When life throws unexpected challenges our way, such as property damage that leaves us without a place to call home, navigating the insurance claim process can often feel overwhelming. A loss of use insurance claim is designed to help get you back on your feet by covering the additional living expenses incurred during the rebuilding process. Crafting a thoughtful letter to your insurance provider is crucial to ensure that your claim is processed smoothly and efficiently. Join me as we explore the key components of an effective loss of use insurance claim letter that can help you reclaim your peace of mind.

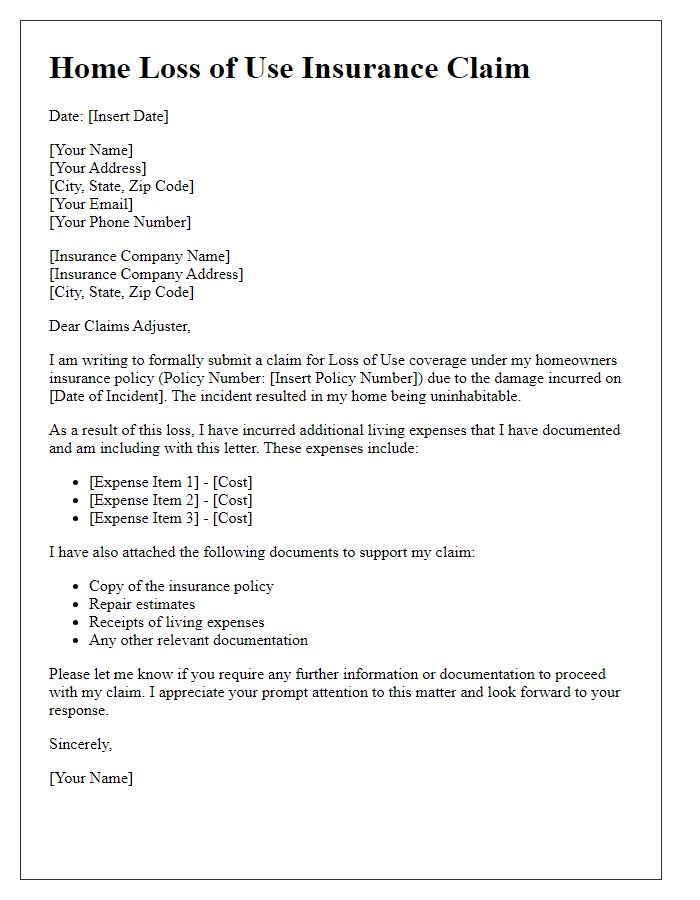

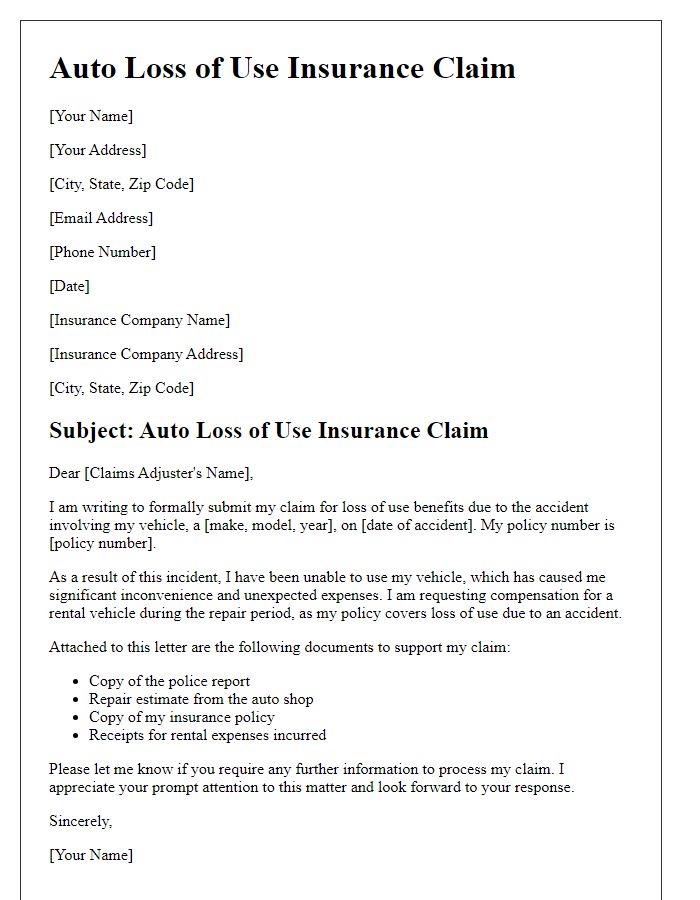

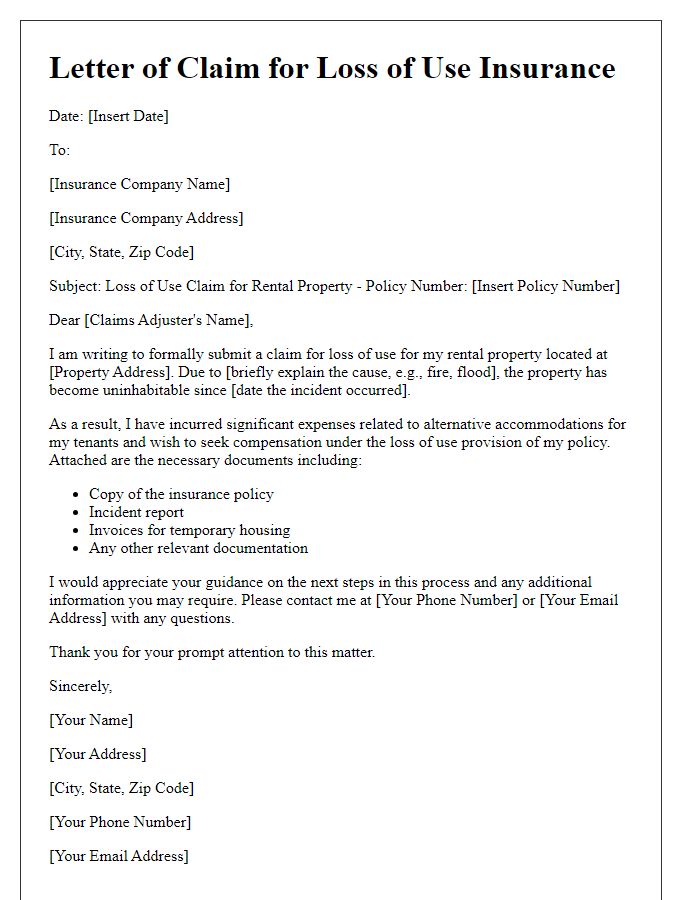

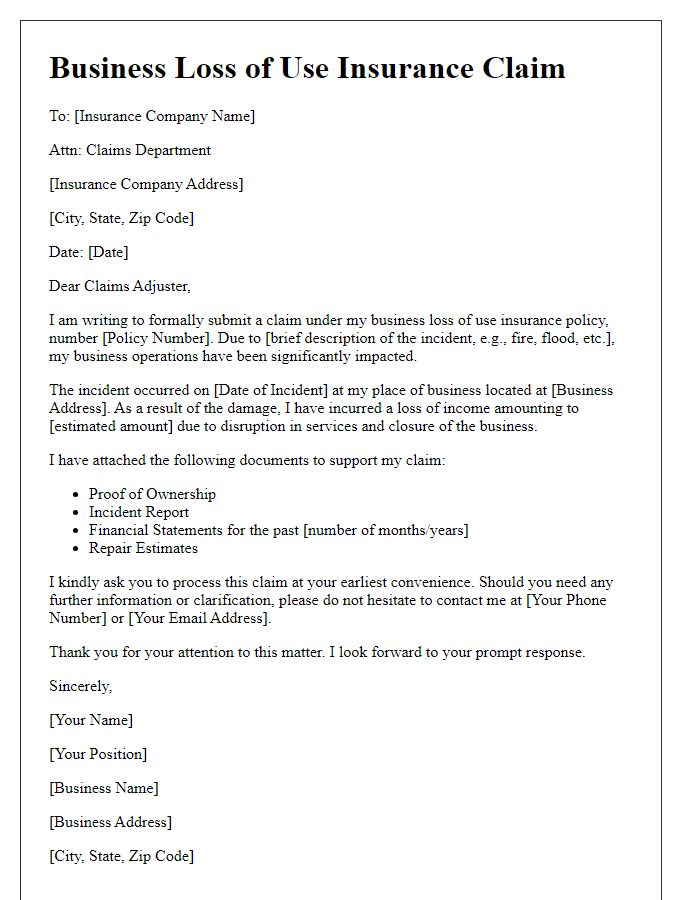

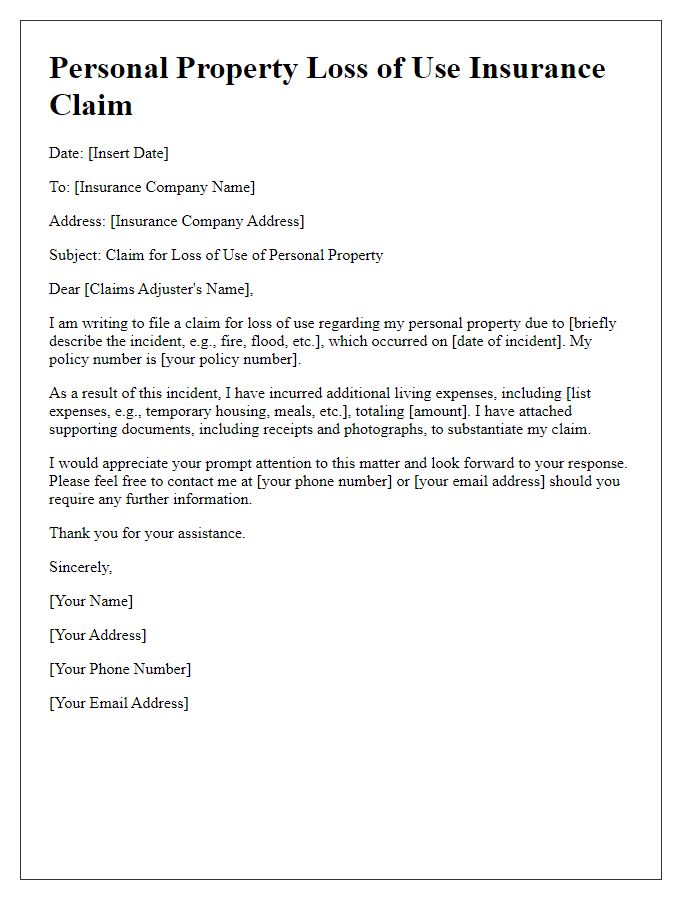

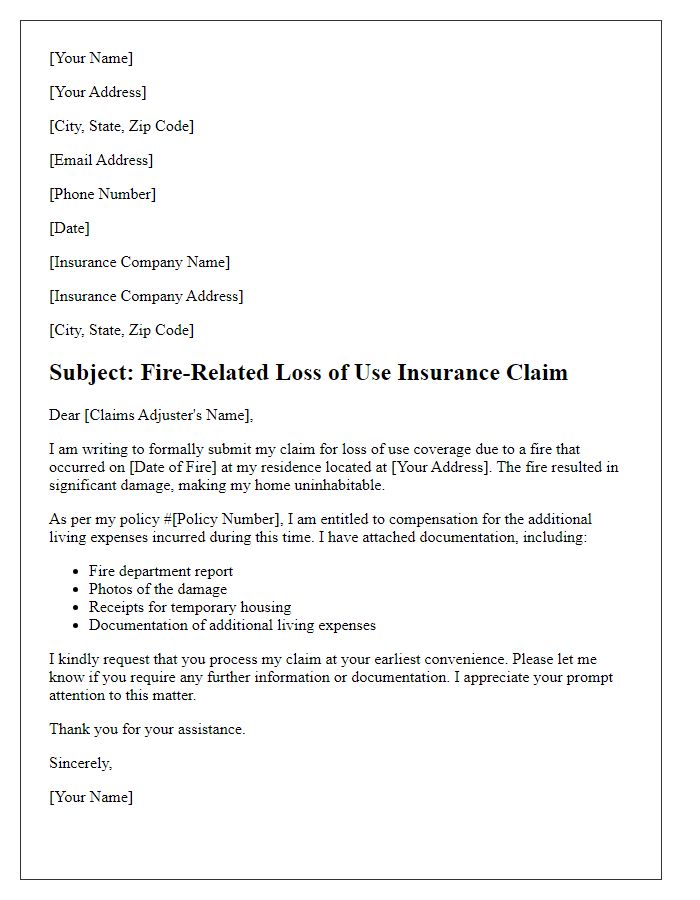

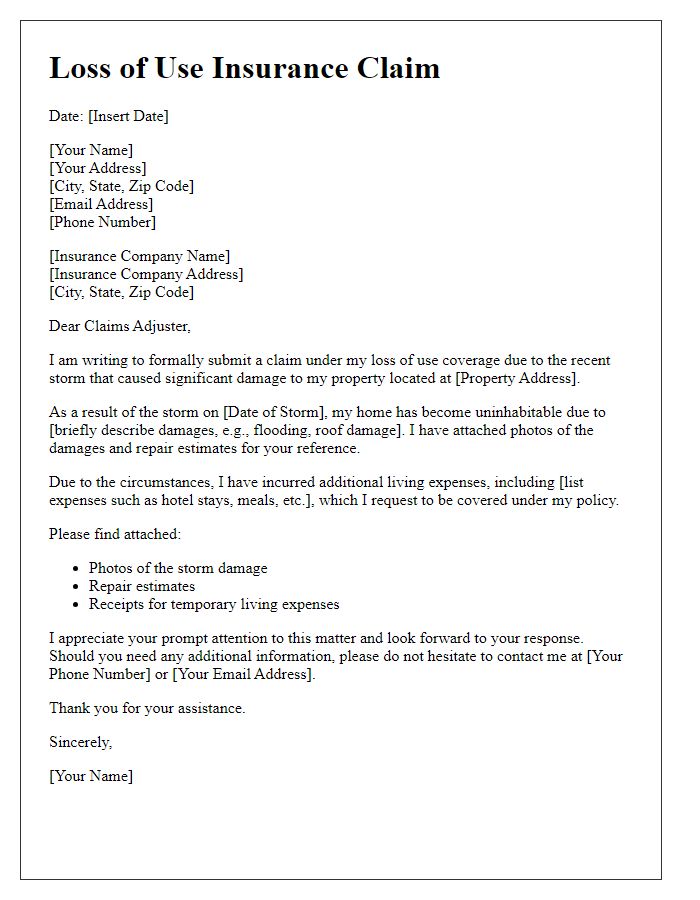

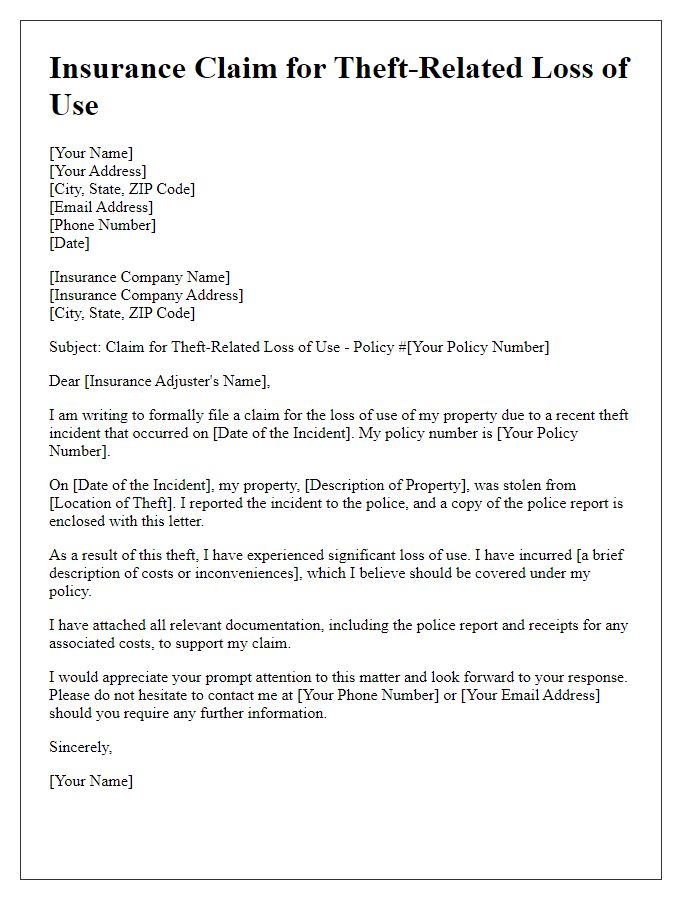

Policyholder Information

Loss of use insurance claims often arise when property has become uninhabitable due to events like fire, flood, or other disasters. Policyholders, typically homeowners or tenants, need to provide detailed information. For a claim, essential details include the policyholder's full name, address of the property affected, insurance policy number indicating coverage specifics, and contact information for direct communication with the insurance provider. Accurate documentation of lost rental income or increased living expenses, such as hotel stays or alternative accommodations during the restoration period, is crucial to substantiate the financial impact from the loss of use. Providing supporting documents like incident reports, restoration estimates, and photographs can strengthen the claim's validity, ensuring a more efficient claims process.

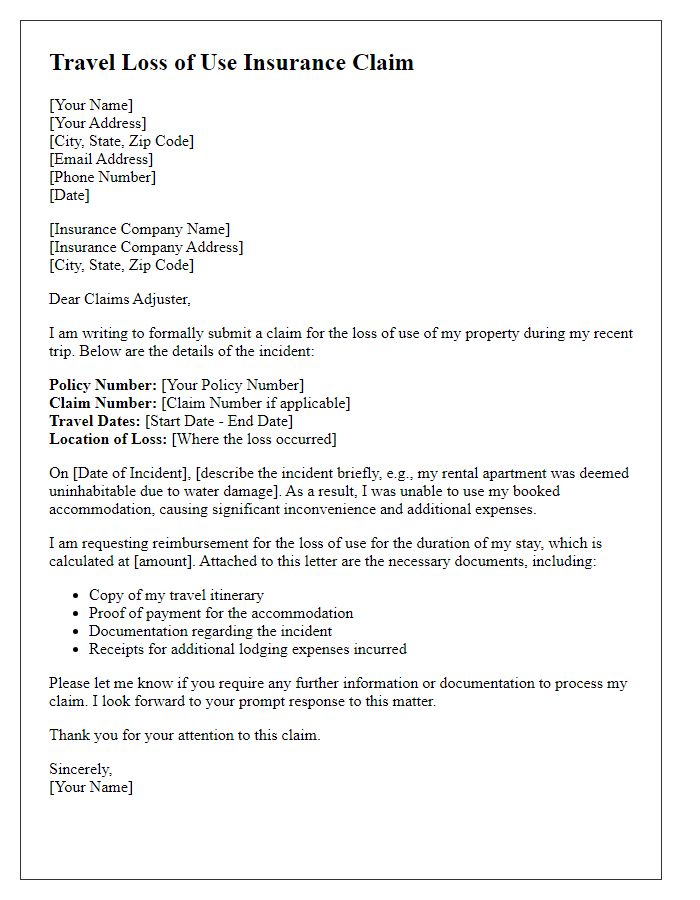

Detailed Incident Description

A comprehensive overview of a loss of use insurance claim highlights the circumstances surrounding the incident that hindered property utility. The claimant, residing at 123 Maple Street, encountered a significant disruption when a sudden water leak occurred on October 5, 2023, due to a burst pipe within the walls. This unexpected event rendered the living area and adjacent rooms uninhabitable, necessitating immediate evacuation and relocation. The prompt assessment by a licensed plumber revealed extensive damage, estimating repair costs at approximately $15,000. Subsequently, temporary housing arrangements were required, resulting in increased living expenses amounting to $2,500 over the course of the repairs. The claim requests compensation for these unforeseen costs, emphasizing the financial impact of the loss of use stemming from the incident.

Date and Time of Loss

The loss of use insurance claim requires precise documentation of critical details, including the date and time of the incident leading to the claim. Accurate identification of the event date is essential for establishing the timeline, which significantly impacts the investigation and resolution process. For instance, if the incident occurred on June 15, 2023, at approximately 3:45 PM, this information should be detailed in the report to avoid discrepancies. Furthermore, referring to specific time zones, such as Eastern Daylight Time (EDT), aids in preventing confusion and ensuring clarity in the documentation. This specificity is crucial as it could influence the calculation of any loss of use benefits being claimed.

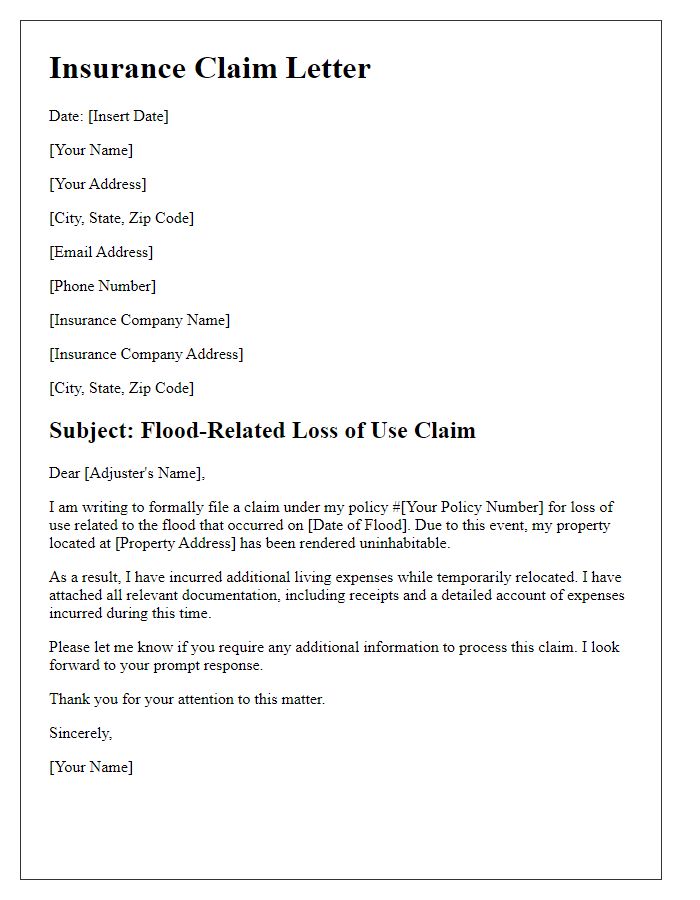

Extent of Damages

Extent of damages is a critical aspect in loss of use insurance claims. For example, in a residential property in Miami, Florida, damages from flooding (caused by Hurricane Elsa in July 2021) can result in significant structural issues, such as weakened foundations and damaged drywall. When assessing these damages, insurance adjusters often look at the square footage affected, which can be over 1,500 square feet in severe cases, leading to costly repairs. Additionally, appliances, such as HVAC systems and water heaters, may be rendered nonfunctional, contributing to the overall loss of use. The disruption in living conditions can force families into temporary housing, incurring added expenses, and further affecting their quality of life. Understanding the depth of these damages is essential for a successful claim process.

Supporting Documentation

Supporting documentation is crucial in substantiating a loss of use insurance claim, such as loss of rental income documentation from properties like apartments or houses. Essential paperwork may include a detailed timeline (dates indicating damages and claims filing), photographs documenting the property condition pre-and post-incident (water damage, fire damage), repair estimates from licensed contractors or services detailing costs associated with restoration efforts (specific amounts), and correspondence with the insurance company highlighting all communications about the claim (dates, responses). Additionally, legal documentation may be necessary, like lease agreements or proof of prior occupancy, to validate claims for lost rental income during the repair period, ensuring a comprehensive and robust presentation of the case.

Comments