If you've recently found an unauthorized insurance transaction on your account, you're not aloneâmany people experience this frustrating situation. It's essential to act quickly and clearly communicate your intent to cancel any unapproved policies. In this article, we'll guide you through the process of drafting a cancellation letter that is both effective and straightforward. So, let's dive in and help you resolve this issue with ease!

Policyholder Information

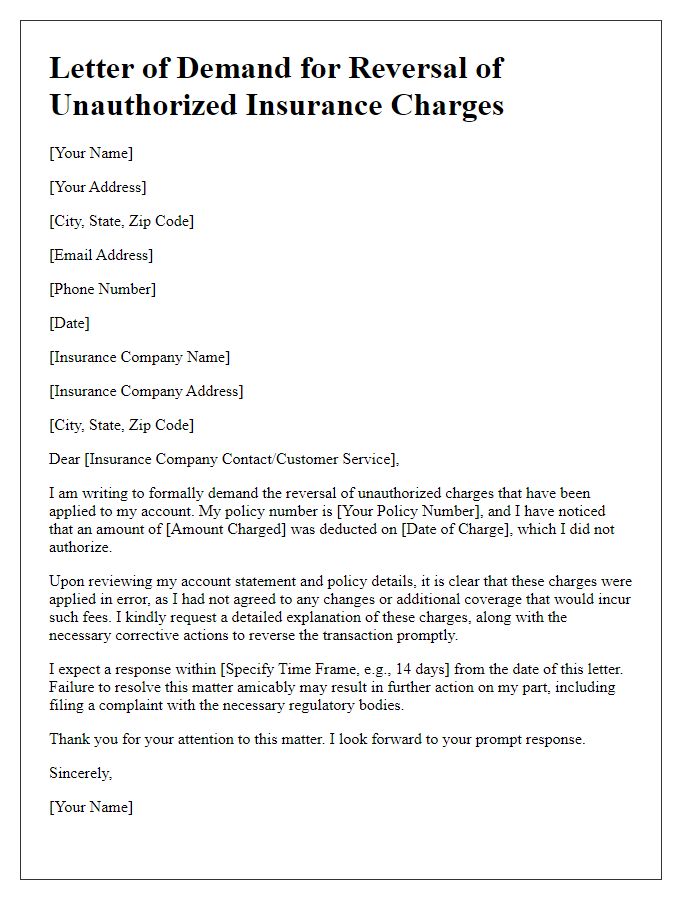

Unauthorized insurance transactions can lead to significant financial and emotional stress for policyholders. Shady practices often include the use of personal information without consent, resulting in unexpected charges on bank statements or credit card accounts. In metropolitan areas like New York City, where insurance fraud is rampant, individuals must remain vigilant against unauthorized changes to their policies. Formal cancellation requests should reference specific policy numbers, date of the transaction, and any applicable bank details to ensure comprehensive dispute resolution. Contacting regulatory agencies, such as the New York Department of Financial Services, may also be necessary for reporting fraudulent activities and protecting consumer rights. Ensuring prompt communication can potentially halt further unauthorized actions and minimize financial repercussions.

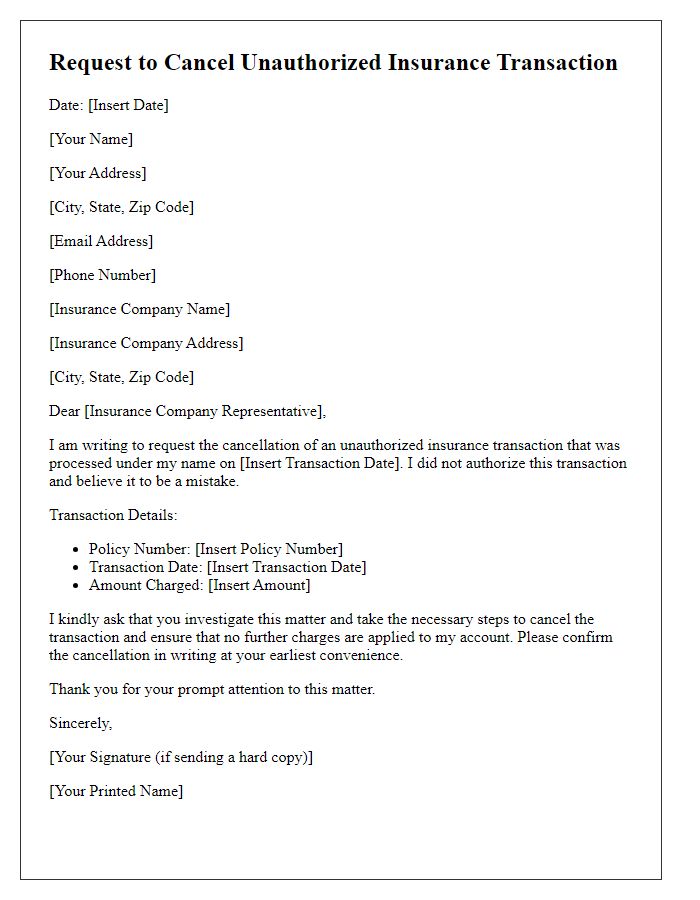

Unauthorized Transaction Details

Unauthorized transactions in insurance can lead to significant financial consequences for consumers. Specific details about the transaction, such as the date (e.g., March 15, 2023), amount (e.g., $250), and policy number (e.g., 123456789) are crucial for effective dispute resolution. Consumers must contact the insurance provider, often located in a specific region like California, to formally report the issue. Documentation, including a bank statement highlighting the transaction, should accompany the request for cancellation. It is essential to emphasize the unauthorized nature of the transaction to protect rights under consumer protection laws, such as the Fair Credit Billing Act or state-specific regulations. This process ensures that companies adhere to ethical standards in billing and provide adequate recourse for unauthorized financial actions.

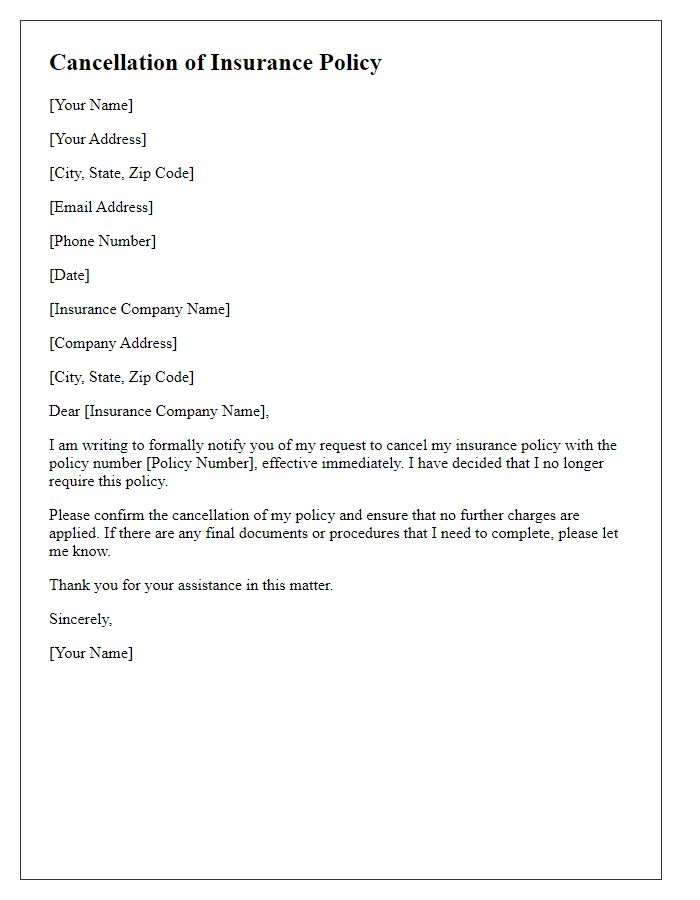

Clear Cancellation Request

Unauthorized insurance transactions can lead to financial distress and confusion. A clear cancellation request should include critical details such as the transaction date (e.g., August 15, 2023), policy number (123456), and service provider name (e.g., ABC Insurance Company). Providing the name of the insured party (John Doe) and the type of policy (auto insurance) adds necessary context. Including a statement of cancellation desire, along with a request for confirmation of the cancellation in writing within five business days, enhances the effectiveness of the communication. Additionally, noting the lack of consent for the policy and emphasizing the need for urgent action helps reinforce the seriousness of the request.

Supporting Documentation

Unauthorized insurance transactions can lead to significant financial and emotional distress for consumers relying on institutions for protection. Important documents include transaction records (e.g., policy numbers), communication logs (email exchanges), and any written consent forms that may or may not have been signed by the policyholder. Details such as the transaction date (e.g., March 15, 2023) and specific amounts charged (e.g., $350 for coverage) are critical. Also, documenting correspondence with customer service representatives from the insurance company can strengthen a cancellation claim. Maintaining a clear timeline of events, from the first notice of the transaction to cancellation requests ensures comprehensive representation of the issue at hand.

Contact Information for Follow-up

Unauthorized insurance transactions can lead to serious financial consequences and identity theft. Victims of fraudulent activities should immediately report the incident to their insurance provider, such as XYZ Insurance Company, located at 123 Insurance Avenue, Springfield. Documentation should include policy numbers, transaction dates, and any communication records. Furthermore, contacting local authorities, such as the Springfield Police Department, at 555-0123 is crucial for filing a report. Following up with the Federal Trade Commission (FTC) via their website can provide additional assistance and resources for resolving the matter. Prompt action is essential to mitigate potential losses and restore peace of mind.

Letter Template For Canceling Unauthorized Insurance Transaction Samples

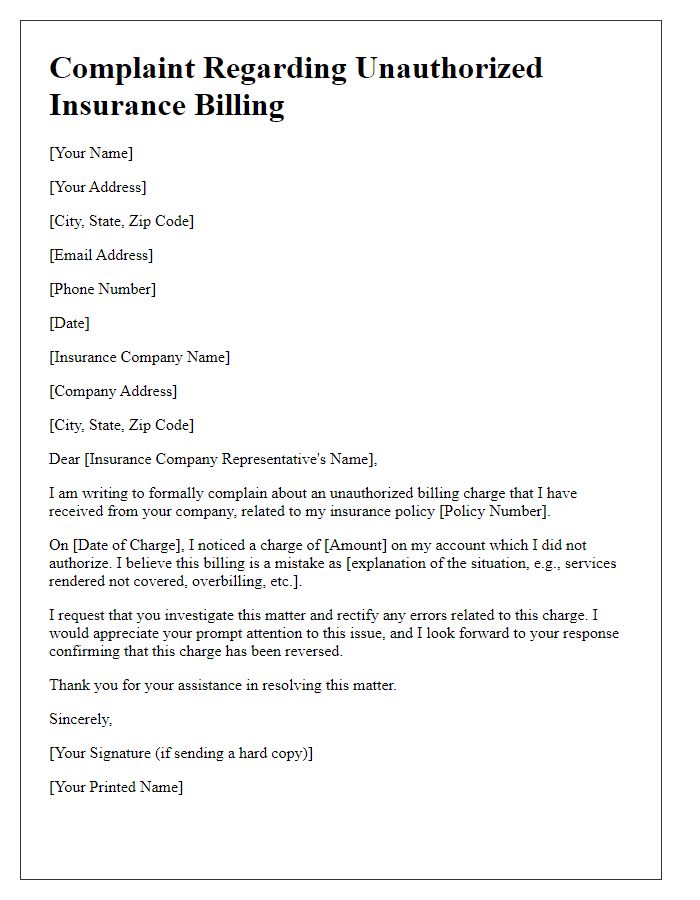

Letter template of request to cancel unauthorized insurance transaction.

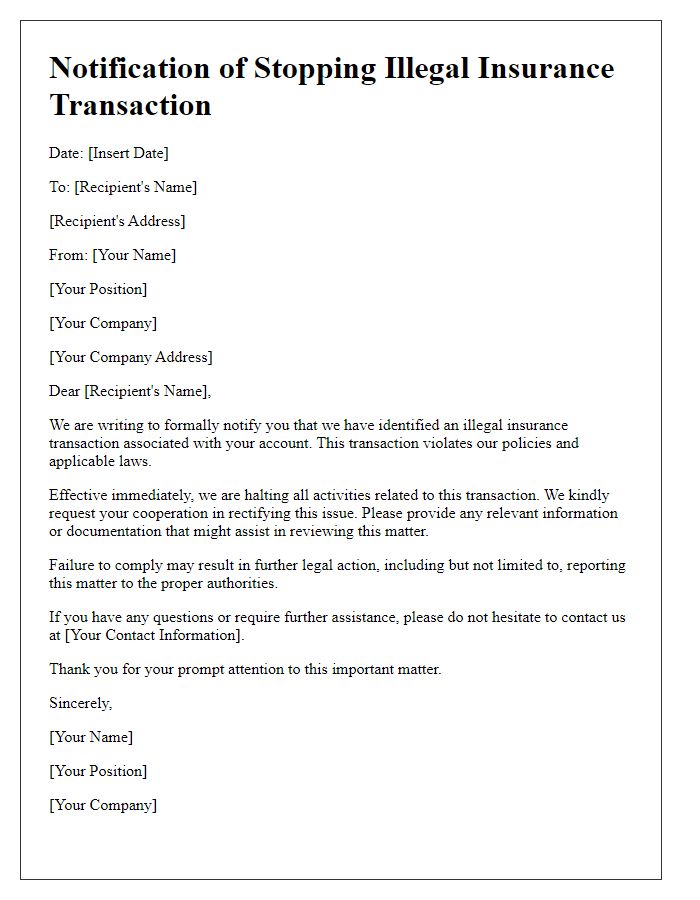

Letter template of notification for cancellation of an unwanted insurance policy.

Letter template of demand for reversal of unauthorized insurance charges.

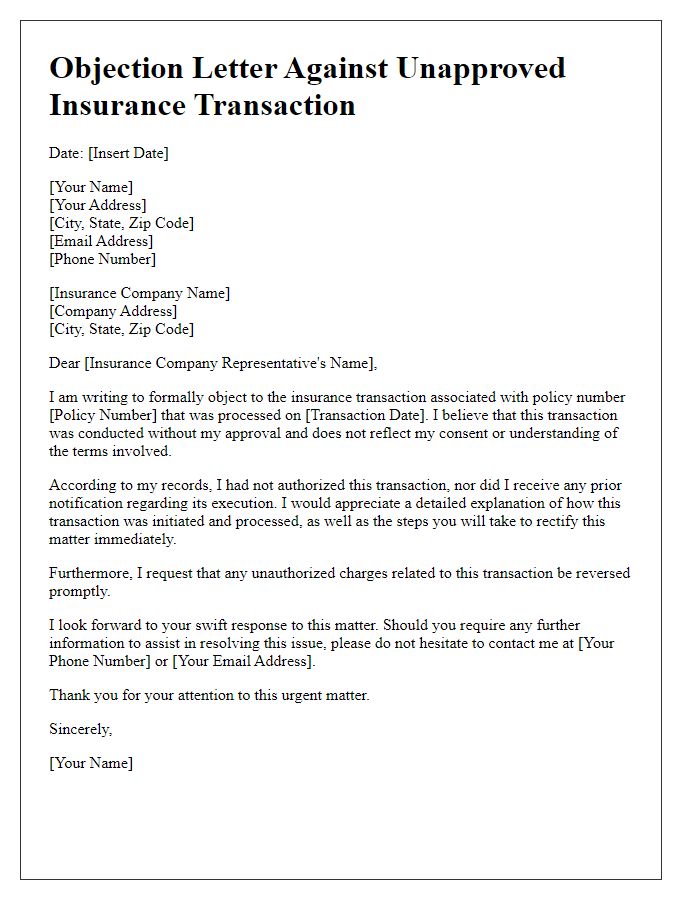

Letter template of objection against an unapproved insurance transaction.

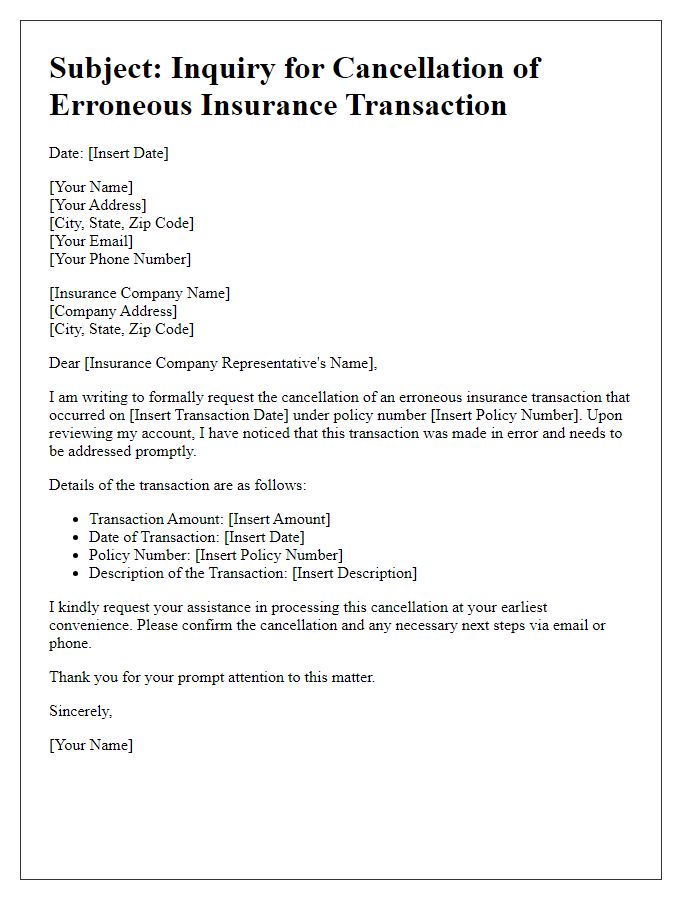

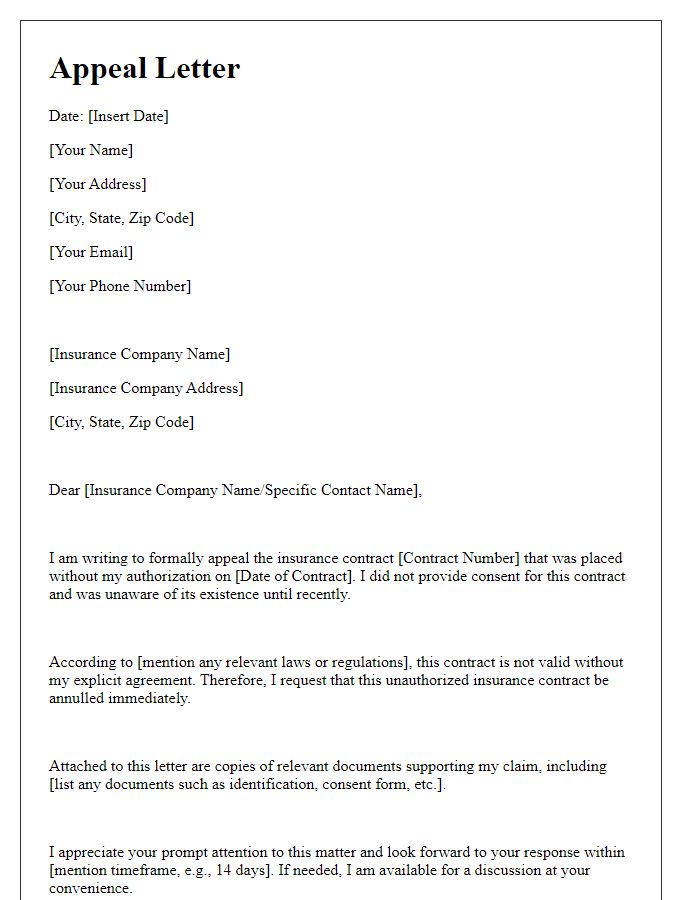

Letter template of inquiry for canceling an erroneous insurance transaction.

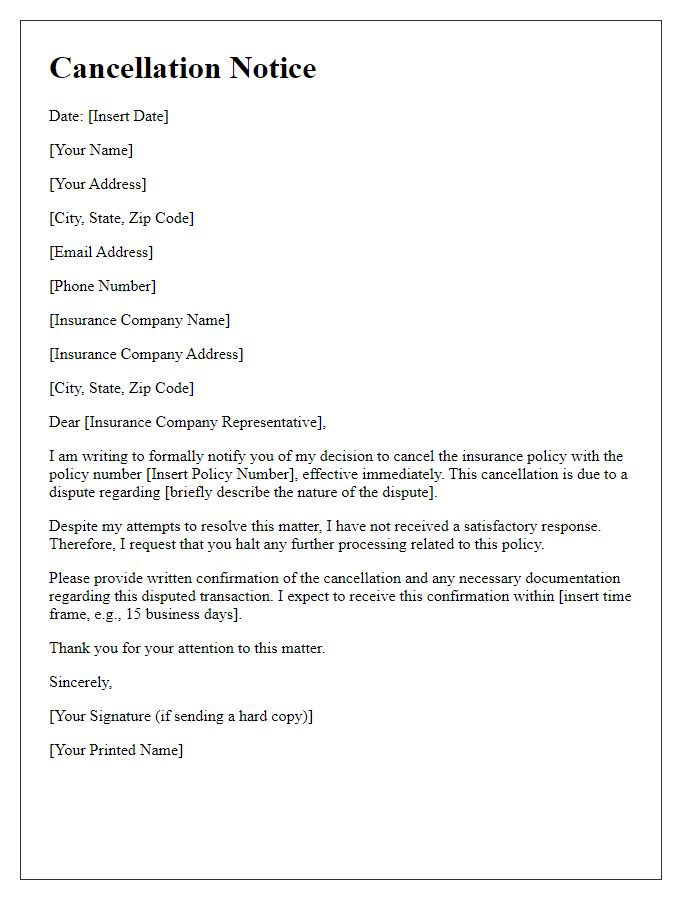

Letter template of cancellation notice for a disputed insurance transaction.

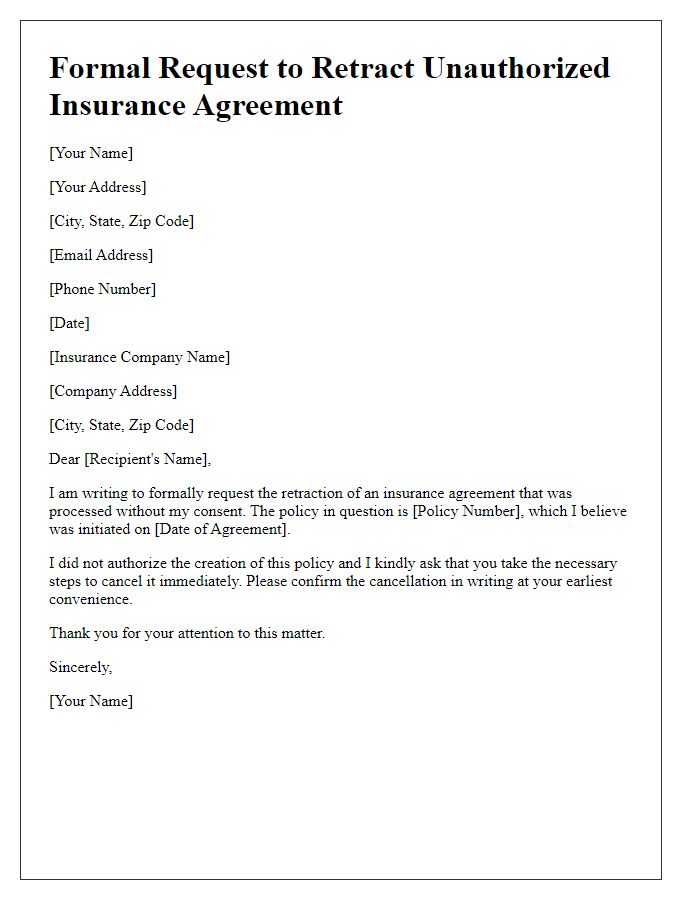

Letter template of formal request to retract an unauthorized insurance agreement.

Comments