If you've ever found yourself worried about the potential impact of flooding on your home, you're not alone. Many homeowners seek peace of mind through flood insurance, but understanding retroactive coverage can be a bit of a puzzle. This type of insurance can offer you financial protection for past flood incidents, ensuring you're not left scrambling when disaster strikes. Ready to navigate the ins and outs of flood insurance retroactive coverage? Let's dive deeper!

Policyholder Information

Flood insurance policies provide essential financial protection against water damage caused by floods, which can lead to significant property loss, especially in high-risk areas such as New Orleans, Louisiana. Policyholders often seek retroactive coverage, allowing them to claim damages incurred during previous flood events. Effective September 2023, the National Flood Insurance Program (NFIP) introduced new guidelines for policyholders requesting such coverage, requiring documentation of flood incidents, including dates and Federal Emergency Management Agency (FEMA) declarations. Additionally, local ordinance compliance and proof of insurable interest are critical components for processing retroactive claims, ensuring policyholders receive the necessary support to recover from flood-related disasters.

Detailed Description of Flood Event

In October 2022, the historic flooding event in Houston, Texas, resulted from unprecedented rainfall totaling over 20 inches within a 48-hour period. The storm, classified as a 1-in-500-year event, overwhelmed local drainage systems, causing extensive inundation in neighborhoods such as Cypresswood and Spring Branch. The floodwaters reached levels of three feet in residential areas, leading to significant damage to properties and infrastructure. Emergency services reported thousands of rescues and evacuations, highlighting the event's severity. Many homeowners found themselves facing immediate repair costs and loss of personal belongings due to the unexpected nature of the disaster. Homes affected included those with existing insurance policies that did not cover flood events, underscoring the urgent need for retroactive flood insurance coverage to address the financial burdens imposed by this catastrophic event.

Date and Location of Incident

Flood insurance policies often cover damages caused by excessive rainfall or rising water levels, with specific dates and locations impacting claim eligibility. For example, the catastrophic flooding event in New Orleans during August 2005 led to widespread damage, prompting policy discussions for retroactive coverage. Areas heavily impacted included the Lower Ninth Ward, where floodwaters reached unprecedented heights, submerging homes and businesses. In some instances, policyholders sought to backdate their claims to coincide with the disaster's onset, arguing for assistance with repair costs incurred during this natural disaster. Such situations highlight the importance of understanding policy terms regarding coverage timelines and geographical specifics in flood-prone regions.

Justification for Retroactive Coverage

Flood insurance policies often provide coverage for damages incurred during specific incidents, typically not extending to claims made after the event has passed. When seeking retroactive coverage, it's essential to present a strong justification for consideration. In many instances, unforeseen circumstances can lead to missed filing deadlines, such as catastrophic flooding events (e.g., Hurricane Harvey in 2017, affecting Texas communities) that overwhelm local resources, making it challenging for policyholders to report damages promptly. Documents can support claims, including photos of damage, community impact reports, or testimonies from neighbors. Additionally, citing previous instances where insurers provided retroactive coverage for similar events may bolster the request. Potential implications for local economies, property values, and community recovery efforts strengthen the argument, emphasizing not only individual suffering but broader societal impacts caused by delays in claims processing. Having well-organized documentation and clear communication can significantly enhance the chances of obtaining retroactive flood insurance coverage.

Documentation and Evidence Provided

Flood insurance policies can provide crucial financial protection against water damage from events such as hurricanes or heavy rainfall. Documentation supporting retroactive coverage claims often includes photographs of damage, signed statements detailing the timeframe of the flood event, and official records from government agencies such as the National Weather Service indicating rainfall levels. Additionally, policyholders may present repair invoices or contractor assessments confirming the extent of water damage in their homes, particularly in areas like New Orleans, Louisiana, historically affected by flooding. Claimants should also include the original policy documents outlining coverage terms and premium payments, highlighting any applicable endorsements for retroactive coverage. Detailed logs chronicling the date of loss and subsequent mitigation steps taken serve to strengthen claims further, facilitating conversations with insurance adjusters to expedite processing.

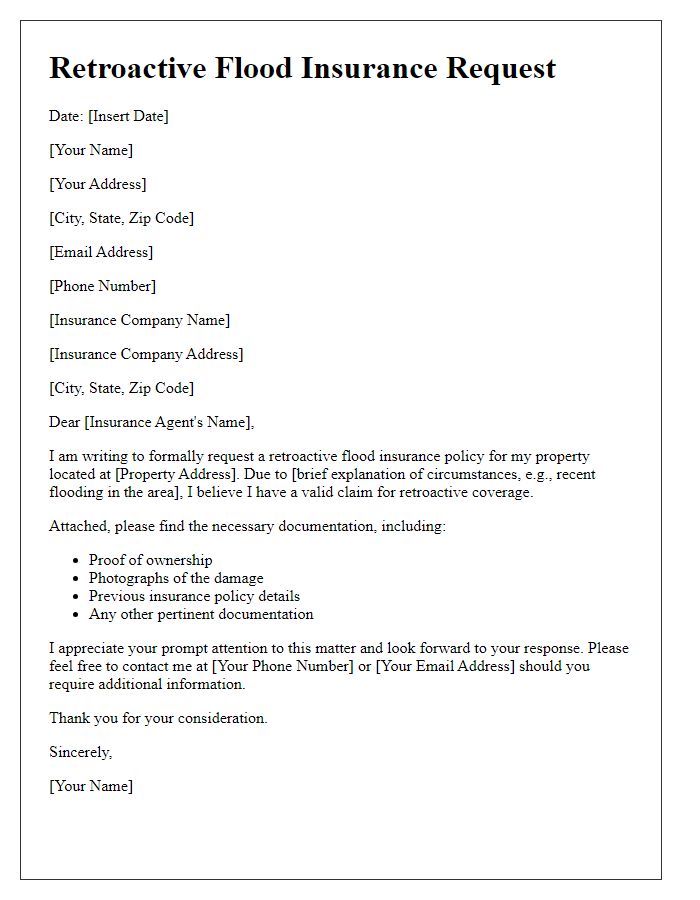

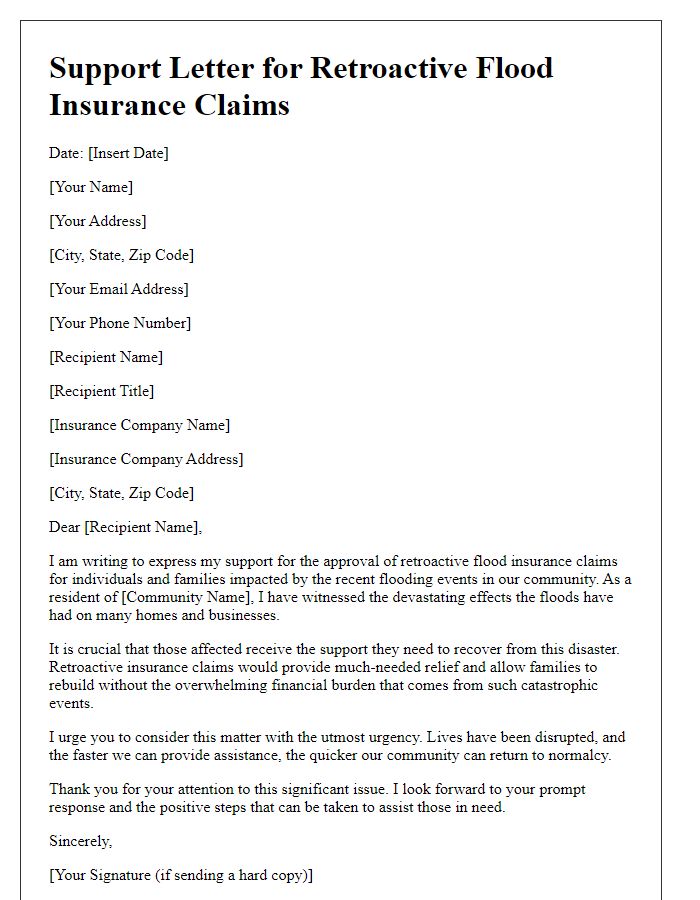

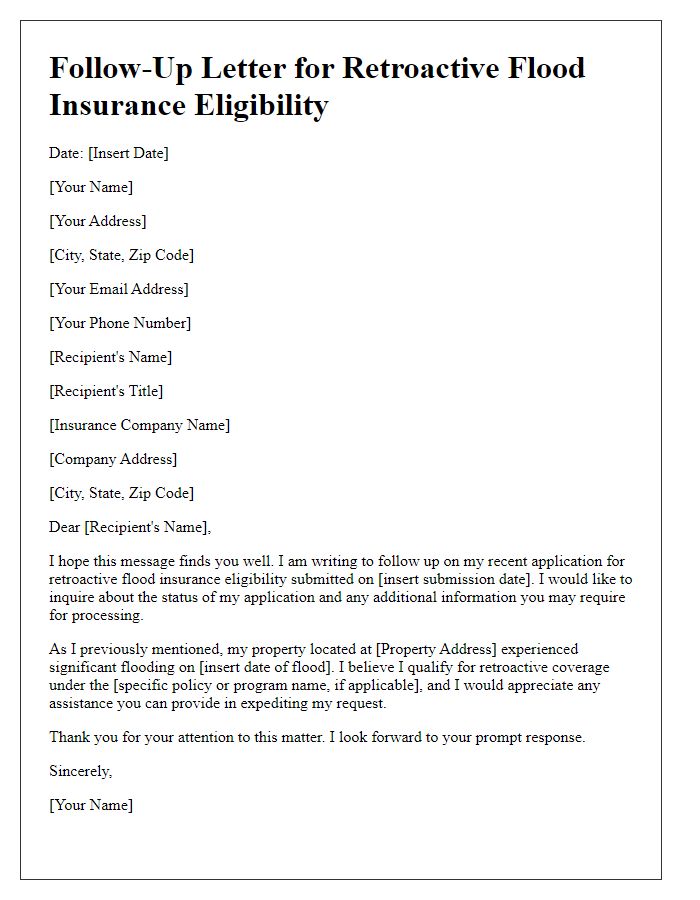

Letter Template For Flood Insurance Retroactive Coverage Samples

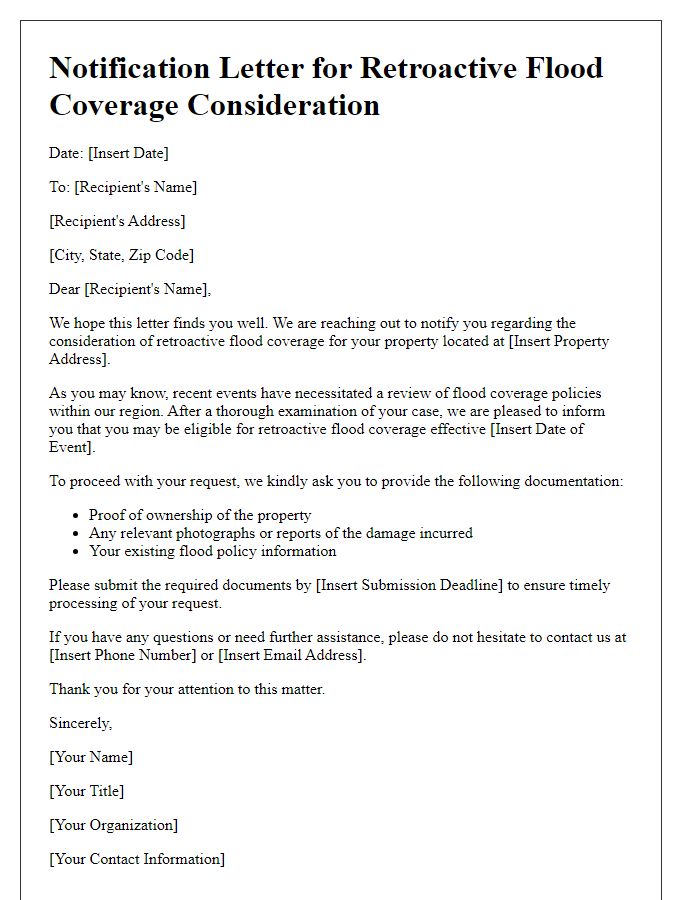

Letter template of notification for retroactive flood coverage consideration

Comments