Are you feeling a bit overwhelmed by the process of submitting an aviation insurance claim? You're not aloneâmany find navigating the intricacies of paperwork and documentation daunting. However, with the right letter template, you can streamline the process and ensure that your claim is clear and professional. Ready to simplify your experience? Let's dive into the essential components of a great aviation insurance claim letter!

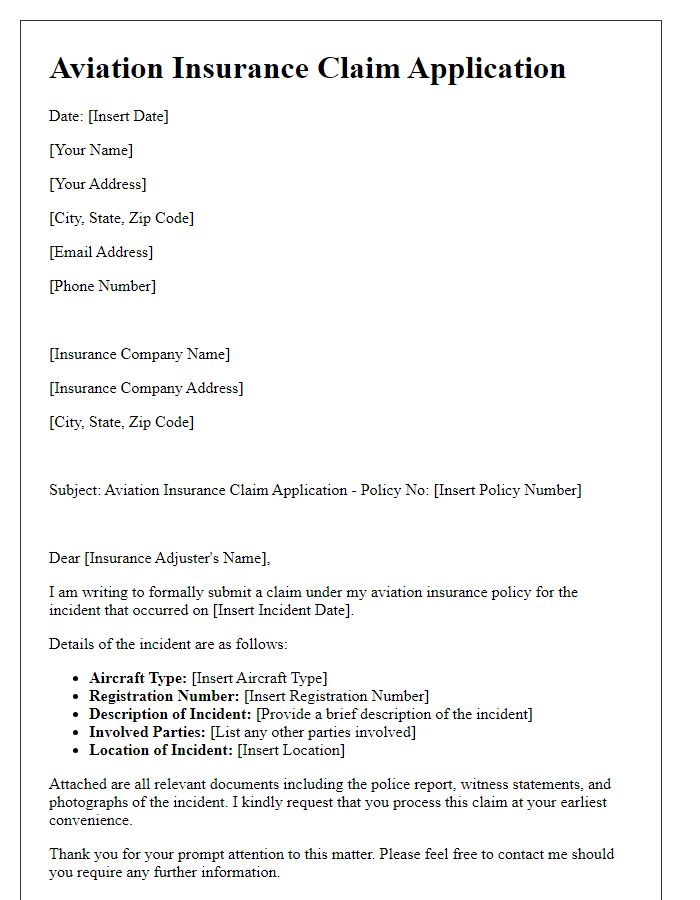

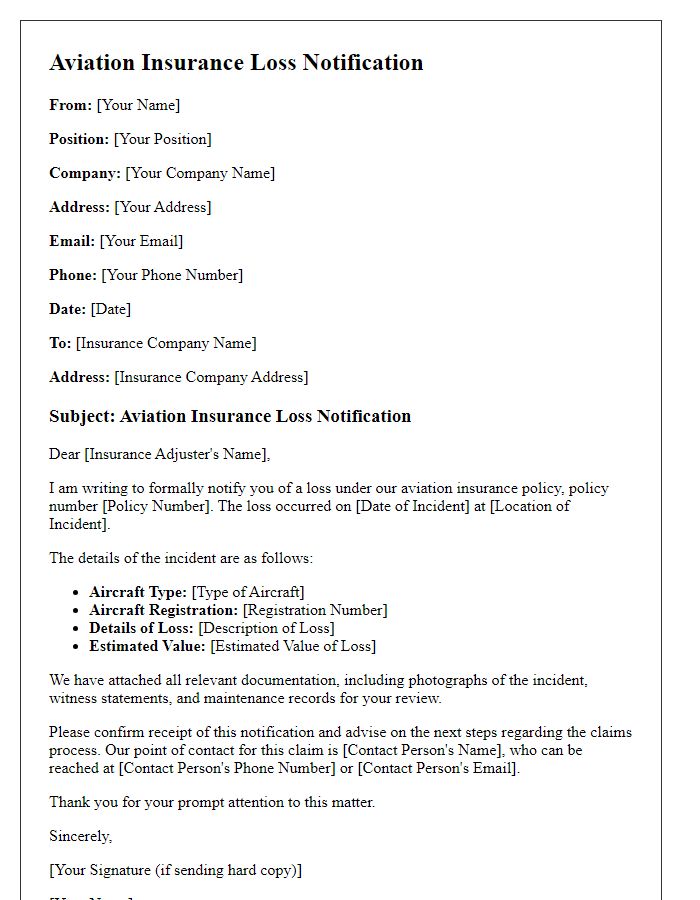

Policyholder Information

Aviation insurance claims require meticulous documentation to substantiate any incident. Policyholder name is critical, along with the policy number, which serves as a unique identifier for the insurance provider. Details about the aircraft, including the make, model, and registration number, are essential to establish context. Incident date is necessary to correlate the claim with the policy terms. Flight plan details, including origin and destination airports, such as Los Angeles International Airport (LAX) or Miami International Airport (MIA), provide vital information on the aircraft's operational environment. Additionally, the nature of the incident--be it damage during a flight operation or ground handling--needs to be clearly outlined to assess the risks involved. A detailed description of the damages sustained, supported by photographs or repair estimates, can further amplify the validity of the claim. Documentation such as incident reports from authorities like the National Transportation Safety Board (NTSB) may also be necessary to substantiate the circumstances surrounding the claim.

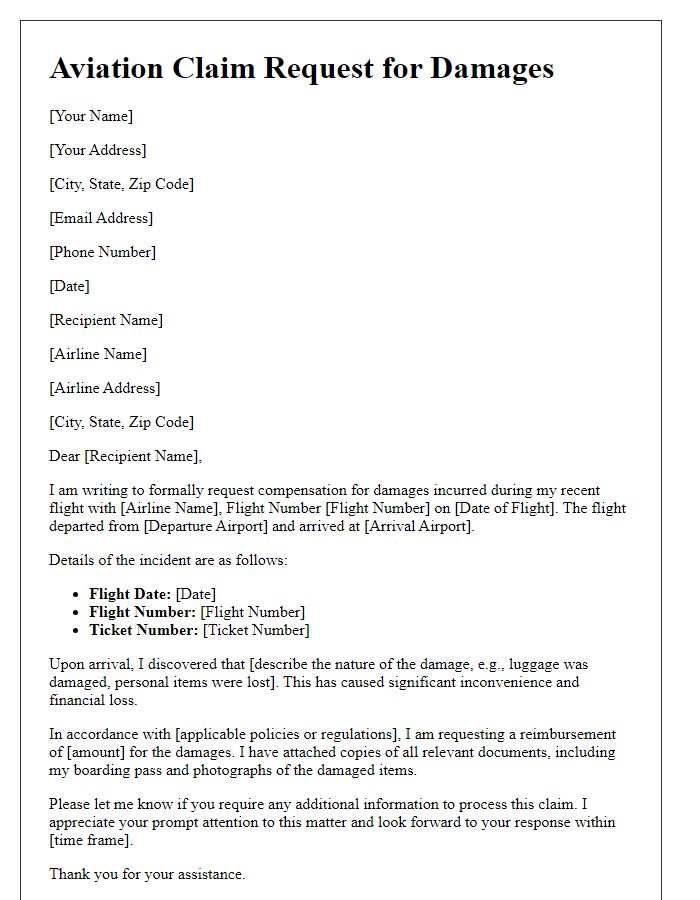

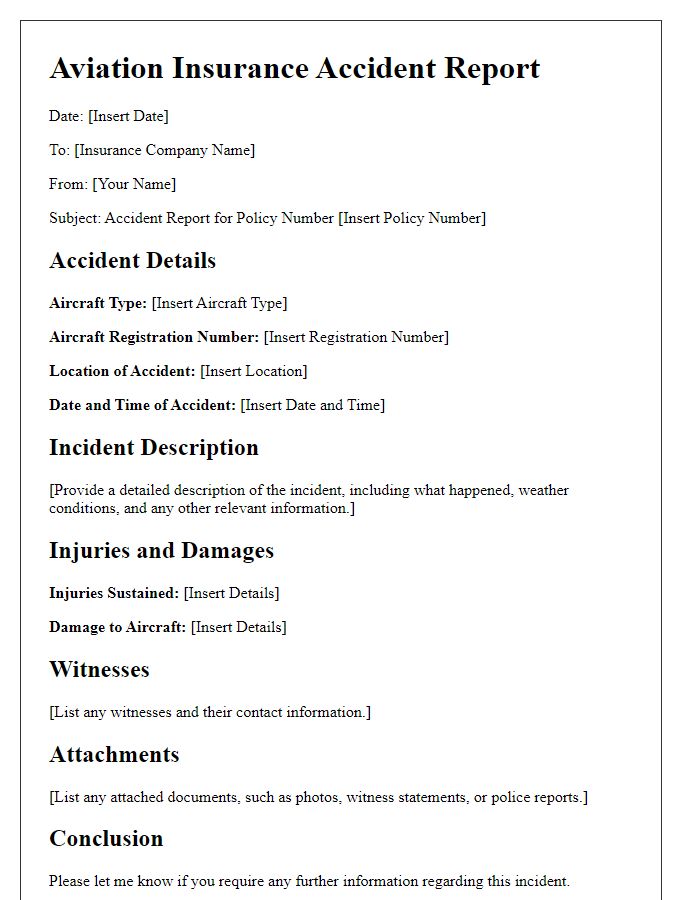

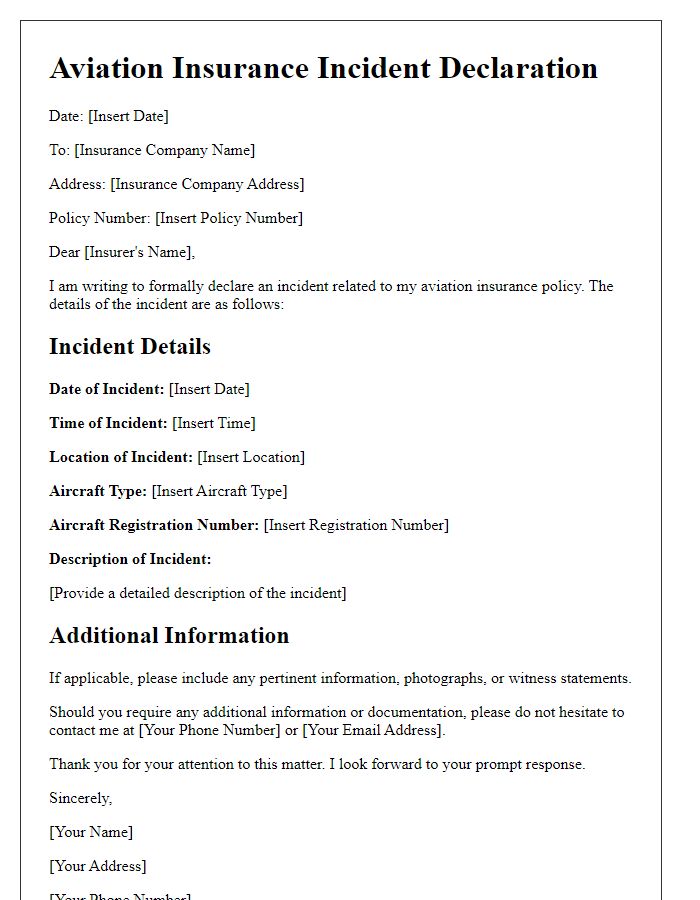

Incident Description

A private Cessna 172 aircraft experienced a mishap on October 15, 2023, during a routine training flight over the San Francisco Bay Area, California. The incident occurred at approximately 2:30 PM local time, when the aircraft encountered unexpected turbulence caused by sudden wind gusts exceeding 30 knots. The pilot, a certified flight instructor with over 1,200 flight hours, attempted to execute a go-around procedure at Hayward Executive Airport (KHWD) as the aircraft approached for landing. Unfortunately, the aircraft descended rapidly due to loss of lift, resulting in a hard landing on runway 21. Structural damage to the landing gear and fuselage was sustained, requiring extensive repairs. The aircraft was safely evacuated and no injuries were reported among the three occupants onboard at the time.

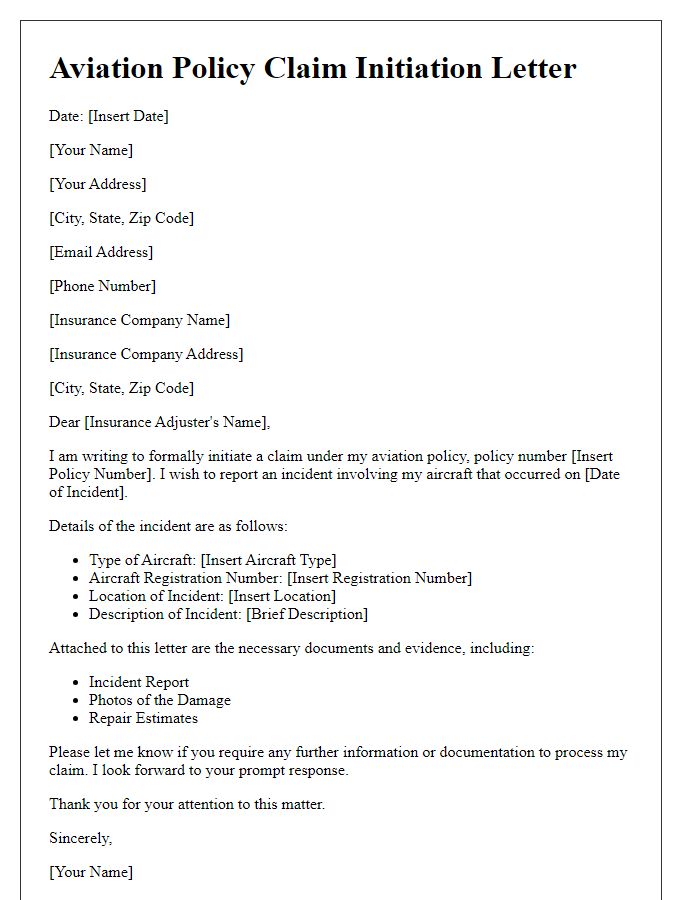

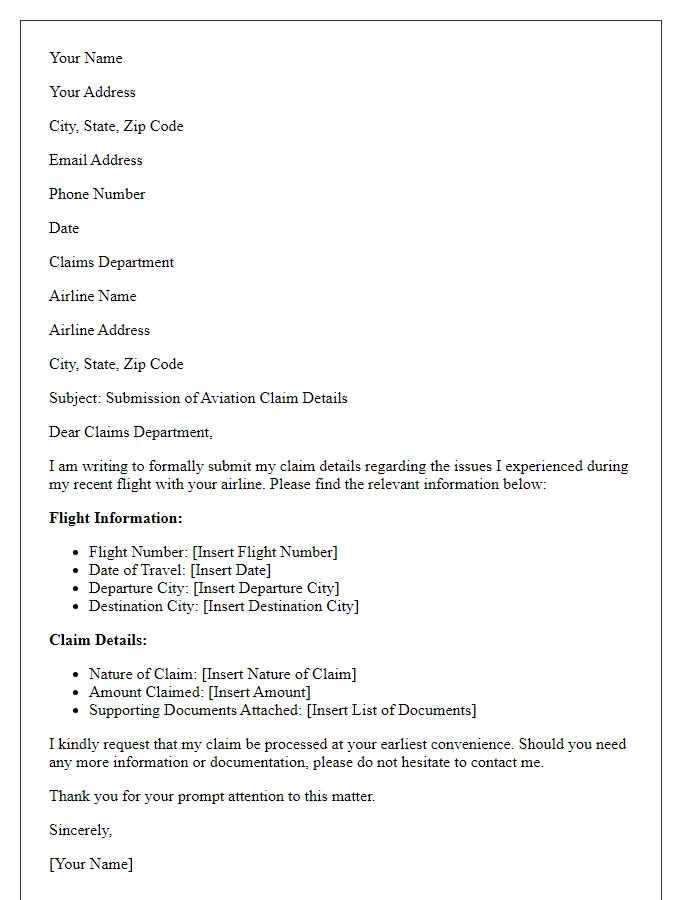

Claim Details

Aviation insurance claims frequently require comprehensive details to ensure efficient processing by providers. The claim number serves as a unique identifier for tracking the status of the claim, especially crucial when dealing with large insurance companies like AIG Aviation or Global Aerospace. The date of the incident, such as an in-flight accident on June 15, 2023, and the aircraft make and model, typically following FAA designation, provide essential context. The damage description should be precise, including estimated repair costs and relevant incidents involving airframe components. Additionally, filing relevant documentation, including maintenance logs and incident reports, facilitates a smoother claim assessment. Specific conditions, like weather scenarios or pilot error, also play pivotal roles in evaluating the legitimacy of claims.

Supporting Documentation

Aviation insurance claim submissions require detailed supporting documentation to substantiate the claim. Essential documents include a completed claim form, which outlines the specifics of the incident, along with a copy of the aircraft registration certificate (for example, Part 47 of the Federal Aviation Regulations for U.S. registered aircraft). Additionally, a report from the aviation maintenance technician, detailing any damage repairs, should be included. Photographs of the incident scene and damages, timestamped for evidence, are critical. For accidents involving third parties, obtaining witness statements and relevant police reports will strengthen the claim. Furthermore, any communication with the Federal Aviation Administration (FAA) regarding the incident may be beneficial. Lastly, invoices for repairs or replacement parts provide a clear account of incurred expenses, helping to establish the financial aspects of the claim.

Contact Information

Aviation insurance claims require specific contact information for effective communication and processing. This includes the claimant's full name, which identifies the individual submitting the claim. A valid phone number allows for real-time communication regarding any questions or additional information needed. An email address is essential for sending notifications, updates, and documentation. The policy number links the claim to the specific insurance plan held, while the date of incident (such as accidents or damage occurrences) provides context for the claim. Additionally, the address of the claimant ensures that all communications are directed accurately and promptly to the appropriate location. This organized presentation of contact details enhances the efficiency of the claims process.

Comments