, the location (city and state), and any involved parties, including policyholders and witnesses. Providing relevant policy numbers ensures that the request is linked to the correct insurance claim. Highlight the necessity for the report to examine specific factors, such as safety procedures, risk assessments, or coverage details. Emphasizing urgency in receiving the report can reflect the importance of resolving the claim efficiently, allowing for timely decision-making concerning compensation or disputes. Including the contact information for follow-ups can facilitate quick communication and ensure the investigation is prioritized.

Justification for Request

The request for an insurance investigation report typically stems from a specific incident or claim that necessitates detailed examination. This report serves as a crucial document that outlines findings from examinations related to potential fraud, loss assessment, or liability determination. Seeking this report is essential to understand the underlying circumstances surrounding the claim, ensuring transparency and accountability while facilitating informed decision-making. By reviewing the investigation's outcome, stakeholders can better navigate the claims process and address any discrepancies or concerns that may have arisen during the assessment. Ultimately, accessing the report fosters trust in the insurance process and promotes compliance with legal and regulatory standards.

Contact Information and Response Deadline

A formal request for an insurance investigation report requires detailed contact information and a specified response deadline. The sender's details, including full name, mailing address, phone number, and email address, must be clearly stated to ensure effective communication. For the receiver, full name, role within the insurance company, and the company's official address should also be included. It's essential to indicate a clear and reasonable deadline for response, typically between 7 to 14 days from the date of the request to ensure timely processing and enable the sender to plan accordingly for any necessary follow-up actions. This clarity helps facilitate a swift and organized response from the insurance company.

Letter Template For Requesting Insurance Investigation Report Samples

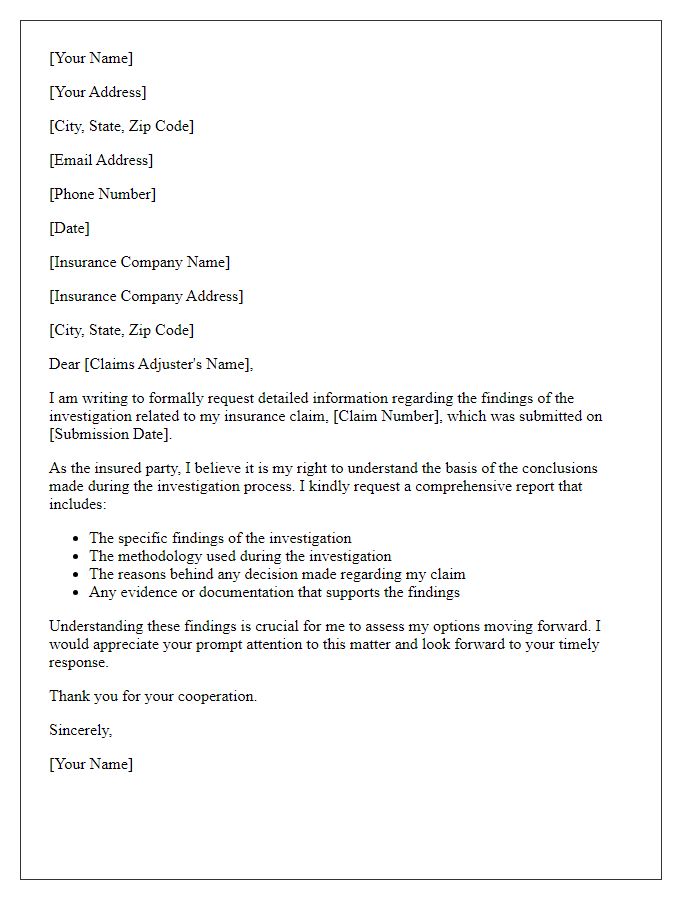

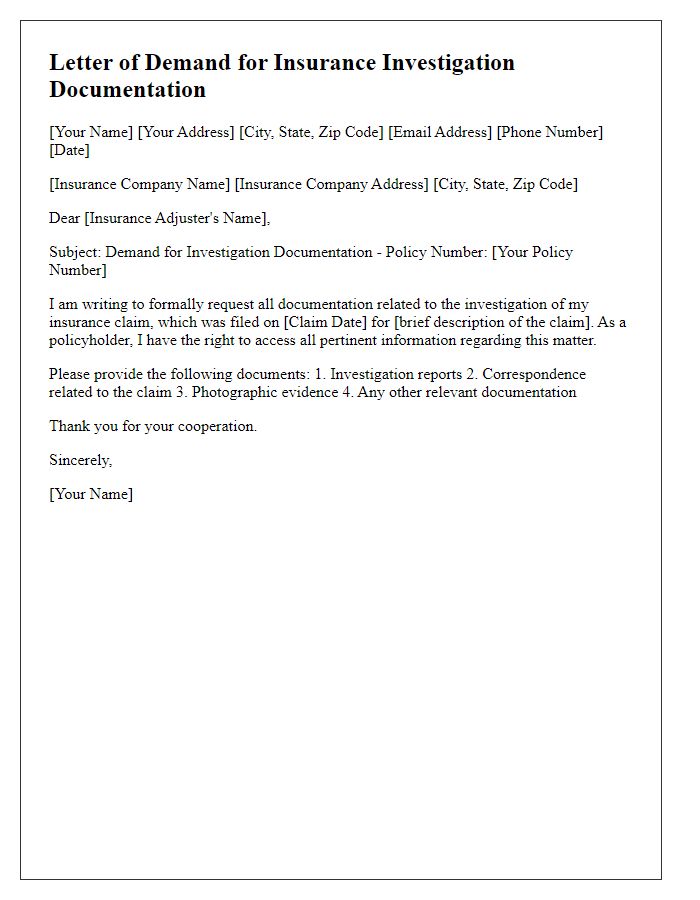

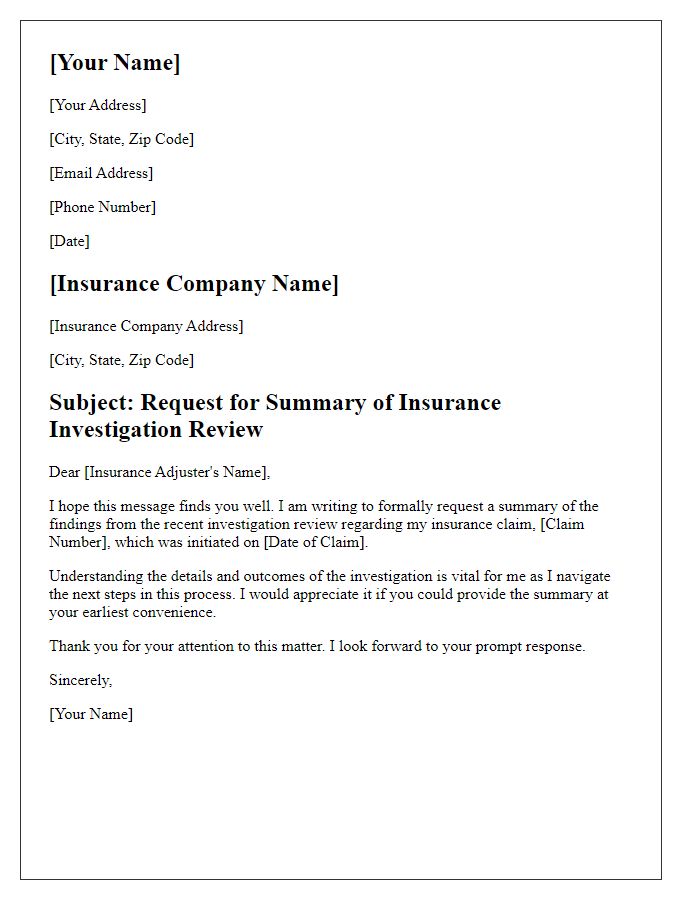

Letter template of request for details on insurance investigation findings

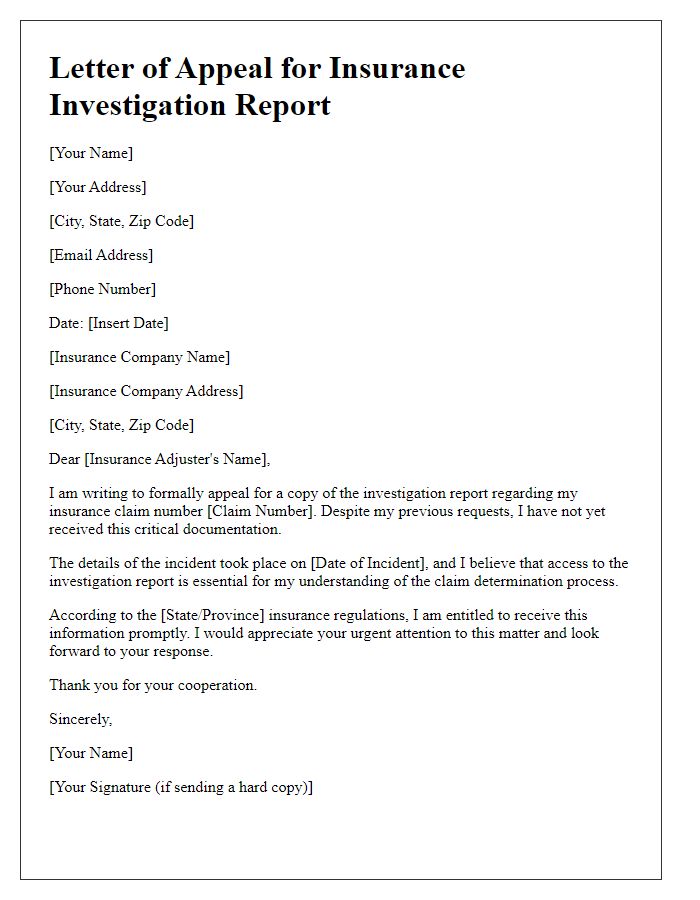

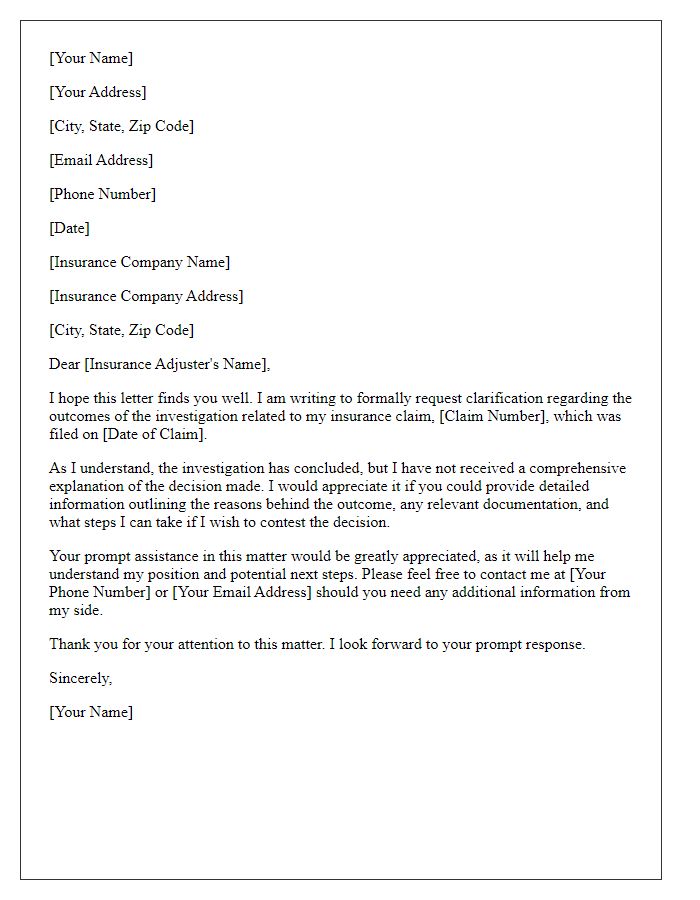

Letter template of appeal for a copy of the insurance investigation report

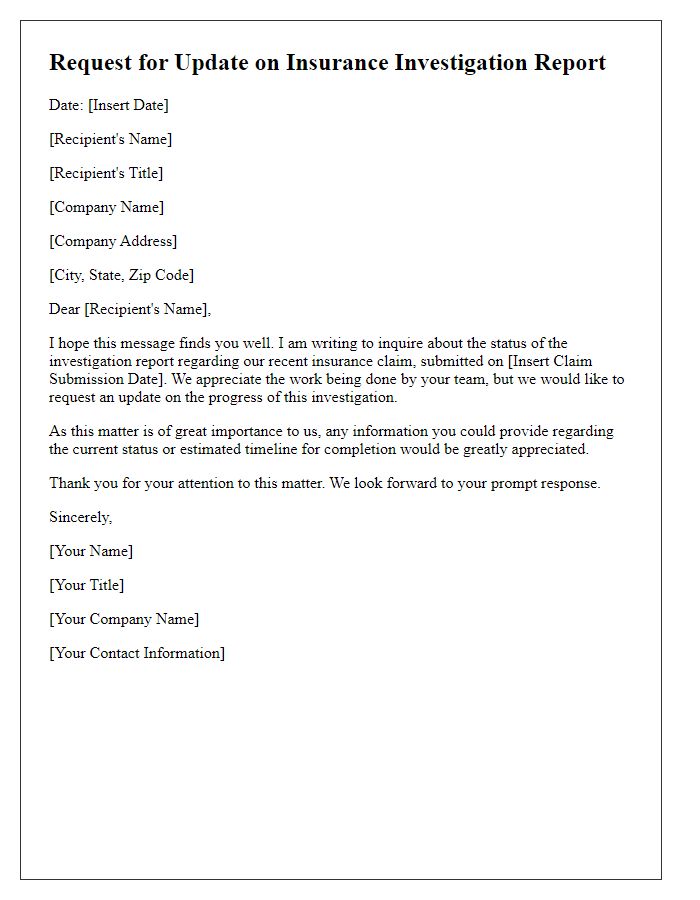

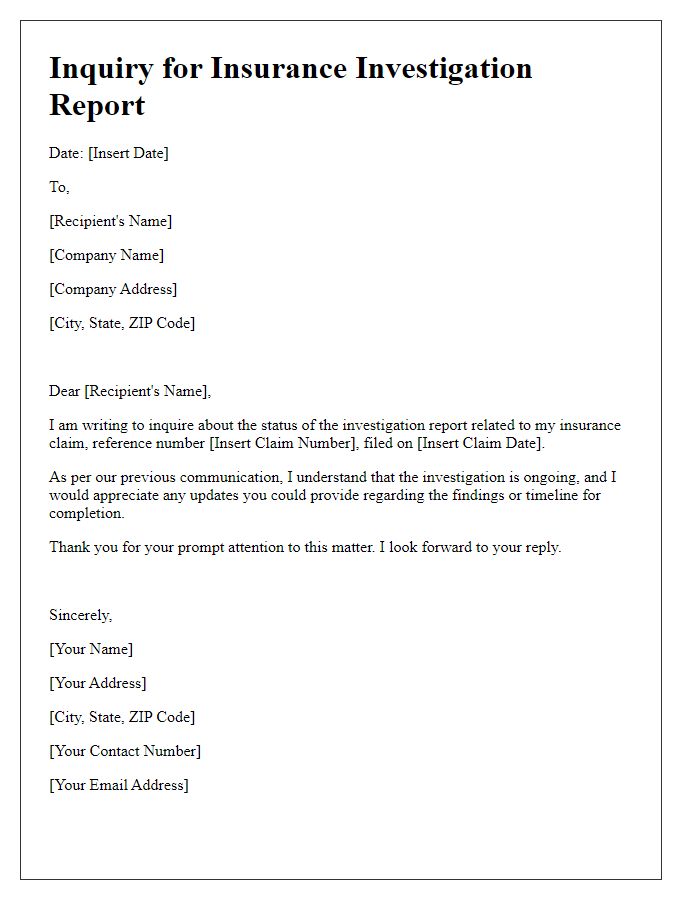

Letter template of solicitation for an update on insurance investigation report

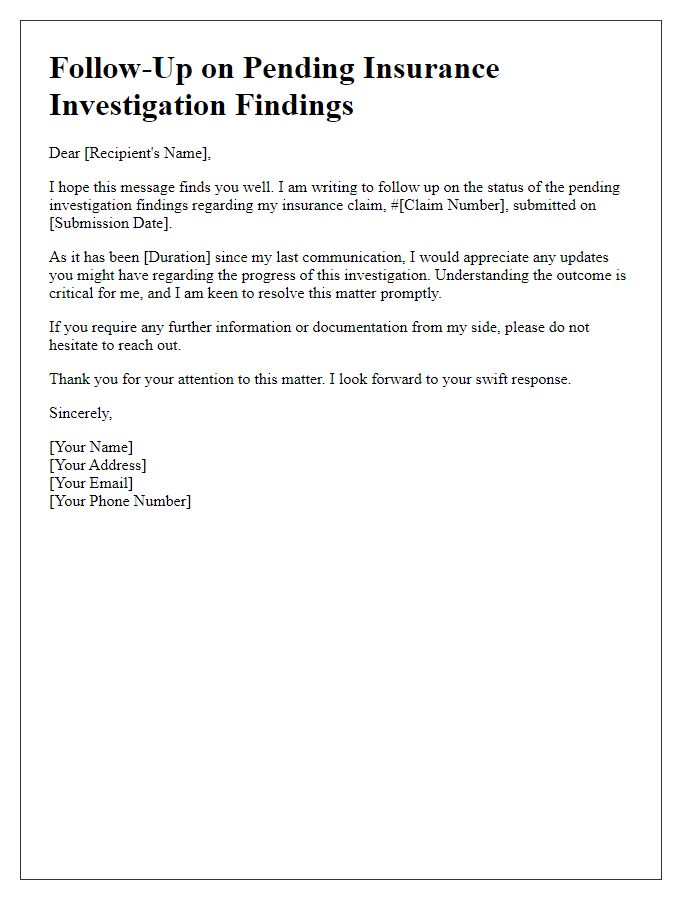

Letter template of follow-up for pending insurance investigation findings

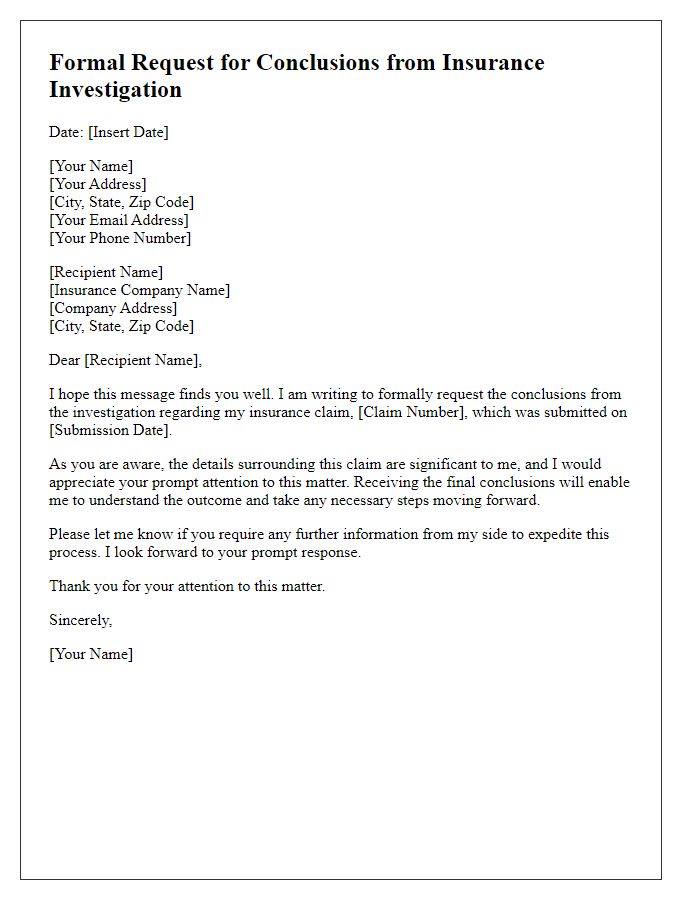

Letter template of formal request for conclusions from insurance investigation

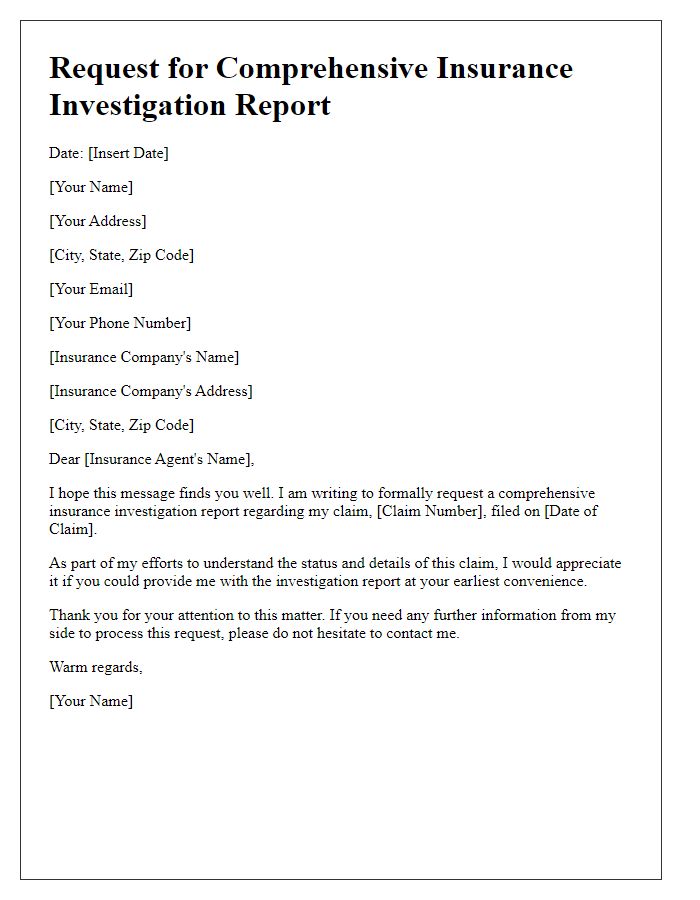

Letter template of request for comprehensive insurance investigation report

Comments