Hey there! We all know that life can get a little hectic, and sometimes we might overlook important tasks, like paying our insurance premium. If you've found yourself in this situation, don't worryâyou're not alone. Join us as we explore a simple yet effective letter template that will help you craft an apology and request for missed premiums, ensuring your coverage stays intact. Read on to discover how you can smoothly navigate this situation!

Subject line clarity

Missed premium payment notifications can create complications for policyholders seeking to maintain active coverage. Insurance companies often send reminders via email or postal mail, highlighting due dates and encouraging timely payments to avoid policy lapses. A clear subject line, such as "Immediate Attention Required: Missed Premium Payment Notification", ensures that recipients understand the urgency of the message. Policyholders should promptly address the missed payment to reinstate coverage and prevent potential claims issues. Communication can include streamlined methods for payment processing, allowing customers to resolve outstanding balances efficiently.

Apology expression

Apologizing for a missed premium payment can create a sense of accountability and openness with the recipient. A clear explanation of the circumstances surrounding the missed payment can be valuable. Stressing the importance of the premium payment, not only for maintaining coverage but also for ensuring financial security, is essential. Additionally, providing options to rectify the situation, such as setting a new payment date or discussing alternative payment arrangements, can reinforce the willingness to resolve the issue and maintain a strong relationship. Maintaining a respectful and understanding tone throughout encourages cooperation and minimizes potential frustration.

Reason explanation

Apologies for the missed premium payment for policy number 12345678. The oversight occurred due to an unexpected medical emergency in July 2023 that required immediate financial attention. Consequently, funds allocated for the insurance premium were temporarily redirected to cover medical expenses. I kindly request your assistance in reinstating my policy and providing information on any penalties or grace periods available. Your understanding in this matter is greatly appreciated, and I am committed to resolving this issue promptly.

Assurance of future compliance

Missed premium payments can lead to significant consequences for policyholders, including lapsed coverage and potential penalties. In 2023, the average insurance premium is projected to increase by 6% in various sectors, stressing the importance of timely payments. Acknowledging the oversight, individuals often seek to reassure their insurance providers regarding future compliance with payment schedules. Setting up automated payment reminders or direct debit options can enhance adherence to payment deadlines, ensuring uninterrupted coverage and maintaining trust in the insurance relationship. By implementing proactive measures, policyholders can mitigate risks associated with missed payments and demonstrate commitment to financial responsibilities.

Request for reinstatement

A missed premium payment can result in the lapse of insurance coverage, which poses significant risks to policyholders during the grace period of 30 days allowed by most insurers. In this critical timeframe, often designated by insurance companies to accommodate unforeseen financial difficulties or forgetfulness, policyholders risk losing essential protection against unforeseen events. To remedy this situation, a formal request for reinstatement must include specific details such as policy identification numbers, the date of missed payment, and a clear indication of the intent to rectify the oversight. Submitting this request promptly is vital, as many insurance providers establish strict guidelines for reinstatement eligibility, often requiring prompt action within the lapse period to restore benefits without penalties or additional fees.

Letter Template For Missed Premium Apology And Request Samples

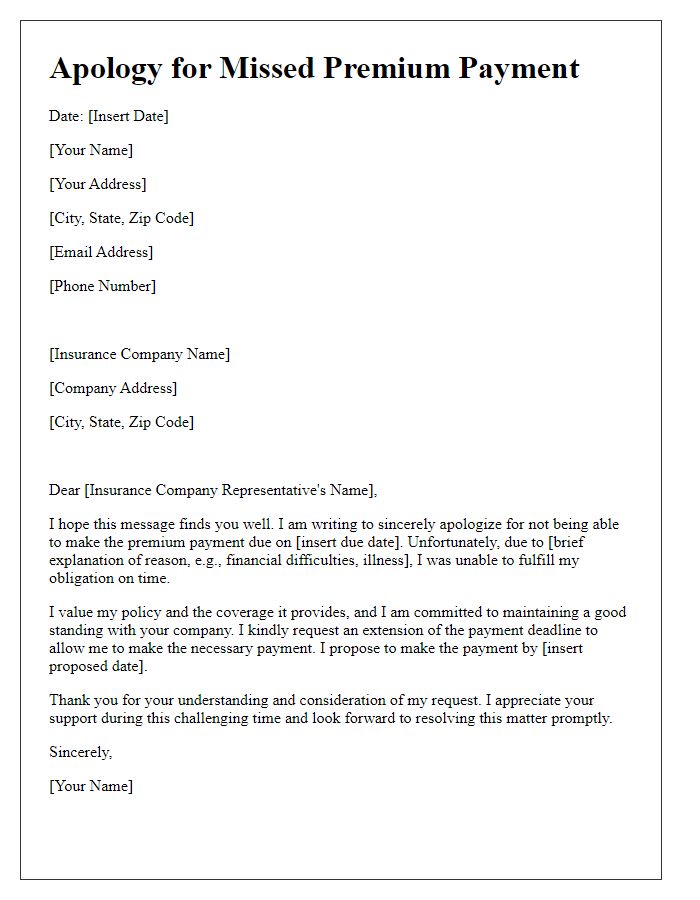

Letter template of apology for missed premium payment and request for extension

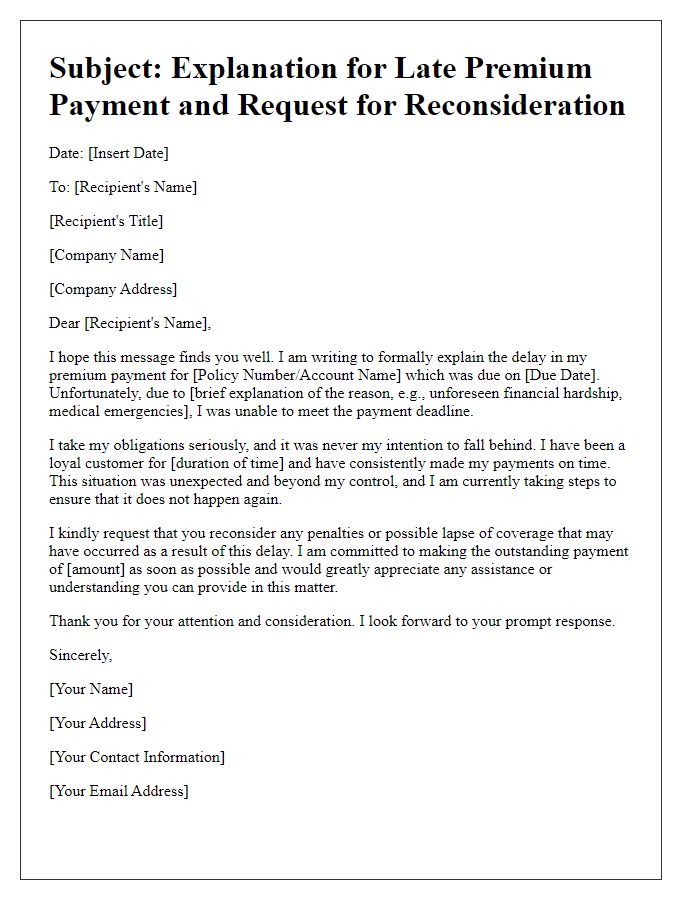

Letter template of explanation for late premium payment and plea for reconsideration

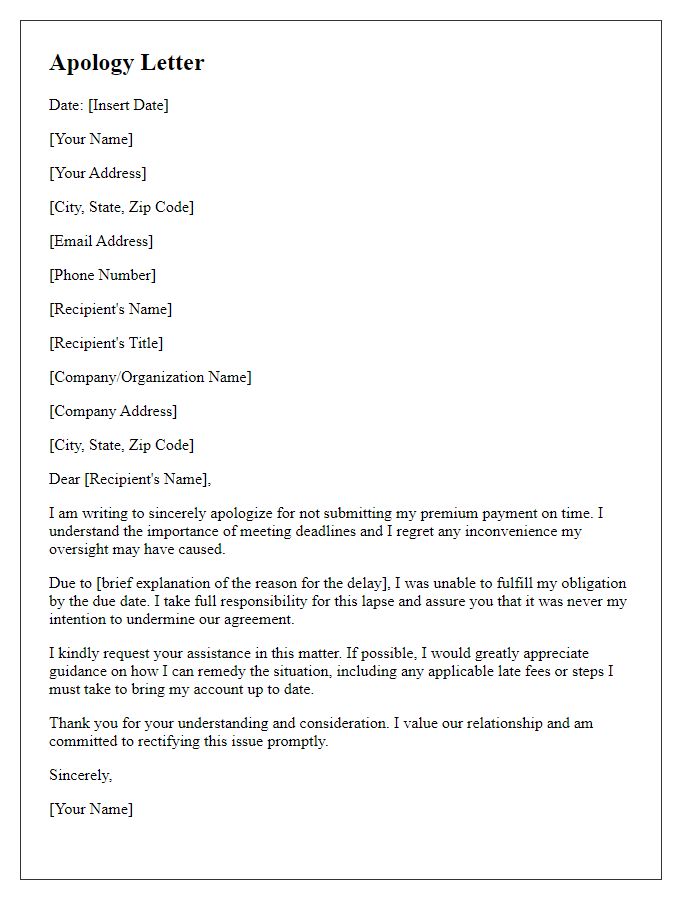

Letter template of sincere apology for not submitting premium on time and requesting assistance

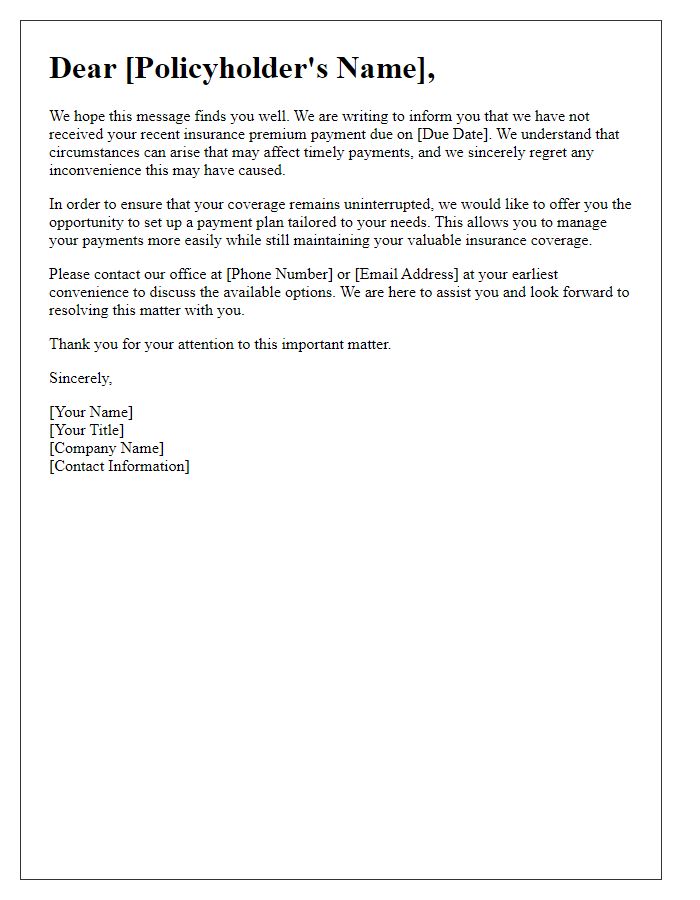

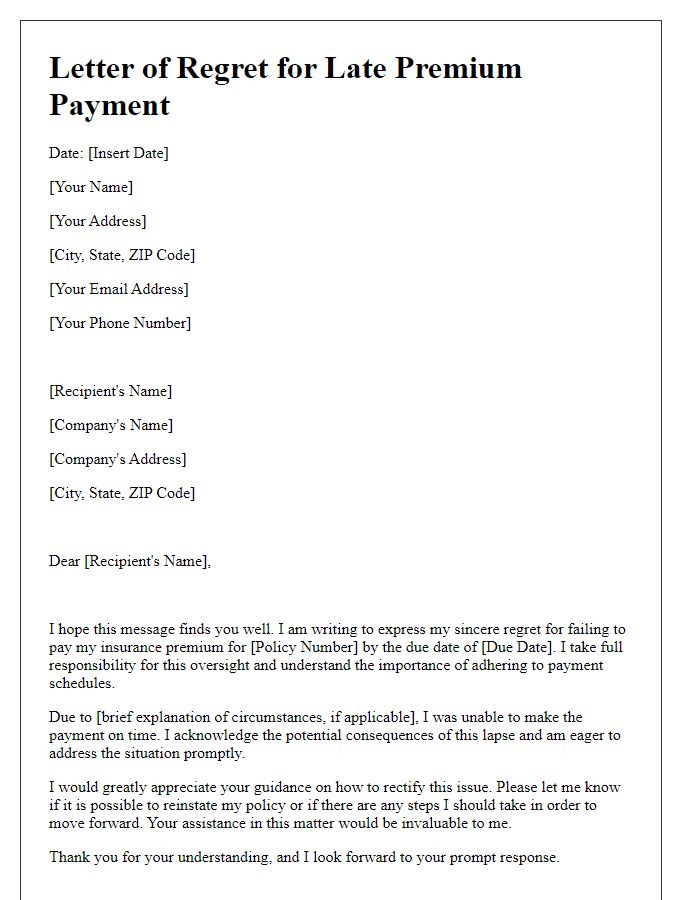

Letter template of regret for missed insurance premium and solicitation for a payment plan

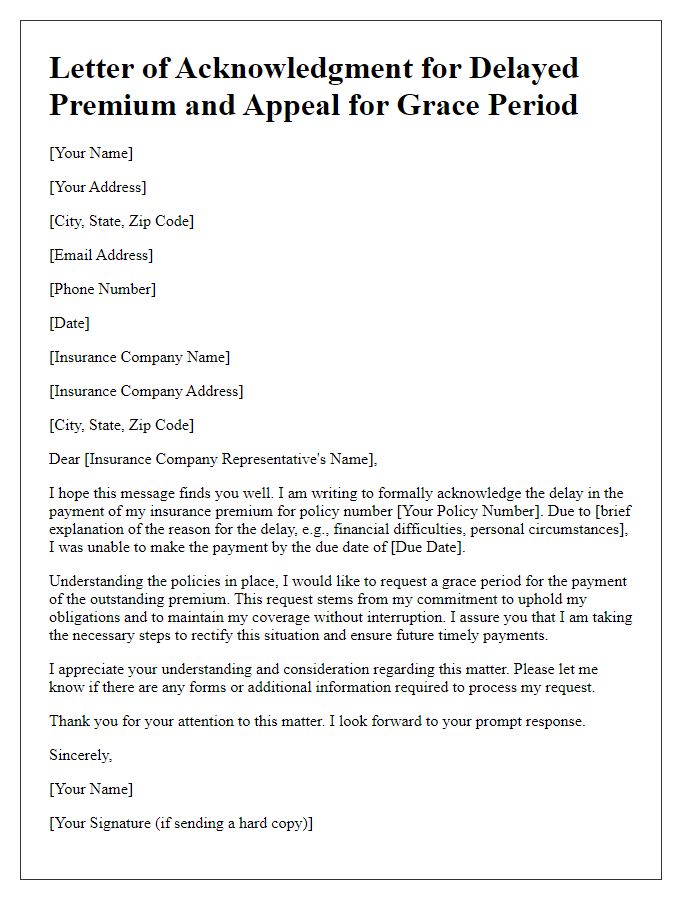

Letter template of acknowledgment for delayed premium and appeal for grace period

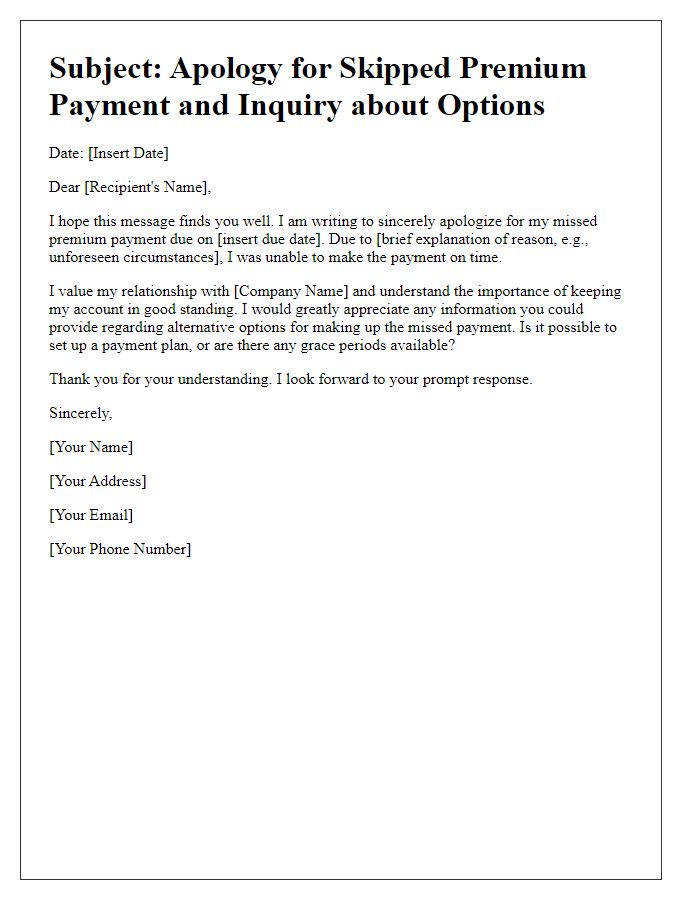

Letter template of apology for skipped premium payment and inquiry about alternative options

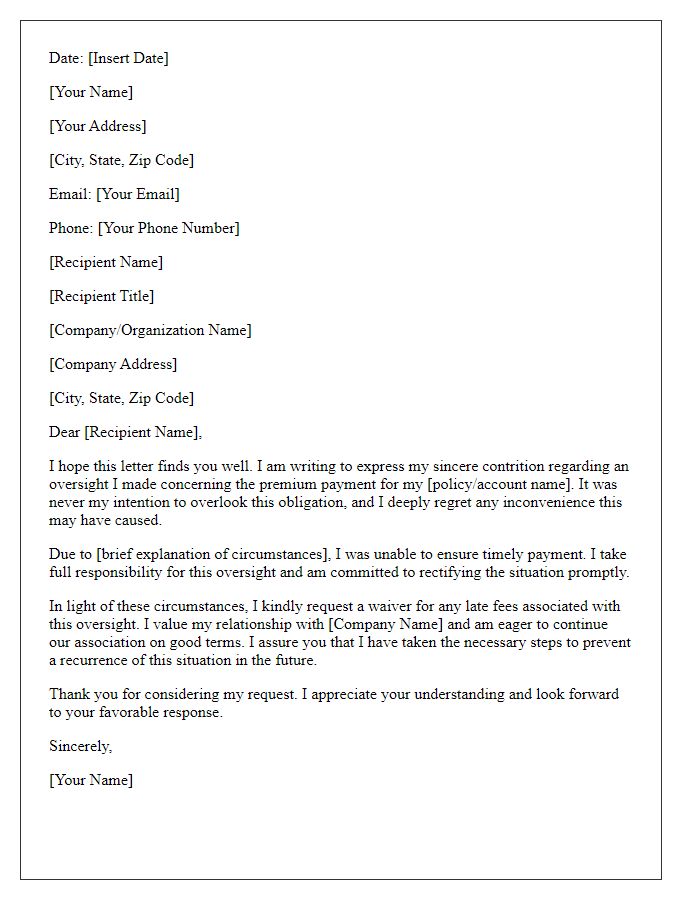

Letter template of contrition for oversight in premium and request for waiver

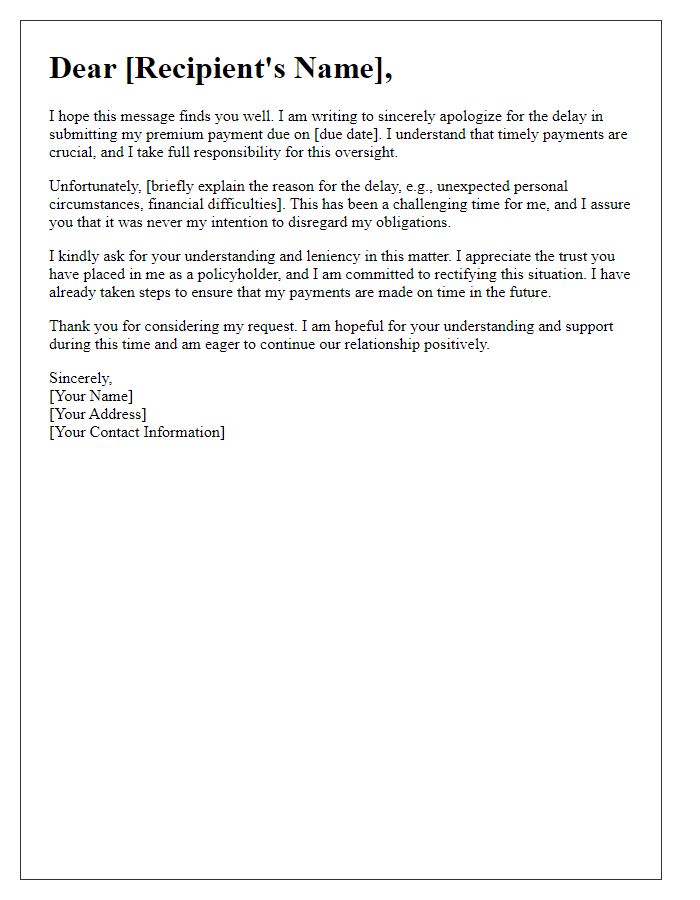

Letter template of heartfelt apology for late premium submission and call for leniency

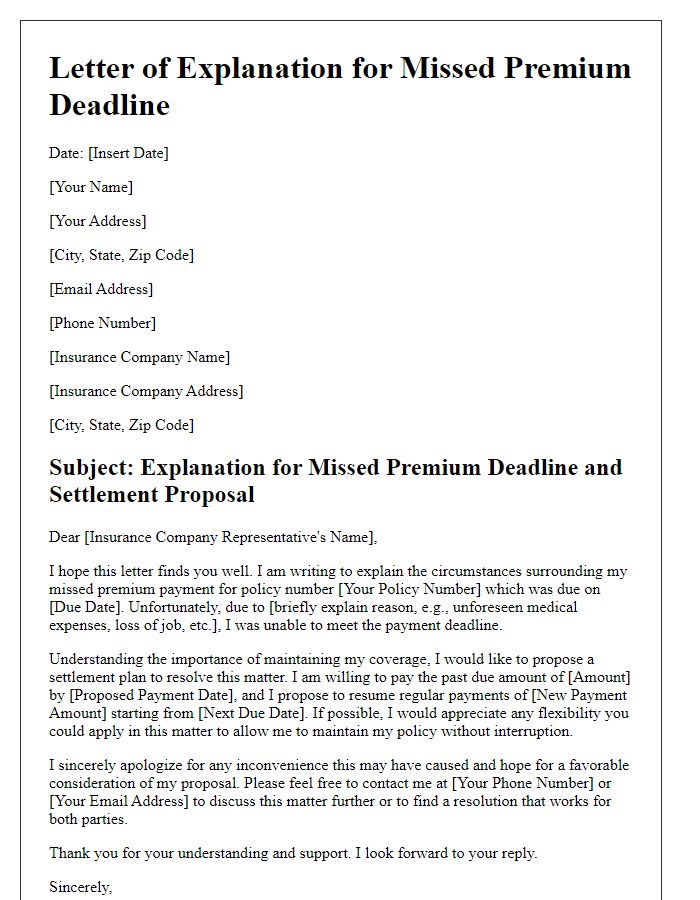

Letter template of explanation for missed premium deadline and proposal for settlement

Comments