Are you navigating the complexities of insurance while facing financial challenges? Applying for a hardship exception can seem daunting, but it's a crucial step toward securing the support you need. In this article, we'll break down the essential components of an effective letter template, providing you with the clarity to express your situation confidently. So, let's dive in and explore how you can effectively advocate for yourself!

Personal Information and Contact Details

Insurance hardship exceptions provide financial relief to policyholders facing unforeseen economic difficulties. The application process typically requires comprehensive personal information, including your full name (such as John Smith), residential address (e.g., 1234 Elm Street, Springfield, IL), phone number (like (555) 123-4567), email address (e.g., johnsmith@email.com), and policy details (policy number or account identifier). Important supporting documents may include proof of income loss (such as layoff letters or medical bills), a statement of financial hardship outlining the circumstances leading to the request, and any relevant identification documents (such as driver's license or social security card) to verify identity. Providing detailed and accurate information increases the chances of a favorable decision from the insurance company.

Insurance Policy Information

Navigating financial challenges can be daunting, especially for policyholders facing difficulties in maintaining their insurance coverage, such as the Affordable Care Act (ACA) health insurance policy. For example, sudden job loss or unexpected medical expenses can disrupt timely premium payments. Policyholders often seek a hardship exception to prevent policy cancellation, particularly in states like California and Texas, where regulations may provide additional protections. Necessary documentation might include proof of income loss, medical bills, and a formal request to the insurance provider outlining the circumstances. Timely submission and clear communication are essential to ensure that the request is processed efficiently and compassionately.

Detailed Explanation of Hardship Circumstances

Financial challenges can impact individuals seeking insurance, particularly during unforeseen circumstances such as job loss or medical emergencies. Hardship exceptions allow policyholders to request flexibility in their coverage requirements. For instance, a sudden reduction in income (over 50% in some cases) due to a layoff can strain one's ability to maintain premium payments. Additionally, unexpected medical expenses (averaging thousands of dollars for surgeries or long-term treatments) can deplete savings, exacerbating financial instability. In some cases, natural disasters (like hurricanes or floods) can lead to significant property damage, further complicating insurance affordability. These scenarios highlight the necessity of understanding mitigating circumstances that warrant an exception to standard insurance protocols.

Requested Exception or Accommodation

Individuals facing financial difficulties may seek an insurance hardship exception to alleviate their premium payments. Organizations, such as health insurance providers, often require documentation detailing income disparities and unexpected expenses, such as medical bills or job loss, as part of the application process. A thorough explanation of the specific hardship and any supporting financial statements, including bank statements or pay stubs, strengthens the request. Timely submission of this request, generally within 30 days of the premium due date, ensures prompt review. Following up with customer service representatives at the insurance company can also expedite the assistance process.

Supporting Documentation and Evidence

The application for an insurance hardship exception requires thorough documentation and compelling evidence to support claims of financial strain. Key documents typically include personal financial statements, tax returns from the previous two years, and bank statements showcasing significant declines in income. Medical bills from healthcare providers, especially those exceeding a certain threshold, can highlight unexpected expenses causing hardship. Additional evidence might include termination letters from employers, proof of job loss with dates, disability documentation, or eviction notices for housing instability. Gathering such documentation effectively demonstrates the genuine need for an exception in the insurance policy due to unforeseen circumstances.

Letter Template For Applying For Insurance Hardship Exception Samples

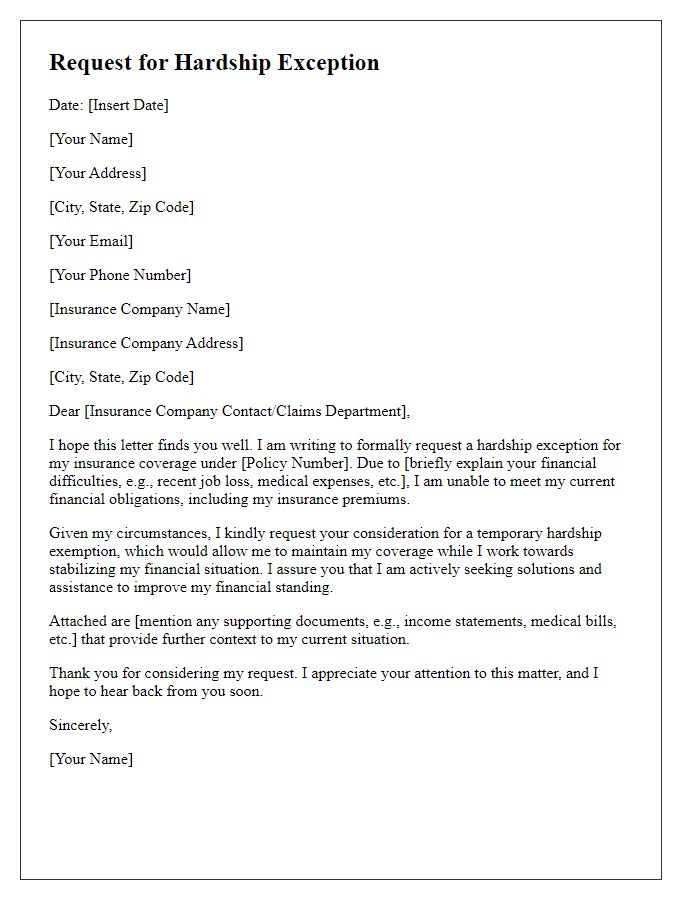

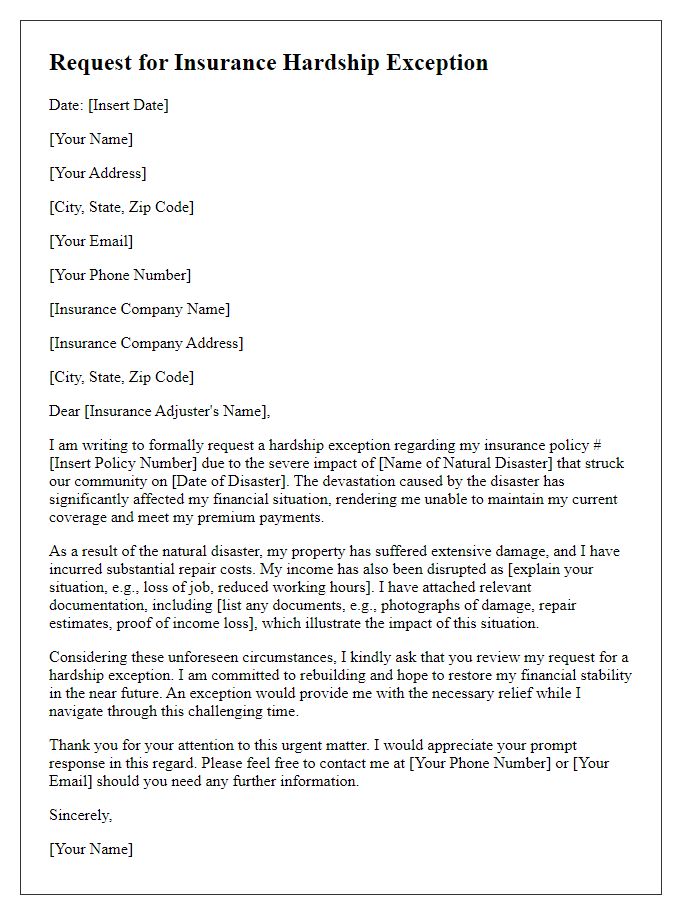

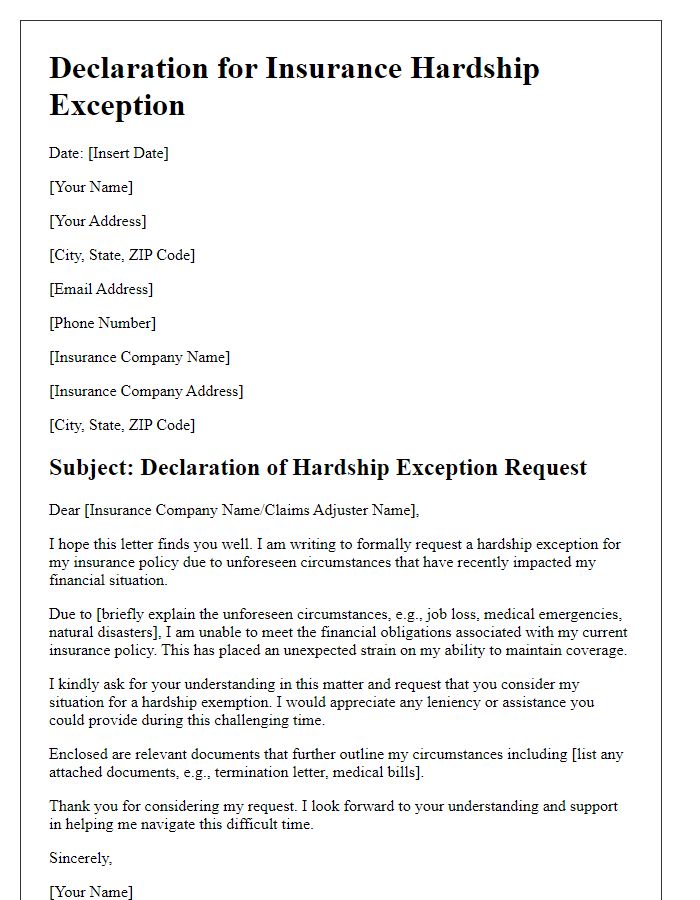

Letter template of request for insurance hardship exception due to financial difficulties

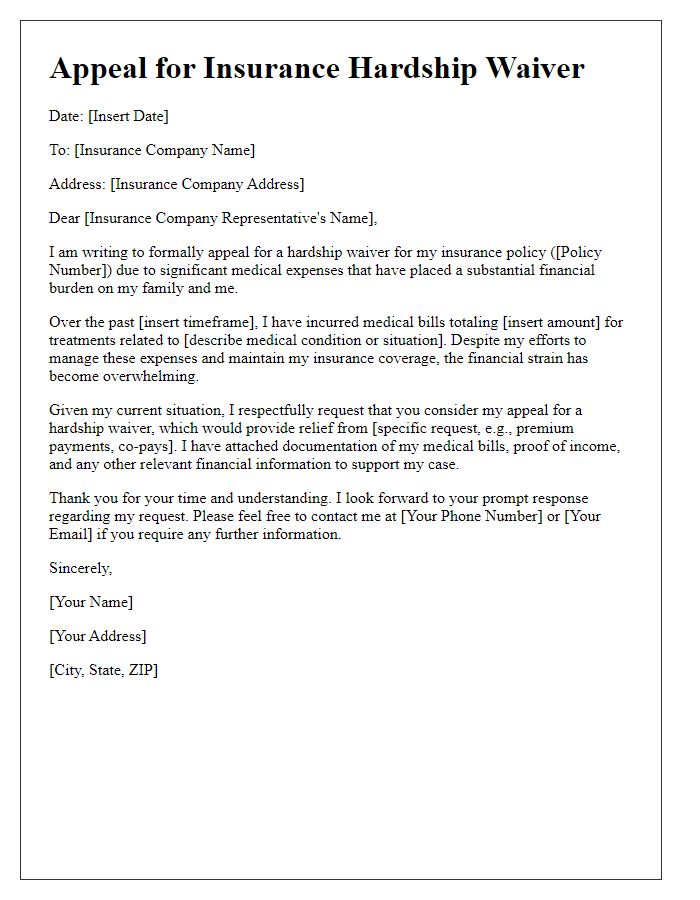

Letter template of appeal for insurance hardship waiver based on medical bills

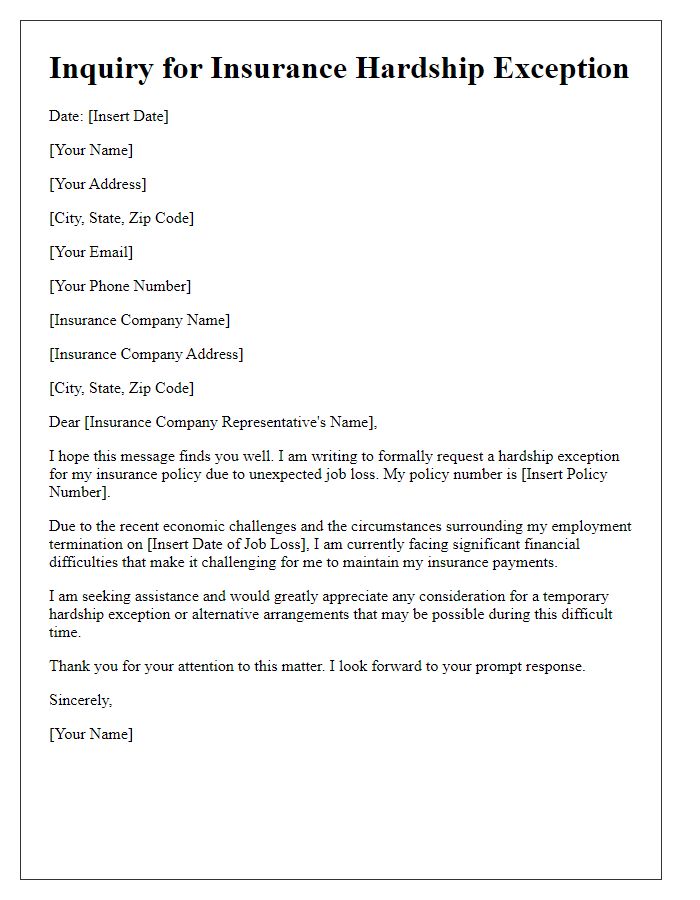

Letter template of inquiry for insurance hardship exception as a result of job loss

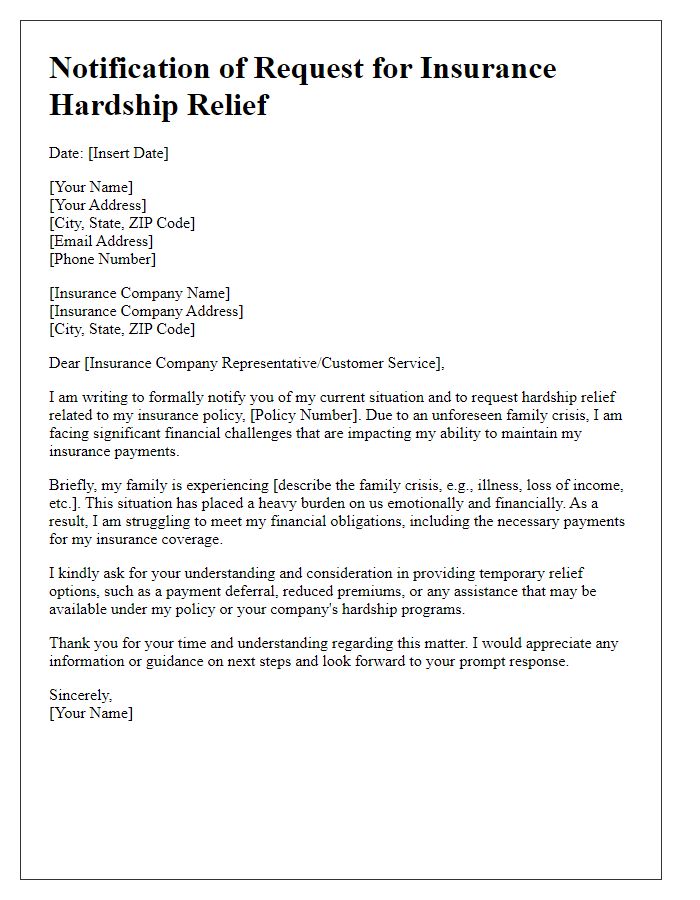

Letter template of notification for seeking insurance hardship relief due to family crisis

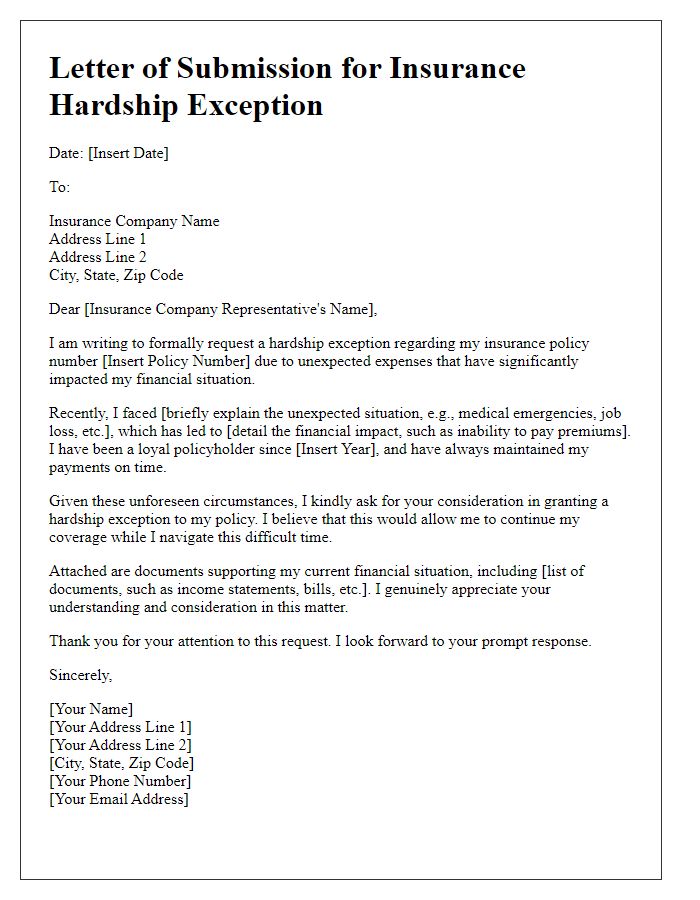

Letter template of submission for insurance hardship exception in light of unexpected expenses

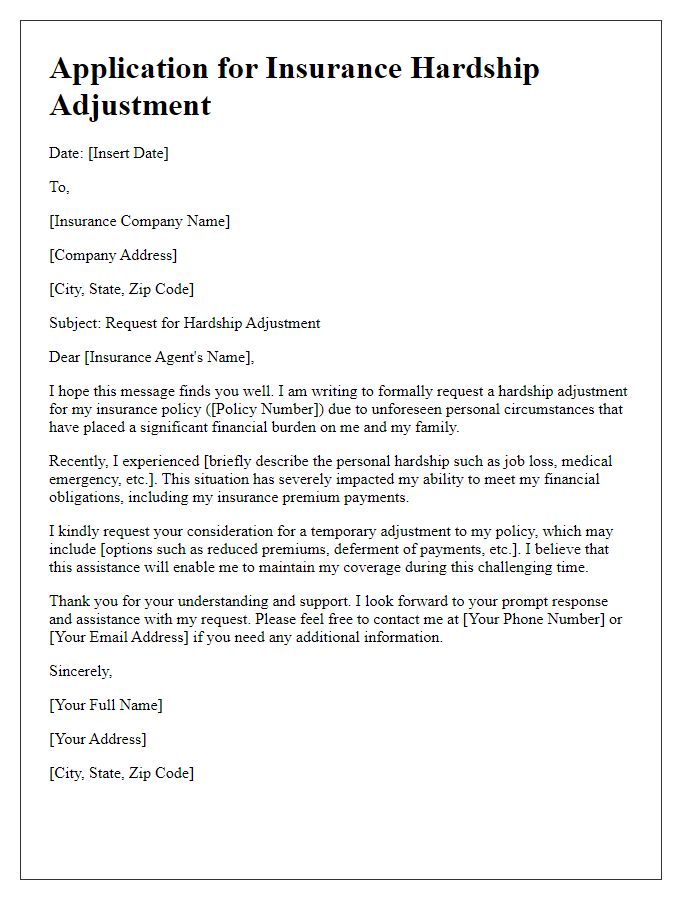

Letter template of application for insurance hardship adjustment following personal hardship

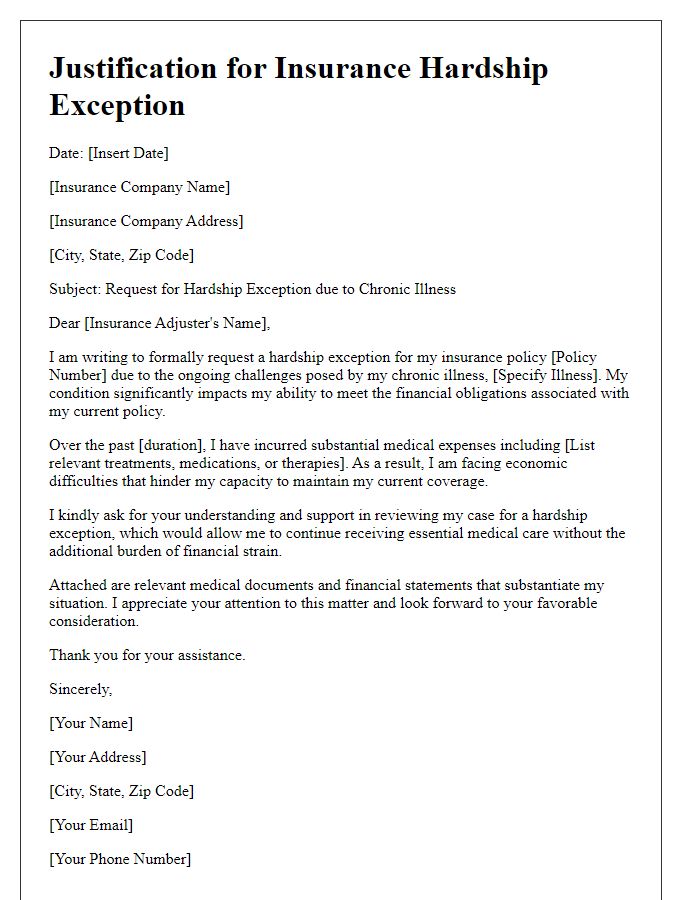

Letter template of justification for insurance hardship exception owing to chronic illness

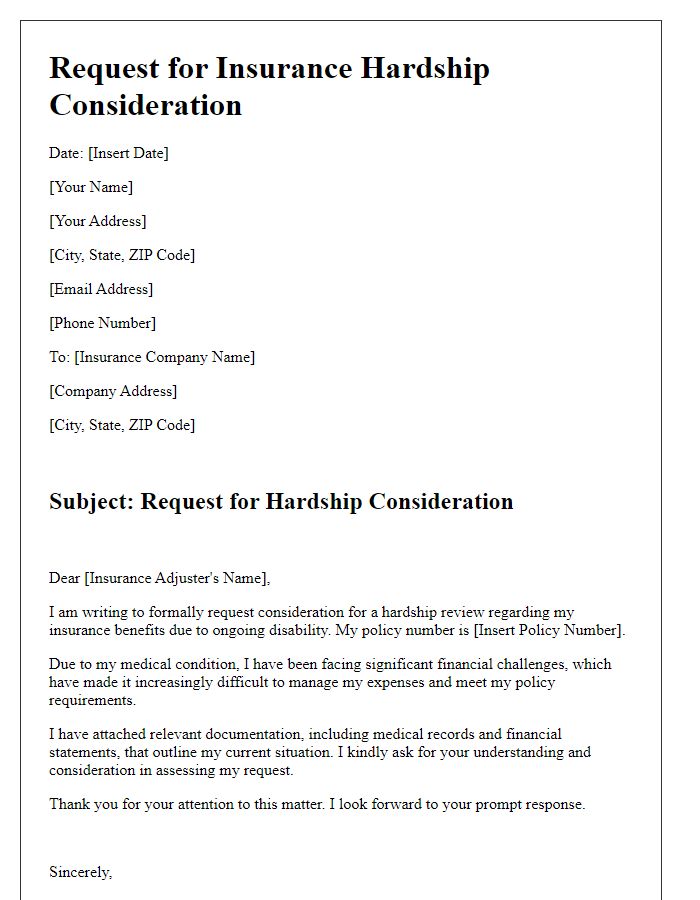

Letter template of request for insurance hardship consideration related to disability

Letter template of plea for insurance hardship exception due to natural disaster impact

Comments