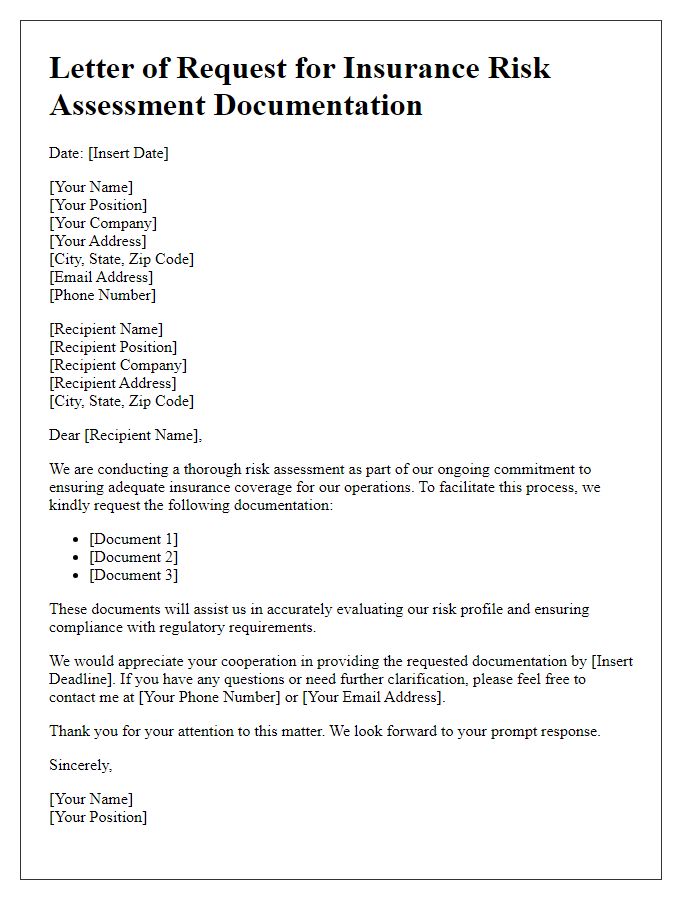

Are you looking to streamline your insurance risk assessment process? Writing a clear and concise letter can make all the difference when communicating your needs to your insurance provider. This essential step not only helps in gathering accurate information but also fosters a collaborative relationship with your insurer. Join us as we explore a helpful template for crafting your request!

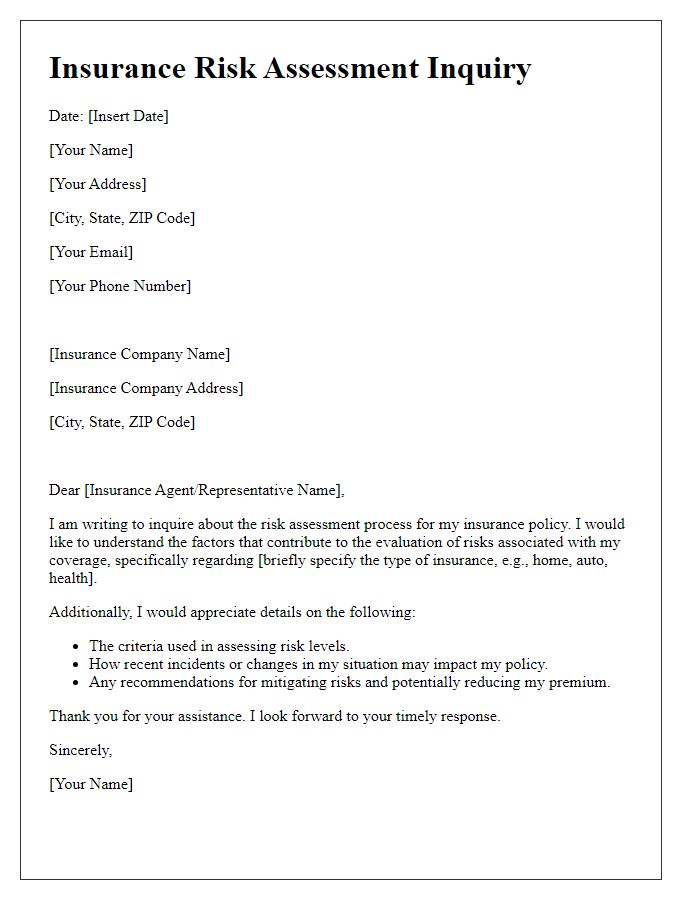

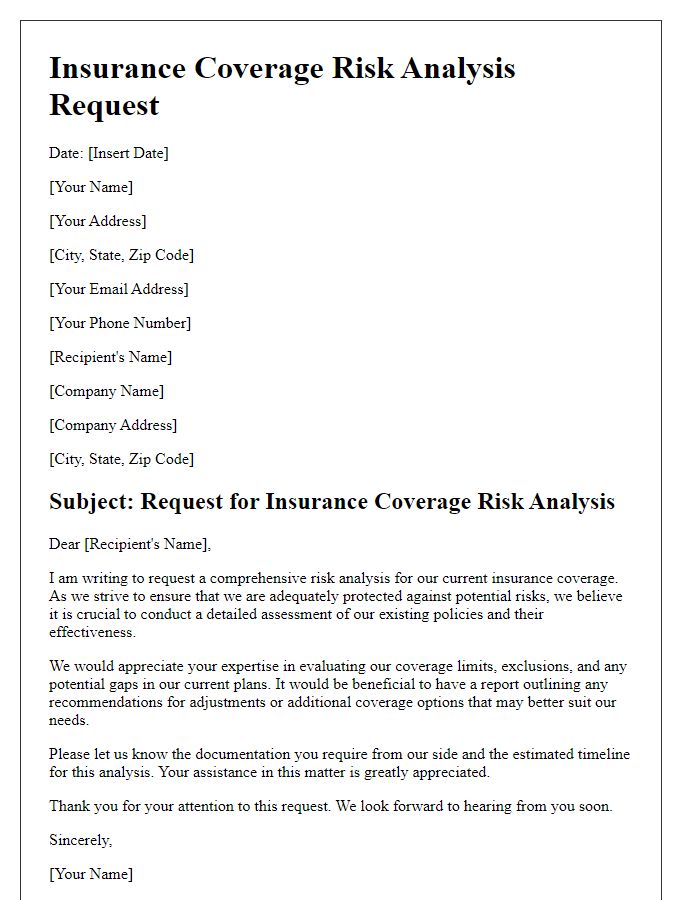

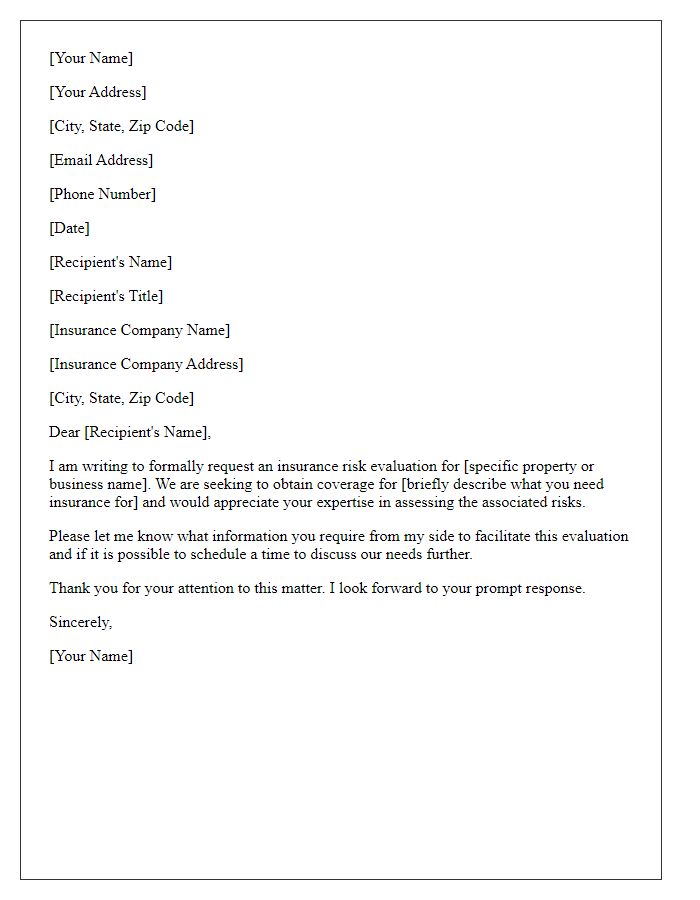

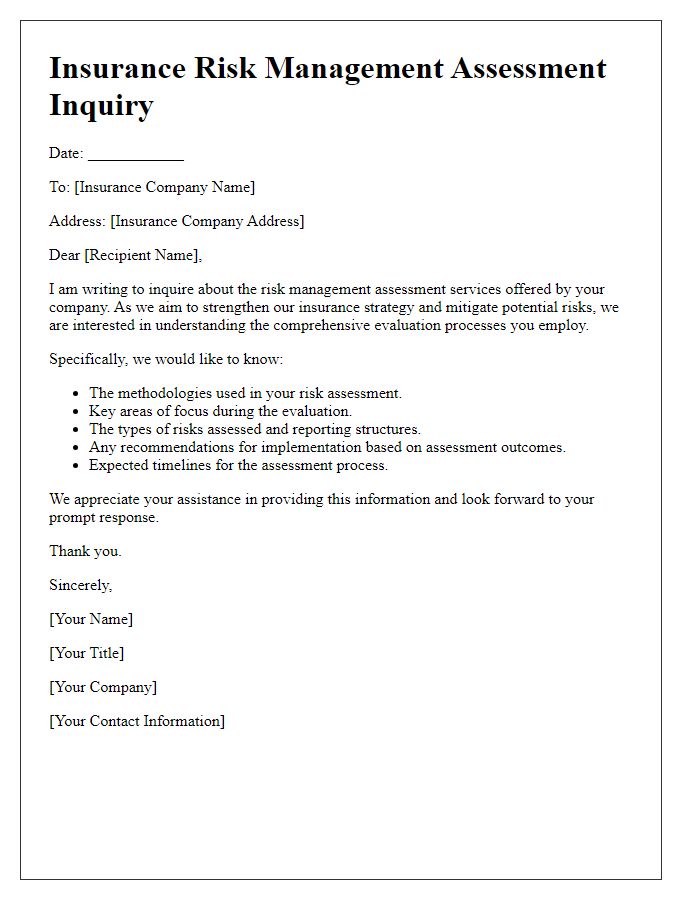

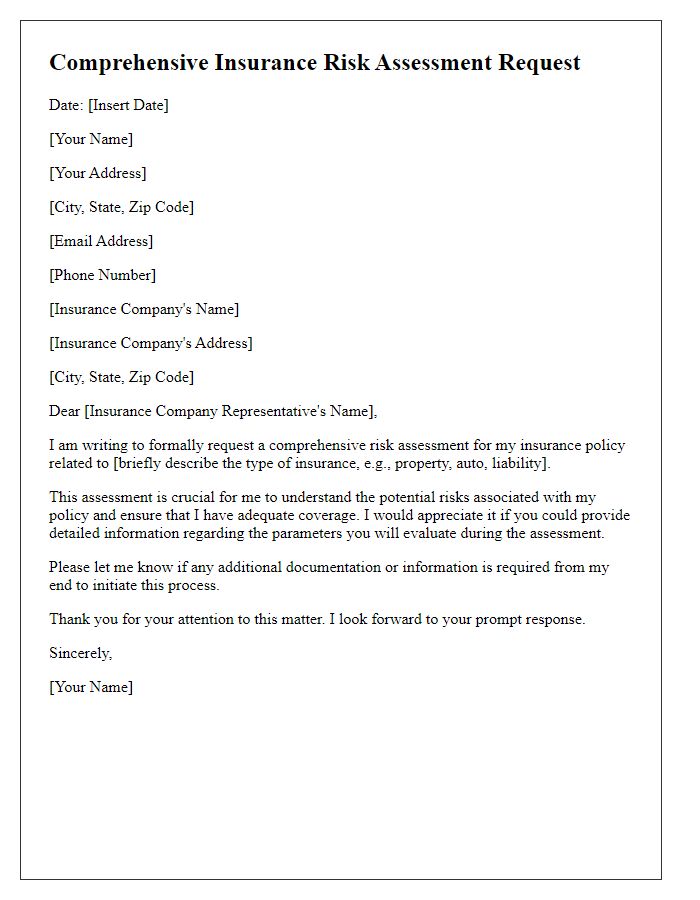

Clear subject line

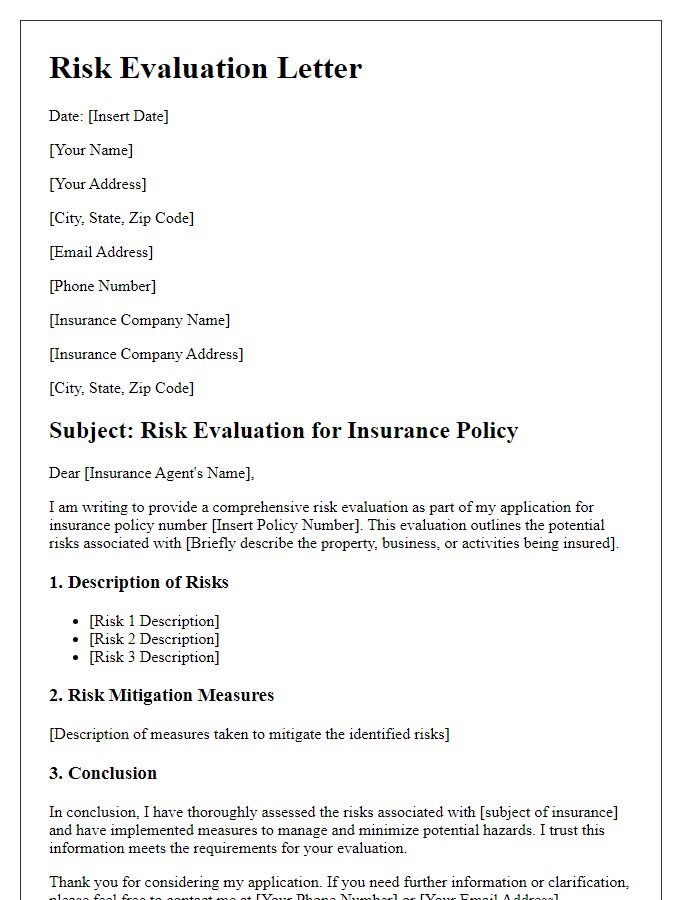

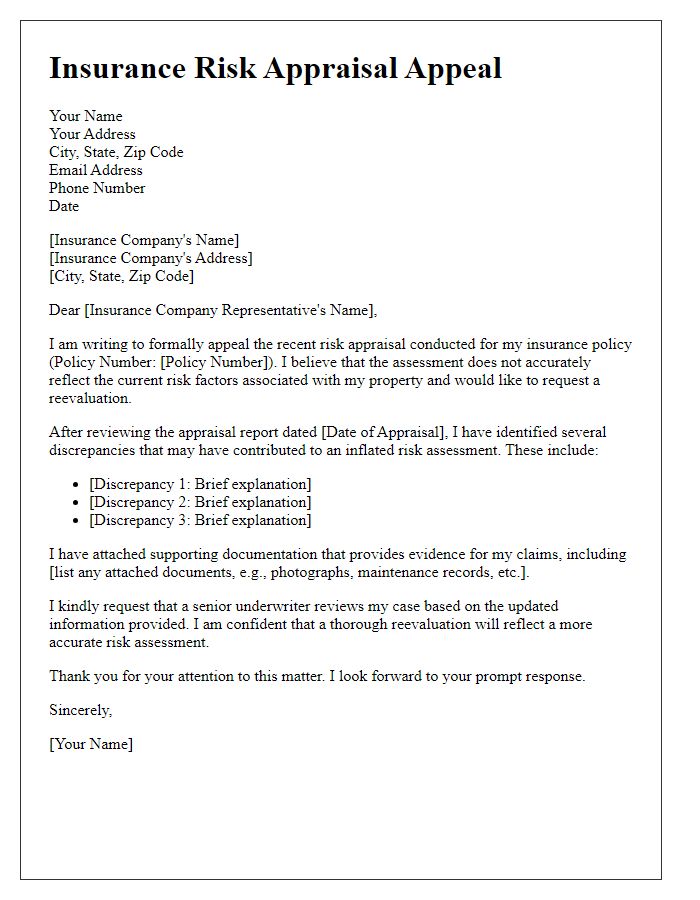

A well-structured insurance risk assessment request can streamline the evaluation process for both the insurer and the insured. Details such as specific policy numbers (for example, PL123456), entity names (like ABC Manufacturing Corp), and relevant incidents (for instance, a fire incident on July 10, 2023, at the Los Angeles facility) enhance clarity and expedite the assessment. Including factors like industry standards, potential liabilities (for example, projected costs related to workplace injuries or property damage), and applicable laws (such as OSHA regulations) provides context vital for the evaluation team. Comprehensive data can assist in determining appropriate coverage levels and assessing premium pricing effectively.

Policyholder details

Insurance risk assessments consider various factors related to individual policyholder details. Relevant aspects might include the policyholder's age, which can influence premium rates, along with occupational background, assessing risk exposure in specific industries. Additionally, health history plays a critical role, including pre-existing conditions that may heighten risk. Geographic location is significant too; residing in flood-prone areas or regions with high crime rates can lead to increased risk evaluations. Property details, such as home age and safety features, contribute further to the overall risk assessment, impacting coverage options and costs. Lastly, claims history reveals previous experiences that might predict future risk, shaping the underwriter's evaluation of the overall risk profile.

Request specifics

Insurance risk assessment requests require precise details to ensure accurate evaluation. Essential elements include property location (specific address including zip code), type of property (residential, commercial, industrial), age and condition of the structure (year built, recent renovations), and safety features (fire alarms, security systems). Additional factors involve insurance coverage sought (liability limits, property protection), prior claims history (dates, nature of claims), business operations if applicable (industry specifics, business tenure), and any unique risks associated with the property (natural disaster zone, high crime area). Providing this information facilitates comprehensive risk assessment and accurate premium quotation by the insurance provider.

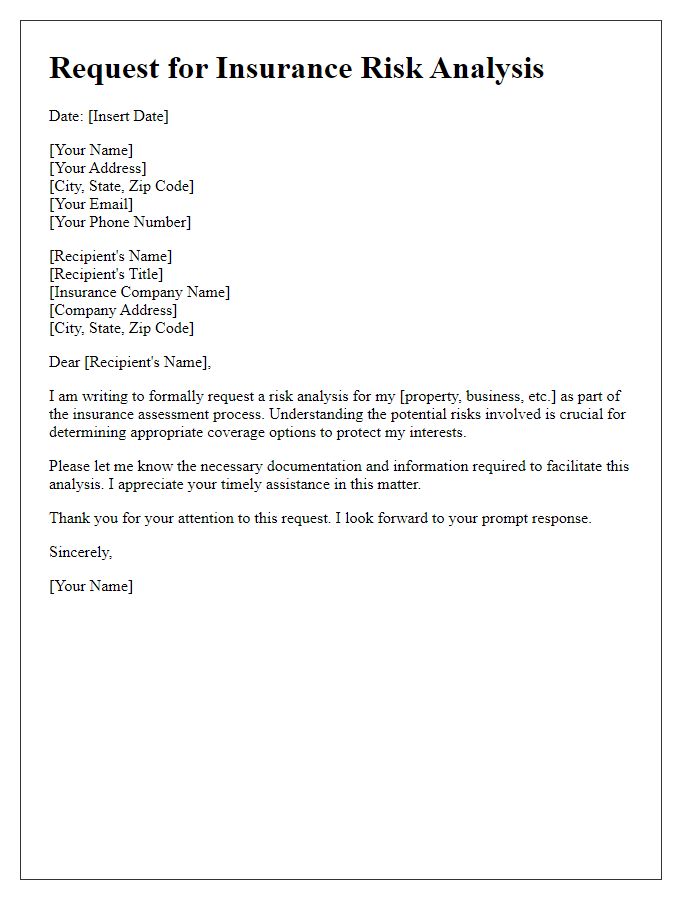

Coverage requirements

Insurance risk assessment plays a crucial role in determining optimal coverage requirements for businesses. Factors such as industry sector, company size (for example, revenue figures above $10 million or employee count exceeding 50), and geographical location (specific considerations for urban versus rural settings) play a significant role. Assessors often evaluate historical loss data, including incidents like theft or natural disasters, to identify vulnerabilities. Other key elements covered may include property damage thresholds, liability limits (often upwards of $1 million), and specific endorsements related to unique risks within sectors, such as cyber liability for technology companies. Comprehensive analysis ensures tailored coverage that meets the unique needs of the business while optimizing risk management strategies.

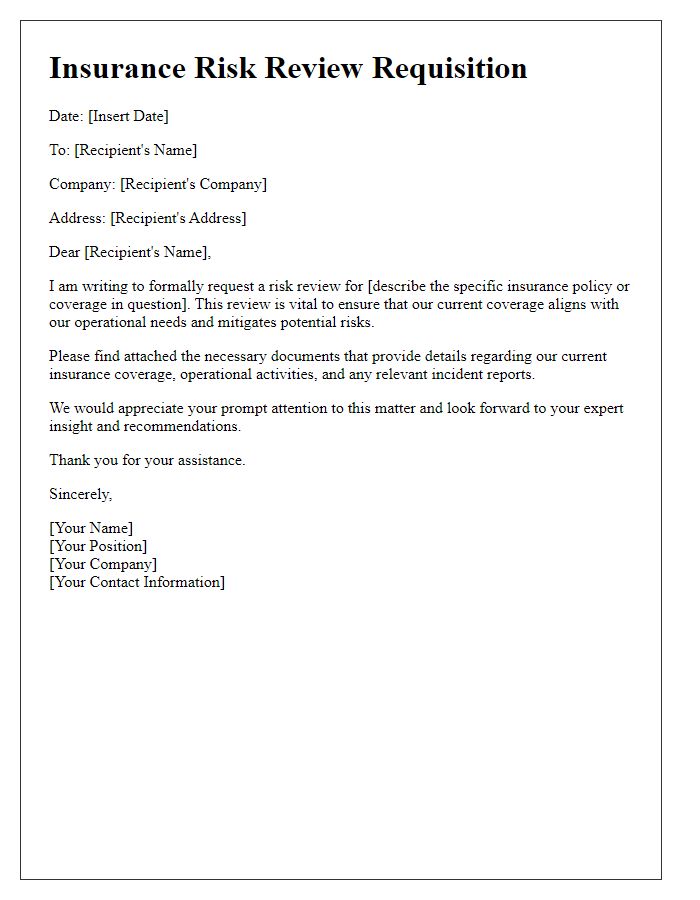

Contact information

Insurance risk assessment involves evaluating potential risks associated with insurable events, including property damage, liability claims, and natural disasters. Understanding risks can improve safety measures, leading to a safer environment. Accurate data collection, including property values and historical claim records, is essential for effective assessments. Risk factors may include location in flood-prone areas like New Orleans, Louisiana, or exposure to earthquakes in regions like California. An effective risk assessment also considers the age and condition of structures, such as older buildings in urban areas, which may have higher insurance premiums. Comprehensive assessments lead to tailored insurance policies that adequately address specific risks.

Comments