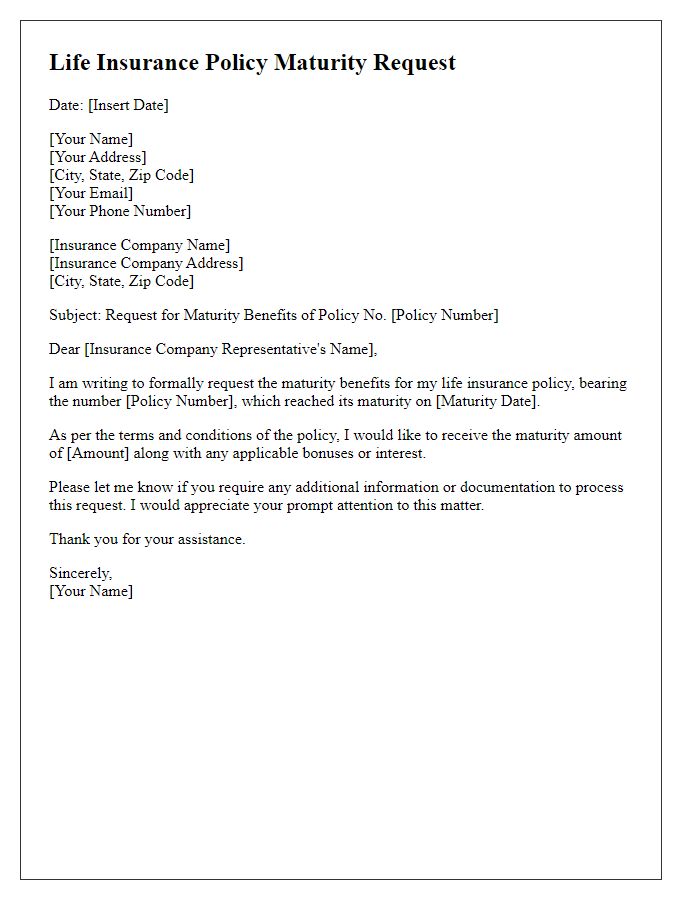

Are you nearing the end of your life insurance policy and wondering how to initiate the maturity claim? Understanding the process can seem overwhelming, but it doesn't have to be! In this article, we'll break down the essential steps to draft a successful life insurance maturity request letter, ensuring you have everything you need to secure your funds. So, grab a cup of coffee and let's dive in to make this process smooth and hassle-free!

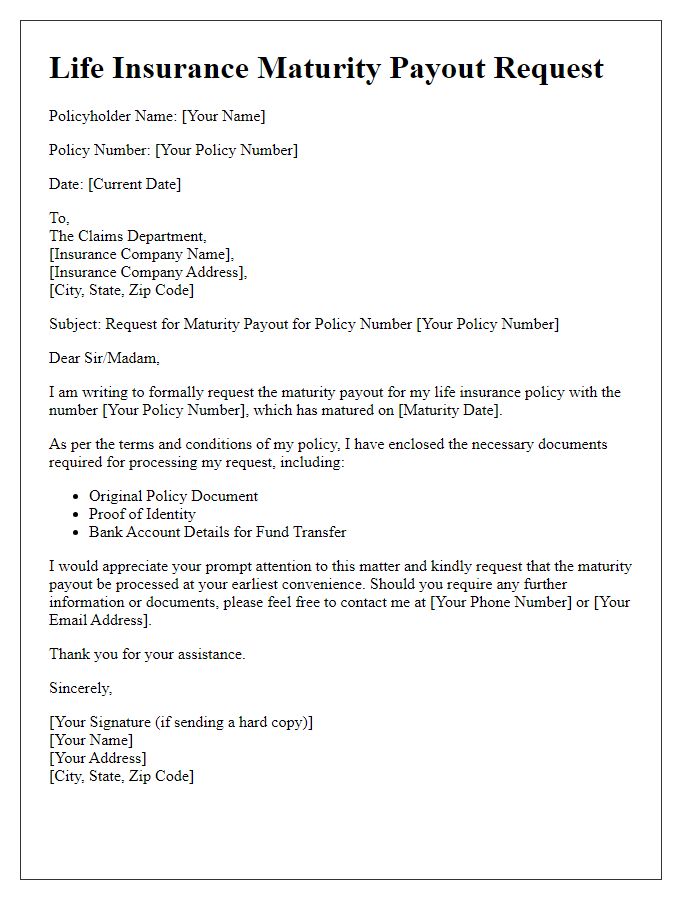

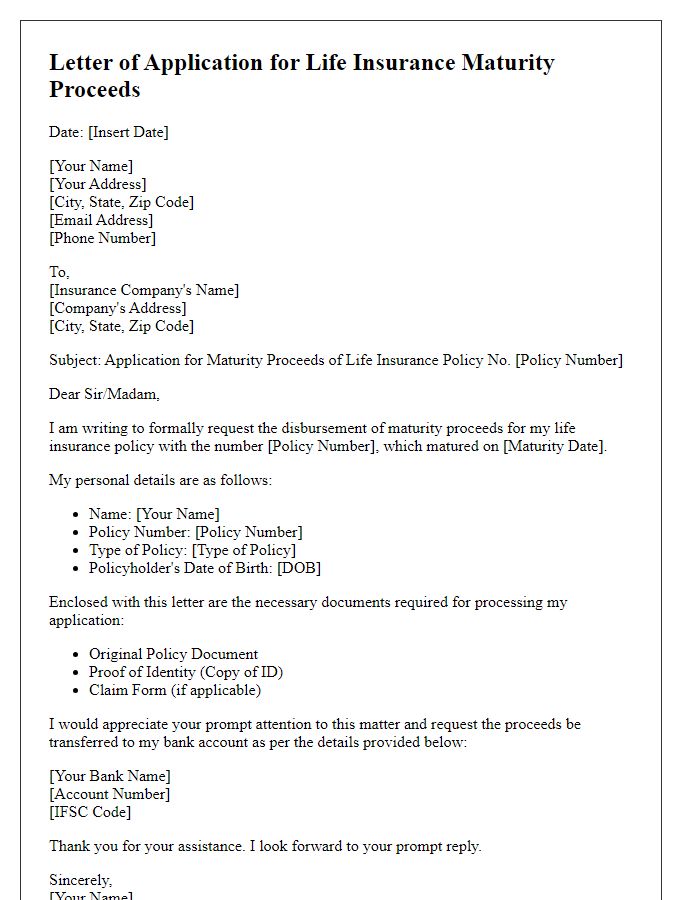

Policyholder's Information

Policyholder information contains vital details essential for processing life insurance maturity requests. Key components include full name of the policyholder, policy number indicating the specific insurance contract, date of birth reflecting the policyholder's age, and contact information such as phone number and email address for communication purposes. Additionally, the address listing both city and state serves as identification and documentation verification. The beneficiary's details, including their relationship to the policyholder, may also be necessary for settlement processing. Documenting this information accurately ensures a smoother transaction and compliance with insurance regulations.

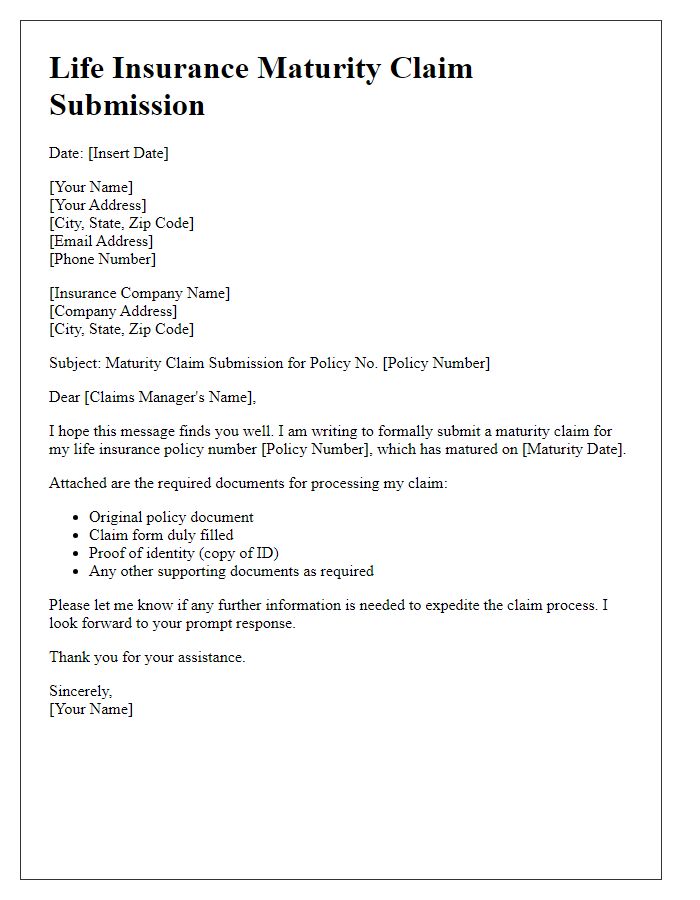

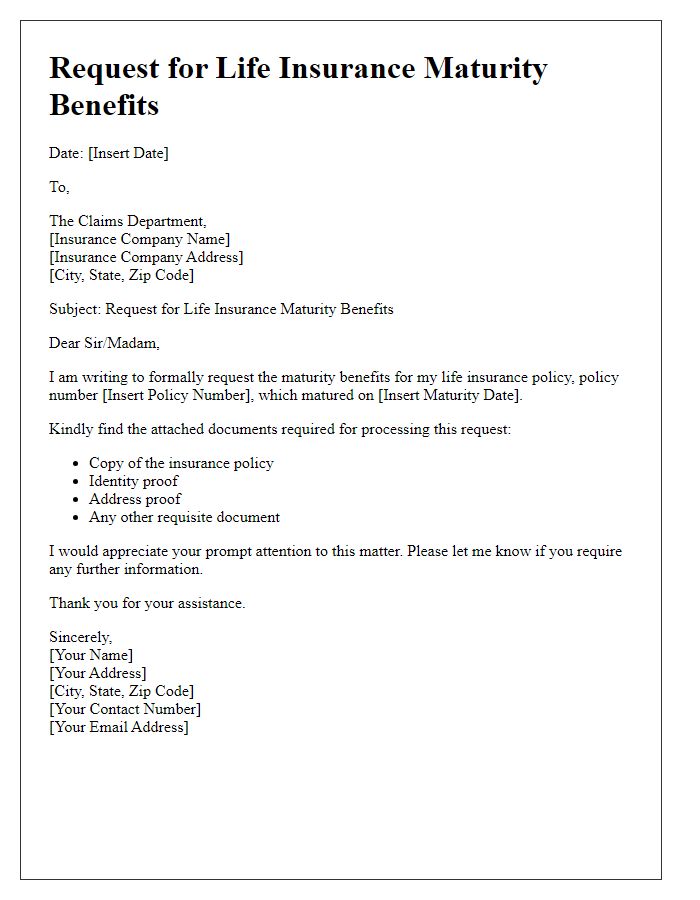

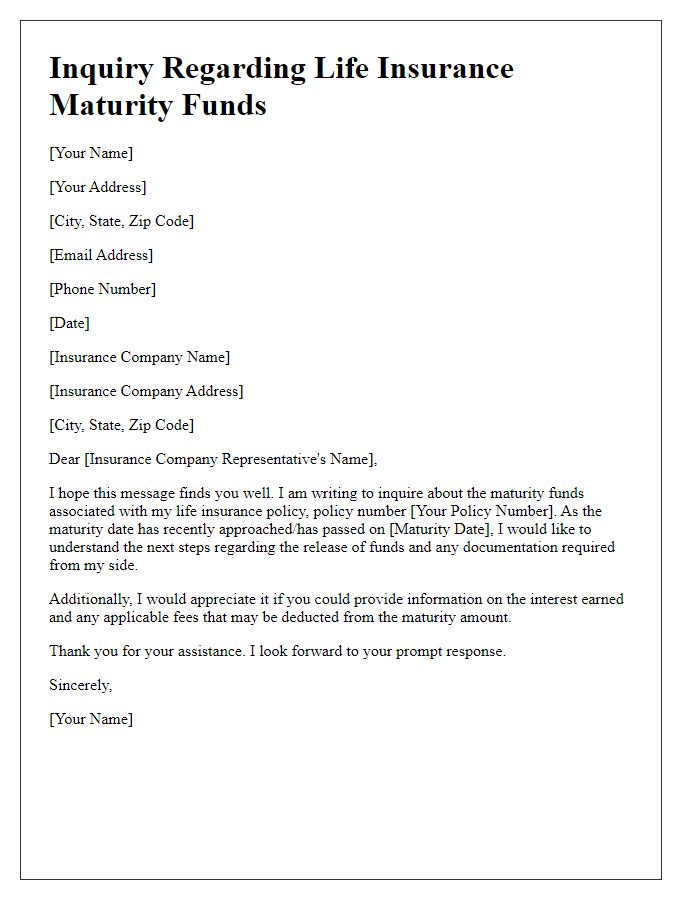

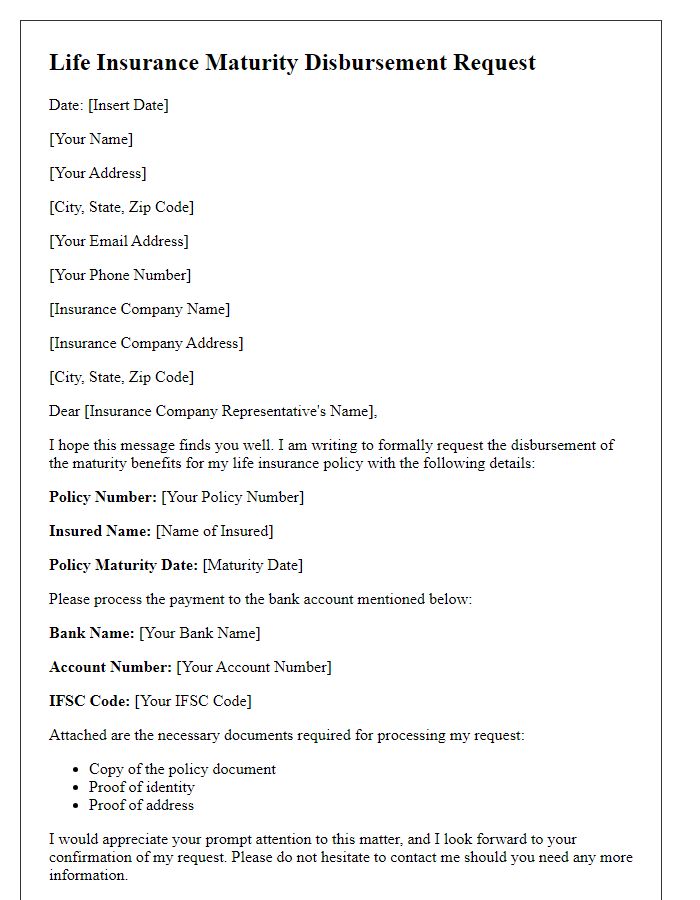

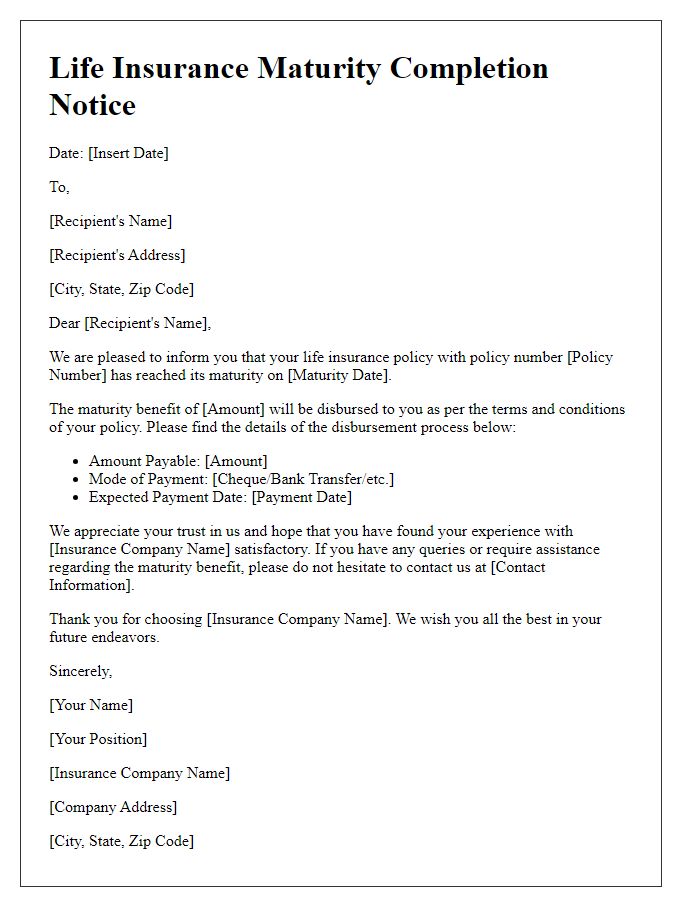

Policy Details

Life insurance maturity requests involve specific policy details that are crucial for processing the claim efficiently. Policyholder identification includes full name and address, while policy number uniquely identifies the insurance contract. Maturity date signifies when the policy reaches its end, enabling the payment of maturity benefits. Sum assured represents the amount payable upon maturity, which may include bonuses accrued over the policy term. Required documents often include the original policy document, identity proof, and bank details for fund transfer. The insurance provider's name, such as MetLife or Prudential, is essential, along with customer service contact information for any inquiries during the claim process. Timely submission of these details ensures a smooth transaction and access to the funds intended for financial security.

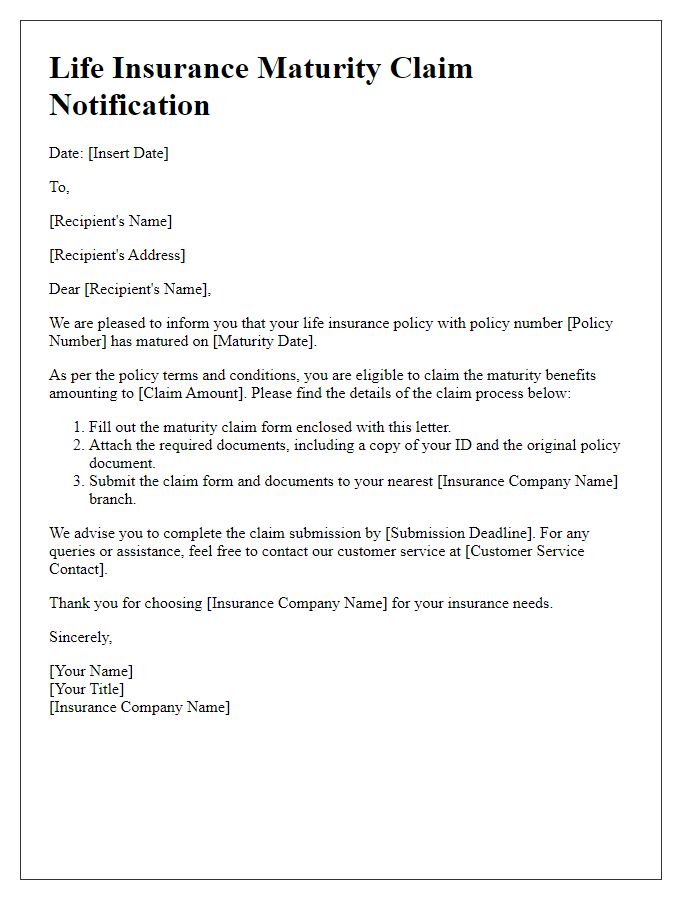

Maturity Date

Upon reaching the maturity date of a life insurance policy, the policyholder can expect a significant financial outcome from their investment. This process typically involves the policy's end, which may be set at a specific duration, often 10, 20, or 30 years from the policy's inception. Upon maturity, the individual is entitled to receive the sum assured, which is the face value of the policy, alongside any accumulated bonuses or interest accrued (typically calculated based on the insurer's performance over the term). The insurance provider, such as Prudential or AIG, requires the policyholder to submit specific documents, including the policy number, proof of identity, and maturity claim form to initiate the payout process. It is crucial for policyholders to keep abreast of the specific claims process tied to their insurance provider and be aware of any tax implications associated with the maturity benefits.

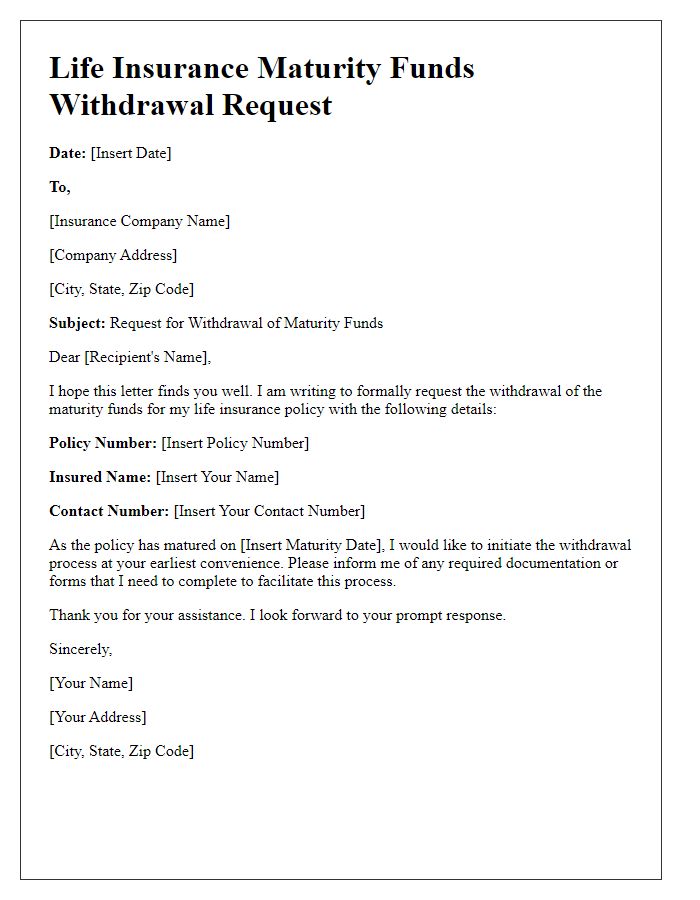

Payment Instructions

To request a life insurance maturity payment, the policyholder should provide detailed instructions on how they would like the funds disbursed. Common payment methods include bank transfer (requires accurate bank details, such as the account number and routing number) or a check made payable to the policyholder at their registered address. If the policyholder prefers a specific financial institution or has an existing account with a preferred bank (notably large banks like Bank of America or Chase), they should specify this information for efficient processing. Additionally, providing a copy of the maturity notice along with personal identification can facilitate a smoother transaction and help prevent any delays in receiving the funds.

Contact Information

A life insurance maturity request involves communicating with the insurance provider to claim the payout after a policy term ends. The process typically requires specific contact information. Policyholders should include their full name, policy number, and address for validation purposes. An email address facilitates quicker communication, while a contact number ensures direct access to representatives for any subsequent queries. Additionally, providing date of birth assists in verifying identity, crucial for processing requests efficiently. Proper documentation must accompany the request, including identification proof and any forms provided by the insurer to ensure compliance with company procedures.

Comments