Are you worried about navigating the complexities of pet insurance claims, especially when your furry friend is unwell? You're not alone; many pet owners find themselves overwhelmed when trying to secure coverage for their pets during difficult times. In this article, we'll break down a straightforward letter template that can help streamline the claims process, ensuring you get the support you need. So, let's dive in and make this claim process a little easierâread on to discover the essentials!

Policyholder Information

Pet insurance claims for illnesses require thorough documentation to ensure a smooth approval process. Policyholder information must include the full name of the pet owner, contact details (address, phone number, and email), along with the insurance policy number specific to the pet insured. Essential details about the pet should also be provided, such as the pet's name, species (dog, cat, etc.), breed (Golden Retriever, Persian, etc.), and age (in years or months). Any prior medical history relevant to the claimed illness, along with veterinary records (including diagnosis date, treatment plan, and expenses incurred), should accompany the claim to substantiate the need for reimbursement. Claims should be submitted to the insurance provider's designated claims department.

Pet Details

Pet insurance claims for illness often require detailed information about the pet involved. For instance, a dog named Max, a four-year-old Labrador Retriever, diagnosed with canine parvovirus, should include specifics such as breed characteristics and common health issues associated with the breed. Additionally, mention the veterinarian, Dr. Lisa Carter, at Sunnydale Animal Hospital, who provided diagnosis and treatment. Including dates of diagnosis, which could be April 15, 2023, and the treatment plan detailing medications or hospitalization will support the claim. It's crucial to mention any previous health conditions or vaccinations, like the recent parvovirus vaccination dated January 2023, to give a full picture for the insurance evaluators.

Illness Description

When filing a pet insurance illness claim, providing a comprehensive illness description is essential. For instance, a Labrador Retriever diagnosed with hip dysplasia, a genetic condition affecting joint stability, requires medical attention. Symptoms such as limping, difficulty standing, or reluctance to exercise may arise. Veterinary reports detailing the diagnosis, radiographic findings (such as X-rays showing joint abnormalities), and treatment plans (like surgery or ongoing medication) enrich the claim. Additionally, specifying acute onset dates (e.g., first observed symptoms on September 15, 2023) and veterinary visit details (clinic name and address, doctor's name) can strengthen the claim.

Veterinary Assessment

Pet insurance claims require a detailed veterinary assessment report outlining the diagnosis and treatment of the pet's illness. This document typically includes vital information such as the pet's name, breed (for example, Labrador Retriever), and age (for instance, 5 years old). The assessment should detail the specific illness diagnosed, such as canine pancreatitis, including its symptoms, such as vomiting and lethargy. Additionally, treatment protocols administered at the veterinary clinic (like intravenous fluids or medications) must be documented, along with the duration of the treatment plan. The veterinarian's contact information, license number, and signature, along with the date of assessment, are crucial for validating the claim. Accurate documentation facilitates prompt processing of the illness claim by the insurance company, ensuring timely reimbursement for incurred veterinary expenses.

Supporting Documentation

Pet insurance claims for illnesses may require supporting documentation, such as a diagnosis from a licensed veterinarian. The documentation should include details like the pet's name, age, and species, along with specific medical conditions diagnosed. Additionally, invoices for treatments and medications, including date of service and itemized costs, are essential. Records of previous health issues and vaccination history can also substantiate the claim. Clear photographs of the pet and their environment may provide useful context. All documentation should be organized chronologically and securely attached to ensure a smooth processing experience by the insurance provider.

Letter Template For Pet Insurance Illness Claim Samples

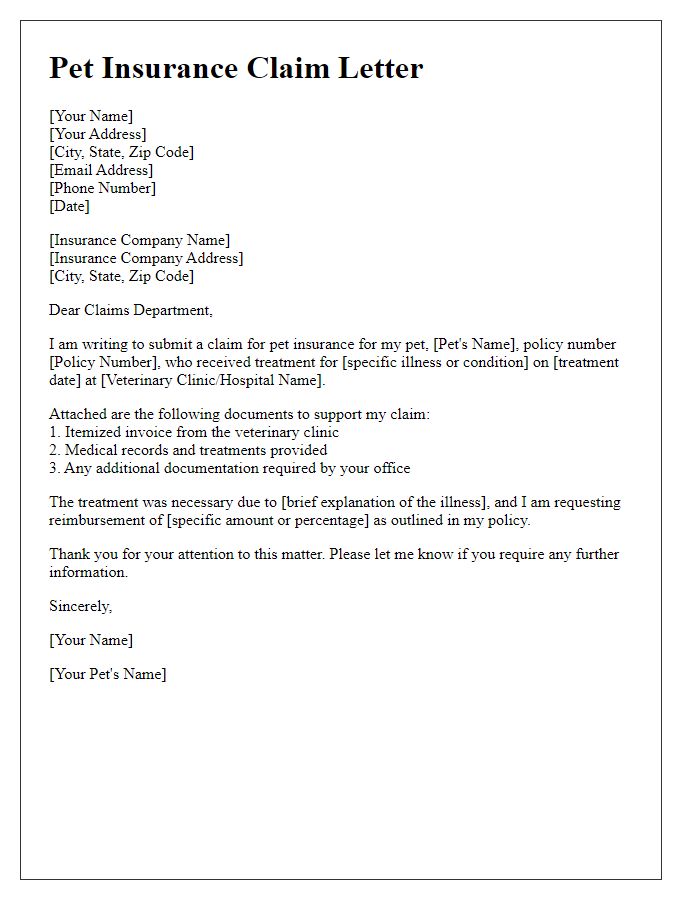

Letter template of pet insurance claim for veterinary illness treatment.

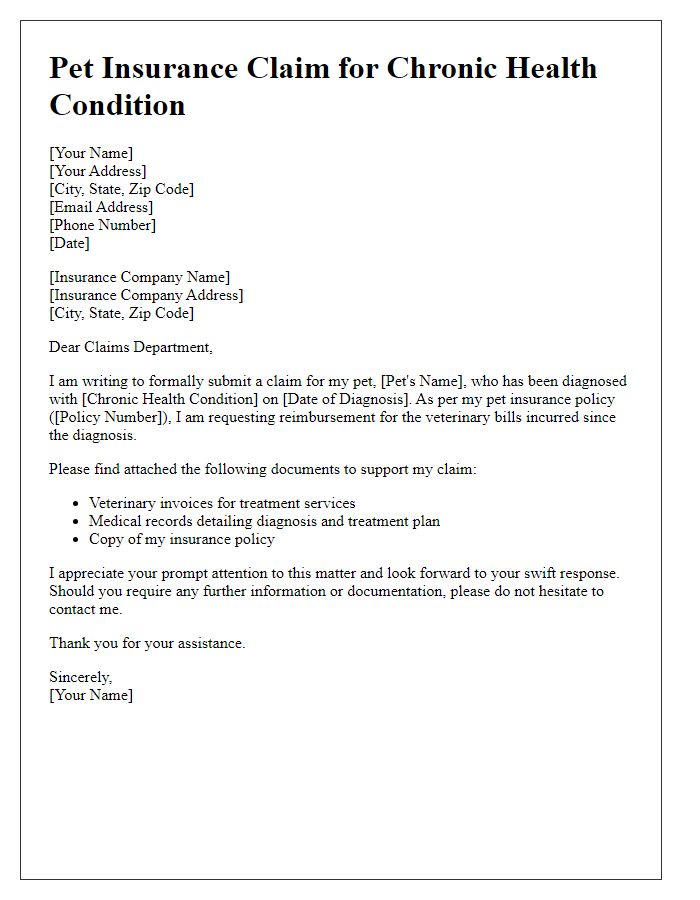

Letter template of pet insurance claim for chronic health conditions in pets.

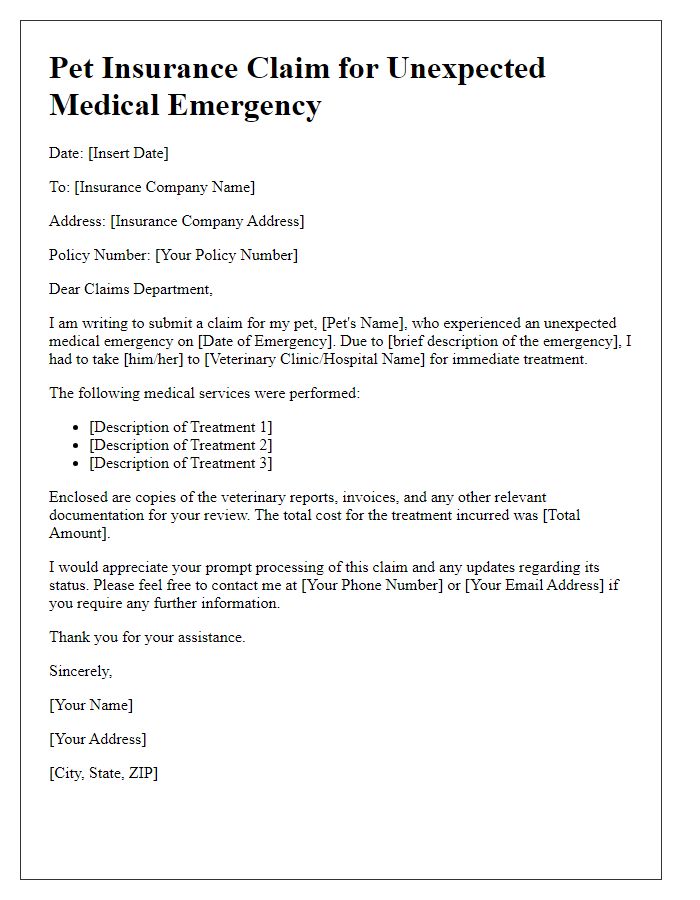

Letter template of pet insurance claim for unexpected medical emergencies.

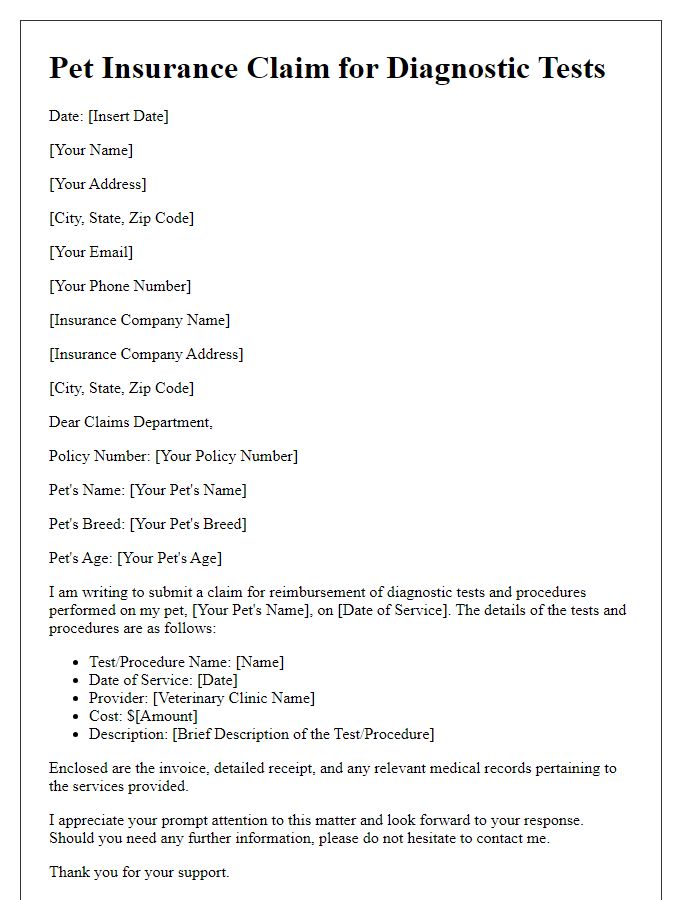

Letter template of pet insurance claim for diagnostic tests and procedures.

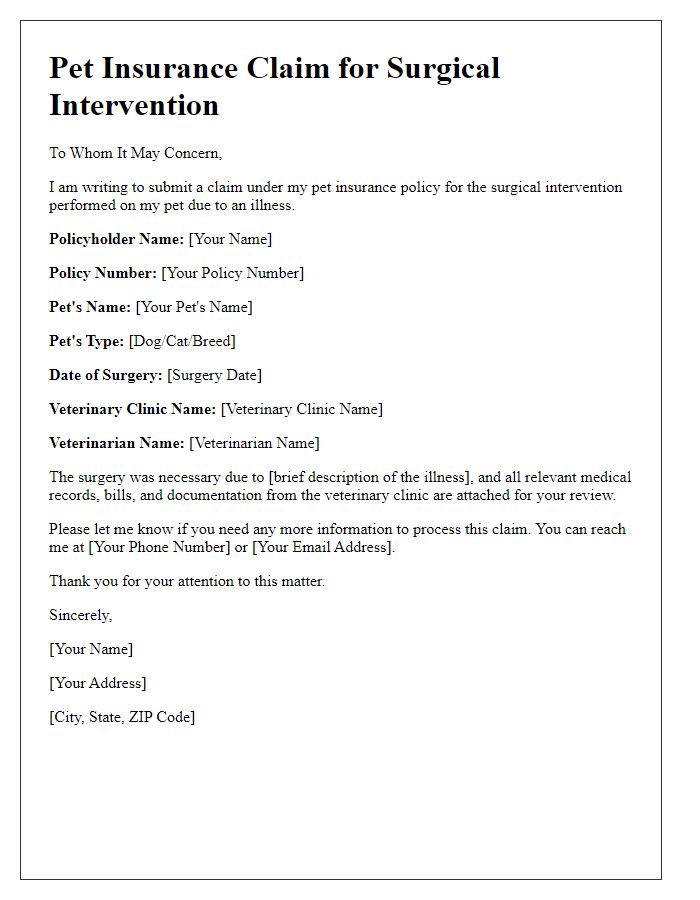

Letter template of pet insurance claim for surgical interventions for illness.

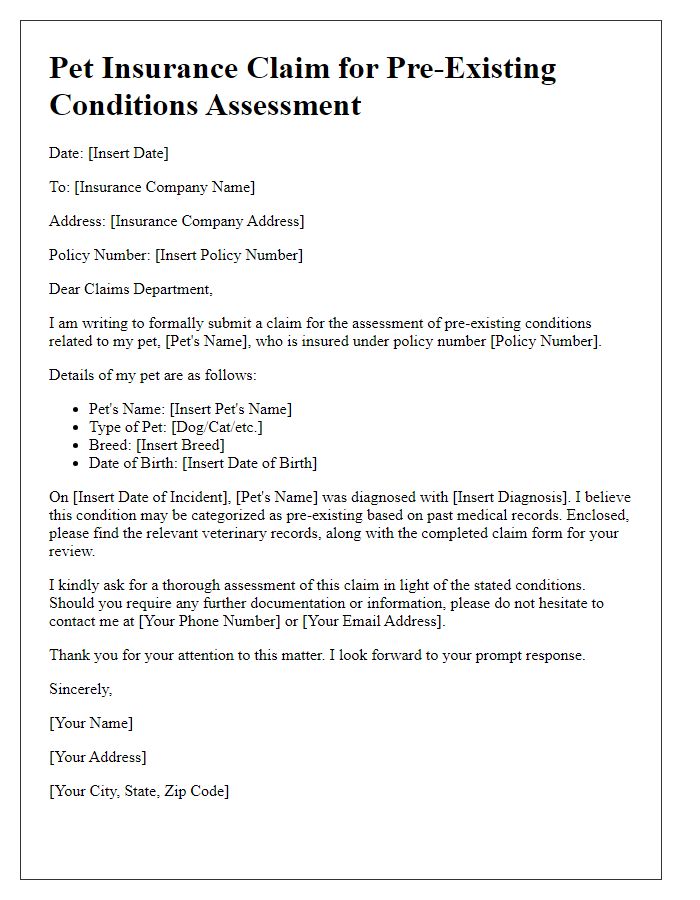

Letter template of pet insurance claim for pre-existing conditions assessment.

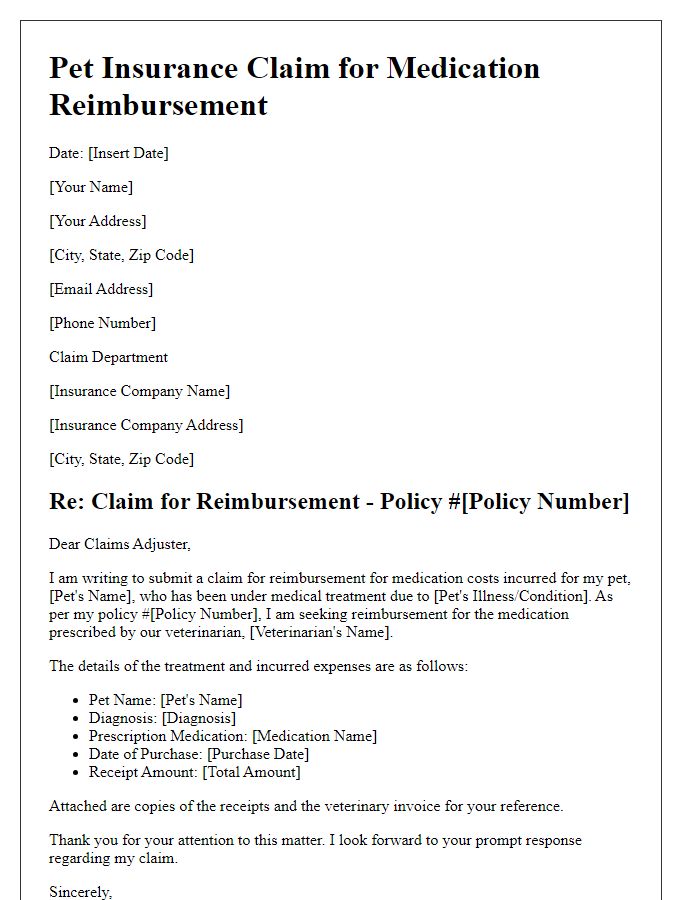

Letter template of pet insurance claim for medication reimbursement for sick pets.

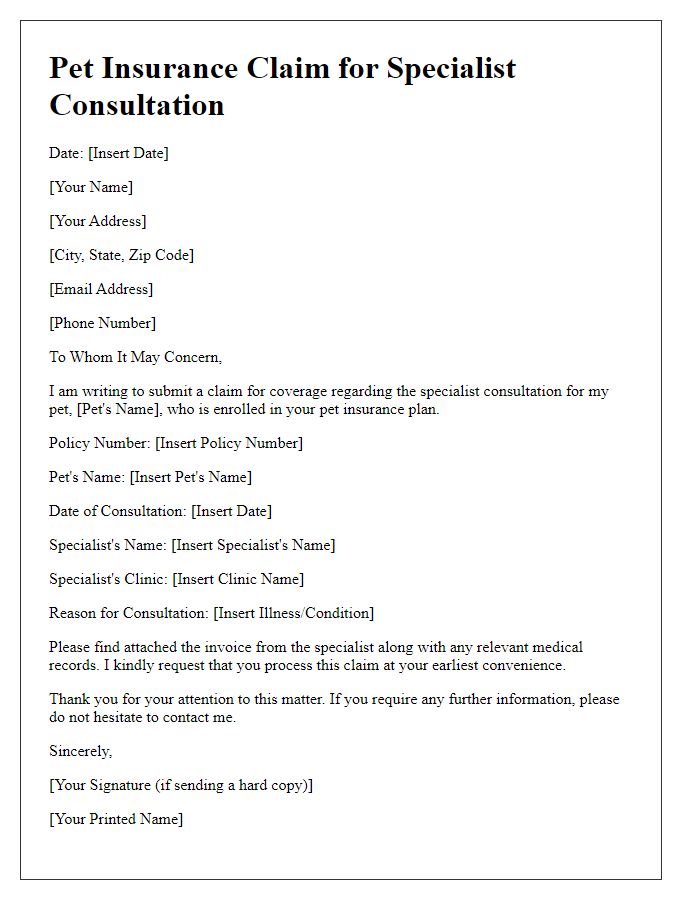

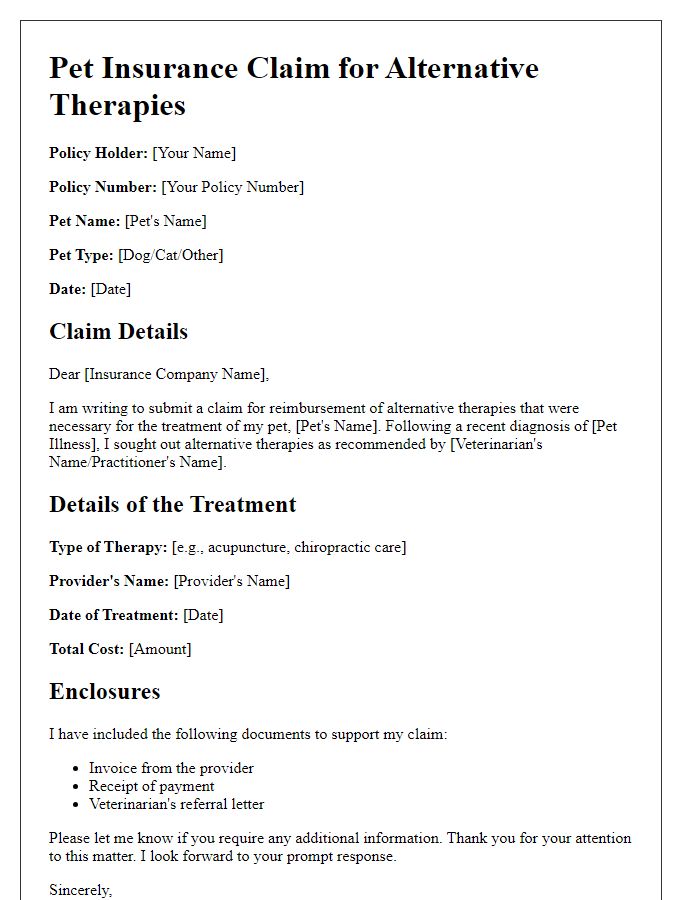

Letter template of pet insurance claim for specialist consultations regarding illness.

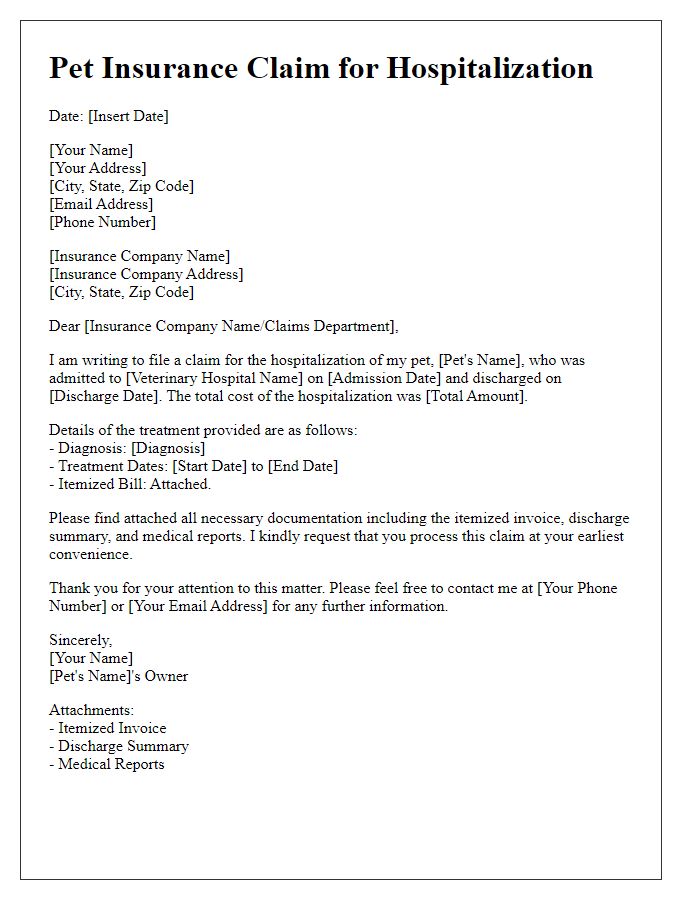

Letter template of pet insurance claim for hospitalization of a sick pet.

Comments